CM Trading Review

Overall CM Trading is considered low-risk with an overall Trust Score of 91 out of 100. CM Trading is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). CM Trading offers four different retail trading accounts namely a Bronze Account, a Silver Account, a Gold Account, and a Premium Account. CM Trading is currently not regulated by the Bank of Namibia.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD100/1,500 NAD

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

South African online forex broker CM Trading was established in 2012 and has since provided traders with strong and user-friendly trading platforms through which they can trade a broad selection of currency pairs and CFDs.

They provide a comprehensive range of innovative trading solutions to its worldwide, global clientele in addition to its primary strategy on the African continent. The broker offers innovative trading platforms and the highest levels of liquidity to all levels of traders.

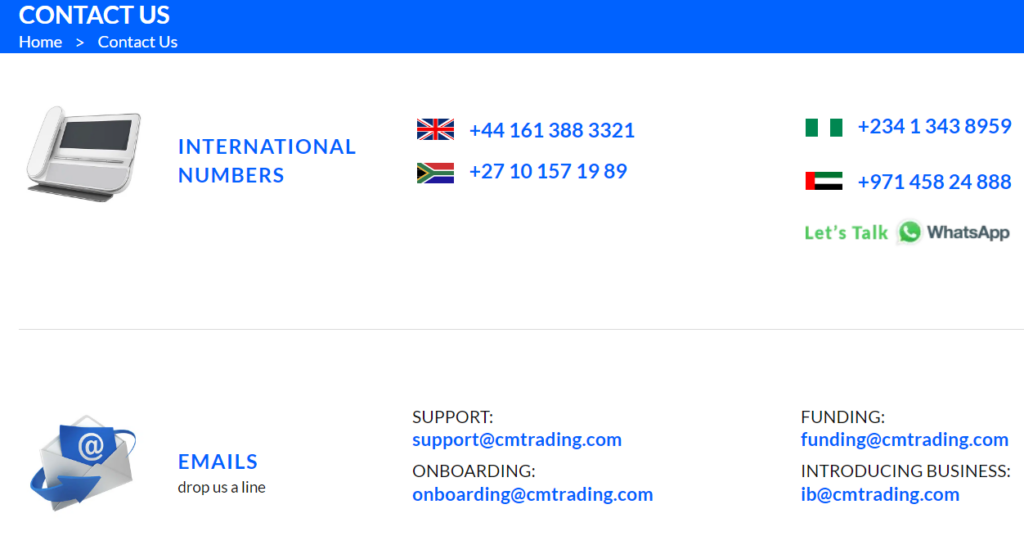

The provision of customer service that is tailored to meet specific requirements is at the heart of CM Trading’s business philosophy. Therefore, to make things as simple as possible for the client, they may contact by Live Chat, email, or one of the various international phone lines.

In addition, each trader may access a range of free educational resources, including e-books, technical analysis tools, and webinars, as well as a selection of training films.

This CM Trading review for Namibia will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

CM Trading accepts Namibian clients and has an average spread from 0.9 pips with zero commission charges. They have a maximum leverage ratio up to 1:200 and there is a demo and Islamic account available.

MT4, CM Trading (Web), CopyKat, Expert Advisors, and Trading App platforms are supported. CM Trading is headquartered in South Africa and is regulated by the FSCA and FSA.

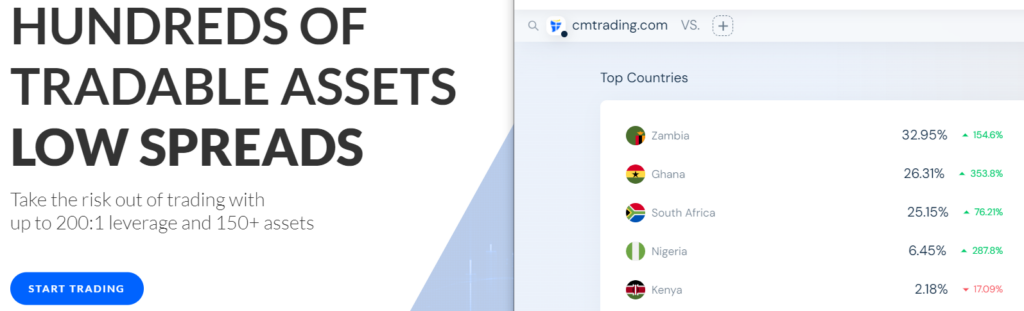

Distribution of Traders

CM Trading currently has the largest market share in these countries:

➡️️ Zambia – 32.95%

➡️️ Ghana – 26.31%

➡️️ South Africa – 25.15%

➡️️ Nigeria – 6.45%

➡️️ Kenya – 2.18%

Popularity among traders

🥇 CM Trading does not have a physical presence in Namibia. However, the broker has a large market share in other African countries, placing it in the Top 15 brokers that serve Namibian retail traders as well as institutional investors.

Where are most of CM Trading’s traders located?

The broker boasts a diverse global clientele, but a significant portion of their traders is located in regions like Africa and the Middle East. These regions have shown substantial growth in online trading activity in recent years.

Do CM Trading’s traders have varied trading strategies?

Yes, CM Trading’s traders employ a wide range of trading strategies. Some prefer day trading, while others opt for longer-term investment approaches. The platform accommodates traders with various strategies, offering tools and resources to support their individual preferences.

At a Glance

| 🏛 Headquartered | South Africa |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2012 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | FSA, FSCA |

| 🪪 License Number | • Seychelles – SD070 • South Africa – 2013/045335/07 and FSP 38782 |

| ⚖️ BoN Regulation | No |

| 🚫 Regional Restrictions | The United States, Hong Kong, Israel, EU regions |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | None Indicated |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.9 pips |

| 📞 Margin Call | From 20% |

| 🛑 Stop-Out | Unknown |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:200 |

| 🚫 Leverage Restrictions for Namibia? | No |

| 💰 Minimum Deposit (NAD) | $100/1,922 NAD |

| ✅ Namibian Dollar Deposits Allowed? | Yes |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based CM Trading customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank Wire Transfer • Bank Transfer • OZOW • Electronic Fund Transfer (EFT) • Skrill • Neteller • Credit Card • Debit Card • MPesa • Local Mobile Money • Cryptocurrencies |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • CM Trading Web • CopyKat • Expert Advisors • Trading apps |

| ✔️ Tradable Assets | • Currency trading • Stocks • Indices • Cryptocurrencies • Commodities • CFDs |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Arabic |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Namibian-based customer support? | No |

| ✅ Bonuses and Promotions for Namibians | No |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is CM Trading a safe broker for Namibians? | Yes |

| 📊 Rating for CM Trading Namibia | 8/10 |

| 🤝 Trust score for CM Trading Namibia | 91% |

| 👉 Open an account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Namibia

The broker is not regulated locally in Namibia but is well-regulated by other international market regulators that oversee and monitor CM Trading’s operations.

Global Regulations

The broker is well-regulated in South Africa and Seychelles as follows:

Client Fund Security and Safety Features

According to the broker, honesty and integrity are fundamental principles, and doing business openly and honestly while placing a premium on the safety and security of customers is of the utmost significance.

In addition to these laws, they store customer monies in accounts that are kept separate from the company’s general finances.

This helps guarantee that customer funds are not utilized for anything other than trading purposes. Clients must be able to withdraw their money wherever and whenever they see fit, therefore the funds must always be available.

Additionally, they use SSL security protocols to provide additional layers of safety.

Is CM Trading a regulated broker?

Yes, they are a regulated broker. They are licensed and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

How does the broker safeguard client funds?

They prioritize the safety of client funds by maintaining segregated accounts. Client funds are kept separate from the company’s operational accounts, reducing the risk of misappropriation.

Awards and Recognition

When traders join the market for the first time with the broker, CM Trading takes great delight in providing them with a trading experience that is individualized to meet their specific requirements and skillsets.

The broker provides its customers with individualized instructional packages in addition to the most innovative technical solutions to guarantee that their trip is both risk-free and rewarding.

Throughout its history, they have been honoured with several accolades, both for its outstanding performance and the quality of the services it provides.

The acknowledgement that the broker received from these accolades serves as motivation for the company to work toward achieving even greater heights and to keep improving the quality of its one-of-a-kind services.

Some of CM Trading’s latest awards are as follows:

Has the broker received any industry awards?

Yes, the broker has received several industry awards for its services. These awards are a testament to their commitment to excellence in online trading. They have been recognized by various organizations for their quality offerings and customer-centric approach.

Can you provide examples of awards received by them?

The have received awards in categories such as “Best Trading Experience” and “Best Financial Broker.” These accolades acknowledge their efforts to provide traders with exceptional trading conditions, innovative platforms, and top-notch customer support.

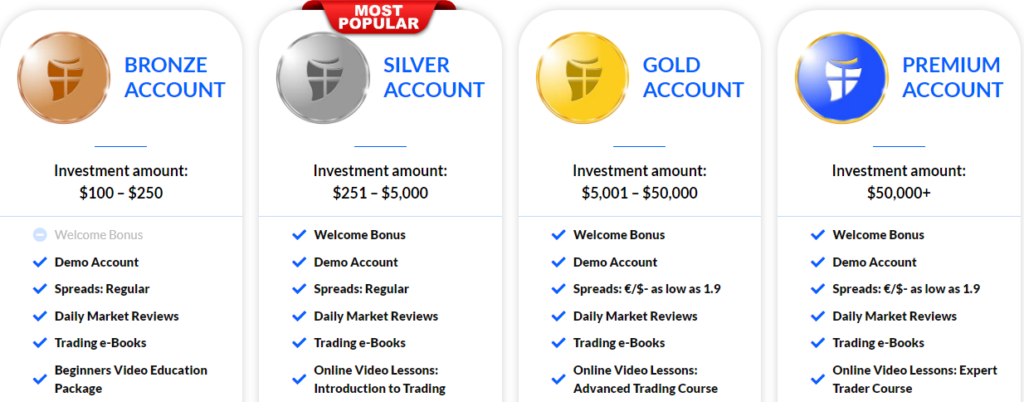

Account Types and Features

Individual investors can take advantage of some of the most favourable trading circumstances available on the market with the broker.

These conditions are offered across four distinct accounts. Traders from around the world and from diverse backgrounds will have different criteria and ambitions, which is why the broker provides so many kinds of accounts to choose from.

➡️ Bronze Account

➡️ Silver Account

➡️ Gold Account

➡️ Premium Account

Bronze Account

This is the most basic form of account that the broker has to offer, and it provides Namibian traders with some of the most fundamental features, including the following:

| Account Feature | Value |

| 💰 Minimum Deposit | $100/1,922 NAD |

| 📊 Spreads from | Regular spreads |

| ✔️ Demo Account | Yes |

| ✍️ Market Reviews | Yes |

| 📚 Trading e-Books | Yes |

| 🚨 Beginners Video Education Package | Yes |

| 👉 Open an account | 👉 Open Account |

Silver Account

This kind of account is quite popular because, in addition to providing several additional advantages and benefits, it also provides more competitive trading conditions, risk-free trading, and live trading signals.

| Account Feature | Value |

| 💰 Minimum Deposit | $251/4,824 NAD |

| 📈 Welcome Bonus | Yes |

| ✔️ Demo Account | Yes |

| 📊 Spreads from | Regular |

| ✍️ Market Reviews | Yes |

| 📚 Trading e-Books | Yes |

| 🚨 Online Video Lessons | Yes |

| ✔️ Risk-Free Trades offered | 1 Risk-Free Trade |

| 👥 Session With Market Analyst | Yes |

| 🚨 Live Webinars with Senior Trading Strategist | Yes |

| 📈 Social Trading | Yes |

| 👉 Open an account | 👉 Open Account |

Gold Account

This is a more sophisticated account than others that came before it, and as a result, it offers improved trading conditions. Because of this, the Gold Account is ideal for day traders, big volume traders, scalpers, and a variety of other trading methods that are common in Namibia.

| Account Feature | Value |

| 💰 Minimum Deposit | $5,001/96,119 NAD |

| ✔️ Demo Account | Yes |

| 📊 Spreads from | as low as 1.9 |

| ✍️ Market Reviews | Yes |

| 📚 Trading e-Books | Yes |

| 🚨 Online Video Lessons | Yes |

| ✔️ Risk-Free Trades offered | 3 Risk-Free Trade |

| 👥 Dedicated Market Analyst | Yes |

| 🚨 Live Webinars with Senior Trading Strategist | Yes |

| 📈 Social Trading | Yes |

| ✔️ Live Trading Signals by Trading Central | Yes |

| 💸 Market Analysis by Trading Central | Yes |

| 📊 Cash Back Rebate | Yes |

| ✍️ ECN Account | Yes |

| 👉 Open an account | 👉 Open Account |

Premium Account

This is the option that is reserved for experienced traders who deal in significant numbers and who are fluent in managing the risks associated with their trading. This sort of account is the most advantageous since it enables traders to take advantage of the greatest perks and the most favourable trading circumstances.

| Account Feature | Value |

| 💰 Minimum Deposit | $50,000/961,000 NAD |

| ✔️ Welcome Bonus | Yes |

| 📱 Demo Account | Yes |

| 📊 Spreads from | as low as 1.9 |

| ✍️ Market Reviews | Yes |

| 📚 Trading e-Books | Yes |

| 🚨 Online Video Lessons | Yes |

| ✔️ Risk-Free Trades offered | 3 Risk-Free Trade |

| 👥 Dedicated Market Analyst | Yes |

| 🚨 Live Webinars with Senior Trading Strategist | Yes |

| 📈 Social Trading | Yes |

| 💸 Live Trading Signals by Trading Central | Yes |

| ✔️ Market Analysis by Trading Central | Yes |

| 💵 Cash Back Rebate | Yes |

| 📊 ECN Account | Yes |

| 👨💻 Customized Account | Yes |

| 🤝 Access to Trading Room | Yes |

| 🛍 Special offers | Yes |

| 👉 Open an account | 👉 Open Account |

Base Account Currencies

Traders can deposit in either Euros or US Dollars using the client site. Clients who want to fund their accounts using currencies other than the US Dollar, such as the Namibian Dollar, will be subject to a margin requirement calculated based on CM Trading’s established rate of exchange.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and the broker offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

When you trade with them, you must sign up for a live account before you can start a demo account. Once registered, you should obtain your login credentials within the same day. The demo account is preloaded with 10,000 USD in virtual funds and if you need more, you can request a top-up from the broker.

With CM Trading’s demo account, you can examine charts, news, and analysis, as well as have access to the fully-featured MT4 and MT5 platforms and experience real-time pricing and actual forex market volatility.

Islamic Account

The broker is a completely Sharia-compliant Islamic forex broker that adheres to all the principles of Islamic law and Islamic finance. They make it possible for Muslim investors to trade without having to pay swap fees or interest on overnight holdings by offering swap-free trading accounts.

Traders who are Muslim and who use an Islamic swap-free account are restricted to only being able to access financial products and instruments that comply with Sharia. Subsequently, cryptocurrencies and stocks are not available for trading.

What types of trading accounts does the broker offer?

CM Trading offers several types of trading accounts, including Bronze, Standard, and Premium accounts. Each account type comes with varying features and benefits, allowing traders to choose one that suits their trading preferences and experience level.

What features can I expect with a CM Trading account?

CM Trading accounts offer a range of features, including access to a wide variety of financial instruments such as forex, commodities, and indices. Traders can also benefit from competitive spreads, leverage options, and educational resources to enhance their trading experience.

Min Deposit

USD100/1,500 NAD

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

How to open an Account

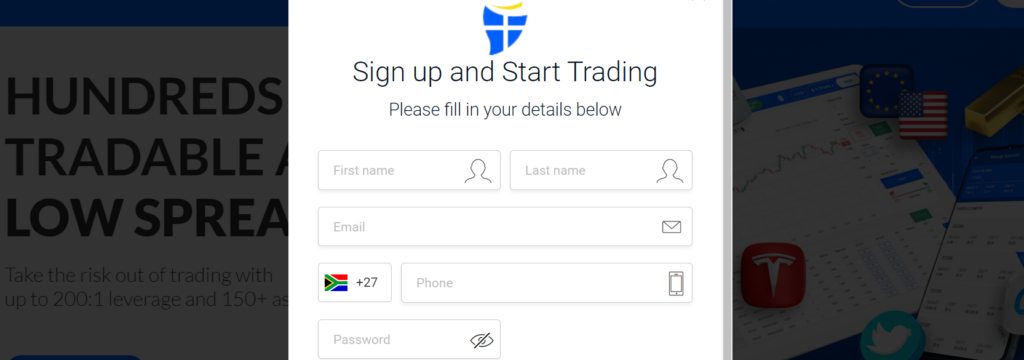

To register an account with them, Namibian traders can follow these steps:

Step 1 – Go to the official CM Trading website

➡️ Go to www.cmtrading.com and click on “Sign Up” in the top left corner.

Step 2 – Fill Out Your Personal Details

➡️ Fill out your personal details and click on “Submit”

Step 3 – Verify Your Account

➡️ Your account has now been created. Click on your name in the top right corner, and click on “Verify Centre” to verify your account.

CM Trading Vs Tickmill Vs AvaTrade – Broker Comparison

| CM Trading | Tickmill | AvaTrade | |

| ⚖️ Regulation | FSA, FSCA | FSA, FCA, DFSA, CySEC, Labuan FSA, FSCA | CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 📱 Trading Platform | MetaTrader 4, MTrading Webtrader, CopyKat, Expert Advisors, trading apps. | MetaTrader 5, MetaTrader 4, WebTrader, Tickmill Mobile App | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | $100/1,922 NAD | $100/1,922 NAD | $100/1,922 NAD |

| 📈 Leverage | 1:200 | 1:500 | 1:30 (Retail) 1:400 (Pro) |

| 📊 Spread | From 0.9 pips | 0.0 pips | Fixed, from 0.9 pips |

| 💰 Commissions | None | 2 per side per 100,000 traded | None |

| ✴️ Margin Call/Stop-Out | From 20% | 100% / 30% | 25%/10% |

| ✴️ Order Execution | Market | Market | Instant |

| 💳 No-Deposit Bonus | Yes | Yes | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Bronze Account, Silver Account, Gold Account, Premium Account. | Pro Account, Classic Account, VIP Account | Standard Live Account, Professional Account Option |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | No | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 3 | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

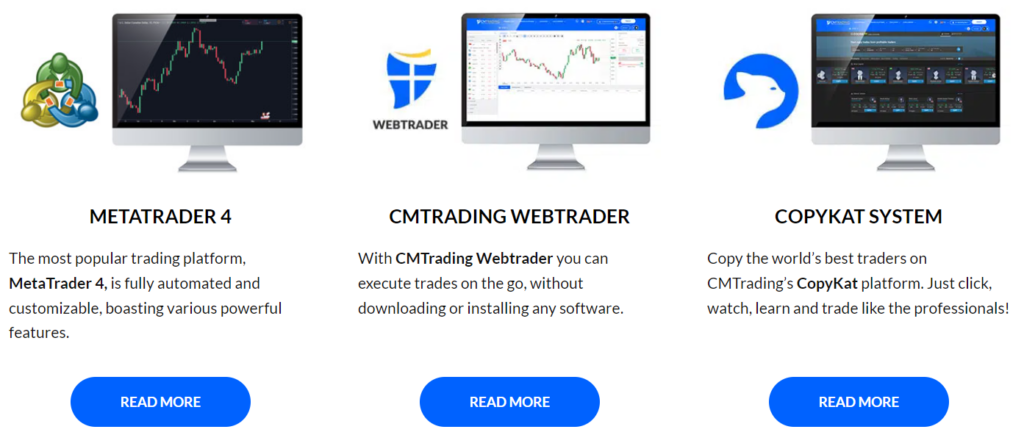

Trading Platforms

The broker offers Namibian traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ CM Trading Web

➡️ CopyKat

➡️ Expert Advisors

➡️ Trading apps

Desktop Platforms

➡️ MetaTrader 4

➡️ Expert Advisors

MetaTrader 4

MetaTrader 4 (MT4) is the world’s most advanced and commonly used trading platform. MetaTrader4 is the best platform for Namibian traders, whether they are beginners or seasoned traders. It is easy to use at all levels and does exactly what traders want it to do.

Each MT4 platform also comes with a MetaEditor. The MetaEditor is the compiler for MQL’s proprietary programming language and can be used to create expert advisors, technical indicators, and a wide range of other tools.

Expert Advisors

For traders who do not know how to program or do not want to construct their own EA strategies, MetaTrader 4 comes pre-loaded with two EAs. Additional EAs may be accessed through a link in MT4 on the MQL user site.

WebTrader Platforms

➡️ MetaTrader 4

➡️ CM Trading Web

➡️ CopyKat

➡️ Expert Advisors

MetaTrader 4

The MetaTrader 4 platform from the broker is the finest alternative for any trading strategy. It not only provides all the required support and tools for EA trading, but it also allows for trading tactics like hedging and scalping. These elements are required for using Technical Analysis to execute trades quickly and efficiently.

CM Trading Web

CM Trading WebTrader is a huge advantage for currency traders since it allows them to trade without having to download or install any software from their mobile devices such as smartphones and tablets.

CM Trading’s WebTrader allows traders to effortlessly access a wide selection of currencies and markets with just a single click, and it works with a variety of Internet browsers.

CopyKat

With CMTrading’s CopyKat, Namibian traders may observe, learn, and copy the advanced methods of successful traders. Regardless of the trader’s degree of expertise, they can start trading like professionals in minimal time.

Expert Advisors

Finally, Expert Advisors are used to automate trading on the MetaTrader 4 platform (EA). EAs are created using the MQL programming language, which was created exclusively for automated trading.

Trading App

➡️ MetaTrader 4

Namibian traders can simply use all the newest trading capabilities with MetaTrader 4’s app. It is very versatile and portable and, subsequently, the MT4 mobile trading option enables investors to use their tablets and smartphones to access the trading platform.

The trading platform, as well as the management of multiple trading accounts, may be accessible from anywhere in the globe at any time.

Range of Markets

Namibian traders can expect the following range of markets from CM Trading:

➡️ Currency trading

➡️ Stocks

➡️ Indices

➡️ Cryptocurrencies

➡️ Commodities

➡️ CFDs

Which trading platforms are available at CM Trading?

The broker provides traders with access to the popular MetaTrader 4 (MT4) platform, known for its advanced charting tools, technical indicators, and automated trading capabilities. This platform is available for both desktop and mobile devices, offering flexibility in trading.

Can I trade using a mobile device?

Yes, the broker offers mobile trading capabilities through the MetaTrader 4 (MT4) mobile app. This allows traders to execute trades, monitor the markets, and manage their accounts conveniently from their iOS or Android mobile devices.

Broker Comparison for Range of Markets

| AvaTrade | JustForex | XM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | Yes |

Min Deposit

USD100/1,500 NAD

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Non-Trading and Trading Fees

Spreads

The spreads traders could expect from CM Trading will be decided by their trading activity, the retail investor accounts they use, and current market conditions. Traders should expect the following minimal spreads on their trades:

➡️ Bronze Account – Regular spreads

➡️ Silver Account – 1.2 pips EUR/USD

➡️ Gold Account – from 0.9 pips EUR/USD

➡️ Premium Account – from 0.9 pips EUR/USD

Commissions

Because the broker costs are already included in the spreads that Namibian traders pay, the broker does not charge any commission fees on transactions.

Overnight Fees, Rollovers, or Swaps

When the trading day is complete, Namibian traders should liquidate their positions as quickly as possible to avoid incurring overnight charges. When faced with overnight fees, these are calculated depending on the size of a trader’s current position, the kind of financial instrument that the trader is trading, and their current position.

Typically, CM Trader calculates overnight fees by dividing the duration of the position by the number of nights. This is then multiplied by the swap (whether buy or sell), multiplied by the number of lots (or position size) and multiplied by the financial instrument’s point value.

Based on this, traders can either expect to pay fees, or they can expect to be credited fees.

Deposit and Withdrawal Fees

In terms of deposit fees, Namibian traders are charged a fee when they deposit funds using crypto wallets. When Namibian traders withdraw funds, they can expect the following fees:

➡️ Bank Wire Transfer – 2%

➡️ Bank Transfer – 2%

➡️ OZOW – 2%

➡️ Electronic Fund Transfer (EFT) – 2%

➡️ Skrill – 2%

➡️ Neteller – 2%

➡️ Credit Card – 2%

➡️ Debit Card – 2%

➡️ MPesa – 2%

➡️ Local Mobile Money – 2%

➡️ Cryptocurrencies – 4%

Inactivity Fees

The broker charges an inactivity fee of $15 once a trading account has become dormant after three consecutive months. This fee goes towards account maintenance and administration and will be applied every month that the version remains inactive.

Currency Conversion Fees

Traders who deposit and withdraw funds in currencies other than EUR or USD will face currency conversion fees.

Are there any non-trading fees associated with the broker’s accounts?

They do not charge non-trading fees like account maintenance fees or inactivity fees. However, it’s essential to review their fee structure and any potential changes in fees as part of your account agreement.

What are the trading fees for CM Trading?

They primarily generate revenue through spreads, which are the differences between the buy (ask) and sell (bid) prices of financial instruments. While they do not charge commissions on trades, spreads can vary depending on the account type and the specific asset being traded. It’s advisable to check the spreads for your chosen instruments in CM Trading’s trading conditions.

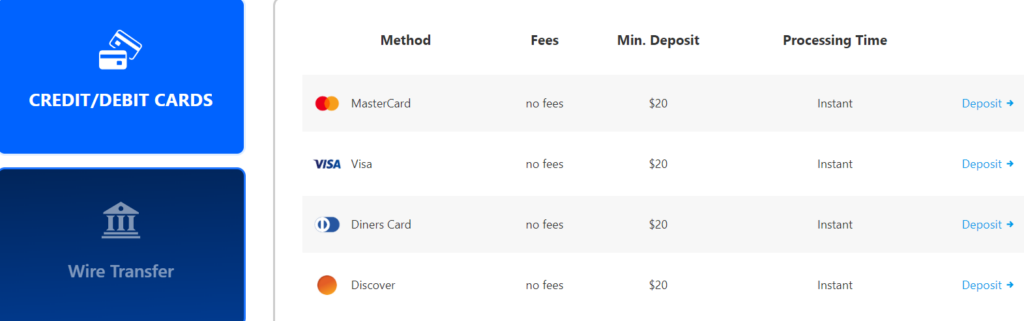

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

➡️ Bank Wire Transfer

➡️ Bank Transfer

➡️ OZOW

➡️ Electronic Fund Transfer (EFT)

➡️ Skrill

➡️ Neteller

➡️ Credit Card

➡️ Debit Card

➡️ MPesa

➡️ Local Mobile Money

➡️ Cryptocurrencies

How to Deposit Funds

To deposit funds to an account with them, Namibian traders can follow these steps:

Step 1 – Go to the CM Trading website and log in.

➡️ Go to the official CM Trading website at www.cmtrading.com and log into your account.

Step 2 – Click on “Deposit”

➡️ In the top right corner of your screen, click on “Deposit”.

Step 3 – Deposit Your Funds

➡️ Choose your method to deposit the funds into your account and make the deposit.

Fund Withdrawal Process

To withdraw funds from an account with them, Namibian traders can follow these steps:

Step 1 – Go to the CM Trading website and log in.

➡️ Go to the official CM Trading website at www.cmtrading.com and log into your account.

Step 2 – Click On Your Account Name

➡️ Click on your account name in the top right corner.

Step 3 – Click “Withdraw”

➡️ Click on “Withdraw” in the dropdown menu and withdraw your funds.

How can I deposit funds into my account?

The broker offers various convenient methods for depositing funds, including bank wire transfers, credit/debit cards, and popular e-wallets like Neteller and Skrill. To make a deposit, log in to your CM Trading account, navigate to the ‘Deposit Funds’ section, and follow the instructions for your chosen payment method.

What is the withdrawal process?

To initiate a withdrawal from your account, log in to your account, visit the ‘Withdraw Funds’ section, and complete the withdrawal request form. The funds are typically returned to the source of the original deposit. Withdrawals are processed efficiently, and the time it takes for the funds to reach your account may vary depending on your chosen withdrawal method and your location.

Education and Research

Education

The broker offers the following Educational Materials:

➡️ eBooks

➡️ Training Videos

➡️ Webinars

➡️ Live Seminars

Research and Trading Tool Comparison

They also offer Namibian traders the following additional Research and Trading Tools:

➡️ Daily Market Reviews

➡️ Trading Signals

➡️ Economic Calendar

➡️ Calculators

➡️ Fundamental Analysis

➡️ Technical Analysis

What educational resources does the broker offer to traders?

They provide a comprehensive range of educational materials to support traders at all levels. These resources include video tutorials, webinars, e-books, and informative articles covering various aspects of trading, from beginner to advanced topics.

Is there a cost associated with CM Trading’s educational materials?

No, the broker’s educational resources are typically provided to traders at no extra cost. They are designed to help traders enhance their skills and knowledge, regardless of their experience level. These resources are readily accessible on the CM Trading website, making it convenient for traders to access valuable information to improve their trading strategies.

Bonuses and Promotions

The broker does not currently offer Namibian traders any bonuses or promotions.

How to open an Affiliate Account

To register an Affiliate Account, Namibians can follow these steps:

➡️ Prospective affiliates can visit the CM Trading website and hover over the “Our Company” tab on the homepage.

➡️ From here, hover over “Partnerships” and click on “Learn More” under “Starting an Introducing Business.”

➡️ Read through the partnership program offered by CM Trading, especially the terms and conditions and the agreement, and click on the “Become a Partner” banner to start the application.

➡️ Complete the secure application form and submit it to CM Trading for review.

➡️ Once approved, you can log into your affiliate portal and start accessing marketing materials to start attracting clients.

Affiliate Program Features

The broker offers a comprehensive variety of affiliate and partner services, including:

➡️ Quick pay-outs

➡️ Transparency

➡️ Dedicated customer service and support

➡️ A personal manager

➡️ An FSCA and FSA-regulated environment

➡️ Attractive and flexible commission schemes

➡️ Localized marketing material

➡️ A high conversion rate

The following tiers of CM Trading’s customer loyalty program are available:

➡️ The Bronze level includes an IB starter kit and free webinar hosting. This level also includes a competitive strategy as well as a certificate of achievement.

➡️ Silver-level members get a dedicated business developer, marketing cash, and promotional materials in addition to the Bronze-level benefits.

➡️ The Gold tier includes extra commissions, personalized marketing material, unique business cards, and custom-built websites.

➡️ Platinum is the highest tier, with unrestricted access to unique tools, promotions, professional assistance, financial advice, and personal customer service from knowledgeable, experienced staff.

How can I become an affiliate?

To become an affiliate, you can sign up for their affiliate program through their official website. Once you’re registered, you’ll gain access to marketing materials, tracking tools, and support to help you promote CM Trading’s services and earn commissions for referred clients.

What kind of commissions can I earn as an affiliate?

The broker offers competitive commission structures for their affiliates. The specific commission rates and structures may vary, and they often depend on factors such as the number of referred clients and their trading activity. You can find detailed information about the commission plans and potential earnings by contacting CM Trading’s affiliate support team or referring to their affiliate program documentation.

Customer Support

The broker can be contacted 25 hours a day, 5 days a week via several communication channels including live chat, telephone, and email address.

How can I contact the broker’s customer support?

The broker provides multiple channels for contacting their customer support team. You can reach them through phone, email, or by using the live chat feature on their website. Their dedicated support staff is available during market hours to assist you with any trading-related inquiries or issues.

What languages does the broker’s customer support team speak?

Their customer support team is proficient in multiple languages to cater to their diverse global clientele. Whether you prefer to communicate in English, Spanish, French, German, Italian, or another supported language, you can expect effective and seamless communication when reaching out to their team for assistance.

Corporate Social Responsibility

The broker is actively involved in giving back to the community as part of dedicated Corporate Social Responsibility (CSR) initiatives. They support talented kids who show potential in sports through the Accelerate Futbol social soccer team.

Does the broker engage in corporate social responsibility initiatives?

Yes, they are committed to corporate social responsibility (CSR). They actively participate in various initiatives aimed at giving back to communities and promoting social and environmental sustainability. These initiatives can include charitable donations, community outreach programs, and environmentally friendly practices within the company.

How can I learn more about their corporate social responsibility efforts?

To learn more about the broker’s CSR initiatives and their commitment to making a positive impact, you can visit their official website. They often provide details about their latest CSR activities, partnerships with charitable organizations, and efforts to reduce their environmental footprint.

Verdict

They are one of South Africa’s major online Forex and CFD providers. Trading is available on four active commission-free accounts, with customers receiving a free MT4 platform download and the CM WebTrader system, as well as an intriguing choice of trading tools.

Min Deposit

USD100/1,500 NAD

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a decent range of instruments offered by CM Trading, spread over several markets | There is no NAD-denominated account, which subjects Namibian traders to currency conversion fees |

| There are user-friendly and powerful trading platforms offered | There are deposit and withdrawal fees charged |

| CM Trading offers commission-free trading, with the broker fee worked into the spread | There are inactivity fees charged on dormant accounts |

| There is a daily market analysis offered to help inspire trade ideas for Namibian traders | NAD deposits and withdrawals are not offered |

| There is a decent selection of educational material offered to beginner Namibian traders | |

| CM Trading supports copy trading | |

| There is an Islamic account offered to Muslim traders | |

| CM Trading has an excellent customer support and is a well-regulated, high trust broker |

you might also like: AvaTrade Review

you might also like: Exness Review

you might also like: HF Markets Review

you might also like: Oanda Review

you might also like: Octafx Review

Frequently Asked Questions

What is the withdrawal time?

The withdrawal time with them ranges from instant withdrawals and can take up to 10 working days on some withdrawal methods.

Can CM Trading trade for me?

No, they cannot trade on your behalf. However, the broker has dedicated customer support that can help traders through the process of trading by providing training.

Is CM Trading an ECN broker?

Yes, CM Trading is an ECN forex broker.

Is CM Trading regulated?

Yes, CM Trading is regulated in South Africa and Seychelles by FSCA and FSA, respectively.

Does CM Trading have Nasdaq?

Yes, CM Trading offers Nasdaq under “NSDQ” or “USTECH” and it can be traded with leverage up to 1:50.

What is the minimum deposit for CM Trading?

The minimum deposit for CM Trading is 1,500 NAD or an equivalent of $100.

Does CM Trading have a no-deposit bonus?

No, CM Trading does not currently offer any bonuses.

Is CM Trading safe or a scam?

CM Trading is a safe broker that has a high trust score and Tier-2 and Tier-3 regulations.

Does CM Trading have Volatility 75?

Yes, CM Trading offers Volatility 75 under “VIX” as a CFD on Indices.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with CM Trading?

➡️ What was the determining factor in your decision to engage with CM Trading?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with CM Trading such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

#1

Read Review

ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA

$100

#2

Read Review

CySEC, FSA, FCA, FSC, FSCA, CMA

$10

#3

Read Review

FSC, DFSA, CySEC, ASIC, CMA

$5

#4

Read Review

FSA, CySEC, FSCA, FSC

$1

#5

Read Review

CySEC, FSCA, FCA, FSA, DFSA, CMA, St. Vincent & the Grenadine

$0

#6

Read Review

CySEC, ASIC, FSCA

$100

#7

Read Review

FSCA, FSC, FSA

$10

#8

Read Review

SVGFSA

$5

#9

Read Review

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

$10

#10

Read Review

FSCA, FSA

$5

#1

$100

Minimum Deposit

#2

$10

Minimum Deposit

#3

$5

Minimum Deposit

#4

$1

Minimum Deposit

#5

$0

Minimum Deposit

#6

$100

Minimum Deposit

#7

$10

Minimum Deposit

#8

$5

Minimum Deposit

#9

$10

Minimum Deposit

#10

$5

Minimum Deposit