Exness Review

Overall Exness is considered low-risk, with an overall Trust Score of 97 out of 100. Exness is licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and four Tier-3 Regulators (low trust). Exness offers five different retail trading accounts namely a Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, and Pro Account. Exness offers a minimum deposit of USD 10 / 160 NAD.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overview

The broker accepts Namibian clients and has an average spread from 0.0 pips with commissions from $0.1 per lot, per side. Exness has an unlimited maximum leverage ratio and there is a demo and Islamic account available. MT4, MT5, and Exness platforms are supported. They are headquartered in Cyprus and regulated by FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA.

Exness is the brand name of a worldwide brokerage business that operates out of two major offices in Seychelles and is a member of the Cyprus Brokers Association.

The brokers’ divisional structure enables worldwide clients to benefit from personalized financial services and investment solutions, while the global brand opens a wide range of opportunities for retail and principally corporate solutions or collaborations, as well as corporate alliances.

The EU-based corporation in Cyprus provides fully regulated services to members across the European Economic Area (EEA) and the rest of the globe.

Furthermore, Exness expanded its worldwide reach by establishing a subsidiary in the United Kingdom, Exness UK Ltd, which is likewise appropriately and completely regulated as well.

They have won numerous awards as a retail broker because it provides stable and reliable brokerage services, as well as a comfortable trading environment tailored to the needs of the most demanding traders.

The trading process is handled using the user-friendly MT4 platform, which offers the ability to trade a variety of CFDs and Futures contracts on a variety of marketplaces.

This Exness review for Namibia will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

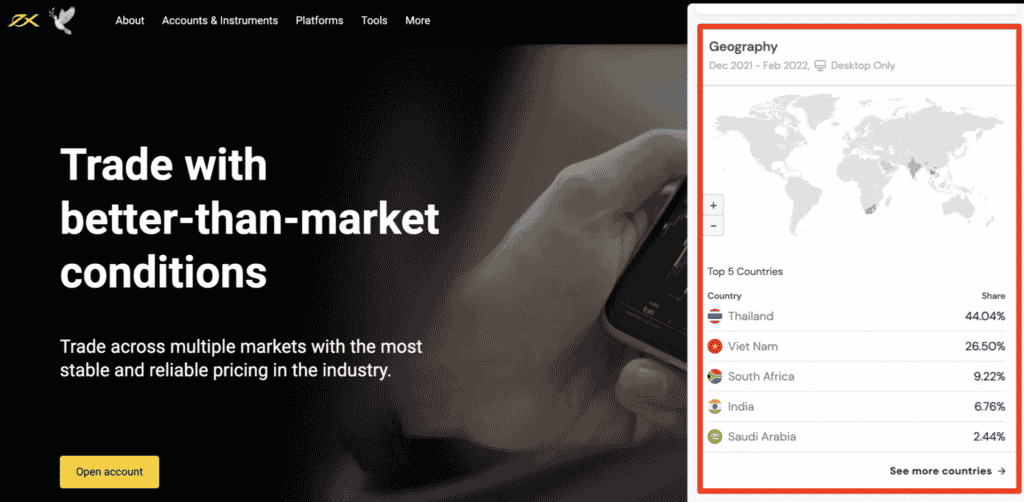

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among traders

How does Exness distribute its traders?

Exness distributes its traders across multiple trading accounts and platforms, allowing them to choose the account type that best suits their trading preferences and strategies. This includes options like Standard, Raw Spread, and Pro accounts, each designed to provide different trading conditions and benefits.

Can I change my trader distribution?

Yes, traders have the flexibility to change their distribution by selecting a different account type or platform that aligns with their evolving trading needs. This allows you to adapt to varying market conditions and optimize your trading experience.

At a Glance

| 🏛️ Headquartered | Cyprus, with offices in United Kingdom, Seychelles, South Africa, the British Virgin Islands, and Curaçao |

| 🏛️ Local office in Windhoek? | No |

| 👍 Accepts Namibian Traders? | Yes |

| 📅 Year Founded | 2008 |

| 📱 Namibian Office Contact Number | None |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 🔎License Number | Seychelles – SD025 Curaçao – 0003LSI British Virgin Islands – SIBA/L/20/1133 Mauritius – GB20025294 South Africa – FSP 51024 Cyprus – 178/12 United Kingdom – 730729 |

| ⚖️ BoN Regulation | None |

| ✴️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 📈 Demo Account | Yes |

| 📈 Retail Investor Accounts | 5 |

| 🚀 Offers a NAD Account? | No |

| 💻 Dedicated Namibian Account Manager? | No |

| 📈 Maximum Leverage | Unlimited |

| 📈 Leverage Restrictions for Namibia? | No |

| 💳 Minimum Deposit (NAD) | 187 NAD or an equivalent to $10 |

| 💳 Namibian Dollar Deposits Allowed? | Yes |

| 💰 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based Exness customers | Unknown |

| 💰 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💳 Deposit and Withdrawal Options | Bitcoin Debit Card Credit Card Internet Banking Skrill Neteller Perfect Money Tether (USDT OMNI) WebMoney Mybux Ozow |

| 💰 Segregated Accounts with Namibian Banks? | No |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Tradable Assets | Forex Metals Crypto Energies Indices Stocks |

| 🌐 Offers USD/NAD currency pair? | No |

| 🌐 USD/NAD Average Spread | N/A |

| 📈 Offers Namibian Stocks and CFDs | No |

| 👨💼 Languages supported on Website | English, French, Indonesian, Portuguese, Spanish, Vietnamese, Arabic, Thai, Chinese (Simplified), Japanese, Korean, Urdu, Bengali, Hindi |

| 👥 Customer Support Languages | Multilingual |

| 👥 Customer Service Hours | 24/7 |

| 👥 Namibian-based customer support? | No |

| 💰 Bonuses and Promotions for Namibians | None |

| ✴️ Education for Namibian beginners | No |

| 📊 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✔️ Is Exness a safe broker for Namibians? | Yes |

| ✔️ Rating for Exness Namibia | 8/10 |

| ✔️ Trust score for Exness Namibia | 97% |

| 👉 Open an account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Namibia

The broker is currently not regulated locally in Namibia by the Bank of Namibia, the official market regulator for the derivatives market and financial markets.

Global Regulations

As a multi-regulated broker and firm, they have offices across the world. The following agencies govern and manage Exness:

Client Fund Security and Safety Features

Customer funds are maintained in segregated accounts at the most reputable banks in the areas where Exness operates. Exness is a member of the Financial Commission. The Financial Commission handles disputes in the financial services industry with a focus on currency trading.

The Financial Commission’s members, such as Exness, have a compensation fund, which may be seen as insurance for its customers. Customers of the Financial Commission may be insured for up to a maximum of €20,000.

Is Exness a regulated broker?

Yes, Exness is a regulated broker. The broker is regulated by the FCA and the CySEC.

How does Exness ensure the safety of my funds?

Exness prioritizes the safety of clients’ funds by employing various security measures. This includes keeping client funds segregated from company funds in top-tier banks, implementing advanced encryption technology for data protection, and adhering to regulatory requirements. Additionally, Exness undergoes regular audits and compliance checks to maintain the highest level of safety for clients’ funds.

Awards and Recognition

The broker has accumulated several industry awards over the past few years, with the most recent awards including:

Has Exness received any awards for its services?

Yes, Exness has been recognized with multiple awards for its outstanding services and contributions to the forex trading industry. These awards highlight its commitment to excellence and innovation in providing a top-tier trading experience.

What kind of recognition has Exness received in the trading industry?

Exness has gained significant recognition in the trading industry, receiving awards for categories such as Best Trading Conditions, Best Educational Broker, and Best Forex Broker. These accolades underscore Exness’s dedication to delivering quality services to its traders.

Account Types and Features

They offer both Standard and Professional accounts. Various levels of trading experience and distinct trading styles will lead to a wide range of account options. Subsequently, Namibian traders have a choice between:

➡️ Standard Account

➡️ Standard Cent Account

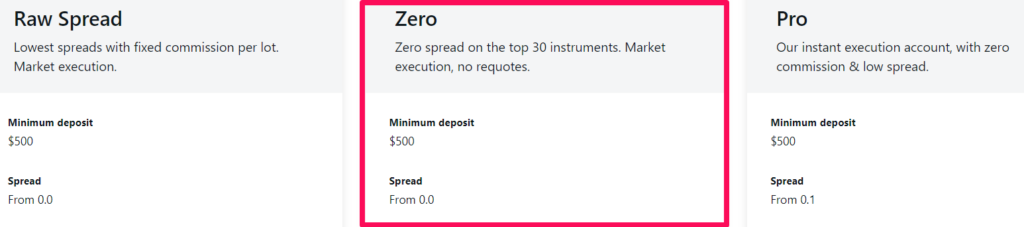

➡️ Raw Spread Account

➡️ Zero Account

➡️ Pro Account

Live Trading Accounts

Standard Account

A standard account is an account that is appropriate for any trader, regardless of their level of experience, ability, or trading style. They are the most prevalent kind of account provided by the vast majority of forex and CFD companies nowadays.

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | $10 / 192 NAD |

| 📊 Spreads | Variable, from 0.3 pips |

| 💵 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, KES, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💸 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| ✔️ Instruments Available | Forex major pairs, minor currency pairs, exotic pairs, energies, cryptocurrencies, stocks, indices |

| 📉 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📊 Maximum positions | Unlimited |

| % Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 60 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

| 👉 Open an account | 👉 Open Account |

Standard Cent Account

Beginner traders who want to gain a feel for the market but are not ready to put their own money at risk will find this account to be the most suitable.

This account is also the ideal choice for experienced traders who want to put their trading strategies to the test in real-time market conditions without the risk of losing their money on the trades.

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | 187 NAD or an equivalent to $10 |

| 📊 Spreads | Variable, from 0.3 pips |

| 💵 Account Base Currency | USC, EUC, GBC, CHC, AUC, CAC |

| 💸 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| ✔️ Instruments Available | Forex, Metals |

| 📉 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📊 Maximum positions | 1000 |

| % Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 60 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

| 👉 Open an account | 👉 Open Account |

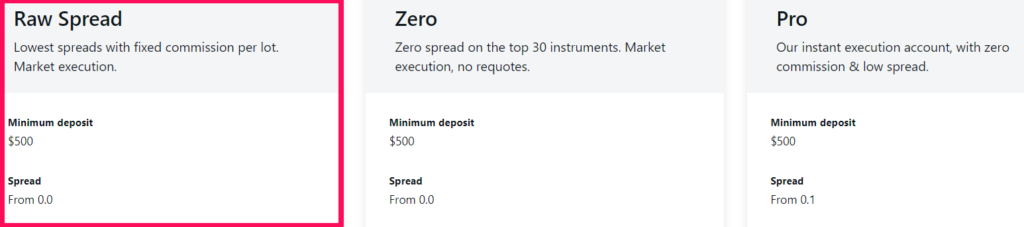

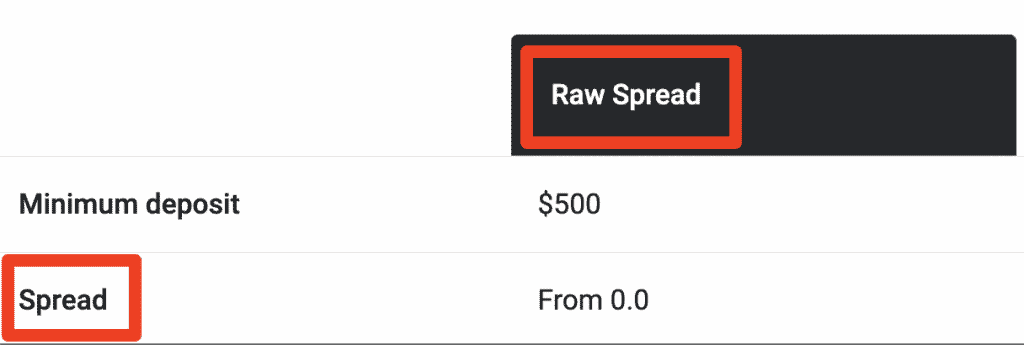

Raw Spread Account

Account types such as this one, which provide competitive and low spreads, are ideal for scalpers, day traders, and algorithmic traders.

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | 9,350 NAD or an equivalent to $500 |

| 📊 Spreads | Variable, from 0.0 pips |

| 💵 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💸 Commission Charges | Up to $3.5 per side, per lot |

| 📈 Maximum Leverage offered | Unlimited leverage |

| ✔️ Instruments Available | Forex, metals, cryptocurrencies, energies, stocks, indices |

| 📉 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📊 Maximum positions | Unlimited |

| % Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 30 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

| 👉 Open an account | 👉 Open Account |

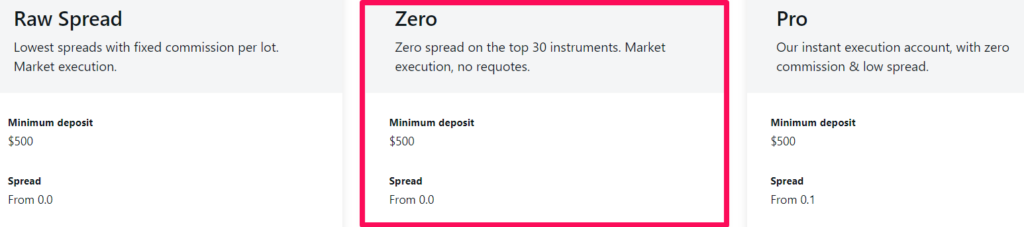

Zero Account

The Zero Account guarantees market execution with no requotes and offers the tightest spreads and the lowest fees in the industry.

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | 9,350 NAD or an equivalent to $500 |

| 📊 Spreads | Variable, from 0.0 pips |

| 💵 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💸 Commission Charges | From $0.1 per side, per lot |

| 📈 Maximum Leverage offered | Unlimited leverage |

| ✔️ Instruments Available | Forex, metals, cryptocurrencies, energies, stocks, indices |

| 📉 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📊 Maximum positions | Unlimited |

| % Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 30 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

| 👉 Open an account | 👉 Open Account |

Pro Account

Professional Accounts are designed for Namibian traders with the most extensive financial market understanding.

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | 9,350 NAD or an equivalent to $500 |

| 📊 Spreads | Variable, from 0.0 pips |

| 💵 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💸 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| ✔️ Instruments Available | Forex, metals, cryptocurrencies, energies, stocks, indices |

| 📉 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📊 Maximum positions | Unlimited |

| % Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 30 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Instant Execution on Forex currency pairs, metals, energies, stocks, and indices and market execution on cryptocurrencies |

| ☪️ Islamic Account | Yes |

| 👉 Open an account | 👉 Open Account |

Base Account Currencies

When registering an account with Exness, traders can choose from the following comprehensive list of base account currencies: AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, and ZAR.

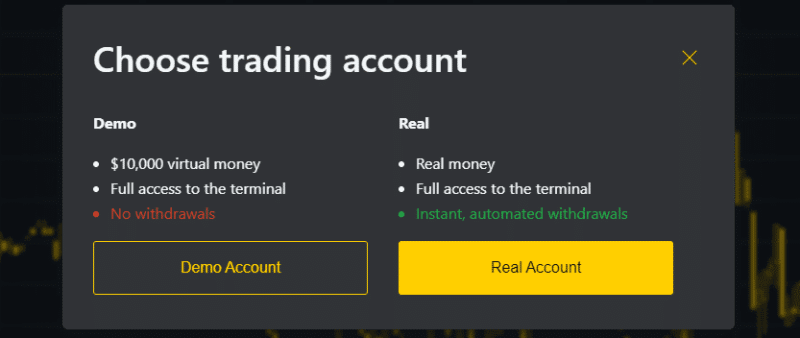

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and the broker offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

You can anticipate a fully-regulated and secure trading environment, where you may establish a trial account to test trading methods or a genuine understanding to join the currency markets.

Exness offers a free Demo account in addition to current financial news from Dow Jones, rich instructional tools, and Web TV with the most recent changes.

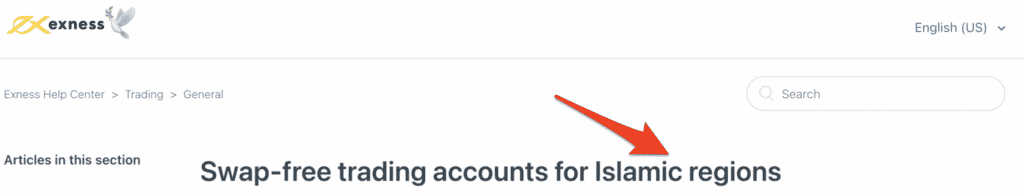

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

Thanks to the Islamic Account option, traders of different skill levels and trading objectives may participate in several financial markets without incurring exposure to various types of interest.

During account registration, the Swap-Free account will be automatically assigned to Muslim traders residing in Islamic countries.

What types of trading accounts does Exness offer?

Exness offers a variety of trading accounts tailored to different trading preferences. These include Cent, Mini, Classic, ECN, and Professional accounts, each designed to accommodate traders with varying levels of experience and strategies.

Can I switch between different Exness account types?

Yes, Exness provides the flexibility for traders to switch between different account types based on their evolving trading needs. Traders can easily upgrade or change their account type through the Exness Personal Area platform.

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

How to open an Account

Traders can create an account by registering and verifying their personal information online. To guarantee a safe trading environment for all traders, the broker has created a Know Your Client (KYC) protocol requiring traders to provide proof of identification and proof of residence.

After completing this step, traders can fill their trading accounts with the minimal amount required to begin trading.

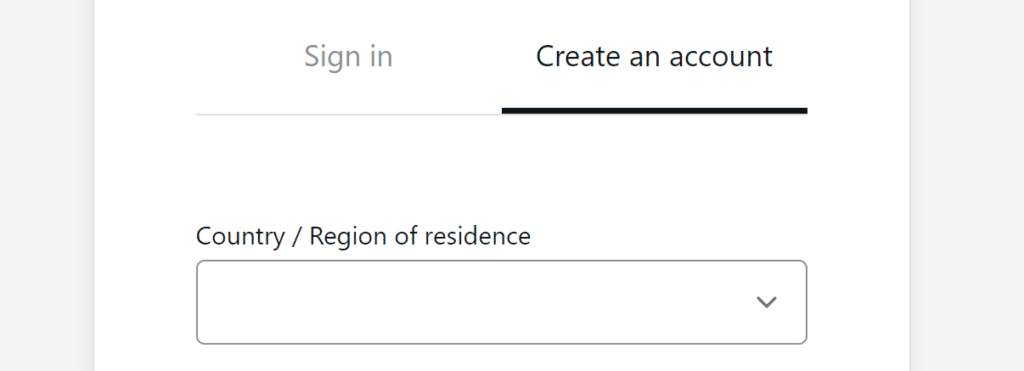

Navigate to the official and at the top right of the screen click on the “open an account” tab.

On the online application form, the applicant enters their country of residence, email, and password that they will use to log in on the website and the Exness Trader app.

After this information has been submitted, the applicant is taken to a screen where the applicant can choose between a demo account which is automatically created with a virtual deposit of $10,000, or a real account.

Exness Vs HotForex Vs XM – Broker Comparison

| Exness | HotForex | XM | |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | FSCA, IFSC, ASIC/AFSL, CySEC, DFSA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • Exness Terminal • Exness Trader app | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 |

| 💰 Withdrawal Fee | No | No | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 187 NAD/10 USD | 93 NAD/5 USD | 93 NAD/5 USD |

| 📈 Leverage | Unlimited | 1:1000 | 1:888 |

| 📊 Spread | Variable, from 0.0 pips | 0.0 pips | 0.0 pips |

| 💰 Commissions | From $0.1 per side, per lot | $3 to $4 | $1 to $9 |

| ✴️ Margin Call/Stop-Out | 60%/0% | • 40%/10% • 50%/20% | • 50%/20% • 100%/50% (EU) |

| ✴️ Order Execution | Market | Market | Market, Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account | • Micro Account • Premium Account • HFcopy Account • Zero Spread Account • Auto Account | • Micro Account • Standard Account • XM Ultra-Low Account • Shares Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | Yes | Yes | Yes |

| 📊 Namibian Dollar Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 5 | 5 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Trading Platforms

The broker offers Namibian traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Exness Terminal

➡️ Exness Trader app

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

The broker enables Namibian traders to trade on MetaTrader 4 in a manner that is tailored to their own trading style. When trading CFDs, there are two different execution choices available: Instant Execution and Market Execution. Namibians may trade their favorite financial products smoothly using the desktop interface of MetaTrader 4, regardless of how complicated the trading technique is.

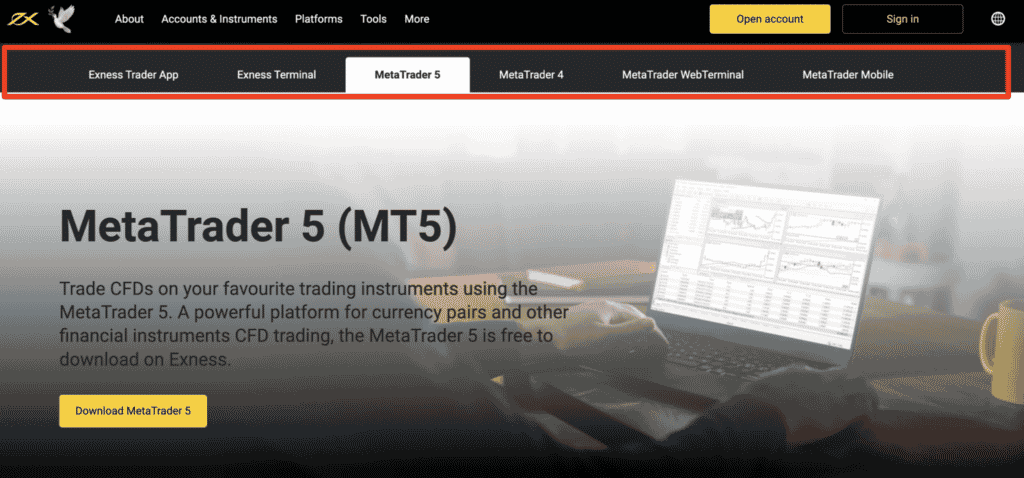

MetaTrader 5

To construct trading robots and technical indicators, MetaTrader 5 has a dedicated MetaEditor application. The tool’s interaction with the platform means that new applications will surface in MetaTrader 5 on their own and could be executed right away.

The following are some of the features of the Exness MetaTrader 5 desktop trading platform:

➡️ Access to a range of tradable instruments

➡️ Spreads from as low as 0.0 pips

➡️ 21 timeframes along with 3 chart types

➡️ Different order types

➡️ A comprehensive hedging system

➡️ 38 built-in indicators, and more

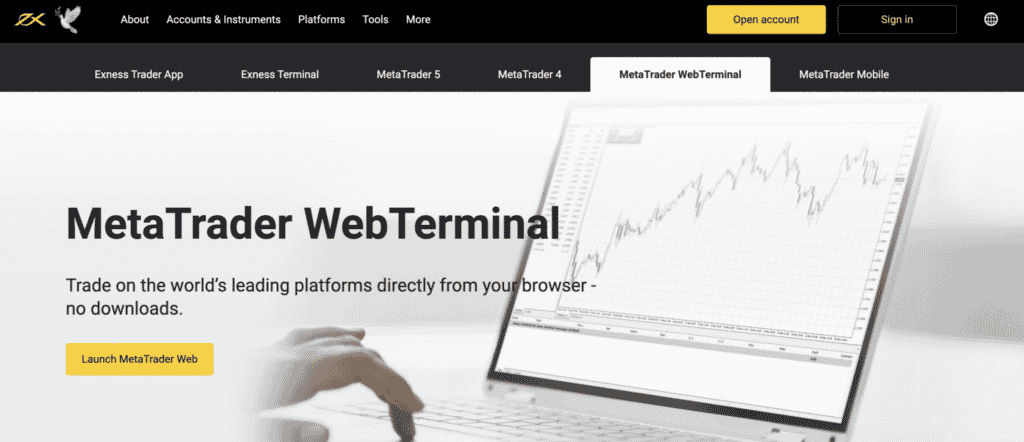

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Exness Terminal

MetaTrader 4

Namibian traders of various skill levels may now participate in the financial markets owing to the multiple instruments available on the terminal, which include flexible trading methods, algorithmic trading, and mobile trading, among others.

These critical capabilities, which are included in Exness’ MetaTrader 4 WebTrader, aid Namibians in identifying entry and exit points, as well as identifying market patterns.

MetaTrader 5

MetaTrader 5 is a trading platform that allows you to trade stocks, options, and futures. Among the trading tools accessible on WebTrader are fundamental and technical research, trading signals, algorithmic trades, and other tools for technical and fundamental analysis.

Namibian investors can easily keep up with the latest financial news by tuning in to live broadcasts of financial news updates on the radio.

To automate trading on the Exness MT5 platform, Expert Advisors analyze market quotes and trade on the financial markets, and then execute transactions on the financial markets.

Exness Terminal

The Exness Terminal, which has an intuitive user interface and the most up-to-date charting tools, offers traders a comprehensive trading experience. For aggressive traders, the terminal includes more than 50 sketching tools as well as more than 100 indication types.

In addition, TradingView delivers charts on the company’s own unique Exness Terminal, which was created by the company’s ingenious programmers and designers. The Exness Terminal is also an HTML 5 online program that is trustworthy, fast, and easy to use.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Exness Trader app

MetaTrader 4 and 5

The MetaTrader 4 and 5 trading terminals are not restricted to desktop computers running Windows, macOS, or Linux.

They are also compatible with mobile devices. Users of iOS and Android smartphones and tablets who have busy schedules may trade while on the go owing to the mobile trading function available on these devices.

Namibian traders now have access to most of the critical components of MetaTrader 4 and MetaTrader 5, including trading orders, interactive charts, and popular analytical tools, and can monitor their trading accounts and perform mobile trading with a single click.

Additionally, traders may get push notifications and engage with other traders using these iOS and Android mobile applications.

Exness Trader app

Namibians may trade with confidence from anywhere in the world thanks to Exness Trader. When picking from more than 200 instruments, traders may take advantage of speedy deposits and withdrawals, as well as on-demand customer care, to maximize their profits.

For Namibians, getting started with the Exness Trader platform is simple since it contains all the necessary tools, such as candlestick charts, indicators, and computing tools. The Exness trading app is the best location to discover CFDs on a wide range of markets, including forex, gold, oil, and indices.

A further advantage is that traders may easily move between multiple charts while maintaining a constant watch on all trading activity.

Range of Markets

Namibian traders can expect the following range of markets from Exness:

➡️ Forex

➡️ Metals

➡️ Crypto

➡️ Energies

➡️ Indices

➡️ Stocks

What trading platforms does Exness offer?

Exness offers the MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their user-friendly interfaces, advanced charting tools, and automated trading.

Can I trade on Exness using mobile devices?

Yes, Exness provides mobile trading options. Traders can access the markets on the go through the Exness mobile app, allowing for convenient and real-time trading from their smartphones or tablets.

Broker Comparison for Range of Markets

| Exness | HotForex | XM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | Yes |

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Trading and Non-Trading Fees

Spreads

Since each account is designed to appeal to a certain kind of trader, the spreads charged will vary depending on the type of account chosen by traders. Namibian traders should expect the following usual spreads to be applied:

➡️ Standard Account – from 0.3 pips EUR/USD

➡️ Standard Cent Account – from 0.3 pips EUR/USD

➡️ Raw Spread Account – from 0.0 pips EUR/USD

➡️ Zero Account – from 0.0 pips EUR/USD

➡️ Pro Account – 0.1 pips EUR/USD

Commissions

The commissions charged on certain accounts are fixed at a predetermined level to ensure that the broker is reimbursed for facilitating the transaction. The following commissions are levied on Namibian traders according to these trading accounts:

➡️ Raw Spread Account – Up to $3.50 per side, per lot

➡️ Zero Account – From $0.1 per side, per lot

Overnight Fees, Rollovers, or Swaps

Trader costs that they may expect to pay when holding positions overnight will vary depending on a variety of variables, including the financial instrument that is being held, the duration of the position, the position size, and the interbank rates.

Some typical overnight fees that Namibian traders can expect include:

➡️ EUR/USD – a long swap of -0.63356 pips and a short swap of 0.14698 pips

➡️ XAG/USD – a log swap of -0.0857 pips and a short swap of -0.0597 pips

➡️ US OIL – a long swap of 0.65 pips and a short swap of -3.9 pips

Deposit and Withdrawal Fees

The broker does not charge Namibian traders any deposit or withdrawal fees.

Inactivity Fees

The broker does not charge any fees when a live trading account becomes dormant.

Currency Conversion Fees

If traders deposit or withdraw funds in any currencies other than the accepted base account currencies, they could face currency conversion fees.

What are Exness trading fees?

Exness charges trading fees in the form of spreads, which are the differences between the bid and ask prices. These fees vary depending on the account type and trading instrument. Exness aims to offer competitive and transparent pricing to its traders.

Does Exness charge any non-trading fees?

Exness may charge non-trading fees, such as inactivity fees for dormant accounts or withdrawal fees for specific payment methods. It’s important to review Exness’ fee schedule to understand the applicable non-trading charges and conditions.

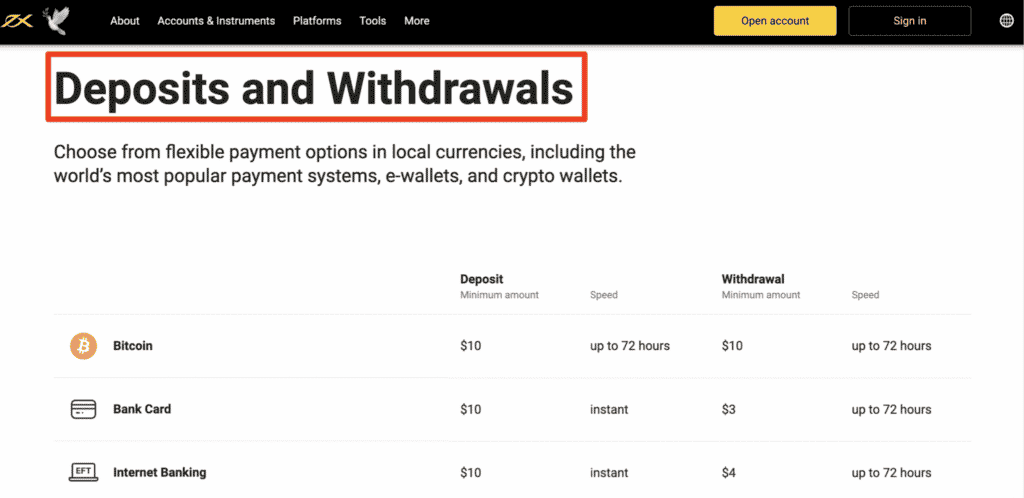

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

➡️ Bitcoin

➡️ Debit Card

➡️ Credit Card

➡️ Internet Banking

➡️ Skrill

➡️ Neteller

➡️ Perfect Money

➡️ Tether (USDT OMNI)

➡️ WebMoney

➡️ Mybux

➡️ Ozow

How to Deposit Funds with Exness

To deposit funds to an account, Namibian traders can follow these steps:

👉 Step 1 – Go To The Official Website

Go to www.exness.com and log into your account by clicking on “Sign In”.

👉 Step 2 – Click on “Deposit”

Once logged in, click on “Deposit” in the left corner of your screen.

👉 Step 3 – Deposit Your Funds

You can now deposit funds into your account.

Exness Fund Withdrawal Process

When Namibian traders establish an Exness account, they are offered the opportunity to choose a regionally-specific payment method. When in the Personal Area, Namibian traders will have access to a list of available payment methods, including local Namibian choices.

Regarding withdrawals of funds, traders must consider information like processing time and commission fees, which will be displayed by the PA.

To make a withdrawal, traders with an Exness trading account may take the following steps:

👉 Step 1 – Go to the Exness Website

Go to the official Exness website at www.exness.com and click on “Sign In”.

👉 Step 2 – Click on “Withdrawal”

Once you are logged in, click on “Withdrawal” and withdraw your funds.

Namibian traders have access to their money at all hours of the day and night, allowing them to withdraw cash at any time. In addition, Namibians must evaluate the following fundamentals before withdrawing cash from their Exness trading account:

➡️ The account’s free margin, which is shown in the trader’s Personal Area, dictates the amount of cash that may be withdrawn at any one time.

➡️ Namibian traders may only withdraw their funds using the same payment method that they used to deposit cash.

➡️ If traders placed money into their Exness account using several payment methods, they must withdraw using those same payment methods in the same proportion.

➡️ Namibians are encouraged to use bank cards first, then Bitcoin, and finally any other expedient method.

How can I make a deposit into my Exness trading account?

To make a deposit, log in to your Exness account, navigate to the “Deposit” section, and choose your preferred payment method, such as bank transfer, credit/debit card, or electronic wallet like Skrill or Neteller. Follow the instructions to complete the deposit securely.

What is the withdrawal process at Exness?

Withdrawals from your Exness trading account can be initiated by logging in and navigating to the “Withdrawal” section. Choose your preferred withdrawal method, enter the necessary details, and follow the prompts to complete the process. Exness aims to process withdrawal requests promptly, ensuring a seamless experience for traders.

Education and Research

Education

The broker does not offer any educational materials but offers the following Research and Trading Tools:

➡️ Analytical Tools

➡️ Trader’s Calculator

➡️ Economic Calendar

➡️ Currency Converter

➡️ Tick History

What educational resources does Exness offer to traders?

Exness provides a range of educational materials to enhance trading knowledge. These include video tutorials, trading guides, webinars, and articles covering various trading topics. Traders of all levels can access these resources to improve their trading skills.

How does Exness conduct market research and analysis?

Exness conducts thorough market research using a combination of technical and fundamental analysis. Their team of experts monitors global financial markets, economic indicators, and geopolitical events to provide traders with up-to-date market insights and analysis. This helps traders make informed trading decisions.

Bonuses and Promotions

The broker does not currently offer any bonuses or promotions to Namibian traders.

Does Exness offer any bonuses to traders?

Exness values responsible trading and regulatory compliance, so they do not currently offer bonuses or promotions. However, traders can benefit from competitive trading conditions and a wide range of services.

Are there any ongoing promotions at Exness?

Exness prioritizes transparency and fairness, and thus, they do not have ongoing promotions or bonuses. Traders can focus on trading with the confidence of competitive trading conditions and reliable services.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

How to open an Affiliate Account with Exness

To register an Affiliate Account, Namibians can follow these steps:

➡️ Visit the official website of Exness and select “More” from the main menu at the top of the homepage.

➡️ Namibians can select “Partnership Program” from the drop-down followed by “Start Now”.

➡️ If Namibians have an existing account with Exness they can simply log into the website and complete the affiliate application.

➡️ If Namibians have not previously registered with Exness they can do so by completing the required fields and submitting the registration form.

➡️ Once registered/signed in, prospective affiliates can select whether they want to be an introducing broker or an affiliate and complete the application for the relevant option.

➡️ Once approved, new affiliates can explore their partner portal to access the comprehensive package offered by Exness and start earning.

Affiliate Program Features

The broker is the industry leader when it comes to frequent and attractive payouts. Each active client referred by an associate generates a commission of up to $1,770 for the affiliate.

They pay for initial deposits (CPA) and leads (CPL), with CPA as follows:

➡️ It pays up to $1,770 depending on the platform, the recommended customer’s nation of residency, and the size of their first deposit, which must be at least $10.

➡️ The CPA plan is selected by default when a trader registers. Exness is available in more than 40 countries worldwide. Additional incentives are given for the highest overall performance.

The CPL strategy offers the following:

➡️ Affiliates from Namibia may earn up to $25 per sign-up for the referral site they use.

➡️ The pay-out will increase according to the number of new participants

➡️ Exness now gets visitors from over 40 countries

➡️ Regular monthly pay-outs

➡️ Incentives for the best overall performance

➡️ A high volume of traffic attributable to Exness’ popularity

Customer Support

They offer helpful support in 15 different languages 24 hours a day, 5 days a week with Chinese and English support available 24/7. Exness’ customer support is friendly and helpful, but not as comprehensive as that of other brokers.

Corporate Social Responsibility

The major focus of Exness has been on the provision of investment services from the company’s foundation in 2008. When it comes to the company’s stance on Corporate Social Responsibility (CSR), CEO Petr Valov is especially enthusiastic about the opportunity it provides to give back.

People can count on Exness to be upfront and honest with them about their goals, while at the same time providing a steady support system to help them achieve their maximum potential in both their professional and personal lives.

Exness is always looking for ways to improve its CSR efforts, whether it is in education, the environment, or addressing any social or medical dangers in the community where people live and work.

Today’s youngsters need access to educational opportunities that are relevant to their future careers, and Exness is doing its part to help make that happen.

Does Exness engage in any corporate social responsibility initiatives?

Yes, Exness is committed to giving back to society. They actively support various social projects and initiatives focused on education, health, and community development to make a positive impact.

How does Exness contribute to environmental sustainability?

Exness takes environmental sustainability seriously. They implement eco-friendly practices and technologies in their operations, reducing their carbon footprint and promoting a greener approach to business.

Verdict

Customers from the United Kingdom, as well as those from other European Union countries, may trade currencies, commodities, and cryptocurrencies at Exness. It is extremely well-regulated and provides traders of all skill levels with a safe and efficient trading environment.

Forex market participants have the option of trading on MT4 or MT5 platforms, as well as a lightweight online platform and mobile execution.

Because the broker uses innovative software and technology, it guarantees lower trading risks. Since traders can expect that their orders will be executed fast and safely, they can rest assured.

Over 30 ways to withdraw and deposit money are available to Namibian traders, including local options. Withdrawals are free and as a bonus, Exness offers free VPS hosting and instant deposits and withdrawals.

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Exness Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is multi-regulated by reputable entities globally | There are no educational materials offered |

| There are multi-currency accounts offered | There is no NAD-denominated account offered to Namibian traders |

| There are a few account types to choose from, providing Namibian traders with a lot of versatility | There is a small selection of tradable markets |

| Both MetaTrader 4 and MetaTrader 5 are offered | |

| Exness offers proprietary social and copy trading | |

| Namibian traders can use Exness’ proprietary trading platforms | |

| Free VPS hosting is offered by Exness to eligible clients | |

| Instant deposits and withdrawals are supported and there are no fees charged |

you might also like: Avatrade Review

you might also like: HF Markets Review

you might also like: FBS Review

you might also like: Forex.com Review

you might also like: Go Markets Review

Frequently Asked Questions

What is the withdrawal time with Exness?

Exness’ withdrawal times range from instantaneous withdrawals up to 72 hours from when the withdrawal request was processed.

Is Exness regulated?

Yes, Exness is regulated by several entities including FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA.

Does Exness have Nasdaq?

Yes, Exness offers access to Nasdaq through US TEC with a spread that starts from 6.5 pips on the Raw Spread Account with commissions of $1 charged.

Is Exness good for beginners?

Yes, Exness is the best broker for beginners. Exness has a diverse range of accounts from the Standard Cent Account to Pro Accounts. In addition, Exness also offers a demo account that can be used to practice trading.

Does Exness have Volatility 75?

No, Exness does not currently have VIX 75 but offers several other popular indices such as AUS200, FR40, HK50, UK100, and many more.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Exness?

➡️ What was the determining factor in your decision to engage with Exness?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Exness such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia