IG Review

Overall, IG is considered low-risk, with an overall Trust Score of 99 out of 100. IG is licensed by eight Tier-1 Regulators (high trust), three Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). IG is currently not regulated by the bank of Namibia

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

250 USD / 4,700 NAD

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IG Review – 25 key points quick overview:

- ✅IG Overview

- ✅IG At a Glance

- ✅IG Regulation and Safety of Funds

- IG Awards and Recognition

- IG Account Types and Features

- How to open an Account with IG in Namibia

- IG Vs SuperForex Vs LiteFinance – Broker Comparison

- IG Trading Platforms

- IG Range of Markets

- Broker Comparison for Range of Markets

- IG Trading and Non-Trading Fees

- IG Deposits and Withdrawals

- How to Deposit Funds with IG

- IG Fund Withdrawal Process

- IG Education and Research

- IG Bonuses and Promotions

- How to open an Affiliate Account with IG

- IG Affiliate Program Features

- IG Customer Support

- IG Corporate Social Responsibility

- Verdict on IG

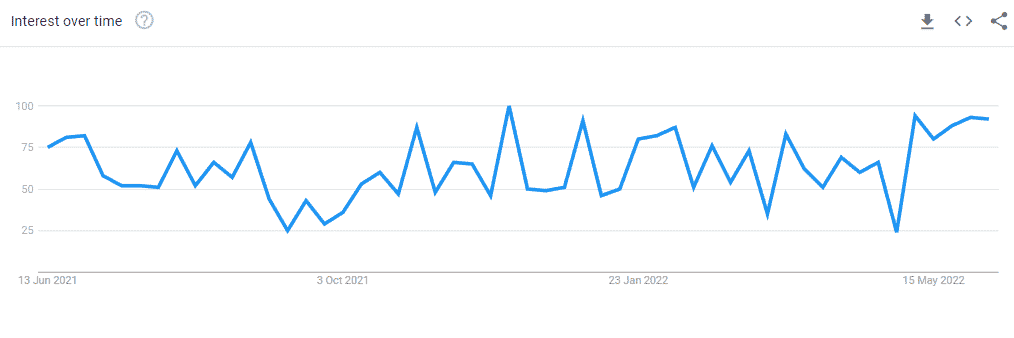

- IG Current Popularity Trends

- IG Pros and Cons

- Frequently Asked Questions

- Conclusion

IG Overview

👉 IG offers seven retail trading accounts namely CFD/DMA Trading Account, Limited Risk Trading Account, Options Trading Account, Turbo24 Trading Account, Share Dealing Account, Spread Betting Account, and a Swap-Free Trading Account.

👉 Stuart Wheeler launched IG Group (IG) in 1974 as the world’s first spread betting company. IG is a subsidiary of IG Group Holdings Plc, a publicly listed conglomerate (LSE: IGG) that enables knowledgeable, decisive, and adventurous individuals to participate in financial markets.

👉 IG allows you to trade and invest in over 18,000 markets, including Forex, stocks, commodities, and cryptocurrencies. They provide a wide range of user-friendly trading systems for easy market research, trade placement, and management.

👉 Because of the broker’s huge liquidity pools, which originate from a few top liquidity sources, IG’s spreads are narrow, commissions are cheap, and trade execution speeds are quick.

👉 This is a fantastic option if you intend on trading regularly and want to cut your trading expenses as much as possible without sacrificing quality.

👉 You will also have access to some excellent trading tools and instructional materials to help you succeed in your trade. This IG review for Namibia will provide local retail traders with the details that they need to consider whether IG is suited to their unique trading objectives and needs.

👉 IG accepts Namibian clients and has an average spread from 0.1 pips with 0.10% commission. IG has a maximum leverage ratio up to 1:200 and there is a demo and Islamic account available.

👉 MT4, IG, ProRealTime (PRT), L2 Dealer, and FIX API platforms are supported. IG is headquartered in the United Kingdom and regulated by FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, and BMA.

IG Distribution of Traders

👉 IG currently has the largest market share in these countries:

➡️️ United Kingdom – 27.7%

➡️️ Japan – 10.7%

➡️️ Australia – 8.2%

➡️️ United States – 5.4%

➡️️ Germany – 5.1%

Popularity among traders who choose IG

🥇 IG does not have a substantial market share in Namibia. However, IG is a large and prominent broker with a prevalent presence across the globe, which places IG in the Top 10 brokers for Namibian traders.

IG At a Glance

| 🏛 Headquartered | London, United Kingdom |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 1974 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • LinkedIn • YouTube |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 🪪 Regulatory Licenses | • United Kingdom (IG Markets Ltd) – 195355 • United Kingdom (IG Index Ltd) – 114059 • Germany – 10148759 • Cyprus (BrightPool Ltd) – 378/19 • Switzerland – FINMA • Dubai – F001780 • Dubai DIFC – 1840 • South Africa – 41393 • Singapore – 200510021K • Japan – FSA • Australia – ABN 84 099 019 851, AFSL 220440 • New Zealand – FSP18923 • United States – NFA ID 0509630 • Bermuda (IG International Limited) – 54814 |

| ⚖️ BoN Regulation | None |

| 🚫 Regional Restrictions | None |

| ☪️ Islamic Account | Yes, Dubai traders only |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 8+ |

| 📊 PAMM Accounts | Yes |

| 🤝 Liquidity Providers | Several Tier-1 partnerships, banks, and others |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.1 pips DMA |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | Unknown |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:200 |

| 🚫 Leverage Restrictions for Namibia? | No |

| 💰 Minimum Deposit (NAD) | 3,900 NAD or an Equivalent to $250 |

| ✅ Namibian Dollar Deposits Allowed? | No |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based IG customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank Wire Transfer • Debit Card • Credit Card • PayPal |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API |

| ✔️ Tradable Assets | • Forex • Indices • Shares • Commodities • Cryptocurrencies • Futures • Options |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 👥 Namibian-based customer support? | No |

| ✅ Bonuses and Promotions for Namibians | No |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is IG a safe broker for Namibians? | Yes |

| 📊 Rating for IG Namibia | 9/10 |

| 🤝 Trust score for IG Namibia | 99% |

| 👉 Open an account | 👉 Open Account |

IG Regulation and Safety of Funds

IG Regulation in Namibia

IG Global Regulations

➡️ Federal Financial Supervisory Authority (BaFin) in Germany

➡️ The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

➡️ The Swiss Financial Market Supervisory Authority (FINMA)

➡️ The Dubai Financial Services Authority (DFSA)

➡️ The Financial Sector Conduct Authority (FSCA) in South Africa

➡️ The Monetary Authority of Singapore (MAS)

➡️ Japanese Financial Services Agency (JFSA)

➡️ The Australian Securities and Investments Commission (ASIC)

➡️ The Financial Markets Authority (FMA) in New Zealand

➡️ The Commodity Futures Trading Commission (CFTC)

➡️ The Bermuda Monetary Authority (BMA)

IG Client Fund Security and Safety Features

IG Awards and Recognition

IG Account Types and Features

➡️ CFD/DMA Trading Account

➡️ Limited Risk Trading Account

➡️ Options Trading Account

➡️ Turbo24 Trading Account

➡️ Share Dealing Account

➡️ Spread Betting Account

➡️ Swap-Free Trading Account

CFD Trading Account

Limited Risk Trading Account

Options Trading Account

Turbo24 Trading Account

Share Dealing Account

Spread Betting Account

Swap-Free Trading Account

IG Live Trading Account Details

United Kingdom Accounts

➡️ Negative balance protection on retail accounts

➡️ Access to spread betting, CFDs, and Share Dealing

➡️ Access to more than 17,000 markets

European Accounts (excluding UK and Switzerland)

➡️ Negative balance protection is applied to retail accounts

➡️ Access to CFDs, Barriers, Vanilla Options, and Turbo Warrants along with 17,000 other instruments

Australian Accounts

➡️ A choice between the IG Trading Account, Limited Risk Account, and Share Dealing Account

➡️ Negative balance protection is active on the IG Trading Account

➡️ Access to several CFD instruments including Options, Digital 100s, and Share Dealing

➡️ More than 17,000 markets can be traded

Switzerland, South Africa, Singapore, and New Zealand Accounts

Dubai Accounts

➡️ Traders can choose either the IG Trading Account, the Limited Risk Account, or Swap-Free Account (only offered to Dubai clients)

➡️ Negative balance protection automatically applied to the IG Trading Account

➡️ CFDs, Options, and the Digital 100s can be traded

➡️ Dubai traders have access to more than 10,000 instruments across different asset classes

Japan Accounts

➡️ There is a choice between the IG Trading Account and Limited Risk Account

➡️ Japanese traders can rest assured because negative balance protection is applied to the IG Trading Account

➡️ CFD trading along with Options and Digital 100s is offered to traders

➡️ Japanese traders can trade over 10,000 financial instruments across asset classes

US (IG) Accounts

➡️ Access is given to the IG Trading Account

➡️ Negative balance protection is applied to this account

➡️ Access to forex trading across a minor, major, and exotic pairs

➡️ More than 80 forex pairs are offered on this account type

USA (NADEX) Accounts

➡️ Traders are given access to a comprehensive Exchange Account

➡️ Exchange-traded binaries can be traded

➡️ A range of markets is spread across 10,000 contracts

IG Professional Account

➡️ Over the previous four quarters, have you averaged 10 substantial sized leverage transactions every quarter?

➡️ Do you have a financial instrument portfolio worth more than €500,000, including cash deposits?

➡️ Have you worked in the financial industry for at least a year in a professional job that required an understanding of derivatives trading?

IG Base Account Currencies

IG Demo Account

IG Islamic Account

How to open an Account with IG in Namibia

➡️ In the top right-hand corner of the official IG website is a button labelled “Create Live Account.” Traders can click this banner to proceed.

➡️ Once the online application form has completely loaded, traders can complete all the required fields by providing their information. Once complete, the form can be submitted.

➡️ Traders will receive an email with a verification link embedded in the email’s body. By confirming their email, traders have completed one of the steps towards having their trading account approved.

➡️ There are various verification methods per region, but the most common one is to provide IG with a valid copy of your Identity document and proof of residence.

➡️ Traders can also anticipate being asked to complete an extensive questionnaire that will identify the degree of trading experience they have. This will enable IG to cater for the specific requirements and goals of each individual trader.

➡️ Namibians can start trading as soon as the first deposit has been deposited into their accounts and their accounts have been approved.

How To Register Your Account

👉 Step 1 – Go to the Official Website

➡️ Go to the IG website (https://www.ig.com/) and click on “Create Live Account”.

👉 Step 2 – Fill Out Your Personal Details

➡️ Fill out your personal information such as your email address, create a username and password for your account, and fill out your country of residence. Follow the next steps to complete your profile.

Min Deposit

250 USD / 4,700 NAD

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IG Vs SuperForex Vs LiteFinance – Broker Comparison

| IG | SuperForex | LiteFinance | |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA | None | CySEC |

| 📱 Trading Platform | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API | • MetaTrader 4 • SuperForex App | • MetaTrader 4 • MetaTrader 5 • LiteFinance Mobile App |

| 💰 Withdrawal Fee | No | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 3,900 NAD | 13 NAD | 0.75 NAD |

| 📈 Leverage | 1:200 | 1:2000 | 1:500 |

| 📊 Spread | From 0.1 pips DMA | From 0.0 pips | 0.0 pips |

| 💰 Commissions | From 0.10% | From 0.013% | From $0.25 per lot on Oil |

| ✴️ Margin Call/Stop-Out | 100%/50% | 30%/40% | 100%/20% |

| ✴️ Order Execution | Market | Market/Instant | Market |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | • United Kingdom Accounts • European Accounts (excluding UK and Switzerland) • Australian Accounts • Switzerland, South Africa, • Singapore, and • New Zealand Accounts • Dubai Accounts • Japan Accounts • US (IG) Accounts | • Standard Account • Swap-Free Account • No Spread Account • Micro Cent Account • Profi STP Account Crypto Account • ECN Standard Account • ECN Standard • Mini Account • ECN Swap-Free Account • ECN Swap-Free • Mini Account • ECN Crypto Account | • ECN Account • Classic Account |

| ⚖️ BoN Regulation | None | No | No |

| 💳 NAD Deposits | No | Yes | No |

| 📊 NAD Account | No | Yes | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 8+ | 11 | 2 |

| ☪️ Islamic Account | Yes, Dubai | Yes | Yes |

| 📈 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📉 Maximum Trade Size | Unknown | None | 100 lots |

IG Trading Platforms

👉 IG offers Namibian traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ IG Platform

➡️ ProRealTime (PRT)

➡️ L2 Dealer

➡️ FIX API

Desktop Platforms

➡️ MetaTrader 4

➡️ IG Platform

➡️ L2 Dealer

MetaTrader 4

👉 Most traders across the globe use MetaTrader 4’s desktop platform because it provides superior capabilities for doing technical analysis and automated trading. There are also an extra eighteen customizable app extensions that may be used.

👉 With IG and MetaTrader 4, you can trade over 18,000 markets spread across currencies, commodities, and other assets, by downloading and installing the platform on any computer that operates on Windows, Linux, or macOS.

IG Platform

👉 The IG online trading platform is accessible to traders from anywhere in the globe who are interested in spread betting (UK) or CFD trading. Traders located in the United Kingdom may use the platform to participate in spread betting (UK).

👉 At any given time, innovative and powerful features may be made accessible to Namibian traders. This platform provides users with access to a variety of learning tools that can be accessed via their browsers. These resources include streaming news, an economic calendar, and trading guidance.

L2 Dealer

👉 L2 Dealer, which can be downloaded for free, provides users with direct access to the stock market through DMA technologies. The availability of tools such as watchlists, alerts, and orders makes it easy to engage in contract for difference (CFD) trading or use the share dealing service.

WebTrader Platforms

➡️ MetaTrader 4

➡️ IG Platform

➡️ ProRealTime

➡️ FIX API

MetaTrader 4

👉 One of the reasons why MT4 Web is so well-liked among traders all around the world is because of how simple it is to use. With IG and MetaTrader 4, you are bound to find a wide variety of trading materials online, such as trading methods, indicators, signals, and even completely automated trading systems.

IG Platform

👉 The progressive web app (PWA) offered by IG may be accessed on any device, without the need to visit a third-party app store, and from any location in the globe, making it accessible to traders all over the world.

👉 PWAs were developed to be much faster and a lot less complicated to use in comparison to the conventional app store approval procedures, which may take several days or even weeks to complete.

ProRealTime

👉 ProRealTime (PRT) is a complete charting package that provides the user community with comprehensive monitoring capabilities, as well as flexible access and strong analytic resources. People who deal with technical charts may find that PRT is helpful to them.

👉 If traders in the United Kingdom participate in spread betting or trade CFDs at least four times each month, they are exempt from having to pay for the trading platform.

FIX API

👉 The FIX application programming interface makes it simple to access real-time market data, historical pricing, and order execution from any trading account held with IG.

👉 This reduces the time and effort that would have been required to trace data across many exchanges and dark pools. In addition, there is the possibility of direct delivery, which guarantees both effectiveness and promptness.

Trading App

➡️ MetaTrader 4

➡️ IG Platform

MetaTrader 4

👉 MetaTrader 4, one of the many trading programs that are now accessible, is one of the most popular for several reasons, including its robust technology, lightning-fast performance, and streamlined account connection across devices.

👉 In addition, IG’s MetaTrader 4 can be used on mobile devices such as tablets and smartphones if they are running iOS or Android.

IG Platform

👉 Trading while on the go has never been easier than it is with IG’s mobile trading platform, which can be downloaded on Android and iOS smartphones, respectively.

👉 Traders in contracts for difference (CFD) and stock/share dealers in the United Kingdom have access to it. Mobile charts from IG are always accessible and provide users with the same functionalities as those found on the web-based platform.

IG Range of Markets

👉 Namibian traders can expect the following range of markets from IG:

➡️ Forex

➡️ Indices

➡️ Share CFDs

➡️ Commodities

➡️ Cryptocurrencies

➡️ Futures

➡️ Options

➡️ Bonds

➡️ ETFs

➡️ Digital 100s

➡️ Interest Rates

Min Deposit

250 USD / 4,700 NAD

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Broker Comparison for Range of Markets

| IG | SuperForex | LiteFinance | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | No | Yes |

| ➡️️ ETFs | No | Yes | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | Yes | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

IG Trading and Non-Trading Fees

Spreads

👉 IG uses variable spreads, which means that typical spreads are defined not only by the financial instrument that is being traded but also by the account that is being utilized and the general market circumstances on the day that trading is taking place. Traders in Namibia should be prepared for some of the following usual spreads:

➡️ Forex – 0.6 pips EUR/USD with an average spread of 0.75 pips

➡️ Forex – DMA spread of 0.1 pips

➡️ Indices – from 0.4 pips on the FTSE 100

➡️ Commodities – from 0.3 pips

➡️ Cryptocurrency – from 0.2 pips on Stellar

➡️ Futures – from 0.6 pips

➡️ Interest Rates – from 1 pip

➡️ Bonds – from 1 pip

Commissions

👉 In most cases, the broker fees charged by IG are included in the spread associated with the relevant financial instrument. However, this is not always the case, and the following commissions may apply to some financial products in certain circumstances:

➡️ EU and UK Shares – 0.10%

➡️ US Shares – $0.2

Overnight Fees, Rollovers, or Swaps

👉 If traders in Namibia hold a short-term contract overnight, they might expect to be credited or debited an overnight fee. This cost applies to any CFD positions held after 10 pm (UK Time). IG does not impose overnight fees on futures and forwards since they are commonly kept for extended periods.

👉 When a Namibian trader wishes to open a larger position than their initial deposit, they use leverage, which involves borrowing money from the broker. To account for the cost of funding a position overnight, a trader must make an interest adjustment to their account.

👉 As seen in the following example, a long position will be added to the formula, while a short position will be subtracted:

➡️ Long Position – Number of contracts x contract value x price (SONIA% + 2.5% admin fee) / 365.

➡️ Short Position – Number of contracts x contract value x price (SONIA% – 2.5% admin fee) / 365.

Inactivity Fees

👉 IG applies inactivity fees to trading accounts that have become dormant after two consecutive years. This fee only applies if the trading account contains some funds, and the fee will be deducted on the first day of every month.

Currency Conversion Fees

👉 Currency conversion charges may apply to CFDs traded in a currency other than your account’s base currency.

👉 IG’s default option is immediate conversion, which converts foreign-currency gains to your base currency and accounts for financing, commission, and dividend costs before crediting your account. Daily, weekly, and monthly conversion options are also available, with a normal price of 0.5%.

Other Fees

👉 IG is extremely transparent where trading and non-trading fees are concerned. In addition to the fees already mentioned, IG also charges the following fees:

➡️ Live Price Data Fees – when traders get live share prices from an exchange to trade share CFDs, IG applies a certain fee.

➡️ ProRealTime Charts can be accessed at a fee of $20.

➡️ Account documentation fees apply on accounts that have failed to provide mandatory W-8 or W-9 forms before the dividend ex-dates of any trades on US-incorporated stocks. In such cases, IG charges a $50 fee.

IG Deposits and Withdrawals

➡️ Bank Wire Transfer

➡️ International Transfers

➡️ Cheques

➡️ ACH

➡️ PayPal

➡️ Debit Cards

➡️ Credit Cards

How to Deposit Funds with IG

➡️ When a trader login into their My IG portal, they may go to the “Deposit” option and select this option.

➡️ Namibian traders can then choose their chosen payment method, deposit currency, and enter the amount they want to deposit in their account.

➡️ Depending on the deposit type, traders may be required to follow additional steps to complete the transaction.

➡️ In addition, traders who transfer money to IG from another jurisdiction must produce evidence of payment to the broker after the funds have been deposited.

IG Fund Withdrawal Process

➡️ Logging into their My IG account and clicking “Withdraw Cash” under “Live Accounts” will allow Namibian traders to withdraw their funds.

➡️ Traders who made deposits with a credit or debit card must use a bank transfer to retrieve their funds.

➡️ To withdraw funds, traders must submit their bank account details that show their names. This is only needed for the very first withdrawal.

➡️ Traders must provide their bank statement showing the first deposit, as well as their banking information, to IG’s helpdesk email, which can be located on the company’s official website’s Help and Support page.

➡️ Once this has been validated, traders can proceed with their withdrawal requests.

IG Education and Research

Education

➡️ IG Academy

➡️ Risk Management Guidelines

➡️ Maximizing Trading Success

➡️ Developing a Trading Strategy

➡️ Webinars

➡️ Seminars

➡️ Glossary

Research and Trading Tool Comparison

➡️ News and Trade Ideas

➡️ Trading Strategies

➡️ Financial Events

➡️ Trade Analytics Tool

➡️ Subscriptions and Downloads

➡️ Special Reports

➡️ Podcasts

➡️ Economic Calendar

IG Bonuses and Promotions

➡️ The Refer a Friend scheme (RAF) allows traders to earn up to $10,000 when they successfully refer friends and family to register a live account with IG.

How to open an Affiliate Account with IG

➡️ Prospective affiliates can visit the official IG website and access the “Marketing Partnership” option from the homepage.

➡️ Read through the information provided on the Affiliate Program and click on the “Fill in our Form” at the bottom of the page.

➡️ Complete the registration form by providing your Name, Email Address, Website, and mobile phone number.

➡️ Submit the application and an IG agent will be in contact regarding the outcome of your application after the IG team verifies that you meet the requirements.

➡️ If your application is approved, you can start exploring the comprehensive program, marketing materials, tools, and several other elements that IG offers its partners.

IG Affiliate Program Features

➡️ Affiliates may earn up to $1000 for each new customer they bring on board who qualifies, thanks to a comprehensive monitoring system.

➡️ To increase the number of times a banner ad is clicked, custom online and mobile banners are created.

➡️ Partners get access to a personal relationship manager as well as IG’s multilingual support staff to help them with any concerns.

➡️ Affiliates may quickly implement an appealing reward program for their customers with the support of IG and the broker’s world-class products.

➡️ Prospective partners must be at least 18 years old to be considered.

➡️ To participate, the affiliate must have a functional website.

➡️ The affiliate’s website should focus primarily on trading and financial services.

➡️ The affiliate’s website must appeal to an audience above the age of 18 and give balanced and impartial content.

IG Customer Support

IG Corporate Social Responsibility

Verdict on IG

IG Current Popularity Trends

👉 According to Google Trends, IG has seen an increase in Google Searches in the past month.

Min Deposit

250 USD / 4,700 NAD

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IG Pros and Cons

| ✔️ Pros | ❌ Cons |

| IG is one of the oldest and largest brokers in the world that is also listed on a stock exchange | Islamic accounts are limited to Dubai residents |

| IG offers a grand selection of accounts and trading platforms | There are currency conversion fees charged |

| There are more than 18,000 markets which can be traded | The minimum deposit is extremely high |

| IG is known for its tight spreads, low commission charges and superior trade execution speeds | There are inactivity fees charged |

| There is an extensive and dedicated trading academy for inexperienced traders | Withdrawal fees apply to several methods |

| There are several powerful advanced trading tools offered by IG | |

| There are several convenient funding and withdrawal options, with fees only charged on some | |

| There is a very transparent fee schedule offered |

Frequently Asked Questions

What is the minimum deposit for IG?

IG’s minimum deposit is 3,900 NAD for Namibian traders.

How much can I withdraw from IG?

The minimum withdrawal with IG is 1,500 NAD or an equivalent to $100.

What is the withdrawal time with IG?

The withdrawal time with IG ranges from between a working day up to five working days.

Is IG regulated?

Yes, IG is well-regulated in five continents and several regions by FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, and BMA.

How long does it take to fund an IG account?

Paypal offers instant deposits while others can take up to 1 business day.

Who owns IG?

IG is owned and operated by the IG Group, based in London, UK. The current CEO is June Forex and IG Group had revenues of £863 million reported for 2021.

Does IG have Nasdaq?

Yes, IG offers Nasdaq across several tradable options to global clients.

Is IG safe or a scam?

IG is one of the safest brokers with an extremely high trust score of 99%.

Does IG have Volatility 75?

Yes, IG offers Volatility 75 (VIX) as a CFD on indices.

Conclusion

➡️ Do you have any prior experience with IG?

➡️ What was the determining factor in your decision to engage with IG?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with IG such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Addendum/Disclosure:

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia