Trade Nation Review

Overall Trade Nation is considered low risk with an overall Trust Score of 80 out of 100. Trade Nation is licensed by two Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). Trade Nation is currently not regulated by the Bank of Namibia.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overview

Trade Nation offers one retail trading account with two live trading options namely a Low Leverage Account and a High Leverage Account.

The broker used to be known as Core Spreads, and it was previously a one-person operation. Since 2014, it has risen to the top of the business for traders wishing to trade without paying large fees or commissions. Core Spreads rebranded to Trade Nation in 2019 and while the brand is still new, it is a large competitor in the forex and CFD trading arena.

They are a multi-regulated online broker with a unique approach to trading. They offer you a basic trading interface that enables you to enter the market quickly and easily.

Overall, the broker is a low-risk platform with an intuitive trading interface that is perfect for Namibian traders. Regardless of trading style or expertise, they offer affordable costs, a secure trading environment, and innovative solutions to a wide spectrum of traders.

This Trade Nation review for Namibia will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

Trade Nation accepts Namibian clients and has an average fixed spread of 0.4 pips with zero commission fees. Trade Nation has a maximum leverage ratio up to 1:30 (Low Leverage Account) and 1:200 (High Leverage Account) and there is a demo account available, but no Islamic Account.

Trade Nation Proprietary platforms and MetaTrader 4 are supported. Trade Nation is headquartered in London and is regulated by FCA, ASIC, FSCA, and SCB.

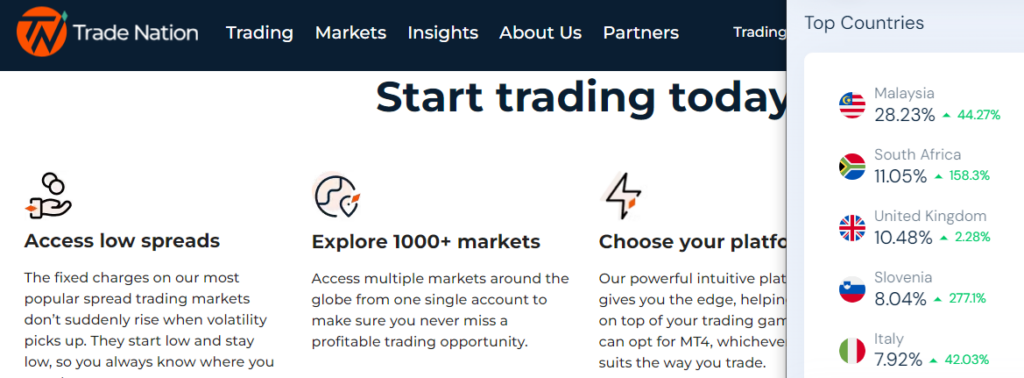

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among traders

What is Trade Nation?

Trade Nation is an online trading platform and brokerage that offers access to various financial markets, including forex, commodities, indices, and shares. It provides traders with the tools and resources needed to execute trades, manage portfolios, and participate in the global financial markets.

Is Trade Nation regulated?

Yes, they are regulated by the Financial Conduct Authority (FCA) in the United Kingdom. This regulatory oversight ensures that the broker adheres to strict standards and guidelines, providing a secure and transparent trading environment for its clients.

At a Glance

| 🏛 Headquartered | London, United Kingdom |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2014 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Twitter • YouTube |

| ⚖️ Regulation | FCA, ASIC, FSCA, SCB |

| 🪪 License Number | • United Kingdom – 525164 • Australia – ABN 93 158 065 635, AFSL 422661 • South Africa – 2018/418755/07, FSP 49846 • Bahamas – 203493 B, SIA-F216 |

| ⚖️ BoN Regulation | No |

| 🚫 Regional Restrictions | The United States |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | Barclays |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant, Market |

| 📊 Average spread | From 0.6 pips |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | No |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:200 |

| 🚫 Leverage Restrictions for Namibia? | No |

| 💰 Minimum Deposit | $0/0 NAD |

| ✅ Namibian Dollar Deposits Allowed? | No, only GBP, USD, EUR, AUD, ZAR, DKK, NOK, and SEK |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based Trade Nation customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Credit Card • Debit Card • Bank Wire Transfer • Bank Transfers • Skrill |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4, Trade Nation |

| ✔️ Tradable Assets | • Indices • Stocks • Precious Metals • Forex • Commodities • Energies • CFDs |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Customer Support Languages | No |

| ✅ Bonuses and Promotions for Namibians | No |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is Trade Nation a safe broker for Namibians? | Yes |

| 📊 Rating for Trade Nation Namibia | 8/10 |

| 🤝 Trust score for Trade Nation Namibia | 80% |

| 👉 Open an account | 👉 Open Account |

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Regulation and Safety of Funds

Regulation in Namibia

The Bank of Namibia does not regulate Trade Nation, but the broker regulations for several other reasons, proving its trustworthiness.

Global Regulations

The broker has a worldwide presence and conducts its business via the following entities:

Client Fund Security and Safety Features

Customer money is kept by Barclays Bank in London in separate bank accounts, while Westpac in Australia holds client funds that are deposited to the broker.

They comply with all relevant rules and regulations, especially those concerning the protection of consumer cash. Customers in the United Kingdom have access to investor protection solutions worth up to 85,000 EUR.

How does the broker ensure the safety of my funds?

They take the safety of your funds seriously. They segregate client funds from their own operational funds, ensuring that your money is held in separate accounts. Additionally, as a regulated broker, they adhere to strict financial standards and regulatory requirements set by the Financial Conduct Authority (FCA), providing an extra layer of protection for your funds.

Are my funds insured with them?

The broker does not typically offer insurance on your trading account funds. However, the safety measures they have in place, including segregation of client funds and regulatory compliance, are designed to protect your funds from financial risks associated with the broker’s operations. It’s essential to review their terms and conditions and risk disclosure documents for complete details on fund protection.

Awards and Recognition

Some of Trade Nation’s latest awards are as follows:

Has the broker received any industry recognition or awards?

They have been recognized and awarded by various industry organizations for their excellence in online trading services. These awards can vary from year to year, so it’s a good idea to check their official website for the most up-to-date information on their accolades.

Where can I find more information about their awards and recognition?

You can find detailed information about Trade Nation’s awards and recognition on their official website. They often have a dedicated section or press releases highlighting their achievements and industry acknowledgements.

Account Types and Features

Trade Nation only has one retail investor account with two different leverage options:

Traders that register with the FSCA and the SCB are allowed for leverage of up to 1:200. Traders who register with ASIC and FCA, on the other hand, are restricted to leverage of 1:30.

There are no fees or deposits to make after a trader has created an account. Traders who establish an account with the broker may pick from a range of base currencies as their default, including GBP, EUR, USD, CHF, AUD, JPY, ZAR, NGN, DKK, NOK, and SEK.

To create a live account, no minimum deposit is necessary, and there is no commission cost since it is already included in the fixed spread that is charged by Trade Nation.

Low Leverage Account

The Low Leverage Account is available to traders who fall under ASIC and FCA regulations, and who are subsequently restricted to leverage up to 1:30, as per regulations.

Some of the common features of a Low Leverage Trade Nation Account are as follows:

High Leverage Account

This account’s main feature is that it offers a higher leverage ratio. This account is only available to traders who register through FSCA or SCB regulations because these market regulators are not as strict as FCA or ASIC.

Higher leverage involves increased risks and therefore this account is more suited to traders who have some experience in the financial markets.

Some typical margin requirements on the High Leverage Account are as follows:

Base Account Currencies

The broker does not allow Namibian traders to register a live trading account in NAD but offers a choice between several other currencies, including GBP, EUR, USD, CHF, AUD, JPY, ZAR, NGN, DKK, NOK, and SEK.

This means that Namibian traders who have bank accounts denominated in NAD, and who make deposits using local currency, could face currency conversion fees for deposits or withdrawals in Namibian Dollars, which increases the overall costs involved with trading and could affect profitability.

Demo Account

The broker provides a free demo account for Namibian traders to experiment with. You may use the demo account to test your trading techniques and get acquainted with the broker’s trading platform, goods, and services.

You can learn what each step entails and what the unfamiliar phrases and ideas mean using the Trade Nation simulator, allowing you to confidently conduct actual deals. You do not have to be a Trade Nation client to use the Trading Simulator, and you do not need a login.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

The broker does not cater to Muslim traders and does not offer halal trading conditions or an Islamic Account that exempts Muslims from overnight interests or fees. This means that traders must ensure that they close their positions at the end of every trading day to avoid being subject to these fees.

What account types are available at Trade Nation?

The broker offers a single standard account type designed to accommodate a wide range of traders. This simplicity ensures that all traders have access to the same features and competitive pricing, promoting transparency and ease of use.

What features can I expect with a Trade Nation account?

With a Trade Nation account, you can access a diverse range of financial instruments, including forex, indices, commodities, shares, and cryptocurrencies. The account features competitive spreads and no commission fees, making it cost-effective for traders.

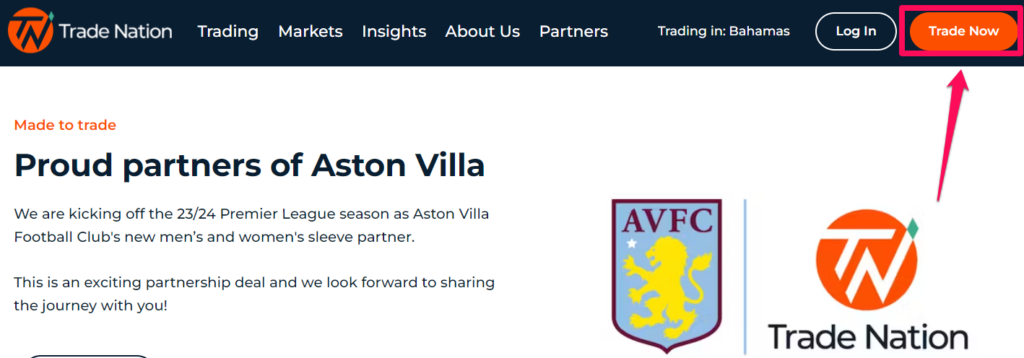

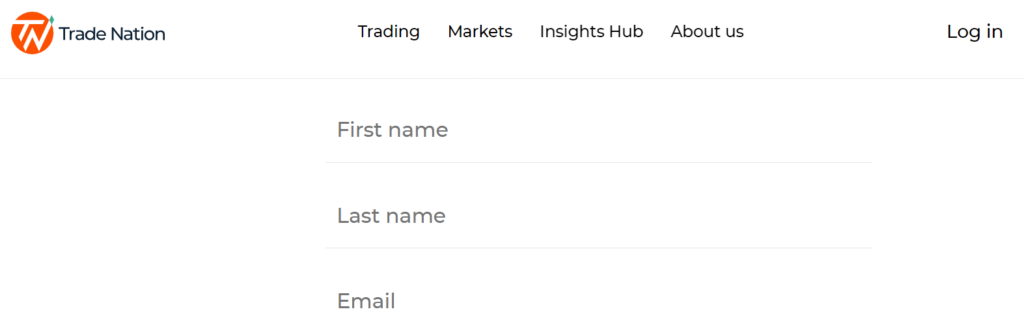

How to open an Account

To register an account with Trade Nation, Namibian traders can follow these steps:

Step 1 – Click on the “Trade now” option.

Step 2 – Fill out the form.

Step 3 -Follow the steps that are provided by email.

Step 4 – Provide identification.

Trade Nation VS IG Group VS FBS – Broker Comparison

| Trade Nation | IG Group | FBS | |

| ⚖️ Regulation | FCA, ASIC, FSCA, SCB | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA | IFSC, CySEC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade |

| 💰 Withdrawal Fee | No | None | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | $0/0 NAD | $0/0 NAD | $1/18 NAD |

| 📈 Leverage | 1:30/1:200 | 50:1 | Up to 1:3000 |

| 📊 Spread | Fixed, from 0.4 pips | From 0.6 pips | Floating, from 1 pip |

| 💰 Commissions | None | 2 cents per share | None |

| ✴️ Margin Call/Stop-Out | 100%/50% | 100%/50% | 40% and 20% |

| ✴️ Order Execution | Instant, Market | Market | STP, ECN |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | • High leverage • Low Leverage | National, International, and Corporate accounts | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | No | Yes |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 2 | 3 | 6 |

| ☪️ Islamic Account | No | No | Yes |

| 💵 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 50 lots | 25 000 lots | 500 lots |

| 👉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Trading Platforms

The broker offers Namibian traders a choice between these trading platforms:

Desktop Platforms

MetaTrader 4

MetaTrader 4

The popular MetaTrader 4 (MT4) platform is also available from the broker. MT4 is a sophisticated but easy-to-use trading platform that is utilized by millions of CFD and FX traders all over the world.

The MT4 platform comes with several built-in tools that may be used to undertake in-depth market analysis and complicated trading.

It features a wide range of chart types and timeframes, as well as support for a variety of order types. In addition, MetaTrader 4 also supports automated trading through expert advisors (EAs) and Namibians can also use one-click trading and the ability to trade directly from the charts.

WebTrader Platforms

MetaTrader 4

The MT4 platform can handle even the most demanding trades and is accessible from a variety of platforms, including most web browsers on desktops, tablets, iPads, smartphones, and other internet-connected devices.

There are so many tools to choose from that most traders hardly ever scratch the surface, with more being added frequently. In addition, traders can also find unique tools and add-ons on the built-in marketplace, and you can even create your own using the MQL editor.

Trade Nation

The broker also offers you the Trade Nation trading platform, which is a proprietary platform that allows you to access the financial markets in a user-friendly manner. The platform assists you in focusing on the most crucial aspects of your life to maximize your potential.

More advanced Namibian traders will also appreciate how the Trade Nation platform provides extensive charting capabilities while maintaining a clean user experience.

12 interactive graph kinds, sketching tools, and the option to change timelines from one minute to one month are some of the platform’s other highlights. In addition, you can easily minimize your losses by establishing orders that guarantee that deals that exceed your risk appetite are immediately exited.

Trading App

MetaTrader 4

Trade Nation allows the use of MetaTrader 4 on iOS and Android smartphones in addition to the robust trading platforms given by MetaTrader 4 online and desktop editions, giving Namibian traders the freedom they need to trade and manage their trading accounts while on the go.

Trade Nation

You can also get the Trade Nation mobile app, which is available for Android and iOS. This is beneficial for those of you who want to trade on the move using your mobile phone.

The mobile app enables you to keep track of your positions, and what is going on in the markets at any given time. You can also configure price alert alerts, so you do not need to spend all day staring at charts and waiting for your price level.

Range of Markets

Namibian traders can expect the following range of markets from Trade Nation:

Which trading platforms are available with the broker?

They offer the MetaTrader 4 (MT4) platform, a highly regarded choice among traders worldwide. MT4 provides advanced charting tools, technical indicators, and a user-friendly interface, making it suitable for both beginner and experienced traders.

Can I trade on the go?

Yes, the broker provides mobile trading capabilities through the MetaTrader 4 (MT4) mobile app. This app is available for download on iOS and Android devices, allowing traders to access the markets, monitor their accounts, and execute trades conveniently from their mobile devices.

Broker Comparison for Range of Markets

| Trade Nation | IC Markets | FBS | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Trading and Non-Trading Fees

Spreads

The broker charges a fixed spread that does not change with market conditions, letting traders know precisely how much money they will make at any given moment. Their spread costs include:

Commissions

The broker charges fixed spreads on trades according to certain trading times during the day. There are no commission fees charged to cover Trade Nation’s fees for facilitating the trade and instead, this fee is included in the spreads that are charged.

Overnight Fees, Rollovers, or Swaps

The broker utilizes the interbank rate for the financial instrument being exchanged for one month to estimate the overnight expenses. They add a 2.5% and 1.25% premium to the trader’s long position to determine the 1-Month London Interbank Offer Rate (LIBOR).

A portion of the trading account will be removed when the 1-month interbank rate falls below 2.5%. This means the broker will deduct 2.5% from the 1-month interbank rate, bringing it down to 1.5%.

Deposit and Withdrawal Fees

The broker does not charge any fees on payment methods used by Namibian traders for either deposits or withdrawals. However, fees from banking institutions may apply and traders will be responsible for paying these.

They do not charge any inactivity fees on dormant or inactive accounts.

Currency Conversion Fees

Because the broker only supports GBP, EUR, USD, CHF, AUD, JPY, ZAR, NGN, DKK, NOK, and SEK as the base currencies for a live trading account, Namibian traders who deposit or withdraw in NAD can be subject to currency conversion fees.

What are the trading fees?

The broker offers competitive spreads on its trading instruments, and the specific fees can vary depending on the asset being traded. Traders should refer to the broker’s official website or trading platform for detailed information on spreads and commissions for each instrument.

Are there any non-trading fees associated with the accounts?

The broker is known for its transparent fee structure. There are no hidden non-trading fees, such as account inactivity fees or deposit/withdrawal charges. Traders can find comprehensive information regarding fees on the broker’s official website or by contacting their customer support.

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

How to Deposit Funds

To deposit funds to an account, Namibian traders can follow these steps:

Fund Withdrawal Process

To withdraw funds from an account, Namibian traders can follow these steps:

What deposit methods are available?

The broker provides a range of deposit options, including bank transfers, credit/debit cards, and electronic payment methods like Skrill and Neteller. The availability of specific methods may vary by region, so traders should check the broker’s website for the most up-to-date information.

How long does it take to process withdrawals?

The broker aims to process withdrawal requests efficiently. The time it takes for funds to reach your account can vary depending on the withdrawal method and your location. Typically, withdrawals are processed within one to three business days, but it may take longer in some cases.

Education and Research

The broker’s website provides educational tools and resources to help traders enhance their skills and expertise.

Traders who wish to learn more about the markets and trading may use a variety of instructional tools and websites. They have created a video to help traders get started with MetaTrader 4. It leads them through the process of linking their MetaTrader 4 account.

CFD trading, FX, spread, and signals are all covered in-depth in the broker’s “trade explained” section. Beginner tips and a trading simulator are also provided to assist new investors in making educated investment decisions.

They offer the following Educational Materials:

The broker also offers Namibian traders the following additional Research and Trading Tools:

Does the broker offer educational resources for traders?

Yes, they provide a range of educational materials to help traders enhance their knowledge and skills. These resources may include webinars, video tutorials, articles, and other educational content. Traders can access these materials on the broker’s website to support their trading journey.

Is there a research section on their platform?

Yes, they typically offer a research section on their trading platform. This section often includes market analysis, news updates, economic calendars, and other research tools to help traders stay informed about market events and make well-informed trading decisions. Traders can use these resources to analyze market trends and plan their trades effectively.

Bonuses and Promotions

The broker offers Namibian traders the following bonuses and promotions:

The Loyalty scheme is geared towards high-volume traders and loyal customers. Traders earn points for every trade that they execute, and this could help them earn a cash rebate of up to 20%.

New traders who register an account for the first time receive 1,000 points to get them started. For every 1 USD traded, traders can earn 1 point. Once the calendar month ends, the points will be added up and the total will determine the rebate that traders will receive.

The points and percentage rebates that traders could earn are as follows:

Does the broker offer bonuses to traders?

The broker generally focuses on providing a transparent and straightforward trading environment. Therefore, they may not offer traditional bonuses or promotions that come with complex terms and conditions.

Are there any special promotions for new traders?

Their approach to promotions may differ from other brokers. They prioritize transparent pricing and trading conditions. While they may not offer specific promotions for new traders, their focus is on providing competitive spreads, efficient execution, and a user-friendly trading environment. Traders should review the broker’s website for the latest information on any available offers.

How to open an Affiliate Account

To register an Affiliate Account, Namibians can follow these steps:

Affiliate Program Features

The broker’s mission is to make the trading industry more transparent and fairer for all traders. They are one of the top FX brokers in terms of dependability and user-friendliness.

Partner users get access to hundreds of well-known markets, as well as many trading platforms and a personalized account homepage. Trade Nation also offers a specialized customer support staff, low spreads, and a slew of additional benefits.

Trade Nation offers a revenue-sharing plan, a cost-per-acquisition (CPA) plan that pays a fixed price for each new customer referred, and a hybrid plan that incorporates the best benefits of both.

How can I join the affiliate program?

Joining the affiliate program is typically straightforward. You can visit the broker’s official website and navigate to the affiliate section. There, you will likely find information on how to sign up as an affiliate. Follow the provided instructions to get started with the program.

What kind of support and resources does the broker offer to its affiliates?

They often provide their affiliates with various support and resources to help them succeed. This may include marketing materials, tracking tools, and dedicated support from the affiliate team. The specific resources available can vary, so it’s a good idea to contact Trade Nation directly or visit their affiliate section for detailed information on the support they offer to affiliates.

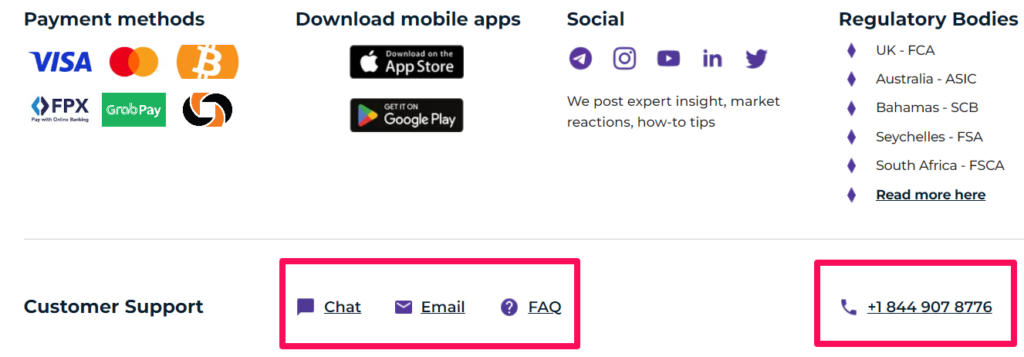

Customer Support

The broker offers customer support 24 hours a day, 5 days a week through several communication channels. While support is only offered in English, customer agents are quick to respond and offer informative answers to any queries that traders may have.

How can I contact the broker’s customer support?

They offer multiple channels for contacting customer support. You can typically reach them through email, phone, or live chat on their website. Visit their official website for up-to-date contact information and hours of availability.

Is the broker’s customer support available 24/5?

They often provide customer support during the trading week, which is typically 24 hours a day, five days a week. However, it’s essential to verify their current support hours, as they may be subject to change based on market conditions and other factors. You can usually find their operating hours on their website or by contacting their support team directly.

Verdict

The broker caters to customers who value openness and minimal trading costs. They are completely forward about what they charge and do not charge.

Even though they do not provide crypto and do not allow traders from the United States, there is plenty to enjoy about this broker.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Trade Nation is well-regulated in four regions by Tier-1, Tier-2, and Tier-3 regulators namely FCA, ASIC, FSCA, and SCB | There is no NAD-denominated account offered, subjecting Namibians to currency conversion fees |

| Trade Nation offers MetaTrader 4 and a powerful proprietary trading platform | There is no Islamic Account option offered to Muslim traders |

| There are no deposit fees, withdrawal fees, or inactivity fees charged by Trade Nation | There are no variable spreads offered |

| There is a free simulator offered to traders and even those who do not yet have an account | There is no FIX API access offered to Namibian traders |

| Traders can earn rebates up to 20% according to their monthly trading volume | Trade Nation does not currently offer Crypto trading |

| There are trading signals offered and copy trading is available | There are no managed account options |

| The Trade Nation platform incorporates Smart News, helping to inspire trade ideas in both beginner and professional traders | |

| There are tight and fixed spreads, with no hidden trading or non-trading fees |

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

you might also like: CM Trading Review

you might also like: IG Review

you might also like: FBS Review

you might also like: XM Review

you might also like: Octafx Review

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Frequently Asked Questions

What is the withdrawal time with the broker?

The withdrawal time ranges from one business day up to five business days, depending on your withdrawal method.

Is Trade Nation regulated?

Yes, they are well regulated in the United Kingdom by the FCA, Australia by the ASIC, South Africa by the FSCA, and the Bahamas by SCB.

Does Trade Nation use MT4?

Yes, they support the use of MT4 alongside its proprietary trading platform.

Does the broker have Nasdaq?

Yes, they offer Nasdaq under US Tech as a CFD and Futures option, with fixed spreads that range from 0.8 pips to 3 pips and margin requirements from 0.5% on the High Leverage Account and 5% on the low leverage account.

Is Trade Nation safe or a scam?

Trade Nation is a safe broker that has been verified.

Does the broker have an NAD account?

No, they do not offer an account denominated in Namibian dollars. They only support GBP, USD, EUR, AUD, DKK, NOK, ZAR, and SEK as the base currencies for accounts.

Is Trade Nation good for beginners?

Yes, the broker is a good option for beginners, attributable to its range of educational materials and excellent trading simulator.

Does Trade Nation have a demo account?

Yes, they offer a free simulator that acts as a demo account.

Does Trade Nation have Volatility 75?

No, Trade Nation does not currently offer access to VIX.

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Corporate Social Responsibility

There is currently no information available on the Corporate Social Responsibility initiatives or projects that they are involved in.