Markets.com Review

Overall, Markets.com is considered low-risk, with an overall Trust Score of 98 out of 100. Markets.com is licensed by two Tier-1 Regulators (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). Markets.com offers one different retail trading account namely a Standard MarketsX Account. Markets.com is currently not regulated by the bank of Namibia

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 100 / 1,500 NAD

Regulators

CySec, ASIC, FCA, BVI FSC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, Markets.com propietary platform

Crypto

Yes

Total Pairs

67

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Markets.com Review – 25 key points quick overview:

- ✅Markets.com Overview

- ✅Markets.com At a Glance

- ✅Markets.com Regulation and Safety of Funds

- Markets.com Awards and Recognition

- Markets.com Account Types and Features

- How to open an Account with Markets.com in Namibia

- easyMarkets Vs SuperForex Vs XM – Broker Comparison

- Markets.com Trading Platforms

- Markets.com Range of Markets

- Broker Comparison for Range of Markets

- Markets.com Trading and Non-Trading Fees

- Markets.com Deposits and Withdrawals

- How to Deposit Funds with Markets.com

- Markets.com Fund Withdrawal Process

- Markets.com Education and Research

- Markets.com Bonuses and Promotions

- How to open an Affiliate Account with Markets.com

- Markets.com Affiliate Program Features

- Markets.com Customer Support

- Markets.com Corporate Social Responsibility

- Verdict on Markets.com

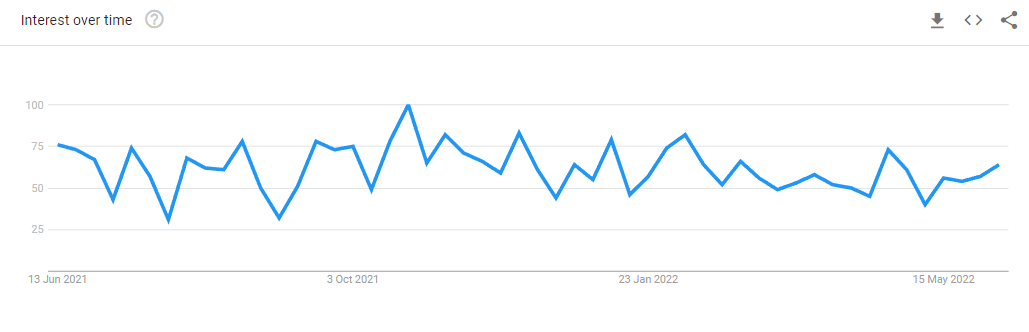

- Markets.com Current Popularity Trends

- Markets.com Pros and Cons

- Frequently Asked Questions

- Conclusion

Markets.com Overview

👉 Markets.com was founded in 2008 and is a subsidiary of Finalto, which is a subsidiary of Playtech PLC, listed on the London Stock Exchange Main Market and is a member of the FTSE 250 Index.

👉 Markets.com is a well-known and licensed broker that offers a diverse choice of trading products across a variety of markets. Award-winning trading solutions for PC and mobile devices allow you to trade different assets in competitive, fair, transparent trading environments.

👉 Markets.com is a terrific broker for traders looking for a comprehensive and reputable online platform with a wide range of account options and features.

👉 This Markets.com review for Namibia will provide local retail traders with the details that they need to consider whether Markets.com is suited to their unique trading objectives and needs.

👉 Markets.com accepts Namibian clients and has an average spread from 0.6 pips with zero commission charges. Markets.com has a maximum leverage ratio up to 1:300 and there is a demo and Islamic account available.

👉 MT4, MT5, and MarketsX platforms are supported. Markets.com is headquartered in South Africa and regulated by ASIC, CySEC, FSCA, FCA, and BVI FSC.

Markets.com Distribution of Traders

👉 Markets.com currently has the largest market share in these countries:

➡️️ United Kingdom – 11.8%

➡️️ Argentina – 10.1%

➡️️ Netherlands – 8.1%

➡️️ Dominican Republic – 7.6%

➡️️ South Africa – 6.7%

Popularity among traders who choose Markets.com

🥇 Markets.com is a well-known South African broker, and although it does not dominate the Namibian forex market, it is a realistic and trustworthy alternative for Namibian traders, placing it in the Top 20 forex and CFD brokers for the country.

Markets.com At a Glance

| 🏛 Headquartered | The British Virgin Islands |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2008 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC |

| 🪪 License Number | • Cyprus (Safecap Investments) – 092/08 • British Virgin Islands (Finalto) – SIBA/L/14/1067 • South Africa (Finalto Pty Ltd) – 46860 • South Africa (Safecap Investments Limited) – 43906 • United Kingdom (Finalto Trading Ltd)- 607305 • Australia (Finalto) – ABN 82158641 |

| ⚖️ BoN Regulation | None |

| 🚫 Regional Restrictions | The United States, Japan, Canada, Belgium, Israel, New Zealand, Russia, Hong Kong, and several other regions |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| 📊 PAMM Accounts | None |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | No |

| 📲 Order Execution | Market and Instant |

| 📊 Average spread | 0.8 pips EUR/USD |

| 📞 Margin Call | 50% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:300 |

| 🚫 Leverage Restrictions for Namibia? | None |

| 💰 Minimum Deposit (NAD) | 1,500 Namibian Dollar or an equivalent to $100 |

| ✅ Namibian Dollar Deposits Allowed? | No, only USD, ZAR, GBP, and EUR |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based Markets.com customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank Wire Transfer • Credit Card • Debit Card • Skrill • Neteller |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MarketsX • Marketsi • MetaTrader 4 • MetaTrader 5 • MarketsX App |

| ✔️ Tradable Assets | • Shares • Bonds • Cryptocurrencies • Forex • Primary CFDs • ETFs • Indices • Blends • Commodities |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Spanish, Thai, Vietnamese |

| 📞 Customer Support Languages | English, French, Spanish, Italian, Arabic, German, Bulgarian |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Namibian-based customer support? | No |

| ✅ Bonuses and Promotions for Namibians | None |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is Markets.com a safe broker for Namibians? | Yes |

| 📊 Rating for Markets.com Namibia | 7/10 |

| 🤝 Trust score for Markets.com Namibia | 97% |

| 👉 Open an account | 👉 Open Account |

Markets.com Regulation and Safety of Funds

Markets.com Regulation in Namibia

Markets.com Global Regulations

➡️ The ASIC in Australia and CySEC in Cyprus are responsible for the regulation of Markets.com AU and Markets.com CY, respectively.

➡️ The respected and demanding Financial Sector Conduct Authority (FSCA) in South Africa, where Markets.com SA has a local office, regulates the company.

➡️ The Financial Conduct Authority (FCA) supervises and regulates Markets.com UK.

➡️ The British Virgin Islands Financial Services Commission (BVI FSC) is responsible for managing Markets.com in addition to regulating it.

Markets.com Client Fund Security and Safety Features

Markets.com Awards and Recognition

Markets.com Account Types and Features

👉 Even though Markets.com does not provide a variety of account kinds, the trading conditions vary depending on which platform is selected. Traders will be able to establish both a genuine and a demo account with a single registration.

👉 After registering an account, Namibian traders will have the option of using the MarketsX, Marketsi, MT4, or MT5 platforms. The MarketsX platform is a multi-asset trading platform for the financial markets, while the Marketsi platform is a financial investing platform.

👉 The Markets.com account is suitable for both novice and expert traders. Markets.com’s account has a low minimum deposit of 1,500 NAD or an equivalent to $100, making it accessible to new traders, and it provides trading on its own platform, which is simpler to use than third-party platforms like MT4 and MT5.

👉 While experienced traders may prefer greater minimum deposits and narrower spreads, Markets.com provides a low-cost trading environment and a broad range of tradable assets in exchange for a fee per lot, making it attractive to more experienced traders.

👉 Markets.com also provides Namibian traders leverage up to 1:300, which is accessible to all worldwide customers regulated by the BVI FSC and FSCA, while only professional traders who are licensed by the FCA, as well as ASIC, are typically eligible to use this leverage.

👉 Traders who adhere to Sharia law may transfer their live trading account to an Islamic Account to avoid overnight fees. Inexperienced and seasoned traders both may benefit from Markets.com’s free practice demo account.

Markets.com Live Trading Account Details

MarketsX Account

| Account Feature | Value |

| 💰 Minimum Deposit | 1,500 NAD |

| 📊 Average Spreads | From 0.8 pips on major forex pairs |

| 💸 Commissions | None |

| 📉 Leverage | Up to 1:300 for non-EU traders |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • MarketsX • Marketsi |

| 👥 Customer Support Offered | Yes |

| 🚨 Trading Signals | Yes |

| 🔧 Trading Tools offered | Yes |

| 📱 Trading Alerts and Notifications | Customizable alerts |

| 📈 Range of Markets | 8,000+ financial instruments |

👉 Additional features on this account include the following:

➡️ Market trade execution

➡️ The use of a range of technical, fundamental, and sentimental analysis across several financial markets

➡️ Access to powerful and advanced charting

➡️ Access to ForexLive.com’s financial commentary

➡️ Access to the Thomson Reuters Stock report

Markets.com Base Account Currencies

👉 When registering an account with Markets.com, traders can choose between USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, and AED as their default account currency. This means that Namibians who deposit or withdraw in NAD could face currency conversion fees, which can affect their profitability.

Markets.com Demo Account

👉 Traders can also establish a Demo Account, which enables them to discover how the platform works and how the markets operate. Demo accounts come with a virtual fund of USD 10,000.

👉 While the demo account is valid for 30 days, this time can be extended if necessary. It is also mobile-friendly, so you can learn how to trade on your phone or tablet.

Markets.com Islamic Account

👉 A forex trader’s trading positions may be open for more than 24 hours on a trading day, depending on their trading style and technique.

👉 This might result in an overnight or rollover cost for the trader. This is an interest that is banned by Sharia law’s Riba rules, which implies that Muslim forex traders are often limited.

👉 With Markets.com, Muslim traders who follow Sharia can register a live account and have it converted into an Interest-Free Islamic Account, exempting them from paying or receiving overnight fees when positions are left open for longer than 24 hours.

How to open an Account with Markets.com in Namibia

➡️ Visit the Markets.com website and click on the option to “Create Account.”

➡️ The application form that loads will require that traders provide some personal information, and financial information, and complete a questionnaire about their trading experience and overall financial market knowledge.

➡️ Next, traders must complete the mandatory KYC process during which they must upload proof of their identity and residence.

➡️ Next, traders must read and agree to the Markets.com risk disclosure, customer agreement, and the terms of business before applying.

➡️ Once Markets.com has received the documentation, the information that the trader provided will be reviewed and the account application will be approved/denied.

➡️ Once approved, traders can make the minimum deposit to start trading.

How to Register Your Account

👉 Step 1 – Go to the Official Website

➡️ Go to Markets.com and click on “Create Account” in the top right corner.

👉 Step 2 – Fill Out Your Details

➡️ Fill out your email address and create a password for your account.

👉 Step 3 – Fill Out Your Country of Residence

➡️ Select Your Country of Residence and Birth.

👉 Step 4 – Complete Your Profile

➡️ Now follow the process of filling out your personal details and click on “Continue” to finalize your account.

easyMarkets Vs SuperForex Vs XM – Broker Comparison

| Markets.com | Pepperstone | IG | |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📱 Trading Platform | • MarketsX • Marketsi • MetaTrader 4 • MetaTrader 5 • MarketsX App | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API |

| 💰 Withdrawal Fee | None | No | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1,500 NAD | 2277 NAD | 3778 NAD |

| 📈 Leverage | 1:300 | 1:400 | 1:200 |

| 📊 Spread | From 0.8 pips | Variable, from 0.0 pips | From 0.1 pips DMA |

| 💰 Commissions | From 15 USD | From AU$7 | From 0.10% |

| ✴️ Margin Call/Stop-Out | 50% | 90%/20% | 100%/50% |

| ✴️ Order Execution | Instant, Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • MarketsX Account • Marketsi Account | • Standard Account • Razor Account | • United Kingdom Accounts • European Accounts (excluding UK and Switzerland) • Australian Accounts • Switzerland, South Africa, Singapore, and New Zealand Accounts • Dubai Accounts • Japan Accounts US (IG) Accounts • USA (NADEX) Accounts |

| ⚖️ BoN Regulation | No | Yes | No |

| 💳 NAD Deposits | No | Yes | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 2 | 2 | 8+ |

| ☪️ Islamic Account | Yes | Yes | Yes, Dubai |

| 📊 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 100 lots | Unknown |

Min Deposit

USD 100 / 1,500 NAD

Regulators

CySec, ASIC, FCA, BVI FSC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, Markets.com propietary platform

Crypto

Yes

Total Pairs

67

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Markets.com Trading Platforms

👉 Markets.com offers Namibian traders a choice between these trading platforms:

➡️ MarketsX

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 The MetaTrader 4 (MT4) platform, which was designed for forex trading, is still one of the most popular and simple-to-use trading platforms. MT4, which is used by millions of traders across the world, provides a wealth of tools and functionality to assist traders of all experience levels to have a seamless and comfortable trading experience.

MetaTrader 5

👉 MetaTrader 5, or MT5, is a multi-asset derivatives platform that was built for trading on a broad variety of forex, futures, stocks, and CFDs. This contrasts with MetaTrader 4, or MT4, which was primarily designed for forex trading.

👉 It is a tuned-up, speedier version of MT4 that supports hedging and netting, and gives an increase in technical indicators as well as greater insight into the market depth and a broader number of periods. Additionally, it delivers an increase in the number of technical indicators.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 A prominent feature of MetaTrader 4 is that the user interface is not too intimidating for those who are new to online trading, and the substantial number of trading tools available should be sufficient to meet the demands of even the most demanding traders.

👉 There are also other free trading tools available to expand the platform’s functionality. You may be certain that your transactions will be executed at the best available rates and with the lowest possible spreads when Markets.com oversees pricing and infrastructure.

MetaTrader 5

👉 Markets.com’s unique trading platform, as well as its MetaTrader 5 support, provides traders with a wide range of investment analysis tools, indicators, and signals to help them make the best trading choices possible.

👉 While new and intermediate traders will find the proprietary platform most useful, expert traders are likely to use MetaTrader 5 instead.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ MarketsX Mobile

MetaTrader 4 and 5

👉 MT4/5 mobile comes with a variety of tools and features that make trading simple and entertaining for traders of all levels of experience. The user interface provides a range of trading tools to fulfil the demands of even the most demanding Namibian investors.

👉 MetaTrader 5, a multi-asset derivatives platform designed to compete with MetaTrader 4, allows traders to trade forex, futures, stocks, and CFDs. MetaTrader 5 allows for hedging and netting, as well as providing a larger range of timeframes and additional technical indicators.

MarketsX

👉 All Android and iOS smartphones and tablets may use the Markets.com mobile app. This user-friendly mobile trading software gives you access to a variety of dynamic tools and innovative trading technologies while you are on the road.

👉 You may trade online using Markets.com’s award-winning trading platform, which provides a wealth of features that can be tailored to your specific requirements.

👉 Markets.com features include a shortlist of your favourite trading instruments, numerous chart views, and sophisticated trading tools, all of which are generated using proprietary algorithms exclusive to Markets.com.

👉 The platform has a snappy, user-friendly design that makes trading a pleasure. In only a few clicks, each function may be accessed immediately from the platform. You may pick a multi-chart view from inside the site, which provides comprehensive charting with novel analytical tools and free real-time quotations.

👉 In addition, the app can be downloaded from the App Store or Google Play by filling out a simple form on the Markets.com website.

Markets.com Range of Markets

👉 Namibian traders can expect the following range of markets from Markets.com:

➡️ Shares

➡️ Bonds

➡️ Cryptocurrencies

➡️ Forex

➡️ Primary CFDs

➡️ ETFs

➡️ Indices

➡️ Blends

➡️ Commodities

Broker Comparison for Range of Markets

| Markets.com | Pepperstone | IG | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | Yes | Yes |

Min Deposit

USD 100 / 1,500 NAD

Regulators

CySec, ASIC, FCA, BVI FSC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, Markets.com propietary platform

Crypto

Yes

Total Pairs

67

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Markets.com Trading and Non-Trading Fees

Spreads

👉 Markets.com offers premium service which includes market-beating spreads that can fluctuate according to the market price, financial instrument, and time of day. When participating in leveraged trading with Markets.com, Namibian traders need only worry about the spread as the broker fee is already included in this.

👉 Some typical spreads that traders can expect from Markets.com are as follows:

➡️ EUR/USD – from 0.8 pips

➡️ USD/JPY – from 1.2 pips

➡️ AUD/USD – from 0.7 pips

➡️ USD/CHF – from 1.7 pips

➡️ USD/CAD – from 1.4 pips

➡️ GBP/USD – from 1.1 pips

Commissions

👉 Markets.com does not charge any commissions on MarketsX, MetaTrader 4, or MetaTrader 5 and traders are only charged the spread, which is marked up to include Markets.com’s broker fee for facilitating the transaction.

Overnight Fees, Rollovers, or Swaps

👉 Each open position at the end of the company’s trading day may be subject to daily overnight rollover costs. The rollover fee calculation technique varies depending on the kind of instrument to which it applies.

👉 Furthermore, since the fee is related to current interbank interest rates, the amount of the charge will fluctuate. This fee will be applied to your account after the trading day, and it may occur without warning.

👉 To prevent an automatic closure of your account, any position retained by you after the trading day will be automatically rolled over to the following trading day. Namibian traders can expect some of these typical overnight fees:

➡️ EUR/USD – a short swap of -12.0485 points and a long swap of -12.0489 points

➡️ Cryptocurrency pairs – short swaps of -12 points and long swaps of -25 points

➡️ BTCFutures – a short swap of -501.2 points and a long swap of -501.2 points

➡️ Brent Toil – a short swap of -1.05 points and a long swap of -1.09 points

➡️ XAU/USD – a short swap of -28.52 points and a long swap of -29.49 points

➡️ AUS200 – a short swap of -63.835 points and a long swap of -67.59 points

➡️ US100 – a short swap of -123.6 points and a long swap of -130.8 points

➡️ VIXX – a short swap of -0.211 points and a long swap of -0.258 points

➡️ APPL – a short swap of -0.592 points and a long swap of -0.62 points

➡️ EUR-BUND-10Y – a short swap of -1.2 points and a long swap of -1.2 points

👉 During substantial refinancing efforts, the Central Bank of the nation whose currency the asset is denominated releases the Key Interest Rate (or an equivalent). The Financing Charge is a product-specific fee that includes the following expenses:

➡️ Forex – 3.75%

➡️ Indices – 3.75%

➡️ Oil – 6%

➡️ Shares – 11%

➡️ Commodities – 6%

➡️ Natural Gas – 10%

Deposit and Withdrawal Fees

👉 Markets.com does not charge any fees on the deposit or withdrawal methods that are offered.

Inactivity Fees

👉 Inactivity fees apply when a trading account becomes dormant after 90 consecutive days. If an account becomes dormant, a $10 fee will be charged to the account until the balance reaches zero, after which the account will be terminated.

Currency Conversion Fees

👉 Currency conversion fees are applied, and they are calculated at 0.6% multiplied by the conversion rate, which is charged by Markets.com when currencies are converted.

Markets.com Deposits and Withdrawals

👉 Markets.com offers the following deposit and withdrawal methods:

➡️ Bank Wire Transfer

➡️ Credit Card

➡️ Debit Card

➡️ Skrill

➡️ Neteller

How to Deposit Funds with Markets.com

👉 To deposit funds to an account with Markets.com, Namibian traders can follow these steps:

➡️ You can clock on the “Menu” that can be found in the top right corner of the platform.

➡️ Select the “Add Funds” option and choose your preferred payment method.

➡️ Provide the amount you wish to deposit and the deposit currency and confirm the details to process the deposit.

Markets.com Fund Withdrawal Process

👉 To withdraw funds from an account with Markets.com, Namibian traders can follow these steps:

➡️ To withdraw funds from your Markets.com account, go to the Menu in the upper right corner of the site and choose the Withdrawal method.

➡️ You may also withdraw via the mobile app if that is more convenient for you.

➡️ Complete the withdrawal request and submit it to Markets.com for processing.

👉 Clients will receive funds using the same payment method they used to deposit, up to the amount deposited. If a deposit is made using a credit card, for example, the monies will be reimbursed to the same credit card.

👉 Credit card deposits are given precedence and will be repaid first (with deposits made within the past 12 months receiving priority), followed by alternative withdrawal methods.

Markets.com Education and Research

Education

➡️ Xray

➡️ eBooks

➡️ Market News

➡️ FAQs

➡️ Webinars

➡️ Analysis

➡️ Market insight

➡️ Fundamental Analysis

➡️ Technical Tools

➡️ Sentimental tools

➡️ Blogger’s opinions

➡️ Hedge Funds Investment Confidence

➡️ Insider Trades

➡️ Trading Analysis Recommendations

➡️ Trends in Trading

➡️ Trading Signals

➡️ Advanced Charting

➡️ Financial Commentary

➡️ Advanced Trading Alerts

➡️ Thomson Reuters Stock Report

Markets.com Bonuses and Promotions

👉 Markets.com does not currently offer any active bonuses or promotions to Namibian traders.

How to open an Affiliate Account with Markets.com

👉 To register an Affiliate Account, Namibians can follow these steps:

➡️ Navigate to Markets Affiliates website by entering “Markets.com Affiliates” into your browser’s search bar.

➡️ Read through Markets.com’s partnership offering, the terms and conditions, Privacy Policy, and the client agreement before signing up.

➡️ Click on the “Become a partner now” banner and complete the Affiliate account application by providing your username, first and last name, email address, and mobile number. Choose a user-selected password, choose your country from the drop-down list, and enter your business information such as company name and website address.

➡️ Apply by clicking on “Register” and wait for a Markets.com affiliate customer agent to be in contact regarding the outcome of your application.

Markets.com Affiliate Program Features

👉 Markets.com offers the following as part of its comprehensive Affiliate Program:

➡️ A dedicated relationship manager and client education that is presented by industry experts.

➡️ Access to landing pages that have the affiliate’s company name and the wording “in partnership with Markets.com.”

➡️ A large portfolio of both local and international assets along with access to robust trading platforms that cater for beginner, experienced, and professional traders.

➡️ Markets.com’s proprietary technical trading tools and online portal access where affiliates can view their client activity in real-time.

➡️ Tailored rebate programmes along with “refer a friend” schemes and deposit bonuses.

➡️ The benefit is that deposits and withdrawals are free, there are no commission charges, and the lowest spreads are charged across assets.

Markets.com Customer Support

👉 This award-winning trading platform comes with great customer service that is available through phone, email, or live chat throughout the trading week to help you with your inquiries and technical concerns. Markets.com also offers a comprehensive FAQ section that covers a variety of issues.

Markets.com Corporate Social Responsibility

👉 Markets.com does not currently provide any information on CSR initiatives or projects.

Verdict on Markets.com

👉 Many internet brokers have a restricted selection of asset kinds and a slew of hidden charges. Markets.com distinguishes itself by providing zero commissions, minimal spreads, and a transparent pricing methodology, as well as a diverse choice of tradable assets.

👉 The substantial number of trading jurisdictions offered on Markets.com adds to the value of the service. From the quick setup method to the ease with which traders may utilize and come up to speed with the unique trading platform, Markets.com stresses simplicity and user experience for traders.

👉 A solid array of teaching and analysis tools, as well as simple deposit and withdrawal conditions, round out the package and make Markets.com even more appealing.

👉 Markets.com’s overall user experience is seamless and dependable. The trading platform’s reliability and easy-to-navigate layout are enhanced by the platform’s friendly customer support offering.

👉 The platform’s feeling of support and professional coaching will appeal to new traders. Professional traders who want to register a pro account will benefit from VIP service as well as increased leverage.

Markets.com Current Popularity Trends

👉 According to Google Trends, Markets.com has seen an increase in Google Searches in the past month.

Markets.com Pros and Cons

| ✔️ Pros | ❌ Cons |

| Markets.com is a high trust broker that has been in operation for 14 years, having built a good reputation | There is a $10 inactivity fee charged on dormant accounts |

| Namibian traders can expect commission-free trading with very tight spreads on MarketsX, MT4, and MT5, which means lower trading costs | There is a currency conversion fee applied |

| There are convenient payment methods offered by Markets.com | NAD is not a default currency for an account or a deposit/withdrawal currency |

| Deposit and withdrawal fees are not charged by Markets.com | Spreads are marked up and there is a limited choice between trading accounts |

| Markets.com offers a demo and Islamic account | |

| There are several advanced tools offered by Markets.com | |

| Markets.com offers dedicated, helpful 24/5 multilingual support to traders | |

| Markets.com welcomes both beginner and professional Namibian traders |

Min Deposit

USD 100 / 1,500 NAD

Regulators

CySec, ASIC, FCA, BVI FSC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, Markets.com propietary platform

Crypto

Yes

Total Pairs

67

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Frequently Asked Questions

What is the minimum deposit for Markets.com?

The minimum deposit for Markets.com is 1,500 NAD or an equivalent to 100 USD.

How do I open a demo account on Markets.com?

You can visit the official website and select the option from the homepage. Next, you must complete a short registration form, verify your contact details, and start trading by downloading your platform of choice between MT4, MT5, and MarketsX mobile.

What is the withdrawal time with Markets.com?

The withdrawal time with Markets.com ranges from as little as 24 hours up to several days.

Is Markets.com regulated?

Yes, Markets.com is regulated in South Africa by FSCA, in the United Kingdom by the FCA, Cyprus by CySEC, and in the British Virgin Islands by BVI FSC.

Who created Markets.com?

Markets.com is an electronic trading platform owned and operated by Playtech.

Does Markets.com have Nasdaq?

Yes, Markets.com offers Nasdaq as a CFD on Indices that can be traded as a Primary CFD, Futures CFD, or Cash instrument under “US Tech 100”.

What type of broker is Markets.com?

Markets.com is a CFD broker that offers a wide range of tradable financial instruments, a standard retail account, a choice between three platforms, and competitive trading conditions.

Is Markets.com safe or a scam?

Markets.com is not a scam broker. Markets.com has an extremely high trust score and has regulations and authorization with two Tier-1 (FCA, ASIC), two Tier-2 (FSCA, CySEC), and one Tier-3 (BVI FSC) market regulators.

Does Markets.com have Volatility 75?

Yes, Markets.com offers Volatility 75 as a tradable instrument under Primary CFDs.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with Markets.com?

➡️ What was the determining factor in your decision to engage with Markets.com?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Markets.com such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia