HF Markets Review

Overall HF Markets (previously HotForex) is considered low-risk, with an overall Trust Score of 85 out of 100. They are licensed by one Tier-1 Regulator, four Tier-2 Regulators, and two Tier-3 Regulators. The broker is currently not regulated by the Bank of Namibia.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overview

They offer five different retail trading accounts namely a Micro Account, Premium Account, HFCopy Account, Zero Spread Account, and an Auto Account.

They accept Namibian clients and have an average spread from 0.0 pips with a $6 to $8 commission round turn. The broker has a maximum leverage ratio of up to 1:1000 and there is a demo and Islamic account available. MT4, MT5, and HF App platforms are supported and headquartered in Cyprus with FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA regulations.

Multi-regulated and socially responsible, they are an online broker with narrow spreads and low commission rates that have racked up countless accolades. Tools and instructional resources are accessible in plenty. In operation since 2010, they are a leading worldwide online broker.

Customers may trade in a broad variety of assets, including Forex, commodities, cryptocurrencies, shares and indices, precious metals, renewable energies, and bonds with them. They also provide institutional clients with a comprehensive range of trading services as well.

There are approximately 1.5 million active account holders and overall, the broker employs more than 200 people throughout the world, and they offer 24-hour assistance in over 27 languages to customers, with customer service and satisfaction an integral part of HF Markets’ overall mission.

HF Markets is one of the top 100 global companies according to World Finance. The Best Client Funds Security Global (Global Brands Magazine) and the Fastest Growing MENA Forex Broker 2019 (International Business Magazine) accolades are only a few of the many honors received.

This HF Markets review for Namibia will provide local retail traders with the details that they need to consider whether HF Markets is suited to their unique trading objectives and needs.

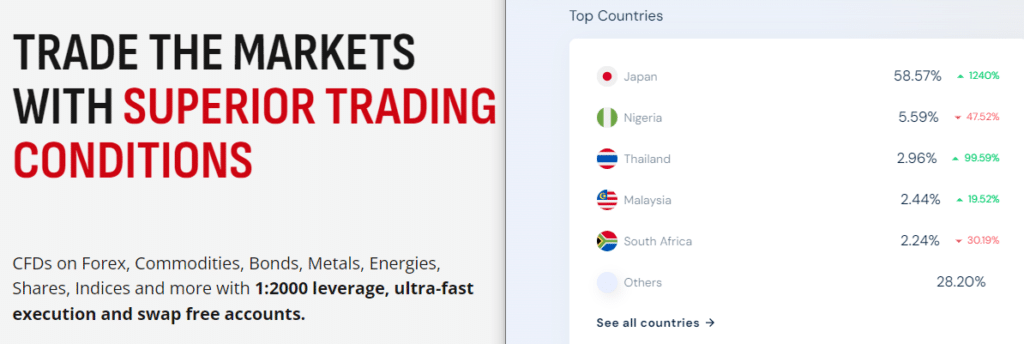

HF Markets Distribution of Traders

HF Markets currently has the largest market share in these countries:

Popularity among traders who choose HF Markets

Where do HF Markets traders come from?

HF Markets has a diverse global clientele, with traders participating from various countries around the world.

Do HF Markets cater to traders from specific regions?

HF Markets provides its trading services to traders from different regions worldwide, allowing a wide range of traders to access its platform and services.

At a Glance

| 🏛 Headquartered | Cyprus |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2010 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | Facebook, Twitter, Telegram, Instagram, YouTube, LinkedIn |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 🪪 Regulatory Licenses | South Africa – FSP 46632, Cyprus – 183/12, Dubai – F004885, Seychelles – SD015, United Kingdom – 801701, Mauritius – 094286/GBL, Kenya – CMA license 155 |

| Registrations | France ACPR – 53684, Germany BaFin – 132342, Hungary MNB – K8761153, Italy CONSOB– 3673, Norway – FT00080085, Spain CNMV – 3427, Sweden FI – 31987, Austria FMA, Bulgaria FSC, Croatia HANFA, Czech Republic CNB, Denmark Finanstilsynet, Estonia FSA, Finland FSA, Greece HCMC, Iceland FME, Central Bank of Ireland, Latvia FKTK, Liechtenstein FMA, Lithuania Lietuvos, Bankas, Luxembourg CSSF, Malta MFSA, Poland KNF, Portugal CMVM, Romania ASF, Slovakia NBS, Slovenia ATVP |

| ⚖️ BoN Regulation | No |

| 🚫 Regional Restrictions | The United States, Canada, Sudan, North Korea, and Syria |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 5 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Barclays UK, BNP Paribas, and others |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.0 pips |

| 📞 Margin Call | Between 40% to 50% |

| 🛑 Stop-Out | Between 10% and 20% |

| ✅ Crypto trading offered? | 0.01 lots |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:1000 |

| 🚫 Leverage Restrictions for Namibia? | None |

| 💰 Minimum Deposit | $0/0 NAD |

| ✅ Namibian Dollar Deposits Allowed? | Yes |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based HF Markets customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | Bank Wire Transfer, Credit Card, Debit Card, Electronic Payment Providers |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5 |

| ✔️ Tradable Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Portuguese, Spanish |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Namibian-based customer support? | No |

| ✅ Bonuses and Promotions for Namibians | Yes |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is HF Markets a safe broker for Namibians? | Yes |

| 📊 Rating for HF Markets Namibia | 9/10 |

| 🤝 Trust score for HF Markets Namibia | 83% |

| 👉 Open an account | 👉 Open Account |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Regulation and Safety of Funds

Regulation in Namibia

They are well-established in Africa but do not have local offices in Namibia or regulations through the Bank of Namibia.

Global Regulations

The HFM Group, which consists of the following enterprises, is known by the unified brand name HF Markets. HFM is therefore regulated and overseen by these market regulators:

HF Markets (UK) Ltd is an entity that is based in the United Kingdom and subsequently regulated by the Financial Conduct Authority (FCA). Since its inception in 2000, the FCA has worked with the UK Treasury to support and enable a financially healthy and successful system in which companies can flourish and consumers can benefit from fair, honest, efficient, transparent, and open markets.

The European Securities and Markets Authority (ESMA) has some influence on trading restrictions in the UK and Europe, which means that traders in these regions are restricted to leverage of 1:30.

One of Cyprus’ leading financial institutions is the Cyprus Securities and Exchange Commission-registered investment firm. CySEC is a member of the Committee of the European Securities and Markets Authority (ESMA), which oversees and regulates investment services enterprises in Cyprus.

HFM (Europe) Ltd. has a responsibility to support market discipline by disclosing information about the company’s capital, risks, and exposure.

To provide a uniform regulatory framework for investment services throughout Europe, they must comply with the EU’s Markets in Financial Instruments Directive (MiFID).

The Dubai Financial Services Authority has granted HF Markets (DIFC) Ltd authorization and regulation (DFSA). DFSA’s mission is to establish, manage, and enforce world-class regulation of financial services in the Middle East’s most important financial center, the Dubai International Financial Centre (DIFC).

The Financial Sector Conduct Authority (FSCA) in South Africa has approved the broker as an authorized Financial Service Provider. The FSCA is a statutory body formed by law to supervise the South African non-banking financial services sector.

The Capital Markets Authority (CMA), issues licenses, oversees, and governs HFM Investments Limited. Because of this rule, they can provide online currency exchange services.

Regulated by the Seychelles Financial Services Authority (FSA), HF Markets (Seychelles) Ltd. As the country’s non-bank financial services regulator, the authority oversees the licensing, regulation, and growth of Seychelles’ nonbank financial services business.

The Financial Services Commission (FSC) of the Republic of Mauritius is responsible for overseeing the activities of HF Markets Ltd.

Client Fund Security and Safety Features

Because each subsidiary of HFM is subject to stringent regulation, customers can have the peace of mind that comes from knowing they are working with a trustworthy and dependable broker that is required to adhere to stringent regulatory requirements.

You have the option of opening an account with the applicable body, and the prerequisites for doing so will depend on your jurisdiction and trading needs.

HF Markets must submit accurate financial reports to the regulator quarterly. In addition, HF Markets must maintain adequate levels of liquid capital to cover all their clients’ deposits, potential fluctuations in the company’s currency positions, and any outstanding expenses.

In addition, an independent internal auditor performs a detailed annual audit to inform the regulator of any deficiencies.

The protection of the cash belonging to HF Markets customers is of top concern. Therefore, HF Markets has adopted extra security measures so that traders may concentrate only on their trading without being distracted by concerns about the protection of their cash.

Client funds are already covered because of several regulatory obligations, and to further shield liabilities against customers, HF Markets EU has an insurance program that does not incur any additional costs for the client.

This insurance is limited to 5 million and covers risks that may lead to financial loss such as errors, negligence, omissions, fraud, etc.

HF Markets EU holds client funds in separate accounts with major global banks so they cannot be used for any other purpose. Because there is protection against negative balances, a customer will not be held liable for a situation in which they have a negative balance even if the market circumstances are turbulent.

Investor Compensation Fund is one of the organizations in which HF Markets EU participates. The establishment of the ICF intends to facilitate the payment of compensation to affected customers of ICF members if essential prerequisites are satisfied.

Is HF Markets a regulated broker?

Yes, HF Markets is a regulated broker. It is licensed and regulated by multiple reputable financial authorities, ensuring the safety and security of client funds and trading activities.

How does HF Markets ensure the safety of client funds?

HF Markets prioritizes the safety of client funds by keeping them in segregated accounts with top-tier banks. Additionally, they participate in investor compensation schemes and adhere to stringent regulatory requirements to provide a secure trading environment.

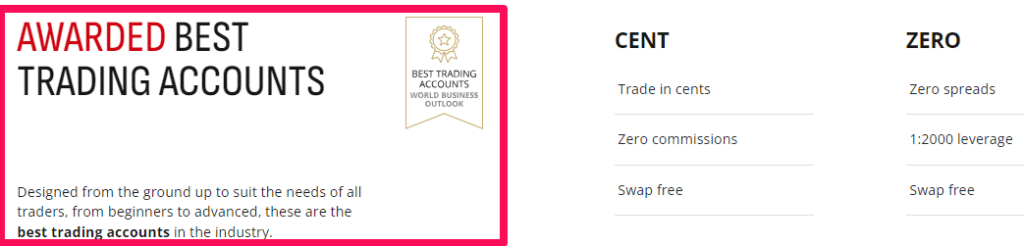

Awards and Recognition

Over its years in operation, the broker has collected several highly prestigious titles from well-respected awarding bodies from around the globe. Some of the most recent awards that they have won include, but are not limited to:

Have HF Markets received any awards for its services?

Yes, HF Markets (HotForex) has received numerous awards and recognition in the financial industry for its exceptional trading services and customer-centric approach.

What kind of awards have HF Markets been recognized for?

HF Markets (HotForex) has been recognized for various awards, including accolades for its customer service, trading platforms, educational resources, and overall excellence in the forex and financial trading industry.

Account Types and Features

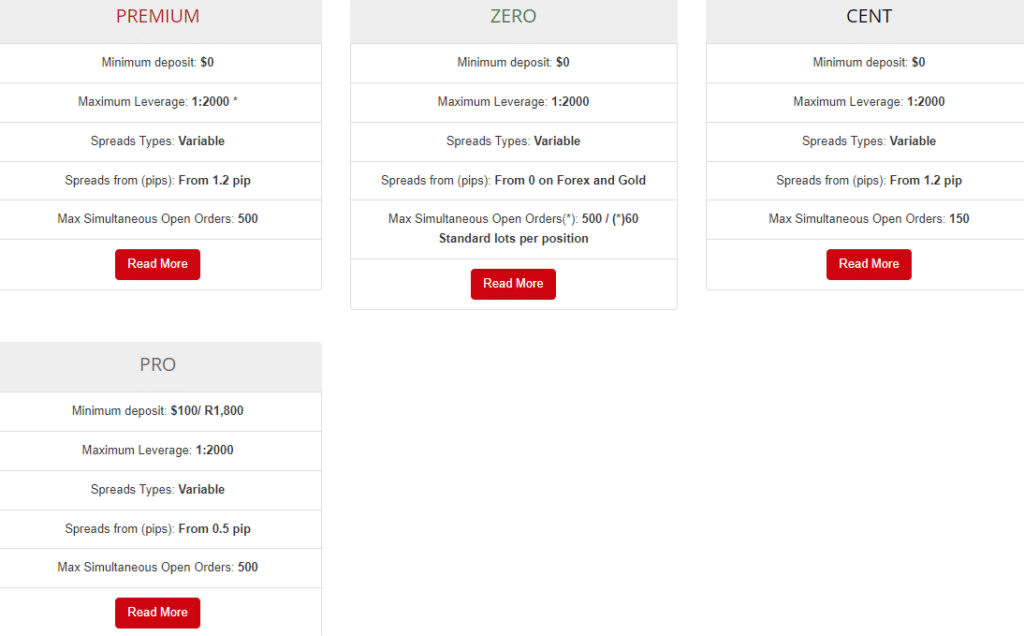

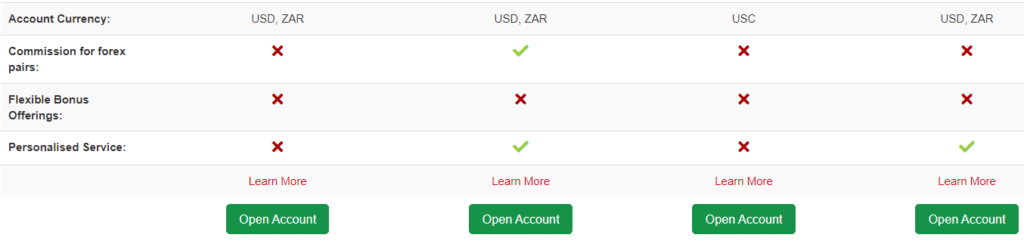

Traders who use the broker have access to a wide range of trading accounts that may be customized to meet their requirements as well as their personal preferences. Retail investors may choose from the following kinds of accounts:

Live Trading Accounts

Premium Account

This sort of account would be beneficial for retail traders that have previous experience. One of the most valuable aspects of this account is the versatility of its position size, which comes with a maximum of sixty standard lots for a single transaction.

| Account Feature | Value |

| 💸 Minimum Deposit | 0 NAD/$0 |

| 📊 Spreads | 1.2 pip |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, Webtrader, Mobile Trading and HFM Platform |

| 🔧 Trading Instruments | All |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:2000 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💸 Maximum Open Orders | 500 |

| 📞 Margin Call / Stop out level: | 50% / 20% |

| 💵 Account Base Currency | USD, ZAR |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| 👉 Open an account | 👉 Open Account |

Zero Spread Account

All types of traders, including active traders, high-frequency traders, day traders (such as scalpers), and traders who use expert advisors, will profit from the minimal trading fees and commissions associated with this account.

The fact that this account does not apply any hidden markups to the spreads is an extra advantage for traders in Namibia who use this account.

| Account Feature | Value |

| 💸 Minimum Deposit | 0 NAD/$0 |

| 📊 Spreads | From 0 on Forex and Gold |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, Webtrader and Mobile Trading |

| 🔧 Trading Instruments | All |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:2000 |

| 📉 Minimum Trade Size | 0.01 LOT (1,000 units of base currency) |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💸 Maximum Open Orders | 500 |

| 📞 Margin Call / Stop out level: | 50% / 20% |

| 💵 Account Base Currency | USD, ZAR |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | From between $3 for Major Forex Pairs and $4 on other instruments per lot traded |

| 👉 Open an account | 👉 Open Account |

The broker offers a Cent Account option, allowing traders to start trading with smaller amounts and lower risk, making it ideal for beginners or those looking to test trading strategies.

| Account Feature | Value |

| 💸 Minimum Deposit | 0 NAD/$0 |

| 📊 Spreads | From 1.2 pip |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, Webtrader and Mobile Trading |

| 🔧 Trading Instruments | Forex, Gold |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:2000 |

| 📉 Minimum Trade Size | 0.01 Lot |

| 📈 Maximum Trade Size | 200 Cent Lots per position / 500 Cent Lots account total |

| 💸 Maximum Open Orders | 150 (Simultaneous) |

| 📞 Margin Call / Stop out level: | 50% / 20% |

| 💵 Account Base Currency | USC |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| 👉 Open an account | 👉 Open Account |

Pro Account

The Pro Account is designed for experienced traders seeking advanced features, tighter spreads, and faster execution speeds to enhance their trading strategies.

| Account Feature | Value |

| 💸 Minimum Deposit | $100/1870 NAD |

| 📊 Spreads | From 0.5 pip |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, Webtrader and Mobile Trading |

| 🔧 Trading Instruments | All |

| 📲 Execution | Market Execution |

| 💰 Maximum Leverage Ratio | 1:2000 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💸 Maximum Open Orders | 500 |

| 📞 Margin Call / Stop out level: | 50% / 20% |

| 💵 Account Base Currency | USD, ZAR |

| 👥 Personal Account Manager | Yes |

| 💵 Commission Charges | None |

| 👉 Open an account | 👉 Open Account |

Base Account Currencies

When Namibians register a live trading account, they can choose between USD or ZAR as the base currency for the account. The broker does not accommodate NAD as a base currency, which could subject Namibians to currency conversion fees when they deposit or withdraw funds.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and HF Markets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

Namibian traders can register a demo account of their choosing either through MetaTrader 4 or MetaTrader 5 across different devices.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

HF Markets offers Muslim traders the opportunity to convert their live trading account into a Swap-Free Islamic Account. Muslim traders who keep open positions overnight will not be charged interest if they use the HF Markets Islamic Account since this account is compliant with Sharia law and the ideals that are associated with Islam.

Traders may convert any of their current trading accounts at HFM into an Islamic Account, which gives them the ability to engage in halal trading without any restrictions.

What types of trading accounts do HF Markets offer?

HF Markets offers a range of trading accounts to cater to different trading preferences, including Premium, Zero Spread, Cent, and Pro accounts.

What features are available in HF Markets’ different trading account types?

Each trading account type at HF Markets comes with specific features tailored to different trading styles and strategies. These features may include varying minimum deposit requirements, spreads, leverage options, and access to additional trading tools and platforms.

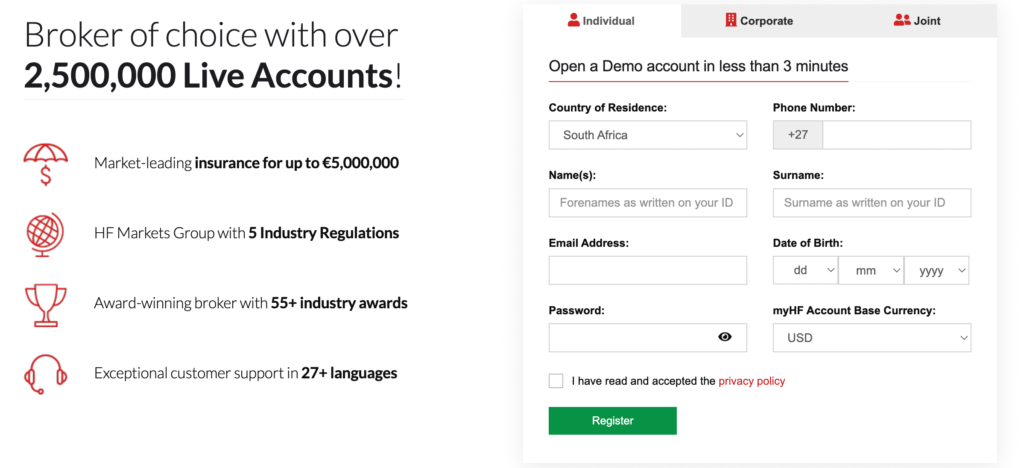

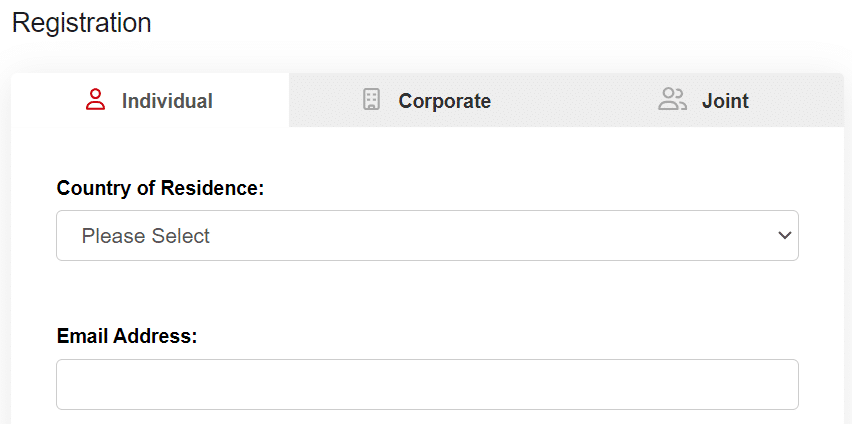

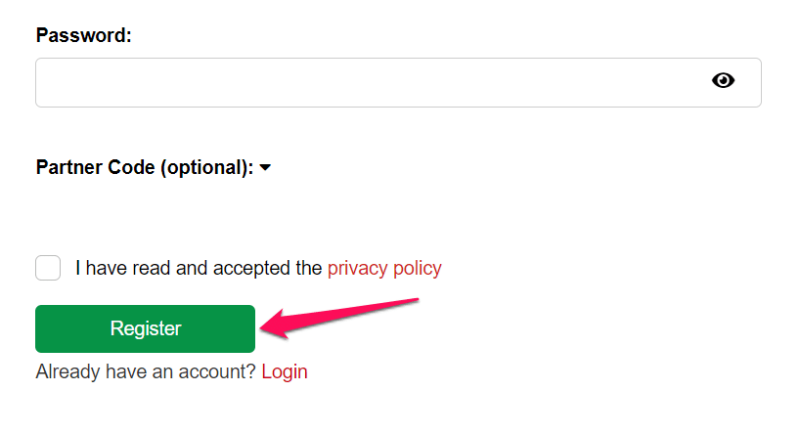

How to open an Account

To register a new account with HFM, Namibian traders can follow these guidelines:

How to Register An Account

Step 1 – Go to the Official Website

Step 2 – Fill Out Your Details

Step 3 – Click on “Register”

HF Markets VS FXGT VS OspreyFX – Broker Comparison

| HF Markets | FXGT | OspreyFX | |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | FSCA, FSA | None |

| 📱 Trading Platform | etaTrader 4, MetaTrader 5, Webtrader, Mobile Trading and HFM Platform | • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 0 NAD | 80 NAD | 383 NAD |

| 📈 Leverage | 1:2000 | 1:1000 | 1:500 |

| 📊 Spread | 1.2 pip | From 0.0 pips | From 0.4 pips |

| 💰 Commissions | $3 to $4 | $10 | From $1 |

| ✴️ Margin Call/Stop-Out | • 40%/10% • 50%/20% | 80%/50% | 100%/70% |

| ✴️ Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes | Yes | No |

| 📈 Account Types | • Premium Account • Zero Spread Account • Cent Account • Pro Account | • Cent Account • Mini Account • Standard Account • Standard FX Account • ECN Account | • Standard Account • PRO Account • VAR Account • Mini Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | Yes | Yes | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 5 | 5 | 4 |

| ☪️ Islamic Account | Yes | No | Yes |

| 💸 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 60 lots | 500 lots | 1,000 lots |

| 👉 Open Account | Open Account | Open Account | Open Account |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Trading Platforms

The broker offers its Namibian traders a choice between the following trading platforms:

Desktop Platforms

MetaTrader 4 and 5

It is possible to manage many accounts on a single screen using the MultiTerminal platform. With the MT4 platform, Namibian traders may anticipate a familiar trading experience, but with much more power and capabilities.

MT5 is a MetaTrader 5 platform that has been tailored to fulfill the needs of customers, regardless of trading style or asset class preferences.

It has more features, more advanced trading tools, better support, and complete control over the trader’s operations. One of the most creative and frequently used trading platforms in the world, MetaTrader 5, is utilized by Namibian traders.

WebTrader Platforms

MetaTrader 4 and 5

The MetaTrader 4 WebTerminal allows traders to trade from any web browser, without the need to install any additional software. Trades can be placed on either a Live or a Demo account, allowing traders to keep track of their full trading history as well as place pending and market orders.

No additional software is required for MetaTrader 5 WebTerminal trading. The WebTerminal, which can be started from any computer and any browser, has all the functionality of the desktop platform.

Trading App

MetaTrader 4 and 5

The Android and iOS MT4 combine excellent charting with trading tools and other advanced features to make it easier for traders to trade on the move. HF Markets’ full-featured trading interface allows traders to access financial markets from anywhere in the world, do technical analysis, monitor movement, and make orders.

The broker provides an MT4 Android, iPad, and iPhone Trader that can be downloaded and utilized right away for the convenience of customers. HF Markets’ software was specifically created to make use of a wide range of mobile device capabilities to give traders full access to their trading accounts and the perfect trading environment.

Mobile traders may now feel in charge of their trading accounts and ready to dive into the markets wherever they are with MetaTrader 5 for iOS and Android-native alternatives.

HF App

With the proprietary App, Namibian traders can remain connected to the financial markets. The App is available to both iOS and Android devices and offers the following unique features:

Range of Markets

Namibian traders can expect the following range of markets:

What trading platforms are available at HF Markets?

HF Markets offers a range of trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms, as well as the HotForex Mobile App for trading on the go.

Can I access HF Markets’ trading platforms from different devices?

Yes, you can access HF Markets’ trading platforms from various devices, including desktop computers, laptops, smartphones, and tablets. This allows you to trade conveniently and efficiently from wherever you are.

Broker Comparison for Range of Markets

| HotForex | Global GT | OspreyFX | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Trading and Non-Trading Fees

Spreads

Market conditions and the financial instrument you select to trade will all influence how much a trader will pay in spreads while working with the broker. The average spreads for each account type are as follows:

Commissions

The commissions charged by the broker are unusually low in comparison to those charged by other forex and CFD brokerages. FX majors and other financial instruments traded by Namibian traders will cost between $3 and $4 in transaction fees.

Overnight Fees, Rollovers, or Swaps

Overnight fees for Namibian traders include the following:

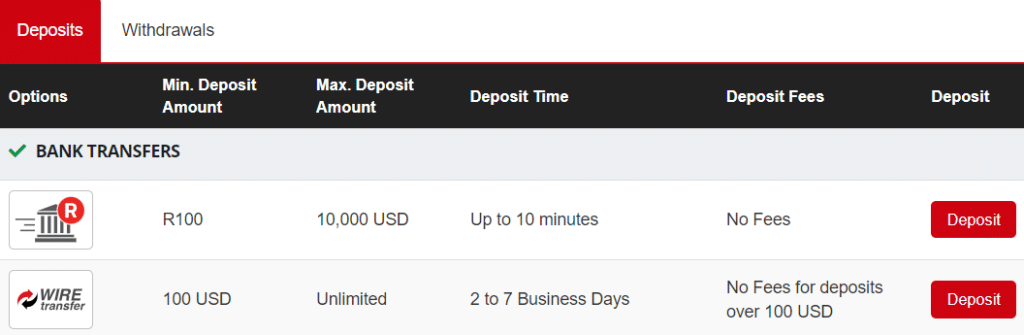

Deposit and Withdrawal Fees

There are no fees indicated for any of the deposit or withdrawal options that HF Markets supports. However, there is a note on bank wire transfers that fees do not apply for deposits over 100 USD.

Thus, if Namibian traders make deposits using bank wire, they may face fees if they deposit less than 1,870 NAD or the equivalent of 100 USD depending on the current exchange rate between USD and NAD.

Inactivity Fees

If a live trading account is dormant for a consecutive six months up to a year, a $5 fee will be charged monthly until the account balance reaches zero and the account is terminated automatically.

Currency Conversion Fees

Namibian traders who deposit funds or withdraw funds in Namibian dollars may face currency conversion fees as HF Markets only supports deposits/withdraws in USD and ZAR.

What trading fees does the broker charge?

The broker charges competitive trading fees, including spreads and commissions, depending on the account type and trading instrument. You can find detailed information about trading fees on their website.

Are there any non-trading fees associated with the broker?

While they offer a transparent trading environment, it’s essential to review their terms and conditions to understand any potential non-trading fees, such as withdrawal charges or inactivity fees, that may apply to your account.

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

How to Deposit Funds

To deposit funds to an account, Namibian traders can follow these steps:

Step 1 – Log into your account.

Step 2 – Choose a deposit amount.

Step 3 – Provide additional information.

Fund Withdrawal Process

To withdraw funds from an account with HF Markets, Namibian traders can follow these steps:

Step 1 – Log into your account.

Step 2 – Click on the fund withdrawal option.

Step 3 – Choose a withdrawal amount.

Step 4 – Complete the withdrawal request.

If traders submit their withdrawal requests before 10 am server time, they may expect them to be processed the same business day, between 7 am and 5 pm server time.

When a withdrawal request is submitted after 10 am server time, it will be processed the next business day between 7 am and 5 pm server time.

How can I make deposits into my trading account?

The broker provides a range of convenient deposit options, including bank transfers, credit/debit cards, and various online payment systems. You can select the method that best suits your preferences and follow the instructions on their website to fund your trading account.

What is the withdrawal process?

To withdraw funds from your trading account, you can submit a withdrawal request through your client portal. The funds will typically be returned to the same method used for the deposit. It’s important to note that HF Markets prioritizes security and regulatory requirements, which may impact the withdrawal process.

Education and Research

Education

The broker offers the following Educational Materials:

The broker offers Namibian traders the following Research and Trading Tools:

What educational resources do they offer to traders?

The broker provides a comprehensive range of educational materials, including webinars, seminars, video tutorials, and trading guides, to enhance traders’ knowledge and skills across various aspects of trading.

How does the broker conduct market research and analysis?

The broker employs experienced analysts who utilize technical and fundamental analysis to provide regular market updates, analysis reports, and insights, helping traders stay informed about the latest market trends and opportunities.

Bonuses and Promotions

The broker offers Namibian traders the following bonuses and promotions:

Does the broker offer any deposit bonuses to traders?

Yes, the broker offers a supercharged bonus for the minimum deposit amount.

Are there any ongoing promotions for existing clients?

The broker may periodically introduce promotions or special offers for existing clients. It’s recommended to check their official website or contact customer support for the latest information on any ongoing promotions or loyalty programs.

How to open an Affiliate Account

To register an Affiliate Account, Namibians can follow these steps:

Affiliate Program Features

Anyone can join the affiliate program, regardless of where they reside. To keep affiliates around for the long haul, they provide attractive incentive schemes and a multi-tier affiliate monitoring system.

The specialized Affiliates Department is available to all affiliates who join the affiliate program, which is an additional perk. The following tools and advantages are available to affiliates:

Customer Support

HFM offers superior customer support that is client-focused and offered across several communication channels 24 hours a day, 5 days a week.

Corporate Social Responsibility

As a company noted for its social duty, the broker donated substantial sums of money to the World Health Organization’s effort to combat the Covid-19 pandemic in the past. Working diligently throughout the world, the team helped to limit the pandemic’s impact on vulnerable areas by leading and organizing activities.

The worldwide non-profit named The Rainforest Alliance received a charitable contribution from them in support of indigenous efforts to mitigate the fires that have decimated the Amazon rainforest, which is popularly referred to as the “lungs of the Earth.”

The broker presented a large donation to the Larnaca Lions Club, the local branch of the Lions Club International, as a means of displaying its support for the community. Dozens of young individuals received financial assistance from them as part of its charitable efforts this year.

The team helped a few young people enjoy the Christmas season in 2017 by providing them with financial assistance and encouragement. The company’s hometown of Larnaca, Cyprus, was showered with presents and toys.

Does the broker have any initiatives related to corporate social responsibility?

They are committed to corporate social responsibility and actively engage in various charitable and community initiatives. These efforts reflect their dedication to making positive contributions to society.

How does the broker contribute to social and environmental causes?

They support social and environmental causes through various philanthropic activities, including donations and community engagement programs. They prioritize giving back to the community and fostering a positive impact.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Verdict

One of the most recognized and licensed online brokers in the industry, the broker offers a wide variety of trading instruments across a wide range of markets and asset classes. Clients like the narrow spreads and cheap commissions that they offer, one of many reasons that they have earned countless accolades.

With the broker, Namibian traders can choose from a wide range of account types and trading platforms, as well as a wealth of trading tools and resources. In addition, their charity efforts are much to be applauded since they demonstrate a high level of corporate social responsibility.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM is one of few brokers with several regulations and registrations around the world | There are no fixed spread accounts offered by HFM |

| There is negative balance protection applied to retail accounts | The broker has a limited range of base account currencies and deposit currencies |

| HFM offers investor protection to eligible clients | There is no NAD-denominated account and Namibians may face currency conversion fees when they deposit or withdraw funds |

| There are commission-free options provided with tight, competitive spreads | There is an inactivity fee charged and Namibian traders can expect currency conversion fees |

| There are several premium trader tools offered to advanced Namibian traders | |

| There is a choice between different accounts, each catering to distinct types of traders | |

| There are demo accounts and Muslim traders can convert their live accounts to an Islamic option | |

| There is a choice between MetaTrader 4 and 5 alongside the proprietary HF App |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Frequently Asked Questions

What is the withdrawal time?

The overall withdrawal time with the broker ranges from up to 10 minutes on Skrill and between 2 and 10 working days on all other withdrawal methods.

Can I withdraw all my money?

Yes, you can withdraw all your money from your account if the funds are not being used to maintain margin requirements on positions.

Is the broker regulated?

Yes, they are well-regulated by FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA in the regions where the broker holds offices.

What is the minimum deposit requirement?

There is no minimum deposit requirement for the premium, zero, and cent accounts. The minimum deposit amount for their pro account is $100/1870 NAD.

Does the broker have Nasdaq?

Yes, they have Nasdaq under US Tech 100 with spreads that start from 2 pips and leverage up to a maximum of 1:200 (for regions other than the EU and UK).

Is HFM safe or a scam?

The broker is a safe broker. They are regulated by Tier-1, Tier-2, and Tier-3 market regulators and are registered in regions around the world, adding to their high trust score.

Can I use HFM in Namibia?

Yes, you can use the broker in Namibia.

Does the broker have MetaTrader 4?

Yes, they offer both MetaTrader 4 and MetaTrader 5 on desktop platforms, web browsers, and mobile devices that run on iOS or Android.

Does the broker have Volatility 75?

Yes, they have Volatility 75. They offer VIX.F (the Volatility Index SP500) as a Futures Contract on Indices. When Namibians trade VIX, they can expect spreads from 0.14 pips and leverage up to 1:100.

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia