Octafx Review

Overall OctaFX is considered low-risk with an overall Trust Score of 4.5 out of 5. OctaFX offers three account types namely OctaTrader, MetaTrader 4 and MetaTrader 5. They provide great pricing options for traders but lack in range of tradeable instruments. OctaFX is currently not regulated by the Bank of Namibia

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overview

The broker accepts Namibian clients and has an average spread from 0.6 pips with zero commission charges. They have a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available. MT4, MT5, OctaFX, and CopyTrade platforms are supported. They are headquartered in Saint Vincent and the Grenadines and regulated by CySEC and SVG FSA.

The broker was established in 2011 and offers strong trading platforms and numerous account options to cater to all kinds of traders.

OctaFX’s goal is to reduce trading expenses as much as possible, and they plan to do so by ensuring that 97.5% of orders are carried out without any slippage by using the STP (Straight Through Processing) and ECN (Electronic Communications Network) models.

The broker provides clients with a variety of Forex and CFD products at costs that are among the most reasonable in the industry. In addition to this, they provide traders with several helpful trading tools, educational materials, and a responsive customer support staff that are all available to assist them.

This OctaFX review for Namibia will provide local retail traders with the details that they need to consider whether OctaFX is suited to their unique trading objectives and needs.

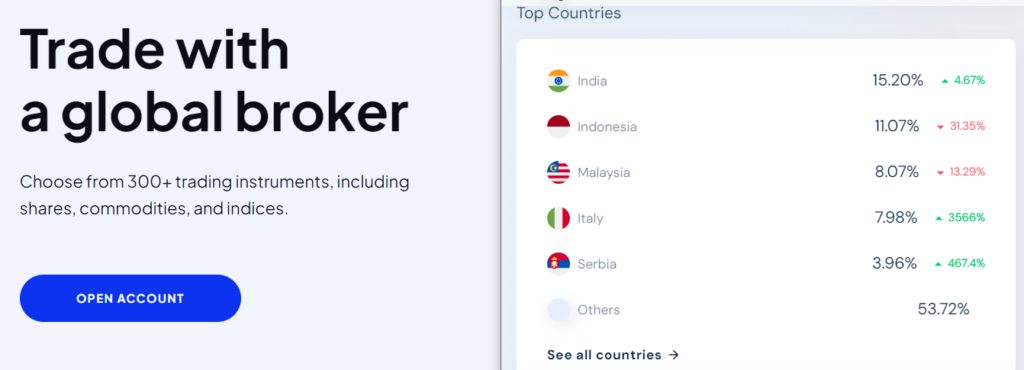

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among traders

Where Are Most OctaFX Traders Located?

OctaFX has a global presence, and its traders are located in various regions worldwide. While there isn’t a specific concentration in one location, the broker caters to traders from diverse geographical regions.

Does the broker Offer Services to Traders in the United States?

No, they do not offer its services to traders in the United States. The broker primarily serves traders from other parts of the world but does not operate within the United States due to regulatory restrictions.

At a Glance

| 🏛 Headquartered | Saint Vincent and the Grenadines |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2011 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | CySEC, SVG FSA |

| 🪪 License Number | • Cyprus – 372/18 • Saint Vincent and the Grenadines – 19776 |

| 🚫 Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.6 pips |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Kenya? | No |

| 💰 Minimum Deposit (NAD) | $25/480 NAD |

| ✅ Namibian Dollar Deposits Allowed? | No |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based OctaFX customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank Wire Transfer • Debit Card • Credit Card • Bitcoin (BTC) • Ethereum (ETH) • Dogecoin (DOGE) • Litecoin (LTC) • Tether TRC-20 (USDTT) • Tether ERC-20 (USDTE) • Skrill • Neteller |

| ⏰ Minimum Withdrawal Time | No |

| 💵 Instant Deposits and Instant Withdrawals? | Yes |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 🕐 Maximum Estimated Withdrawal Time | Up to 5 Working Days |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • OctaFX App |

| ✔️ Tradable Assets | • Forex • Index CFDs • Commodities • Cryptocurrencies • Energies • Precious Metals |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Malaysian, Hindi, Bangla, Thai, Spanish, German, Vietnamese, Portuguese, Arabic, Chinese (Simplified) |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Customer Support Languages | Multilingual |

| ✅ Bonuses and Promotions for Namibians | Yes |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is OctaFX a safe broker for Namibians? | Yes |

| 📊 Rating for OctaFX Namibia | 7/10 |

| 🤝 Trust score for OctaFX Namibia | 67% |

| 👉 Open an account | 👉 Open Account |

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Regulation and Safety of Funds

Regulation in Namibia

The broker is an international broker that is based in Saint Vincent and the Grenadines, with no regulations or licenses in Namibia with local market regulators.

Global Regulations

They have been given authorization by the Financial Services Authority of SVG (FSA SVG), which will allow OctaFX to undertake financial services operations. CySEC is the regulatory body that oversees Octa Markets Cyprus Ltd., which has its headquarters in Cyprus.

Because of Brexit, OctaFX had no choice but to shut its operations in the United Kingdom and switch from being licensed by the Financial Conduct Authority to being licensed by the Cyprus Securities and Exchange Commission.

Client Fund Security and Safety Features

The safety of any deposits that Namibian traders make is guaranteed by the broker, as stated on the website that is officially associated with OctaFX. The money belonging to traders is kept in separate accounts with top-tier banking institutions, as mandated by several international legislation.

For this reason, the balance sheets of the broker and those of its customers are maintained completely distinct from one another.

Because OctaFX uses some of the most innovative technology, your confidential information, as well as your financial transactions, are completely protected and safe. This is achieved by using a designated Personal Area that is encrypted with 128-bit SSL.

OctaFX’s extensive “Know Your Customer” (KYC) procedures ensure that all new traders’ identities and address proof are validated, therefore authorizing all transactions, and ensuring their safety.

In addition, the broker mandates that all withdrawal requests from traders be followed up with an email confirmation. Because of the use of 3D Secure technology, financial transactions involving Visa and Mastercard are not only secure but also open to public scrutiny.

The negative balance protection offered by OctaFX ensures that a trading account’s balance will be brought back up to a positive number if it drops below zero. The risk management system restricts the amount of money that traders may lose to the amount of money that traders have put into the account. This is done to safeguard clients from experiencing financial hardship.

Is OctaFX a Regulated Broker?

Yes, they are a regulated broker. It is authorized and regulated by reputable financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Saint Vincent and the Grenadines Financial Services Authority (FSA).

How Does the Broker Ensure the Safety of Funds?

They prioritize the safety of funds by segregating client funds from the company’s operational funds. Client funds are held in reputable banks, providing an added layer of security. Additionally, OctaFX uses advanced encryption technologies to protect financial transactions and sensitive information, further enhancing the safety of funds.

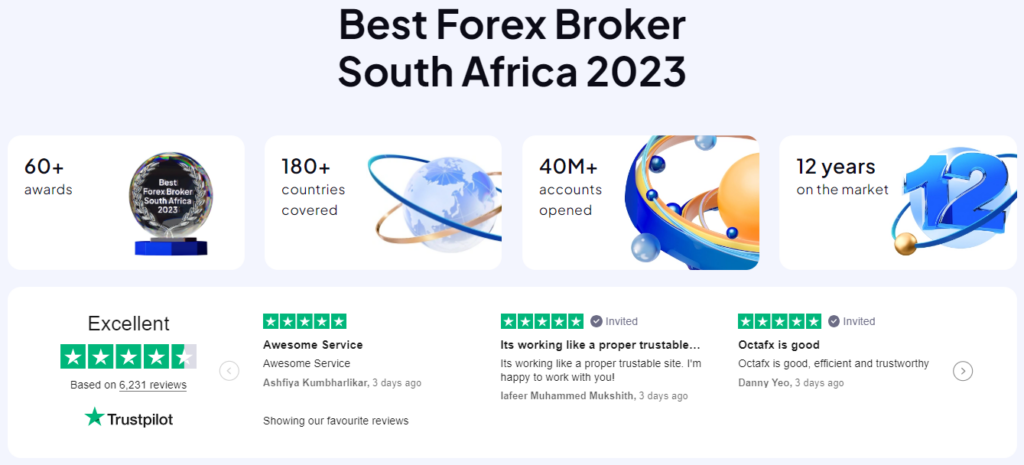

Awards and Recognition

The broker has received numerous awards and recognitions in the forex trading industry, underscoring its commitment to excellence. These accolades span various categories, including customer service, trading conditions, and technological innovation.

They have been honoured with awards such as “Best Forex Broker Asia,” “Best ECN/STP Broker,” and “Best Forex Broker Nigeria,” among others.

These accolades reflect the broker’s dedication to providing top-tier trading services and support to its clients across the globe. OctaFX’s consistent recognition in the industry highlights its position as a trusted and innovative broker in the competitive world of forex trading.

Has OctaFX received any awards for its trading services?

Yes, the broker has been honoured with multiple awards in the forex industry. These awards include recognition for its customer service, trading conditions, and regional excellence.

What are some notable awards the broker has won recently?

They have recently received awards such as “Best Forex Broker Asia 2022” and “Best ECN/STP Broker 2022.”

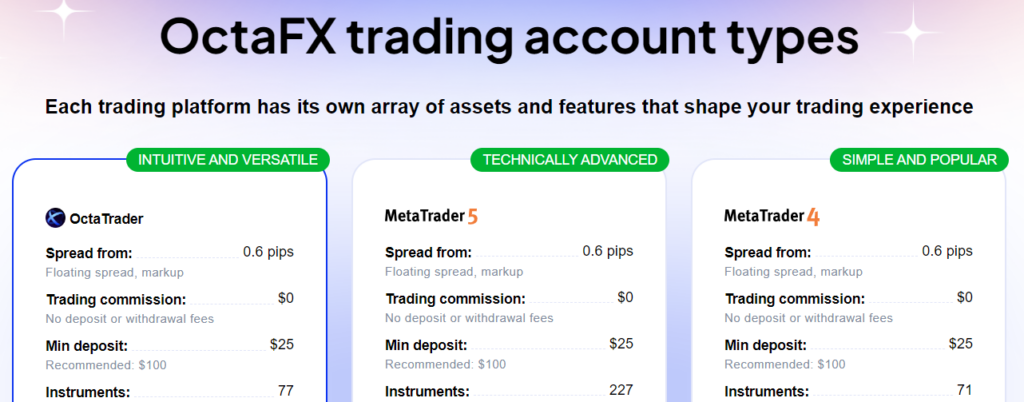

Account Types and Features

The broker offers three dynamic and customizable trading accounts to traders in Namibia, and they may select whichever one best suits their needs. According to the trading approach, level of experience and level of knowledge, as well as trading style, each of these two types of trading accounts is best suited for a different kind of trader.

Namibian traders can choose between:

MetaTrader 4 Account

Because of the one-of-a-kind trading circumstances, it offers and the reduced level of risk it entails, this account type might be beneficial to novice forex traders. An entry-level trading option is provided for each of the following assets inside this kind of account:

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | $25/480 NAD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, the mark-up is added to the spread |

| 🔧 Instruments offered on account | 32 currency pairs + gold and silver + 3 energies + 4 indices + 30 cryptocurrencies |

| 📊 Leverage Ratios | Forex 1:500 (ZARJPY 1:100) Metals 1:200 Energies 1:100 Indices 1:50 Crypto 1:25 |

| 💵 Minimum Trading Volume | 0.01 lots |

| 📈 Maximum Trading Volume | 200 lots |

| 📞 Margin Call/Stop-Out | 25% / 15% |

| 📲 Trade Execution Type | Market |

| 📊 Trade Execution Average Speed | Under 0.1 seconds |

| 💳 Base Account Currency Options | USD |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

| 👉 Open an Account | 👉 Open Account |

MetaTrader 5 Account

This account is best suited for experienced traders who are active participants in a diverse variety of financial markets and assets. It offers these traders the most advantageous trading circumstances and innovative technology, including the following sophisticated features:

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | $25/480 NAD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, the mark-up is added to the spread |

| 🔧 Instruments offered on account | 32 currency pairs + gold and silver + 3 energies + 10 indices + 30 cryptocurrencies + 150 stocks |

| 📊 Leverage Ratios | Forex 1:500 (ZARJPY 1:100) Metals 1:200 Energies 1:100 Indices 1:50 Crypto 1:25 Stocks 1:20 |

| 💵 Minimum Trading Volume | 0.01 lots |

| 📈 Maximum Trading Volume | 500 lots |

| 📞 Margin Call/Stop-Out | 25% / 15% |

| 📲 Trade Execution Type | Market |

| 📊 Trade Execution Average Speed | Under 0.1 seconds |

| 💳 Base Account Currency Options | USD |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

| 👉 Open an Account | 👉 Open Account |

OctaTrader Account

The OctaTrader Account is designed for traders seeking a high degree of flexibility and precision in their trading strategies. It provides access to a suite of advanced tools and features, making it suitable for both novice and experienced traders.

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | $25/480 NAD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, the mark-up is added to the spread |

| 🔧 Instruments offered on account | 32 currency pairs + gold and silver + 3 energies + 10 indices + 30 cryptocurrencies |

| 📊 Leverage Ratios | Forex 1:500 (ZARJPY 1:100) Metals 1:200 Energies 1:100 Indices 1:50 Crypto 1:25 |

| 💵 Minimum Trading Volume | 0.01 lots |

| 📈 Maximum Trading Volume | 50 lots |

| 📞 Margin Call/Stop-Out | 25% / 15% |

| 📲 Trade Execution Type | Market |

| 📊 Trade Execution Average Speed | Under 0.1 seconds |

| 💳 Base Account Currency Options | USD |

| ✔️ Trading Strategies Allowed | Scalping |

| ☪️ Islamic Account Offered? | Yes |

| 👉 Open an Account | 👉 Open Account |

Base Account Currencies

The broker only permits trading accounts to be denominated in EUR and USD, which is quite restrictive for traders, particularly Namibians who would have bank accounts in NAD.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and OctaFX offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

The Demo Account replicates the performance of a genuine account, providing a realistic representation of forex trading. Traders, on the other hand, practice their skills using fictitious money in a practice account rather than actual cash.

The Demo Account is a learning tool, and for traders to begin using it, all they need to do is sign up for an account on the OctaFX website and build a profile there.

Consequently, Namibian traders will have the opportunity to get acquainted with the functionalities of the platform as well as the dynamics of the Forex market.

Traders get access to this helpful tool for an infinite amount of time, and they can use it to better comprehend forex and CFD trading as well as estimate their risk exposure. The functionality of the demo account is identical to that of the actual account, except for the use of virtual funds.

In addition, traders in Namibia can:

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

OctaFX’s Islamic Account is a service that has won several awards and makes it possible for Muslim traders to make a profit from trading strategies that include medium- to long-term investments without having to deal with any complications.

The absence of overnight fees is one of the aspects that sets them apart from its competitors. Traders who practise Islam and utilize the Islamic Account do not have to pay any additional fees because of this.

What is an OctaFX Islamic Account?

An OctaFX Islamic Account, also known as a swap-free account, is designed for traders who cannot participate in interest-bearing transactions due to their religious beliefs. It eliminates overnight swaps while providing access to the forex market.

How can I open an OctaFX Islamic Account?

To open an Islamic Account with OctaFX, you need to register with the broker and contact their customer support to request the conversion of your existing account into a swap-free Islamic Account.

How to open an Account

To register an account with OctaFX, Namibian traders can follow these steps:

Step 1 – Go to the Official Website

Step 2 – Fill Out Your Details

OctaFX vs AvaTrade Vs Exness – Broker Comparison

| OctaFX | AvaTrade | Exness | |

| ⚖️ Regulation | CySEC, SVG FSA | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 OctaFX App CopyTrade App | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade | MetaTrader 4 MetaTrader 5 |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | $25/480 NAD | $100/1,922 NAD | $10/192 NAD |

| 📈 Leverage | 1:500 | 1:400 | Unlimited |

| 📊 Spread | 0.6 pips | Fixed, from 0.9 pips | Variable, from 0.0 pips |

| 💰 Commissions | None | None | From $0.1 per side, per lot |

| ✴️ Margin Call/Stop-Out | 25%/15% | 25%/10% | 60%/0% |

| ✴️ Order Execution | Market | Instant | Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | MetaTrader 4 Habitual Trader MetaTrader 5 Smart Trader | Standard Live Account Professional Account Option | Standard Account Standard Cent Account Raw Spread Account Zero Account Pro Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | No | Yes |

| 📊 Namibian Dollar Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 5 | 1 | 5 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an Account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Trading Platforms

OctaFX offers Namibian traders a choice between these trading platforms:

Desktop Platforms

MetaTrader 4 and 5

Traders of all experience levels will find that MT4 is a good option when seeking a platform that is not only simple but also sophisticated and powerful. It has a user-friendly interface that is easy to use and can be adjusted to meet your requirements in a variety of ways.

The UI of MT5 has been improved with the addition of new features, which has made it even simpler to use. In addition to new fundamental and technical indicators, 21 different periods, graphical objects, extra order types, and an economic calendar, this platform also provides support for a more extensive selection of order types.

WebTrader Platforms

MetaTrader 4 and 5

MT4 has several built-in indicators that may be used for technical analysis, and it also can run automated systems known as expert advisers. You have a total of nine distinct timeframes from which to choose.

Real-time market execution and rigorous risk management are just two of the many important tools that are at your disposal. Traders in Namibia will also have unlimited access to a greater variety of markets in addition to the extra features and services made available by MetaTrader 5 Web, a more sophisticated version of MT4.

Traders may get access to these WebTrader via the official OctaFX website, where they can log in with their credentials and begin trading. Traders can also use these WebTrader directly from OctaFX’s mobile app.

Trading App

MetaTrader 4 and 5

Traders will find it much simpler to engage in mobile trading thanks to the OctaFX Android and iOS MetaTrader 4 and 5, which combine powerful charting capabilities with a variety of trading tools and other innovative features. The full-function trading interface that OctaFX provides enables traders to access financial markets, do technical analysis, track movement, and execute orders from any location around the globe. OctaFX also enables users to watch the movement of the market.

OctaFX App

Traders can make deposits and withdrawals of money in a timely and secure manner thanks to the unique OctaFX Trading App. In addition, the app enables users to monitor their accounts, manage their deposits, and manage accounts. Currently, the proprietary software is only available for use on mobile devices that use the Android operating system.

CopyTrading App

You have the flexibility to invest any amount for any length of time with the OctaFX Copytrading program, and you may take out your earnings whenever you choose. You may effortlessly manage your investment no matter where you are in the globe since all the configurations are straightforward to understand.

Range of Markets

Namibian traders can expect the following range of markets from OctaFX:

What trading platforms does the broker offer?

The broker offers the widely acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, known for their user-friendly interfaces, advanced charting tools, and automated trading capabilities.

Can I trade on the broker using a mobile device?

Yes, they provide mobile trading capabilities through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile apps. These apps are available for download on both iOS and Android devices, allowing traders to access the markets on the go.

Broker Comparison for Range of Markets

| OctaFX | SuperForex | Global GT | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | No | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Trading and Non-Trading Fees

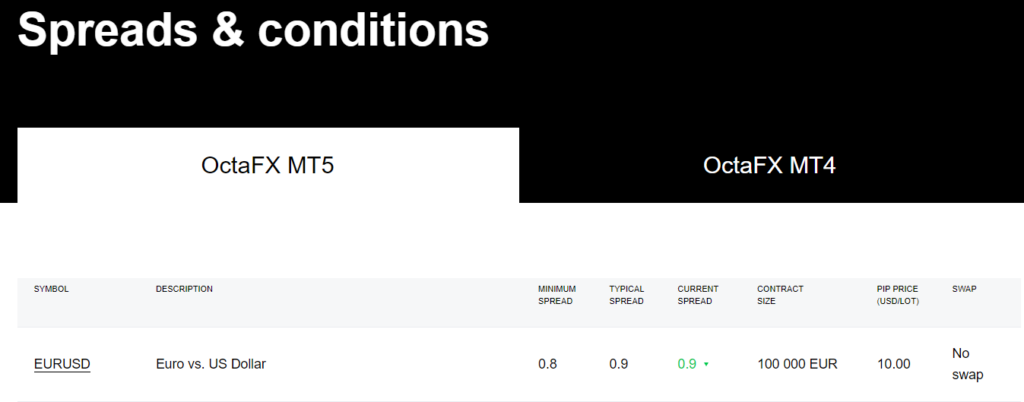

Spreads

OctaFX’s variable spreads are marked up to account for the broker’s service fee, which is incurred in the process of arranging the transaction. OctaFX will determine the spreads for each transaction based on the kind of financial instrument that is being transacted as well as the conditions of the market on that trading day.

Some typical spreads that Namibian traders can expect include:

Commissions

OctaFX does not charge any commissions on trades as the broker’s fee for facilitating the trade is already worked into the spread.

Overnight Fees, Rollovers, or Swaps

The overnight and swap charges for each financial instrument that may be traded are presented in a manner that is easy to understand in the complete overnight fee schedule that is offered by OctaFX. These expenses are determined by several factors, including the interbank rates, the market conditions, the size of the position, and other variables.

Some typical overnight fees that Namibian traders can expect are as follows:

Deposit and Withdrawal Fees

OctaFX does not charge any fees on either deposits or withdrawals. Namibian traders, however, may face processing fees from their payment provider or banking institution.

Inactivity Fees

OctaFX does not charge any fees when live trading accounts go dormant.

Currency Conversion Fees

Because there are limited base account currencies, Namibian traders could be subject to currency conversion fees when they deposit or withdraw in NAD.

What are the trading fees on OctaFX?

OctaFX offers competitive spreads, and there are no commissions on most account types. However, it’s essential to review the specific fees for your chosen account, as some may have different fee structures.

Does the broker charge any non-trading fees?

The broker generally does not charge non-trading fees such as account maintenance fees or deposit/withdrawal fees. However, third-party fees, like those from payment providers, may apply depending on your chosen transaction method.

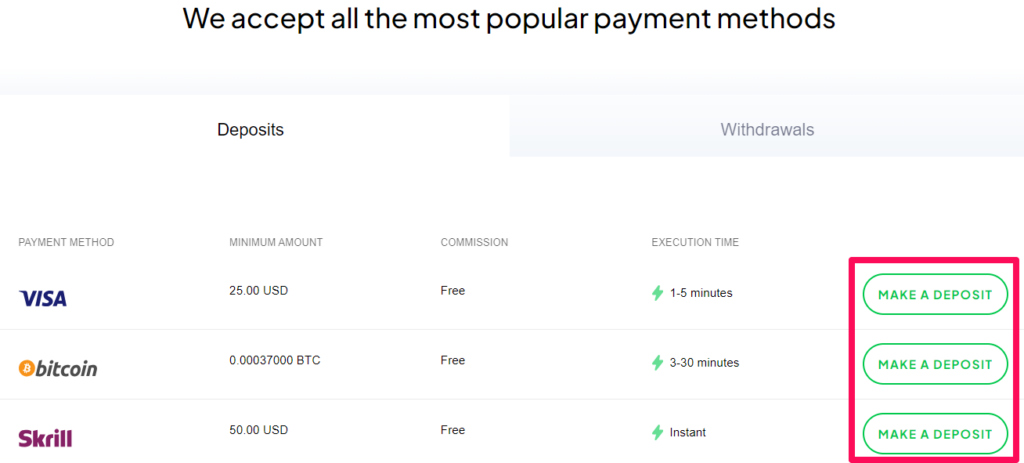

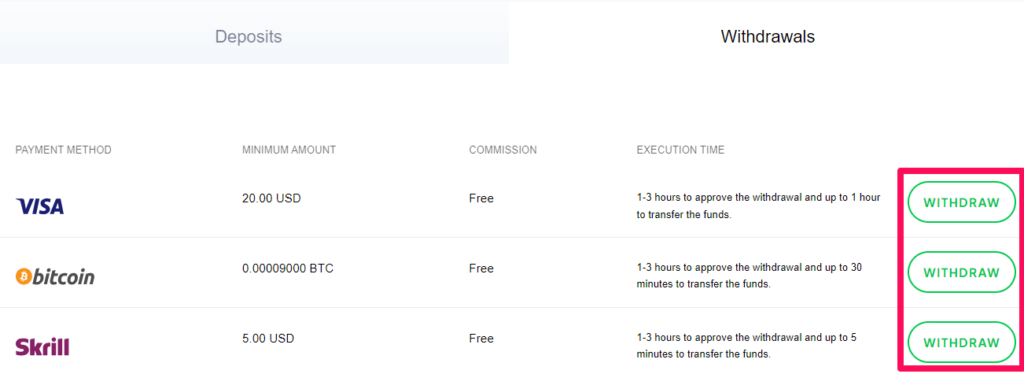

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

How to Deposit Funds

To deposit funds to an account with OctaFX, Namibian traders can follow these steps:

Fund Withdrawal Process

To withdraw funds from an account with OctaFX, Namibian traders can follow these steps:

What deposit methods does the broker offer?

The broker provides a variety of deposit methods, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. You can choose the method that suits you best.

Are there any fees for deposits and withdrawals?

The broker generally does not charge fees for deposits and withdrawals. However, third-party fees from payment providers may apply, depending on the chosen transaction method. It’s advisable to check with your selected payment provider for any associated fees.

Education and Research

Education

The broker offers the following Educational Materials:

The broker offers Namibian traders the following Research and Trading Tools:

Does the broker offer educational resources for traders?

Yes, they provide a range of educational materials, including tutorials, articles, and webinars, to help traders enhance their knowledge and skills.

Does the broker offer market research and analysis?

Absolutely, they offer market analysis, daily news, and insights to help traders stay informed about market trends and make informed trading decisions.

Bonuses and Promotions

The broker offers Namibian traders the following bonuses and promotions:

How to open an Affiliate Account

To register an Affiliate Account, Namibians can follow these steps:

Affiliate Program Features

The following are some of how OctaFX’s strong affiliate program is beneficial to its partners:

Affiliates have the option of forming individual connections with the broker, which enables them to operate with the platform that is most suited to meet their requirements. In addition to that, there is a Master IB program that provides additional training in addition to regular IB contests.

Customers with 60 or more referrals can earn up to $12 for each lot that is traded in for partners. Customers can profit from the most advantageous trading conditions and programs, both of which are customizable at this level. This gives customers the ability to optimize their overall earnings.

How can I join the Affiliate Program?

To join the Affiliate Program, you can visit their website and sign up as an affiliate. Once approved, you can start referring traders and earning commissions.

What kind of commissions can I earn through the Affiliate Program?

The broker offers competitive commissions for affiliates, including revenue share and CPA (Cost Per Acquisition) plans. The exact commission rates may vary, so it’s advisable to check their affiliate program details for the latest information.

Customer Support

The broker’s customer support is available 24 hours a day, 7 days a week to help traders in any way that they can. The finance department of OctaFX operates from 6 am to 10 pm (EET) Monday to Friday, while the Account Verification department works from 8 am to 5 pm, Monday to Friday.

How can I contact OctaFX customer support?

You can reach the customer support team through various channels, including live chat on their website, email, and phone. They are available 24/5 to assist you with any inquiries or issues.

What languages does the customer support team speak?

OctaFX’s customer support team is proficient in multiple languages to accommodate its diverse global clientele. Whether you prefer to communicate in English, Spanish, Portuguese, Indonesian, or other supported languages, their team is equipped to provide effective assistance.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Verdict

The broker offers trading platforms that are very adaptable and strong, and they provide a variety of account types to accommodate various kinds of traders. Trading fees are quite low compared to those of competitors, and customer support responds quickly to inquiries.

Although the trading instruments may be too restricted for some, the forex offering is certainly sufficient to meet the requirements of most customers. OctaFX provides clients with the option of opening one of two live trading accounts, which are known as MT4 and MT5, respectively.

Both accounts provide great trading conditions, with spreads that average 0.6 pips, making them some of the narrowest in the business. This is one of the most competitive aspects of both accounts. In addition, OctaFX does not levy any commissions or fees on deposits or withdrawals, nor does it assess any costs for periods of inactivity.

AutoChartist is a copy trading tool, and the account monitoring service enables novices to learn from successful traders discreetly. An Islamic option is available on all account types, and new traders will benefit from the excellent analytical section and range of useful trading tools.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| OctaFX offers sophisticated trading platforms and two powerful trading apps | There is an extremely limited selection of trading instruments and asset classes offered |

| The trading accounts are both commission-free | There are only two available trading accounts |

| There are several modern funding options offered | There is no NAD-denominated trading account for Namibian traders |

| Namibian traders are given access to AutoChartist and several other tools | OctaFX has a low trust score because there is no Tier-1 regulation |

| Negative balance protection is offered on retail accounts | |

| OctaFX is well-regulated and follows strict client fund security protocols | |

| Namibian traders are not restricted on any trading strategies |

you might also like: XM Review

you might also like: Oanda Review

you might also like: HF Markets Review

you might also like: Exness Review

you might also like: AvaTrade Review

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Frequently Asked Questions

What is the withdrawal time?

The withdrawal time with the broker ranges from a minimum of 5 minutes on Skrill and Neteller up to 3 hours on other payment providers.

Is OctaFX regulated?

Yes, they are regulated by the Tier-2 CySEC in Cyprus and the Tier-3 SVG FSA in Saint Vincent and the Grenadines.

What is the minimum deposit?

The broker has a minimum deposit of 480 NAD or an equivalent of $25 when you register a trading account.

Can I use OctaFX without verification?

No, you cannot use the broker without verification. To deposit and withdraw funds, you must verify your account by submitting your proof of identity and residential address.

Does OctaFX have Nasdaq?

Yes, the broker has Nasdaq as part of its offering of CFDs on Indices under “NAS100”.

Is OctaFX good for beginners?

Yes, they are good for beginners. The broker offers a one-of-a-kind combination of trading accounts and platforms, together with associated educational materials, that are appropriate for traders of all experience levels.

Who is the owner of OctaFX?

While the owner’s information is not given, Georgios D. Pantzis is currently the CEO.

Is OctaFX safe or a scam?

They are not a scam. However, OctaFX’s low trust score is attributable to a lack of regulations from Tier-1 market regulators.

Does OctaFX have Volatility 75?

No, they do not currently offer Volatility 75.

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Corporate Social Responsibility

The broker takes immense pride in being a socially responsible and ethical business. OctaFX is actively involved in supporting a variety of charitable organizations and causes, making all efforts necessary to assist people who need assistance.

The broker considers it both a part of its purpose and its obligation to work toward elevating the standard of living enjoyed by handicapped individuals all around the world.

Does the broker engage in any corporate social responsibility initiatives?

OctaFX is committed to corporate social responsibility and actively participates in various initiatives, including charitable activities and community development programs.

Can I learn more about their corporate social responsibility efforts?

Yes, you can find detailed information about OctaFX’s corporate social responsibility initiatives on their official website or by reaching out to their customer support.