- Fully Regulated

- Expertly Reviewed

- Secure & Trusted

- Transparent Fees

- Mobile Friendly

Find The Best Broker For Your Trading Level.

NASDAQ forex Brokers

Cryptocurrency Trading platforms

Volitality 75 Forex Brokers

How to Buy Bitcoin

Forex Trading Brokers in Namibia

We explore everything from A -Z how to become a skillful trader and who are the best forex brokers in Namibia for your style of trading.

For Namibian Investors, forex trading can be a way to diversify.

Quick Content

Pros and Cons of Forex Trading

How to Start Trading in Namibia?

Currency Pairs

Forex Trading Basics

Forex Terminology

Forex Charting

Forex Trading Risk Management

Forex Trading Strategies

Forex Trading Platforms

Best Forex Brokers in Namibia

Top 10 Best Forex Brokers in Namibia

| 🏛️ Forex Broker | 🔒 Open an account | 👨🏿Accepts Namibian Traders | ⚖️ Regulation | 📈 Leverage | 💰 Minimum Deposit |

| Exness | 👉 Open Account | ✔️Yes | FSCA, FSA, CySEC, FCA, CBCS, FSC (BVI), FSC (Mauritius) | 1 : Unlimited | $10/187 NAD |

| Trade Nation | 👉 Open Account | ✔️Yes | FCA, ASIC, FSCA, SCB | 1: 200 | $0/0 NAD |

| AvaTrade | 👉 Open Account | ✔️Yes | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA | 30 : 1 | $100/1,870 NAD |

| HFM | 👉 Open Account | ✔️Yes | CySEC, FCA, DFSA, FSCA, FSA, CMA | 1 : 2000 | $0/0 NAD |

| FBS | 👉 Open Account | ✔️Yes | IFSC, FSCA (South Africa), ASIC, CySEC | 3000 : 1 | $1/18 NAD |

| Alpari | 👉 Open Account | ✔️Yes | FSC | 1 : 100 | $100/1,870 NAD |

| eToro | 👉 Open Account | ✔️Yes | CySec, FCA | 1 : 30 | $10/187 NAD |

| JustMarkets | 👉 Open Account | ✔️Yes | FSA | 1 : 3000 | $1/18 NAD |

| XM | 👉 Open Account | ✔️Yes | IFSC, CySec, ASIC | 1000 : 1 | $5/93 NAD |

| IG | 👉 Open Account | ✔️Yes | IGRs | 50 : 1 | $0/0 NAD |

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is Forex Brokers?

Forex brokers are financial firms that facilitate the trading of foreign exchange (forex) currencies for individuals. These brokers offer trading platforms and tools that allow traders to buy and sell various currency pairs.

They offer services such as real-time price quotes, charting tools, technical analysis, and access to leverage. Forex brokers play a crucial role in providing traders with the necessary infrastructure to engage in currency trading.

You’ll learn all you need to know about being a great trader and which forex brokers in Namibia are best suited for your style of trading in this comprehensive guide. Namibian traders can easily take advantage from the competitive, exciting environment offered by forex trading as it is accessible to all over the age of 18.

➡️ Namibia has Exchange Control regulations which are not only used to control the local demand for foreign currency to safeguard the nation’s foreign exchange reserves but also to distribute available foreign currency in the best interest of Namibia overall.

➡️ To start trading forex in Namibia you must be over 18 years old, and every individual has an investment allowance of 6 million Namibian Dollars for foreign investment and trades.

➡️ Forex trading in Namibia may only be performed with your own funds; you are not allowed to use loaned money.

➡️ Namibian traders, like others, are obligated to pay tax on Forex earnings as these funds are seen as capital gains.

➡️ While there are no restrictions placed on forex brokers, Namibians are advised to only use the services of those regulated by Tier-1, Tier-2, and Tier-3 market regulators.

How profitable is forex trading for individuals and retail traders? How much do you need to start trading forex in Namibia? Can you keep your full-time job while you trade forex part-time? What are the significant risks involved with trading forex in Namibia?

These are just a few questions that many Namibian traders may have as beginner forex traders. Explore our website to find the answers to these questions and more.

Foreign Exchange Trading is a legal activity in Namibia that is governed by the Bank of Namibia (BoN). While the Bank of Namibia does not officially regulate forex brokers who carry out financial activities, regulators such as the FSCA, FCA, CySEC, and others, provide Namibians with protection.

We reveal the best brokers with verified regulations who offer their services locally in Namibia. Namibians can rest assured that these are trusted and legitimate brokers that garner a high trust score and/or rating.

Forex Trading Pros and Cons

| ✔️ Pros | ❌ Cons |

| The forex market has the lowest entry criteria of all financial markets, making it the most accessible. | Traders in Namibia might face unexpected and dramatic volatility in the currency market, just like any other market. |

| The MetaTrader trading platform is available to Namibians who want to engage in online currency trading. | Major players in the forex market, such as banks, hedge funds, and financial institutions, trade billions of dollars every day, which gives them an advantage over small-volume individual traders. |

| Retail traders may use forex leverage to raise their exposure and profit margins. | Because the forex market is an over-the-counter (OTC) market, regulatory safeguards are less stringent than those in other markets, such as the stock market. |

| Because of the enormous daily trading volumes, there is a great deal of opportunity to make quick money in the market. | Forex trading has no residual returns and capital gains are generated only when one of two currencies in a pair appreciates. |

| When it comes to FX trading, Namibians have an abundance of short-selling opportunities. | |

| Financial trading in the Forex market is the world’s most liquid. | |

| It is possible to do detailed technical analysis in Namibia to assist traders to become more successful. | |

| A minuscule amount of price manipulation by insiders is possible, although this is unlikely because of the decentralized nature of the FX market and the lack of power of insiders. | |

| Because the bid-ask spread is the main factor in determining forex trading expenses, there are fewer fees and commissions to pay. | |

| Forex trading has a lower tax burden than trading in other financial markets, such as stocks and bonds. | |

| Traders in Namibia may use expert advisors and other trading robots to automate their forex trading. |

Step-by-Step on How to Start Trading Forex in Namibia

➡️ Step 1 – Learn about Forex Trading

➡️ Step 2 – Learn the Basic Forex Trading Terminology

➡️ Step 3 – Register a Demo Account with A Broker of Your Choice

➡️ Step 4 – Learn about the Risks of Forex Trading

➡️ Step 5 – Learn about different Trading Strategies

➡️ Step 6 – Develop a Solid Trading Plan

➡️ Step 7 – Use Your Demo Account to Practise Trading

➡️ Step 8 – Register a Real Account When You Are Ready

➡️ Step 9 – Choose a Trading Platform

➡️ Step 10 – Deposit Funds into the Account and Start Trading

✅ Step 1 – Learn about Forex Trading

To trade currencies, you must first understand how the forex market works, which differs from other exchange-based systems like stocks or futures.

To purchase and sell foreign currency, most retail traders choose to work with a forex trading service provider rather than a big bank. Forex trading services negotiate on your behalf with banks, obtaining the lowest possible pricing and adding their own market spread.

In addition, you can engage with the order books of market makers directly with the help of certain service providers.

Thus, skilled traders can buy and sell forex without the spread and instead, they will be trading at the rates supplied by currency suppliers, plus variable commissions, and this is known as direct market access or DMA.

It can take months and even years to learn about forex and to help Namibians in their journey, the following resources are freely available on the Internet and from brokers:

➡️ Webinars, Seminars, guides, books, tutorials, and more.

➡️ Copy Trading platforms and brokers such as eToro, OctaFX, and many more.

➡️ Demo Accounts offered by brokers and trading platforms

➡️ Cent, Micro, and Mini Accounts that allow smaller position sizes

✅ Step 2 – Learn the Basic Forex Trading Terminology

There are significant distinctions between the foreign exchange market and other financial markets, such as the stock market and the market for commodities.

The foreign exchange market is a world unto itself. For instance, participants in the foreign exchange market have produced their own vocabulary of jargon terminology that is exclusive to this sector.

If you are serious about learning how to trade forex, you should begin to acquire a grip on forex terminology by reading the meanings of popular phrases used in the forex market below.

➡️ Currency Pair – A currency pair consists of two currencies in which the value of the first currency, which is referred to as the base currency, is stated in terms of the value of the second currency, which is referred to as the counter currency.

➡️ Contract for Difference (CFD) – Contracts for Difference, often known as CFDs, are financial instruments that are not permitted in the United States but are available in other markets elsewhere. You can invest in CFDs without really having to own the underlying asset.

➡️ Commodity Currencies – Commodity currencies are currencies from nations whose economies are primarily dependent on the exportation of certain commodities. Countries such as New Zealand, Russia, Canada, and Australia are just a few examples.

➡️ Derivatives – A financial instrument known as a derivative derives its value from another asset, such as a currency. Forex derivatives are quite popular since they may combine the values of two or more currencies and then trade shares based on the combined value of those currencies.

➡️ Position – Position refers to the net amount of a currency pair that is held to gain exposure to changes in the exchange rate of that currency pair. Forex traders take positions to speculate on the movement of currency exchange rates.

➡️ Long and Short – A long or short position is one in which the base currency of a currency pair has been net acquired or sold by the trader. When you believe that the pair’s exchange rate will go up, you will take a long position. On the other hand, you will take a short position when you believe that the exchange rate will go down.

➡️ Pip – PIP is an abbreviation that stands for “point in percentage,” which refers to the lowest possible change in the exchange rate of a currency pair.

➡️ Leverage and Margin – The size of a trading position that you can manage with a particular amount of “margin” or money put on deposit in your trading account to be kept by your broker as security against trading losses is referred to as the position’s leverage.

➡️ Exchange Rate – The amount of the counter currency that must be paid in return for one unit of the base currency in a transaction involving a foreign exchange is referred to as the exchange rate.

➡️ Risk-Reward Ratio – The risk-to-reward ratio is an assessment of how much profit may be made relative to how much was risked. A trader may, for instance, utilize a risk/reward ratio of 1:3, which indicates that they are prepared to risk one dollar to earn three dollars.

➡️ Broker – The definition of a broker is an intermediate company that acts on your behalf to carry out transactions in financial markets. Retail foreign exchange traders engage in currency pair trading on margin by opening trading accounts with internet brokers.

➡️ Order – An instruction that you send to your broker to carry out a transaction on your behalf is called an order. You can use the trading interface provided by your online broker to place an order to purchase financial instruments.

✅ Step 3 – Register a Demo Account with A Broker of Your Choice

After you have gained an understanding of certain fundamental vital ideas, opening a demo trading account is the most effective approach to get your feet wet and begin gaining experience.

Demo accounts provide users with the opportunity to practice trading in real-time environments while utilizing simulated funds and real-time market data. Real trading experience may be gained in this manner without the need to risk any actual funds.

✅ Step 4 – Learn about the Risks of Forex Trading

Where forex trading is concerned, you must never risk more money than you can afford to lose. When deciding how much to invest in Forex at first, it comes down to your individual financial situation and your risk tolerance.

Trading can be an intense and stressful activity at times and to alleviate this, you should trade more cautiously, allowing you to deal with these circumstances.

Namibian traders’ risk might be difficult to estimate, and it refers to the amount of money you would be ready to lose before exiting the market. Although this may be an overestimate of the danger, you may later alter your mind and accept a higher amount of risk.

Sometimes the market moves quicker than you can keep up with and using a stop-loss order could help you put an end to trade and assess the risk.

However, you should be aware that a standard stop order does not provide any guarantees. Stop orders become orders to trade on the market after they have crossed a certain threshold.

Subsequently, slippage may prevent your stop-loss order from being executed in a fast-moving or gapping market.

✅ Step 5 – Learn about different Trading Strategies

When it comes to gaining an understanding of how to trade Forex, it is vital to have a set of appropriate trading methods at your disposal. The following is a list of popular classifications of trading strategies that can be used by Namibian traders:

➡️ Scalping

➡️ Day Trading

➡️ Position Trading

Scalping

Scalping is an extremely popular type of day trading that involves making many deals that are held for just a few seconds to a couple of minutes at most.

Scalpers are traders who seek to make many deals with little earnings (sometimes only a few pips). Some investors believe that it is one of the most sophisticated trading systems available. Charts with a short timeframe are often used by scalpers.

Day Trading

The practice of initiating and closing deals during the same trading day is known as day trading. The duration of a typical trade is a few hours.

You will not be negatively impacted by significant market shifts that take place overnight if you use this technique, which is one of the strategy’s many advantages. Day trading is a frequent trading method used by novices in the foreign exchange market.

Swing trading is a type of trading strategy that involves holding deals open for a period of a few days at a time.

Position Trading

Positional trading comprises tracking long-term price patterns to realize the most possible profit from significant market movements.

Positional trading is a technique that is taken for the long term, in contrast to the other three methods on this list, which are short-term strategies. Therefore, Namibian position traders need an elevated level of self-control and perseverance.

✅ Step 6 – Develop a Solid Trading Plan

As with sailing, if you do not know where you are going, you will get lost and must battle the waves. If you have tried and found your trading technique to be usually profitable and simple to adhere to, then you should put up a forex trading plan that includes that approach.

Your money management and risk evaluation methods should be an integral aspect of your trading strategy. Your trading success and risk management may be improved if you choose transactions with appealing risk-to-reward ratios and trade sizes that are appropriate for your trading account.

Other parts of trading that you will need to learn include quickly taking essential losses and recovering emotionally from trading losses.

✅ Step 7 – Use Your Demo Account to Practise Trading

Using a demo trading account is the most effective method for getting started with putting what you have learned into practice. By using a demo account, you can start trading Forex without making an initial commitment.

Furthermore, because you are dealing with virtual money, you can experience the real Forex markets without taking any risks.

By combining the usage of a demo account with a live account, you could put your trading techniques through their paces in a setting that does not expose you to any monetary loss before moving on to the real markets.

A demo account is an excellent place to start if you are new to foreign exchange trading and want to gain a sense of how the real markets work at the same time.

One of the most important parts of learning is making errors, but if you use a trial account, you will not have to worry about losing money in the process.

There is no better way to put everything you have learned into practice than with a free sample trading account, which is the best place to begin.

Thus, with a demo account, you can trade in a live trading environment, trade with virtual money, and use the most recent real-time trading data and analysis at the same time.

✅ Step 8 – Register a Real Account When You Are Ready

To get started with foreign exchange trading, you will need to open a trading account with a brokerage that specializes in that market. You cannot trade forex without a forex broker to facilitate the transaction.

Namibian traders who want to open a real-time trading account must first fill out an online application that asks for personal information such as name, address, phone number, e-mail address, job history, financial information, and previous trading experience.

The trader’s contact information such as a mobile number and email can be tested by the forex broker for validity.

A “Know Your Client” (KYC) procedure is needed for Namibian traders in addition to the application, which verifies their identity and residency based on the information they gave in the application. The KYC is part of the requirements of market regulators in most countries worldwide

To prove their identity, Namibian traders can upload:

➡️ A copy of their identity card

➡️ Driving license copy

➡️ Passport copy

The proof of address that Namibian traders must provide includes any of the following:

➡️ An updated utility bill

➡️ A bank or credit card statement

➡️ Any other document that has been issued by the Namibian government and shows your full name and residential address

✅ Step 9 – Choose a Trading Platform

After your application and accompanying papers have been received, reviewed, and approved by your broker’s staff, you may begin downloading your trading platform. This may be a desktop terminal, a mobile app, or access to a Web-based browser without the need to download or install anything.

Once your account has been validated and authorized, you may log in using the credentials you registered or got from your broker.

✅ Step 10 – Deposit Funds into the Account and Start Trading

You must deposit cash into your trading account before you can begin trading unless your broker provides a no-deposit incentive that does not need a deposit.

When it comes to funding your account, you may only use the payment methods that your broker accepts and those are listed on the broker’s website.

Most forex brokers require a minimum deposit requirement that you must meet to begin trading.

This guarantees that you have enough funds to fulfil the margin need when you make a deal. If the minimum deposit is minimal, you may use leverage to trade larger positions despite your small initial investment.

5 Best Currency Pairs for Beginner Namibians to Trade

As a novice to Foreign Exchange, it is normal that you would want things to be as easy as possible. Because of this, selecting the appropriate currency pairs to trade may assist you in gaining an edge.

Furthermore, if you are just getting started, concentrate on 5 to 10 currency pairings. This will allow you to have a few good possibilities each month without being overburdened.

You will have more time to study and understand the process of being successful if you have a list this small. It will also be much simpler to put what you have learned into practice.

The 5 best currency pairs for Namibian beginners to trade in 2024 are:

➡️ EUR/USD (Euro and United States Dollar)

➡️ GBP/USD (Pound Sterling and United States Dollar)

➡️ USD/CHF (US Dollar and Swiss Franc)

➡️ USD/CAD (US Dollar and Canadian Dollar)

➡️ GBP/JPY (Pound Sterling and Japanese Yen)

EUR/USD

The volatility and liquidity of the EUR/USD are both adequate, but not excessive. When trading EUR/USD, you will not witness as many large price fluctuations as you would when trading other currency pairings, except for economic reports like the non-farm payroll on the first Friday of the month.

When analysing price movement on EUR/USD, one may utilize basic technical analysis approaches that take past price reversal zones into account.

GBP/USD

GBP/USD is a solid currency pair to trade. Despite the higher volatility of this big currency pair, gains grow since the price tends to move farther.

GBP/USD is simple to follow since it tends to stay in a certain direction for a long time. Forex newbies should start with the GBP/USD currency pair. If you want to improve your technical analysis abilities, this is a better choice than the standard EUR/USD pair.

USD/CHF

The US Dollar and Swiss Franc currency combination is one of the most actively traded currency pairings in the world, and there is a highly robust and constant demand for both currencies around the globe.

Because of this, there is a substantial amount of liquidity accessible while trading USD/CHF, which means that you can almost trade in real-time without any need to wait.

Although this main currency pair’s volatility is higher than that of EUR/USD, the price tends to move further, which means that gains may be increased.

With USD/CHF, your Forex talents will be tested a little bit farther than they would be with EUR/USD, but your eye for technical analysis will subsequently be sharpened.

USD/CAD

The United States dollar and the Canadian dollar, often known as USD/CAD, is a key currency pair that follows a trajectory that is comparable to that of USD/CHF.

Namibian traders must note that the price of oil might alter the price of the USD relative to the CAD. Subsequently, for fundamental analysis, you should look at the charts of oil prices to determine whether oil prices are going up or down.

When trading USD/CAD, investors should also pay attention to interest rates, inflation rates, gross domestic product, and unemployment numbers.

Also, keep in mind that the payroll for all non-farm businesses in the United States is processed on the last Friday of every month. The publication of the data influences all dollar pairings.

The EUR/USD currency pair is the most suitable choice for Forex newcomers, while the GBP/USD, USD/CHF, and USD/CAD pairs are more suitable choices for Forex traders who already have some experience in trading price movement.

GBP/JPY

As a minor cross-currency pair, GBP/JPY has a prominent level of liquidity and trading volume. As with GBP/USD, the route taken by GBP/JPY is similar.

It is a wonderful currency pair for intermediate and expert Forex traders to use. Because of its great liquidity and volume, it is one of the best currencies to trade in the Forex market overall.

4 Best Currency Pairs for Professional Namibians to Trade

Professional traders have a better understanding of risk management and how to take advantage of turbulent market situations to increase their profits. Professional traders in Namibia can consider adding these currency pairs to their forex trading portfolios:

➡️ EUR/USD

➡️ USD/JPY

➡️ GBP/USD

➡️ AUD/USD

EUR/USD

For a variety of factors, EUR/USD is the most popular currency pair in the Forex market. In the first place, the euro and the dollar are the official currencies of the world’s two most powerful regions by global trade and influence.

These nations publish economic statistics daily, some of which have a greater influence on the EUR/USD than others.

EUR/USD increases if Euro Area data is better than expected. If things become worse, the EUR/USD will drop. The US data follows a similar pattern. USD will rise and EUR/USD will fall due to better-than-expected US statistics (as USD is a quote currency).

Because of these and other political developments, the EUR/USD might move in either direction. The main central banks, such as the US Federal Reserve and the European Central Bank, are responsible for much of the volatility in the foreign exchange market.

USD/JPY

There are two safe-haven currencies in the world today: the dollar and the yen. Risk currencies tend to climb during periods of economic expansion and prosperity, while safe-haven assets tend to fall during periods of instability and uncertainty.

GBP/USD

As the official currency of the United Kingdom, the British pound sterling (GBP) is in use. After the US dollar and the euro, the pound is the third most often traded currency. Although the UK was a member of the European Union for some time, the country has never adopted the euro.

When Britain announced its intention to leave the European Union (EU) in March 2020, it sent the pound soaring in both GBP/USD and EUR/GBP exchange rates.

AUD/USD

Many traders see the Australian dollar as a risky asset. In times of high risk-taking, it tends to increase. A favourable correlation between equities and AUD (Aussie) is attributable to this.

Furthermore, Australia’s proximity to China makes it a natural link. As a result, when China releases economic statistics, the yuan and the Australian dollar are both affected.

8 Best No-Deposit Forex Brokers in Namibia

You can start trading forex without risking any of your own money by using a forex no-deposit bonus, which is a free initial deposit from your broker.

A no-deposit bonus is intended for novice traders who are still learning to trade, and who could benefit from free trading credit.

➡️ Trade Nation – 1,000 points when Namibians register an account

➡️ Tickmill – 10% Reward

➡️ SuperForex – $88 No-Deposit Bonus

➡️ MTrading – $30 No-Deposit Bonus

➡️ FBS – Up to $100 Quick Start and $140 Level-Up Bonus

➡️ XM – $30 No-Deposit Bonus

➡️ RoboForex – $30 No-Deposit Bonus

➡️ InstaForex – $1,000 No-Deposit Bonus

Trade Nation

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Trade Nation offers a loyalty scheme to Namibians where they can earn 1,000 trading points once they register and verify their trading account. In addition to this, Namibians can earn points for every unit of base currency that they trade using a Trade Nation Account.

Trade Nation Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC, FSCA, SCA |

| 📱 Social Media Platforms | • Facebook • YouTube |

| 💻 Trading Accounts | • Low Leverage Account (1:30) • High Leverage Account (1:200) |

| 📊 Trading Assets | • Indices • Stocks • Precious Metals • Forex • Commodities • Energies • CFDs |

| 📈 Minimum spread | From 0.4 pips |

| 📱 Demo Account | Yes |

| ☪️ Islamic Account | No |

| 💻 PAMM Accounts | No |

| 💰 Bonuses and Promotions for Namibians | No |

| 🥇 Trust score for Namibia | 80% |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Trade Nation does not charge a minimum deposit, offering Namibian traders with flexibility | There is a limited selection of funding options |

| The broker offers transparent fixed financial spread trading across several asset classes | The spread costs are not the lowest in the industry |

| There is a powerful desktop platform, innovative mobile trading app, and web-based trading platform | There are leverage restrictions on the UK and Australian clients |

| There is commission-free trading offered | United States clients are not accepted |

| There is a wide selection of educational content and beginner guides as part of an all-inclusive education material package | Inactivity account fees may apply |

| There is a dedicated customer service team offered | |

| There is an active business community offered along with a dedicated affiliate program | |

| Trade Nation offers international stability through a well-established regulatory framework | |

| There is no deposit fee or withdrawal fee charged on deposit or withdrawal methods | |

| There are several base currencies to choose from when registering a retail investor account |

Tickmill

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

New traders who register an account with Tickmill will be eligible for a $30 Welcome Account without having to make an initial deposit first. This promotion is only offered to new clients and allows for profits made on the bonus to be withdrawn.

Tickmill Unique Features

| 🔎 Broker | Tickmill |

| 📝 Regulation | CySEC, FCA, FSA, FSCA, Labuan FSA |

| 💻 Trading Desk | Meta Trader 4, Meta Trader 5, Webtrader, Mobile App. |

| 🎉 No Deposit Bonus | $30/561 NAD |

| ➖ Min. Deposit from | $100/1870 NAD |

| 🔁 Spreads from | 0 pips |

| ➕ Max Leverage | 1:500 |

| 💳 Commission | 2 per side per 100,000 traded |

| 🛑 Inactivity Fee | None |

| 🚀 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| The broker offers commission-free trading across financial instruments | The broker does not accept clients from the United States and some other regions |

| There are powerful trading platforms to choose from | Fixed spread accounts are not offered |

| The broker is well-regulated in several regions | |

| There is a selection of popular financial instruments that can be traded | |

| There are several advanced trading tools offered |

SuperForex

Min Deposit

1 USD / 18 NAD

Regulators

IFSC

Trading Desk

Metatrader 4, Mobile App

Crypto

Yes

Total Pairs

300

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

SuperForex offers an $88 no-deposit bonus to every customer who registers a live trading account, followed by full account verification. There is no initial deposit to earn this bonus and all traders must do is select the “Get the No Deposit Bonus” banner after verifying their account.

SuperForex Unique Features

| 🔎 Broker | SuperForex |

| 📝 Regulation | IFSC |

| 💻 Trading Desk | Metatrader 4, Mobile App |

| 🎉 No Deposit Bonus | $88/1645 NAD |

| ➖ Min. Deposit from | $1/18 NAD |

| 🔁 Spreads from | 0.5pips |

| ➕ Max Leverage | 1:1000 |

| 💳 Commission | 1% – 5% plus additional fees |

| 🛑 Inactivity Fee | None |

| 🚀 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| SuperForex offers user-friendly trading software | US clients are restricted from registering with SuperForex |

| There is a low minimum deposit requirement | |

| Traders have access to wide range of training resources | |

| SuperForex offers a range of useful trading tools | |

| There are social trading opportunities provided |

MTrading

Min Deposit

USD 100

Regulators

Not Regulated

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

MTrading provides Namibians with a $30 welcome bonus that does not require an initial investment. However, Namibians must complete the full verification process to be considered eligible for this no-deposit bonus.

MTrading Unique Features

| Feature | Information |

| ⚖️ Regulation | None |

| ⚖️ BoN Regulation | No |

| ✔️ Accepts Namibian Traders? | Yes |

| 💳 Minimum deposit | $10 / 192 NAD |

| 📊 Average spread from | 0.1 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

| 🚀 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Offers powerful online trading platforms across multiple devices | Unregulated broker |

| News and analytics available for advanced traders | There are no standalone trading tools offered |

| There are several flexible funding options supported | The spreads are not the lowest |

| Traders have access to various articles and tutorials | Traders from the United States, United Kingdom, and other regions are not accepted |

| The broker offers a no-deposit bonus |

FBS

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

FBS offers two different no-deposit bonuses namely a Quick Start Bonus and Level Up Bonus. The $100 Quick Start bonus can be earned when Namibians register an account through the FBS mobile app. This will guide them through a 7-step program where they will be taught how to trade without risks.

The Level Up bonus is an account that traders can register to earn $140 free in the Personal Area once the account is verified. Traders can get an additional $70 when they trade over 20 consecutive days, allowing them to withdraw profits that they have made.

FBS Unique Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA, FCA |

| ⚖️ BoN Regulation | No |

| ✔️ Accepts Namibian Traders? | Yes |

| 💳 Minimum deposit (NAD) | 5 USD / 93 NAD |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

| 🎉 Trading Platform | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade |

| 🎉 Open Account | Open Account |

| ✔️ Pros | ❌ Cons |

| FBS offers competitive trading conditions with some of the lowest spreads | There are wide spreads charges on some accounts |

| There are several account types to choose from | There is a limited number of tradable instruments |

| There are many social trading opportunities | There are several regional restrictions applied |

| There is an ultra-low minimum deposit requirement | |

| The broker is well-regulated and trusted |

XM

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

To verify their performance in a genuine trading environment, XM provides a $30 bonus for new customers. Once you claim your bonus, it will be immediately added to your trading account.

There is no limit on how much money you may remove from your trading account; however, any withdrawal of cash will void your trading bonus.

XM Unique Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ BoN Regulation | No |

| ✔️ Accepts Namibian Traders? | Yes |

| 💳 Minimum deposit (NGN) | USD 5 / 97 NAD |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:888 |

| 👥 Customer Support | 24/5 |

| 🎉 Trading Platform | Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

RoboForex

Min Deposit

10 USD / 186 NAD

Regulators

FSC

Trading Desk

MT4, MT5, MobileTrader, StockTrader, WebTrader

Crypto

Yes

Total Pairs

32

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Verified traders who register a live trading account with RoboForex can access a $30 welcome bonus that does not require an initial investment.

RoboForex Unique Features

| Feature | Information |

| ⚖️ Regulation | FSC |

| ⚖️ BoN Regulation | No |

| ✔️ Accepts Namibian Traders? | Yes |

| 💳 Minimum deposit | 10 USD / 186 NAD |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | 24/7 |

| 🎉 Open Account | Open Account |

| ✔️ Pros | ❌ Cons |

| The broker offers more than 12,000 markets that can be traded | US clients are not accepted |

| There are several flexible account types offered | There are no fixed spread accounts |

| Trading education is offered to all traders | |

| There are several powerful trading tools | |

| The broker applies negative balance protection to all retail trading accounts |

InstaForex

Min Deposit

$1/18 NAD

Regulators

CySEC, FSC

Trading Desk

Metatrader 4, Metatrader 5, Multiterminal, WebTrader

Crypto

Yes

Total Pairs

4

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

InstaForex’s No-Deposit Bonus is a terrific way to get started in the Forex market. This is your ticket to the world’s biggest and most liquid market, where many traders now make the bulk of their living.

Our unmatched order execution quality in actual trading situations may be evaluated without risking any of your own money attributable to a $1,000 incentive. Once requested, the bonus is instantly applied and may be used for trading right away.

InstaForex Unique Features

| Feature | Information |

| ⚖️ Regulation | FSC, BVI, SIBA |

| ⚖️ BoN Regulation | No |

| ✔️ Accepts Namibian Traders? | Yes |

| 💳 Minimum deposit | $1/18 NAD |

| 📊 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/7 |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons | |||

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients | |||

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted | |||

| The broker is well-regulated and offers competitive trading conditions | ||||

| There is a choice between retail investor accounts, each suited to different types of traders | ||||

| There is a wide range of tradable assets offered |

Forex Trading – Stock Trading – Cryptocurrency Trading Compared

| 💰 Forex Trading | 💰 Stock Trading | 💰 Crypto Trading | |

| ⏰ Market Hours | 24/5 | 9 am – 3 pm (GMT+3) Monday to Friday | 24/7 |

| 💸 Trading Speed | Instant | Slow | Instant |

| 💰 How is it traded? | OTC | Exchanges | OTC/Exchanges |

| 📊 Price Fluctuation | Fast | Slow | Fast |

| 📉 Min. Trade Size | 0.01 lots | 1 share or fractions | 1 lot or fractions |

| 💰 Volatility | High | Low | High |

| 💧 Liquidity | Very High | Blue Chip Stocks are the most liquid | Only major crypto e.g. BTC, ETH, LTC, DOGE, etc. |

| ⬆️ Trading Volume | High | High | Medium |

| ⚖️ Regulation | $6.6 Trillion | 7,369,200 | $500 Billion+ |

| 💵 Investment Horizon | Short, Medium, Long-Term | Medium and Long-Term | Short, Medium, Long-Term |

| 📉 Average Leverage Ratios | 1:100 – 1:3000+ | <1:100 | <1:10 |

| 📊 Susceptibility to Macroeconomic Factors | Yes Rarely as turbulent as Crypto | Yes Economic Performance | Yes Consumer Behaviour Supply and Demand |

5 Most Successful Forex Traders in Namibia

Michael Amushelelo

In addition to being one of the wealthiest forex dealers in Namibia, Amushelelo is often regarded as the most successful person in the industry. When he was younger, the co-founder and current CEO of Amushe Inc. had a keen eye for business from an early age.

Before establishing his own firm, he made his living as a young adult by selling lollipops and cleaning the yards of his neighbours in exchange for payment. Michael Amushelelo has had his fair share of legal issues in addition to his many accomplishments and successes.

Because of the charges that he committed fraud and laundered money, he has been arrested several times, and in the year 2020, his property was seized for these reasons.

Gregory Cloete

Ameshelelo’s business partner, Gregory Cloete, is also active in the forex market and generates income because of his trading activities. Gregory does consider himself to be a debt counsellor, tracer, claims consultant, and mentor in addition to his trading activities.

Cloete, an expert in the field of cryptocurrencies, is now charging a tuition charge of $2,000 for his training and trading workshops.

Understanding how bitcoin operates, making investments in cryptocurrencies, and analysing the appreciation and depreciation of cryptocurrency are all topics that are covered in his courses.

Gregory is one of the wealthiest forex dealers in Namibia, even though he has not published the exact amount of his net worth.

Namcash

Another successful young Namibian trader who is making it big in the foreign exchange trading market and making it into the list of the wealthiest foreign exchange dealers in Namibia is Nyangi One, also known as Namcash. Namcash is both the founder and Chief Executive Officer of Namcash Fx Institution.

In addition to that, he instructs students on foreign exchange trading, covering topics such as an introduction to foreign exchange trading, technical and fundamental analysis, and trading methods that are successful in foreign exchange.

Jeremiah Mootseng (Wizkid)

Jeremiah Mootseng is another young forex trader who has learned the art of forex trading and is successfully profiting from it.

In addition to engaging in trading himself, Mootseng is an educator who offers free lectures on trading strategies through Facebook and YouTube. In addition to that, he is a trading hub-Nam partner in the training program.

Mootseng looks forward to Sandile Shezi, the forex master of South Africa, as his mentor. Just like his guru, Mootseng is making steady strides toward being an impending billionaire, and he is one of the wealthiest forex traders in Namibia.

Bosso Forex

Bosso is a successful forex trader in Namibia who shares his expertise with beginner traders through seminars.

How to Choose a Forex Broker in Namibia

Traders who have complete faith in their forex broker are free to focus all their energy, time, and attention on developing their trading techniques and increasing their chances of financial success.

For novice traders just getting started in the market, selecting a forex broker to work with is the first and most significant step.

When looking for a broker, there are various aspects to take into consideration. One of the most important is choosing a broker that offers competitive spreads, many markets to trade in, a demo account, and educational materials to assist traders in expanding their expertise.

When performing research on foreign exchange brokers, it is important to be sure to choose a broker that has a good reputation and is regulated in the country or region where the trading will take place.

A broker’s role in the foreign exchange market is critical information to have. Here are a few various kinds of forex brokers to get you started:

➡️ Market Makers – Instead of relying on liquidity providers to protect their clients’ holdings, Market Makers accept the risk themselves. In other words, a client’s loss is a broker’s gain, and the other way around.

➡️ STP – that the broker does not have to intervene when orders (trades) are carried out. Having a profitable customer base is good for the broker since they will trade more and be around for a longer period.

➡️ DMA – Direct Market Access (DMA) and Straight Through Processing (STP) resemble each other. In contrast to traditional brokers, those who use Straight Through Processing (STP) may immediately fulfil orders and mitigate their risks by using third-party liquidity providers. A DMA order goes directly to the exchange and is filled at a price set by the liquidity provider.

➡️ ECN – ECN brokers match buy and sell orders using an Electronic Communication Network that automatically pairs buyers and sellers.

Regulation and Authorization

In various countries, forex trading is governed uniquely, and the requirements for formal registration with the financial authorities might be highly stringent.

Regardless of whether you are a trader or an investor, you need to be sure that the brokerage firm you pick is regulated.

Most forex brokers opt to be registered in offshore jurisdictions, whilst some forex businesses want to remain in the country. Offshore legislation tends to be more lenient and simpler to follow.

Europe, the United Kingdom, the United States, Japan, and Australia are home to regulatory bodies that adhere to a basic approach and adhere to rigid rules.

A trader must have a complete awareness of the regulatory status of the brokerage firm or dealing desk with which they are working. A forex broker needs to have a regulated status so that prospective customers may form an opinion about the broker’s credibility.

Trading and Non-Trading Fees

An investor’s decision on which forex business to trade with might be influenced by the fees and commissions disclosed by the broker.

Data supply and regulation often need a cost. Factual expenses, which are based on trading volumes, frequency, and other account statistics, should be well understood by a trader.

To produce a unique solution, a trader must consider all the predicted fees and link them to the trading model that is being used. The difference between the price at which an asset is acquired and the price at which it is sold is referred to as the spread.

In most cases, the spread should be as narrow as possible for the trader’s benefit. Because of this, it is common to come across brokers advertising “low spreads.” The commission is another additional price that must be considered.

Numerous brokers make available a variety of account kinds, each of which is tailored to a certain trading strategy and comes with its own unique commission schedule.

For instance, one account may not charge a commission on trades but have wider spreads, whilst another account may have tighter spreads but charge a separate fee for the commission on each transaction.

This structure was developed so that the trader may choose the account type that is likely to function the best for their trading strategy while also having the lowest possible cost to them.

The use of swaps is another factor that traders who initiate and maintain currency positions overnight need to take into mind.

These kinds of transactions are subject to a cost that is referred to as a swap rate, and the value of this fee may either be positive or negative, depending on the currency pair that is being traded and whether the position is long or short.

Range of Markets

A great broker should provide clients with access to a diverse range of trading items to choose from. Traders must be aware that there are opportunities outside of trading currencies, even if currencies are their primary emphasis.

For example, traders may see a trading opportunity in oil, cryptocurrency, or the stock market that they want to take advantage of. It would be aggravating if they were unable to do so for the simple reason that their broker did not provide the product in question.

Look for a broker that, in addition to currencies, gives you access to commodities, stock indices, share CFDs, and cryptocurrency CFDs (Contracts for Differences).

Customer Support

Good client service is a must-have for every broker. Things may go wrong with every service, whether it is a platform outage, a price problem, a faulty account statement, or some other technological issue.

You need to know that the broker you are dealing with can be contacted and that you will get a swift response from them if anything goes wrong.

Many brokers provide round-the-clock customer service to meet the demands of their customers. In addition, the broker’s ability to support a wide range of languages is a barometer for the broker’s worldwide reach and suitability for the needs of traders from various cultural backgrounds.

The website of a broker should be informative enough to explain the most common problems that may arise during trading. An issue could be fixed and removed by the trader if it is communicated correctly.

Of course, not every situation will be covered in the FAQ section, so having dedicated support personnel on call to help traders at all hours is essential.

This is a suitable time to talk about the broker’s communication options, which include phone, live chat, email, and the name and position of the person in charge. Traders will benefit from knowing this information.

When trading on a demo account, the trader must assess the effectiveness of the broker’s assistance early on to minimize money losses. It is ideal to discover in advance the degree of expertise of the broker’s items.

Accounts and Features

Trading accounts may be divided into:

➡️ Nano – 100 units of the base currency

➡️ Micro – 1,000 units of the base currency

➡️ Mini – 10,000 units of the base currency

➡️ Standard – 100,000 units of the base currency

Traders must note the features that brokers offer on different accounts including the option for an Islamic or Swap-Free account, negative balance protection, minimum and maximum trading volumes, and so on.

Trade Execution and Overall Execution Policy

In a fast-moving market, execution speed is critical since it delivers more precise pricing. Because scalping tactics and automated trading systems (often referred to as “trading robots”) handle multiple transactions in a brief period, it is extremely critical for these traders.

Transactions that are executed merely a few milliseconds too late could result in a monetary loss for Namibian traders. Namibians must remember that the execution speed of a broker’s actual trading environment may differ from that of a demo account.

Education and Research

Brokers routinely provide education and research to assist their customers in becoming better traders.

From simple blog entries to e-books and courses to entire online academies and collaborations with specialized instructors, this may take many forms. The use of live seminars and online webinars to assist traders in their development is also common.

Trading Platform

Traders have the freedom to choose the gear and software that best fits their needs. Some traders prefer web-based tools, while others prefer desktop software.

Choosing the proper trading platform depends on the preferences of the trader. Clients looking to trade on a platform should be confident that it will not freeze or crash often amid global breaking news or events, that are likely to occur.

A trading platform should be quick and easy to use when it comes to placing and closing trades. Trading and controlling limits, stop-losses, and other parameters benefit from one-click operations. Additional tools and visualizations are also available on several platforms.

Deposit and Withdrawal Options and Speed

It is convenient to be able to make deposits and withdrawals from a trading account in a variety of ways.

Even while credit card deposits are often the most popular since they are fast and secure, some brokers also provide regionally specific choices for various regions (for example, P24 in Poland). Cryptocurrencies have been more popular as a method of making or withdrawing money in recent years.

Before You Start Trading, Read these Few Basics to Forex Trading

➡️ Trading of currencies takes place on a market called the foreign exchange market.

➡️ The ability to acquire goods and services both locally and beyond international boundaries is one reason why currencies are significant.

➡️ To conduct international commerce and business, currency conversion must first take place.

➡️ This international market is distinguished from other similar ones in that there is no one marketplace where foreign currency may be bought and sold.

➡️ Instead of taking place on a single centralized exchange, currency trading is now done electronically over the counter, often known as OTC for short.

➡️ All transactions take place between traders all over the globe via the use of computer networks.

➡️ Currencies are exchanged across the globe in the main financial capitals of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich.

➡️ The forex market operates twenty-four hours a day, five and a half days a week.

➡️ To carry out foreign exchange transactions, you must register an account with your bank or a regulated broker.

➡️ An investor can make a profit from the difference in interest rates offered by two distinct economies by purchasing the currency offering the greater rate of interest and selling short the currency offering the lower rate of interest.

➡️ People typically mean the spot market when referring to the foreign exchange market.

➡️ Companies who need to hedge their foreign currency risks out to a specified date in the future tend to be more interested in the forwards and futures markets since these markets provide greater flexibility.

➡️ Trading in the most essential underlying real asset for the forwards and futures markets, the spot market has traditionally been the most profitable type of foreign exchange trading. This is attributable to the fact that it deals in the currency itself.

➡️ A private contract between two parties to purchase a currency at a future date and a preset price in the over-the-counter markets is known as a forward contract.

➡️ A futures contract is a typical contract where two parties agree to accept the delivery of a certain currency at a future date and a specific price. Futures are not traded over the counter but on exchanges.

➡️ Buying and selling products and services outside of one’s own country exposes businesses to the risk of currency volatility. Forex markets provide the ability to hedge currency risk by setting an agreed-upon price for the transaction to be performed.

➡️ Daily volatility in the currency markets is caused by factors such as interest rates, trade flows, tourist demand, economic strength, and geopolitical risk.

20 Forex Terms You Must Know

Learning the language of forex is the best approach to get started. To help you get started, here are some definitions:

➡️ Forex Account – A forex trading account is used to conduct currency transactions. There are four sorts of forex accounts based on the magnitude of the trade, namely a Nano, Micro, Mini, and Standard Account.

➡️ Bid – The price at which you are prepared to sell a currency is referred to as its bid. A market maker in a certain currency is the entity that is accountable for consistently responding to buyer inquiries by placing bids.

➡️ Ask – The price at which a trader is willing to purchase a certain currency is referred to as the “ask” (or “ask price”), and this price is indicated by the word “ask.”

➡️ Bearish Market – The antithesis of a favourable market, the word “bear market” refers to the drop in the price of an asset, currency, or security. The phrase “bear market” may also be reduced to “bear,” and the adjective “bearish” is used to describe the status of the currency market while it is declining.

➡️ Bullish Market – This word denotes when the price of an asset, currency, or security rises, as opposed to falling. As with “bear market,” “bull market” is often abbreviated, so you can expect to hear the phrases “bull” and “bullish” used frequently.

➡️ CFD (Contract for Difference) – Namibians can speculate on currency price swings without holding the underlying asset via a contract for difference (CFD). Those who believe that the price of a certain currency pair will go up will invest in contracts for difference (CFDs) related to that currency pair, while those who believe that the price will go down would sell CFDs related to that currency pair.

➡️ Leverage – Traders might use leverage from forex brokers to increase their purchasing power. It allows the trader to deposit a little quantity of money while yet being able to exchange vast amounts of currencies. For example, a leverage of 1:100 means that a trader’s buying power is increased by 100 times.

➡️ Lot – The units of trade for currencies are called “lots.” The four most frequent sizes of lots are called standard, mini, micro, and nano, respectively. One hundred thousand units of the currency constitute a lot according to the industry standard. Mini lots are made up of 10,000 units of the currency, and micro-lots are made up of 1,000 units. Traders can also buy currencies in lesser amounts called “nano lots,” which are worth 100 units of the currency. The choice of lot size has a big effect on how much money the trade makes or loses overall. The bigger the size of the lot, the more money you can make (or lose), and vice versa.

➡️ Limit Order – “Margin” refers to the amount of money you need in your account to keep a position open.

➡️ Long/Short Position – This is the opposite of taking a short position when an investor looks to benefit from falling market prices by purchasing a base currency. A short position is the opposite of a long position since it takes advantage of a currency’s drop in market value. The trade is considered short when the base currency in the pair is sold.

➡️ Margin – A “margin” is the amount of money that must be in an account to keep a trade open.

➡️ Spread – The disparity between the purchase and sell prices of a currency is known as the bid/ask price difference. There are no commissions to be paid by forex traders; instead, they earn their money via the spreads they charge. Many variables have an impact on the magnitude of the spread. Position size, currency demand, and volatility are a few factors to consider.

➡️ Pip – “Percentage in point” is the smallest price change in currency markets, which is equivalent to four decimal points.

➡️ Base Currency – The first currency stated in a currency pair is known as the “base currency.”

➡️ Quote Currency – The second currency listed in any currency pair is always referred to as the “quote currency.”

➡️ Demo Account – A demo account is a forex trading account where virtual monies are used. This enables any trader to test the market by executing transactions in a setting that does not need the use of actual funds.

➡️ Exchange Rate – The exchange rate refers to the cost of exchanging one currency for another. The exchange rate is the foundation upon which the foreign exchange market is based.

➡️ Exposure – “Exposure” refers to the amount of capital invested in a currency and its related market risks.

➡️ Fundamental Analysis – Determining the influence of significant political and economic occurrences including unemployment rates, announcements of interest rate changes, and others, on the foreign exchange market. As a technique of predicting the future direction of the market according to their portfolios, traders do such analyses.

➡️ Technical Analysis – Investors employ technical analysis to estimate future currency market price fluctuations. This is achieved by analysing current and historical market data using trade indicators, charts, and other relevant tools.

Understanding Forex Charting (with examples)

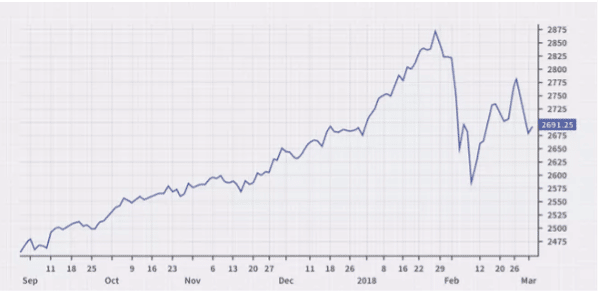

A forex chart is a graphical representation of the relative price movement of currency pairs across various timeframes. Charts are used by technical analysts and day traders to detect trends and other patterns that may suggest reversals, continuations, entry locations, and exits.

These are the three main chart types that Namibians will come across:

➡️ Line

➡️ Bar

➡️ Candlesticks

Line

Line charts are useful tools for determining broad patterns, such as those affecting a currency. Forex traders rely on these charts the most since they are the most fundamental and widespread sort of chart.

They show the last price that was traded for the currency within the timeframe that the user has entered. The trend lines that are drawn on a line chart may be used in the process of formulating trading strategies.

Bar

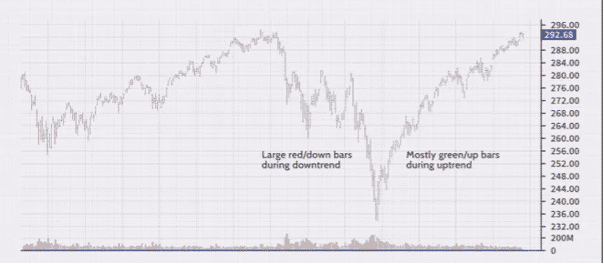

Bar charts are used to illustrate certain timeframes for trading, as they are in other contexts. Line charts, on the other hand, are more limited in what they can show.

One day of trading is represented by a single bar chart, which shows the OHLC (Opening, Highest, Lowest, and Closing) for each deal.

A trading day’s starting and closing prices are represented by dashes similarly. To signify price fluctuation, green or white might be utilized, whereas red or black can be used during periods of falling prices.

Candlesticks

Japanese rice merchants were the first to adopt candlestick charts in the eighteenth century. They are more visually appealing and easier to read than earlier chart types.

The top half of a candle indicates the opening price and maximum price point employed by a currency, while the bottom half indicates the closing price and lowest price point.

A down candle is coloured red or black to indicate dropping prices, whereas an up candle is coloured green or white to indicate increasing prices.

Using the patterns and shapes of candlestick charts, market direction and movement may be determined. Popular candlestick chart forms include the hanging man and the shooting star.

Effective Risk Management for Namibian Forex Traders

Individual steps that enable traders to safeguard against the downside of a deal are referred to as forex risk management. More risk implies a bigger likelihood of large profits, but it also means a greater potential for large losses.

Subsequently, being able to manage risk levels to reduce losses while maximising returns is a critical ability for every trader. Namibian traders can use the following fundamentals for effective risk management:

➡️ Risk Appetite

➡️ Position Size

➡️ Stop-Loss Orders

➡️ Leverage

➡️ Controlling Your Emotions

Risk Appetite

Proper forex risk management begins with determining your risk tolerance. The size of your position may wind up being too large if you do not know how much you are willing to lose. This might lead to losses that limit your capacity to take on the next transaction, or worse.

One to three per cent of your account balance should be your maximum risk tolerance for each transaction. Suppose you have $100,000 in your account, and your risk amount is $1,000-$3,000.

Position Size

Position sizing, or the amount of lots you buy or sell in a transaction, is critical since it protects your account while also increasing your upside potential. Your stop placement, risk percentage pip cost and lot size must all be taken into consideration when deciding on the size of your position.

Stop-Loss Orders

Another important idea in forex trading risk management is the use of stop-loss orders, which are established to end a deal when a specified price is achieved. If you know when you want to get out of a position, you can avoid potentially large losses.

Leverage

Traders can take on more risk by using leverage in the forex market, which increases the profit potential but also increases the danger. Subsequently, leverage must be handled with caution. Overall, traders should avoid employing high leverage ratios at all costs.

Controlling Your Emotions

When you are putting your money at risk in any financial market, you need to be able to control your emotions. You may be putting yourself in unnecessary danger if you allow your emotions to influence your judgments.

Maintaining a forex trading notebook or record may help you remove your emotions from the equation and trade objectively, rather than relying on your impulses.

Best Forex Strategies for Namibian Traders Revealed

The two most basic forms of foreign exchange transactions are known as long trades and short trades. The trader places their wagers on the value of the currency increases over time so that they may profit from the long-term trading approach.

A wager that the price of a currency pair will fall in the future is the basis of a short trade. A trader’s approach to trading may be fine-tuned by using technical analysis tactics like breakout and moving average. There are four other sorts of trading techniques based on the length and quantity of trades:

➡️ Scalping

➡️ Day Trading

➡️ Swing Trading

➡️ Position Trading

Scalping

Short-term trades are kept for a few seconds or minutes at the most, and profit amounts are limited to the number of pips gained. When making these kinds of deals, it is a clever idea to keep track of how much profit you have earned over a period.

Namibians cannot deal with elevated levels of volatility since they are dependent on price fluctuations being predictable. Consequently, traders try to restrict their employment of these methods to the busiest periods of the day and the currency pairs with the most liquidity.

Day Trading

Trades that last less than a day are known as day traders. A day trade might last for hours or just a few seconds. Day traders require a solid understanding of both technical analysis and several of the most important technical indicators to maximize their earnings.

As with scalping, the success of a day trader is dependent on little profits accrued during a single trading day.

Swing Trading

The trader in a swing trade keeps the position for days or weeks rather than just a single day. When governments make important pronouncements or when the economy is in turmoil, swing trading may be advantageous.

Because of the longer timeframes that are involved in swing trading, it is not necessary to always keep an eye on the market during the trading day. Swing traders should be able to assess the influence of economic and political changes on currency movement in addition to technical analysis.

Position Trading

If you are looking for a long-term investment strategy, a position trade is the way to go. Because it justifies the exchange, this kind of transaction requires fundamental analytical ability on the part of the parties involved.

An Introduction to Forex Brokers

It is necessary to provide a concise explanation of the market in which brokers function before we can comprehend what a broker is and what they accomplish in the industry.

What is the Role of a Forex Broker?

Because the currency market is decentralized, there is not a single exchange that all transactions must go through. This contrasts with other markets, such as the New York Stock Exchange and the London Stock Exchange, which are both centralized.

Instead, the foreign exchange market is based on something known as the interbank system, which is a worldwide network that consists of financial institutions trading currencies directly with one another.

The use of a broker is required for regular retail traders to get access to this network. Brokers provide services to traders, such as leveraged trading, and make it possible for traders to purchase and sell currency pairs.

How do Forex Brokers Make Money?

The spread, which is the difference between the purchase price and the sale price, as well as other costs, such as commission charges, are how brokers generate revenue.

The Importance of Market Sentiment in Forex Trading

Investors may use market sentiment to their advantage. You might profit from a shift in market sentiment by keeping an eye on where the market is headed. In financial markets, emotions are important, but making reasonable judgments based on them is difficult.

Even if you believe you can read the emotions of yourself and others, you could get disoriented if you attempt to grasp the collective mood of the group. Emotions and market sentiment are two different things.

When it comes to trading in financial markets, investors may take advantage of the fact that the markets are driven by human emotions.

For example, in stock trading, a company’s stock price may not always equal its book value because investors are looking beyond the fundamentals of the firm and pricing in their mood, which may be impacted by all sorts of factors.

There’s little doubt about the significance of mood in the markets, but it also underscores the need to incorporate it within a broader strategy that includes both technical and fundamental research.

To trade the market is one thing, but to understand market mood is quite another. To earn money while trading, you must utilize market sentiment as a tool to get an advantage over your competitors and execute deals ahead of the competition.

The Effects of Leverage in Forex Trading

One of the reasons so many individuals are drawn to trading forex as opposed to other financial products is that forex leverage is often significantly bigger than stock leverage. In the absence of transaction costs, the use of leverage does not affect success likelihood.

If you placed trades randomly, without any specific insight or ability, and aimed to capture gains of the same magnitude as your maximum stop loss, you would typically win 50 percent and lose 50 percent of the time.

This is reflected by the horizontal dashed line on the graph, which is independent of the leverage used.

This scenario is altered by transaction fees, which function as a barrier between you and a lucrative deal. Another way to express this is to argue that expenses tilt the odds against you. This adjustment in probabilities is negligible at most leverage levels.

However, when your leverage is so large that the margin backing your transaction is less than 10x to 20x your expenses, your likelihood of incurring a loss increases dramatically.

This is because expenses erode the sustaining margin, resulting in a significant chance of liquidation. This is simple to comprehend if you consider the most extreme scenario, in which your supporting margin and transaction expenses on trade are identical.

You would execute the deal, but the transaction charges would leave you with little margin to sustain your position. This would result in you being promptly closed out with a 100 percent likelihood every time, regardless of your trading style or market movement.

MetaTrader 4 VS MetaTrader 5

| 4️⃣ MetaTrader 4 | 5️⃣ MetaTrader 5 |

| MetaTrader 4 offers a user-friendly interface that most Namibian traders will find useful | The same UI design, but with more options, services, and benefits |

| Features a total of nine distinct timeframe | Features There are a total of 21 distinct timeframes |

| There are currently four unfulfilled orders (buy stop, buy limit, sell limit, sell stop) | Six Orders are Still Pending (buy stop, buy limit, buy stop limit, sell stop, sell limit, sell stop limit) |

| Features Hedging is possible using the MQL4 programming language | Features A Programming Language Called MQL5 allows for Hedging and Netting |

| Built-in indicators: 30, 2,000 Custom Indicators, 700 paid indicators | Offers 38 Indicators, 44 Analytical Objects, and unlimited charts are included. |

| Does not have the depth of the market | Market depth is offered |

| There is no economic calendar | Economic calendar is built-in |

| Google Chrome, Mozilla Firefox, Apple Safari, Internet Explorer, Opera, and Microsoft Edge are all supported browsers by WebTrader | Google Chrome, Mozilla Firefox, Apple Safari, Internet Explorer, Opera, and Microsoft Edge are all supported browsers by WebTrader |

| Desktop terminal provided for use on Windows Vista/7/8 and Mac OS X | Desktop terminal provided for use on Windows Vista/7/8 and Mac OS X |

| The App is available on both iOS and Android devices | Apple’s iOS and Android devices are supported by the app |

| Three Execution Types are available | Four execution types are supported |

| Trading on an exchange is not permitted | Namibians can participate in exchange trading |

| There are 1,024 different symbol combinations. | There are unlimited symbols offered |

| No Policies Regarding Partial Order Filling | There are several partial order filling policies |

| Fill or Kill is the order fill policy | The Policy for Order Filling is Fill, Kill, or Cancel Return |

| Restricted to Tables in Reports | Offers Immediately Tables and Charts in Reports |

| Zip compression is not available for the Time & Sales Exchange Data Log File | Included are data on the exchange of time and sales. Zip compression of log files is done automatically. |

| A total of 31 Graphical Objects are included in this collection | More than forty-four graphic objects |

| Single-Threaded Strategy Tester is an option. | A multi-currency Multi-Threaded Strategy Tester with actual ticks is available. |

| Attachments are not permitted, despite the availability of a robust email system. | Attachments may be sent by email using the comprehensive system. |

| Unicode is not multilingual | There is support for multilingual Unicode. |

| Transferring funds between accounts is not available. | Transfers between accounts are permitted. |

| There is no MQL5 community chat built into the software | The MQL5 community chat is integrated within the page. |

| Suitable for: People who are new to forex trading or those who want a more user-friendly platform | Suitable for: Namibian traders that require a wide range of options when it comes to their trading program. |

Best Forex Brokers in Namibia

We have carried out extensive research and tested several platforms to provide Namibians with the best brokers. Certain elements are highlighted according to the broker’s offering and other notable features are also noted.

Best MetaTrader 4 / MT4 Forex Broker in Namibia

Min Deposit

USD 0 / 0 NAD

Regulators

FSA, FCA, ASIC, DFSA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

66

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Axi is the best MT4 forex broker in Namibia. Axi offers Namibians commission-free accounts along with AutoChartist and free VPS Hosting. Beginners can use the comprehensive Axi trading academy to give them a boost in their forex trading journey.

Best MetaTrader 5 / MT5 Forex Broker in Namibia

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best MetaTrader 5 forex broker in Namibia. XM applies negative balance protection to all retail trading accounts. Namibian traders are not restricted in the trading strategies they decide to use with XM.

XM provides MT5 across several devices to ensure seamless account integration.

Best Forex Broker for beginners in Namibia

Min Deposit

250 USD / 4,700 NAD

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is the best forex broker for beginners in Namibia. IG has one of the largest financial instrument portfolios of more than 18,000 tradable items.

IG is known to have a transparent fee schedule and a well-regulated trading environment. Beginners have access to a plethora of educational materials and resources.

Best Low Minimum Deposit Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HF Markets is the best Low Minimum Deposit Forex Broker in Namibia. HF Markets only requires a 70 NAD ($5) minimum deposit to start trading global financial markets. HF Markets offers powerful trading platforms and an innovative proprietary trading app. A negative balance is automatically available to retail accounts.

Best ECN Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators