4 Best Forex Brokers with Minimum $1 Deposit in Namibia

The 4 Best Forex Brokers with a Minimum 1 USD Deposit in Namibia revealed. We tested and verified the best minimum of 1 Dollar (18 NAD) forex brokers for Namibia Traders.

This is a complete list of a minimum of One Dollar deposit forex brokers in Namibia.

In this in-depth guide you’ll learn:

- What is a minimum $1 deposit broker?

- Who are the best $1 minimum deposit forex brokers for Namibians?

- A list of low-deposit Forex brokers to help you start trading

- Which NASDAQ Forex brokers offer a low minimum deposit?

- How to choose a forex broker – Compare them side by side against each other.

- Which brokers offer no minimum deposit?

- Which brokers offer a signup bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best-tested minimum $1 deposit forex brokers for Namibians…

Let’s dive right in…

- Louis Schoeman

4 Best Forex Brokers with Minimum $1 Deposit in Namibia – Comparison

| 🥇 Broker | 👉 Open an Account | 🎉Regulation | 💰 Minimum Deposit in Namibian Dollars? | 🎉 Trading Platform |

| 1. FBS | 👉 Open Account | IFSC, FSCA, ASIC, CySEC | 18 NAD ($1) | MetaTrader 4, MetaTrader 5, FBS Trader |

| 2. OANDA | 👉 Open Account | ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA | 18 NAD ($1) | Metatrader 4 and Metatrader 5 |

| 3. Trade Nation | 👉 Open Account | FCA, ASIC, FSCA, and SCB | 18 NAD ($1) | TN Trader, Metatrader 4 |

| 4. JustMarkets | 👉 Open Account | FSA, CySec, FSCA, FSC | 18 NAD ($1) | MetaTrader 4, MetaTrader 5, JustMarkets App |

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What are Forex Brokers with Minimum $1 Deposit?

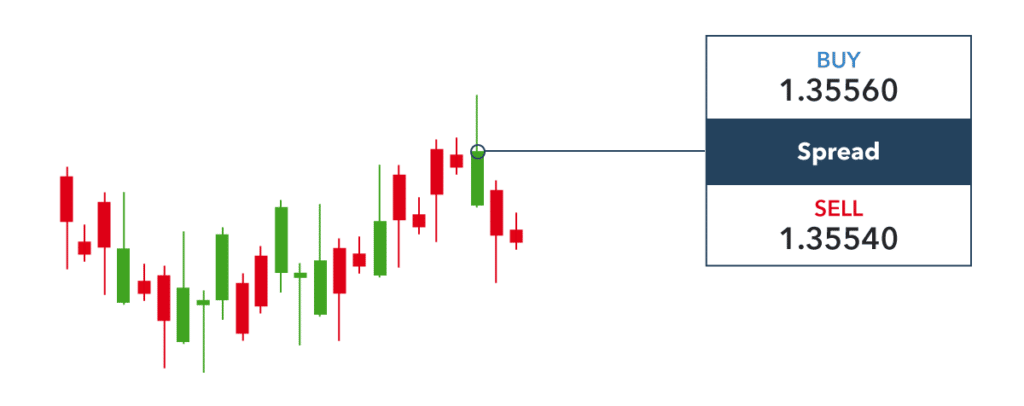

A minimum deposit or initial deposit is the minimum amount of money required to open an account with a financial institution, such as a bank or brokerage firm. Forex Brokers with a Minimum $1 Deposit require $1 (18 NAD) or less to open an account.

4 Best Forex Brokers with Minimum $1 Deposit in Namibia Summary

FBS – Overall, Best Forex Broker with a Minimum $1 Deposit in Namibia

Oanda – Innovative Mobile Trading App Offered

Trade Nation – Commission-Free Trading Offered

- JustForex – Islamic Swap-Free Accounts Offered

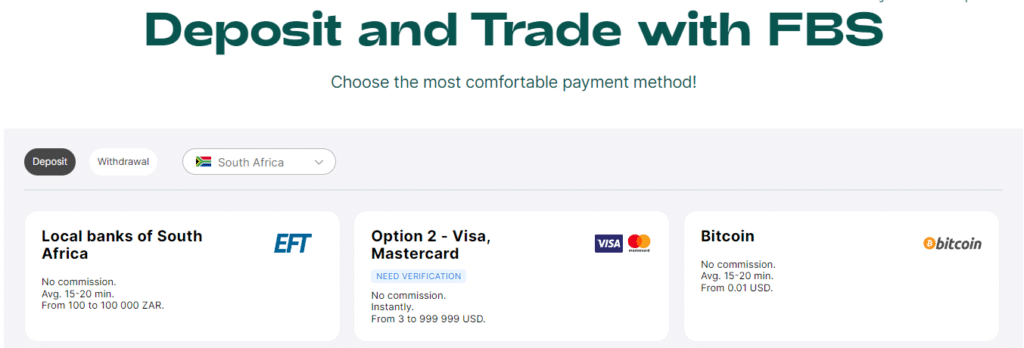

FBS

FBS is regarded as an average risk, with a Trust Score of 75 out of 100. One Tier-1 regulator (high trust), two Tier-2 regulators (average trust), and one Tier-3 regulator (low trust) license FBS. FBS is based in Belize and is governed by the IFSC, CySEC, ASIC, and FSCA.

FBS provides six retail trading accounts: an FBS Cent Account, an FBS Micro Account, an FBS Standard Account, an FBS Zero Account, an FBS ECN Account, and an FBS Crypto Account.

FBS accepts Namibian clients and has an average spread of 0.0 pips with a round-turn commission of $6. FBS offers a maximum leverage ratio of up to 1:3000, as well as a demo and Islamic account. Platforms supported include MT4, MT5, FBS Trader, and CopyTrade.

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

FBS has millions of customers in over 150 countries worldwide. Furthermore, FBS allows Namibian traders to buy and sell over 75 different trading products across multiple financial asset classes.

FBS is a popular choice for many traders because it is a long-standing online forex and CFD broker. FBS Inc. was founded in 2009 and has grown in size, strength, and financial resources since then.

As a result, FBS now has offices and partners in countries all over the world. According to FBS, hundreds of new online trading accounts are opened every day, and these accounts are owned by both traders and new business associates.

FBS Overview

| Account Feature | Value |

| 💳 Minimum Deposit | 18 NAD equivalent to $1 |

| 📈 Average spread | Floating, from 1 pip |

| 🔎 Commission | None |

| 📈 Leverage | Up to 1:1000 |

| 📅 Maximum opening positions | 200 |

| 📊 Order volume | Between 0.01 to 1,000 cent lots |

| 📈 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, FBS Trader |

| 🚀 Tradable Instruments | Forex, precious metals, indices, energies, forex exotics, stocks |

| ☪️ Swap-Free Islamic Option | Yes |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| There is a very low minimum deposit required | Several regions are restricted from service |

| FBS is an online broker with regulation through IFSC and the Cyprus Securities and Exchange Commission | The spreads on some accounts are very high |

| There is a choice between investor accounts | Inactivity fees apply to dormant accounts |

| Traders have access to fast, flexible payment methods | The demo account expires after 40 days |

| The trading conditions are favourable and competitive | Withdrawal fees and deposit fees are charged |

| There are demo accounts and Islamic Accounts | There is a limited selection of funding options and there are only two base account currencies |

| Customer service is available 24/7 | Currency conversion fees are charged on deposits made in currencies other than USD and EUR |

| The broker is reputable and has a high trust score | |

| FBS is an official trading partner that offers a comprehensive affiliate program | |

| There are several bonuses and promotions offered |

Oanda

Overall, OANDA is considered low-risk, with an overall Trust Score of 92 out of 100. OANDA is licensed by eight Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). OANDA is headquartered in the United States and regulated by IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, and BVI FSC.

OANDA offers three different retail trading accounts namely a Standard Account, Core Account, and a Swap-Free Account.

OANDA accepts Namibian clients and has an average spread from 0.1 pips with a $40 commission according to trading volume. OANDA has a maximum leverage ratio up to 1:200 and there is a demo and Islamic account available. OANDA, MT4, MT5, and TradingView platforms are supported.

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

OANDA performs everything from currency conversions to FX data services for corporations to giving an established worldwide online brokerage service to consumers looking to trade the retail FX and CFD markets.

In addition, OANDA ranks among the best online forex brokers due to its well-organized website, stated purpose of openness, emphasis on customer education and research, different user interfaces, and worldwide regulatory monitoring.

OANDA Overview

| Account Feature | Value |

| 📈 Average Spreads | Variable, from 1 pip |

| 🔎Commissions (Per 1 mil traded) | None |

| 📈 Maximum Leverage | 1:200 |

| ✴️ Minimum lot size | 0.01 lots |

| 📊 Instruments | 81 |

| 🔎Stop-Out | 50% |

| 🌐 One-Click Trading offered? | Yes |

| 📈 Strategies allowed | All |

| 📊 Base Account Currency | USD, EUR, HKD, SGD |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Proprietary desktop trading platforms offered alongside MetaTrader 4 and 5 | Fixed spreads are not offered |

| Offers an impressive array of financial instruments including most currency pairs | There is a monthly inactivity fee applied |

| Innovative mobile trading apps and mobile platforms provided | |

| There are several advanced charting tools and charting features offered | |

| Negative balance protection is applied to accounts | |

| The broker accepts a wide range of trading strategies including algorithmic trading, hedging, scalping, and more | |

| There is a comprehensive range of trading tools and analytical tools offered | |

| Deposit fees are not charged and there are several deposit options | |

| Offers a decent selection of educational materials including educational articles | |

| Client funds are kept in segregated accounts |

Trade Nation

Overall, Trade Nation is considered the average risk, with an overall Trust Score of 80 out of 100. Trade Nation is headquartered in London and is regulated by FCA, ASIC, FSCA, and SCB.

Trade Nation is licensed by two Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). Core Spreads rebranded to Trade Nation in 2019 and while the brand is still new, it is a large competitor in the forex and CFD trading arena.

Trade Nation offers one retail trading account with two live trading options namely a Low Leverage Account and a High Leverage Account.

Trade Nation used to be known as Core Spreads, and it was previously a one-person operation. Since 2014, it has risen to the top of the business for traders wishing to trade without paying large fees or commissions.

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overall, Trade Nation is perfect for Namibian traders. Regardless of trading style or expertise, Trade Nation offers affordable costs, a secure trading environment, and innovative solutions to a wide spectrum of traders.

Trade Nation accepts Namibian clients and has an average fixed spread of 0.4 pips with zero commission fees. Trade Nation has a maximum leverage ratio up to 1:30 (Low Leverage Account) and 1:200 (High Leverage Account) and there is a demo account available, but no Islamic Account.

Trade Nation Proprietary platforms and MetaTrader 4 are supported.

Trade Nation Overview

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC, FSCA, SCA |

| 📱 Social Media Platforms | • Facebook • YouTube |

| 💻 Trading Accounts | • Low Leverage Account (1:30) • High Leverage Account (1:200) |

| 📊 Trading Assets | • Indices • Stocks • Precious Metals • Forex • Commodities • Energies • CFDs |

| 📈 Minimum spread | From 0.4 pips |

| 📱 Demo Account | Yes |

| ☪️ Islamic Account | No |

| 💻 PAMM Accounts | No |

| 💰 Bonuses and Promotions for Namibians | No |

| 🥇 Trust score for Namibia | 80% |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Trade Nation does not charge a minimum deposit, offering Namibian traders with flexibility | There is a limited selection of funding options |

| The broker offers transparent fixed financial spread trading across several asset classes | The spread costs are not the lowest in the industry |

| There is a powerful desktop platform, innovative mobile trading app, and web-based trading platform | There are leverage restrictions on the UK and Australian clients |

| There is commission-free trading offered | United States clients are not accepted |

| There is a wide selection of educational content and beginner guides as part of an all-inclusive education material package | Inactivity account fees may apply |

| There is a dedicated customer service team offered | |

| There is an active business community offered along with a dedicated affiliate program | |

| Trade Nation offers international stability through a well-established regulatory framework | |

| There is no deposit fee or withdrawal fee charged on deposit or withdrawal methods | |

| There are several base currencies to choose from when registering a retail investor account |

JustMarkets

JustMarkets is an online foreign exchange trading platform and a forex broker that operates from Seychelles where its parent company, Just Global Markets Ltd. holds registration and licensing through the Financial Services Authority (FSA), a Tier-3 regulator. JustMarkets is headquartered in Seychelles and regulated by the FSA.

JustMarkets offers seven different retail trading accounts namely a Standard Cent Account (MT4), Standard Account (MT4), Pro Account (MT4), Raw Spread Account (MT4), Standard Account (MT5), Pro Account (MT5), Raw Spread Account (MT5). MT4, MT5, and JustMarkets App platforms are supported.

Min Deposit

10 USD / 186 NAD

Regulators

FSA, CySec, FSCA, FSC

Trading Desk

MetaTrader 4, MetaTrader 5, JustMarkets App

Crypto

Yes

Total Pairs

240+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

JustMarkets accepts Namibian clients and has an average spread from 0.0 pips with a $6 commission round turn. JustMarkets has a maximum leverage ratio up to 1:3000 and there is a demo and Islamic account available.

JustMarkets Overview

| 💰 Maximum leverage up to | 1:3000 |

| 💰 Commission Charges | None |

| 📊 Swap-free option? | Yes |

| 📈 Average spreads from | 0.3 pips |

| 📊 Minimum order size | 0.01 lot |

| 📊 Maximum order size | 100 Lots |

| 📊 Maximum orders | Unlimited |

| 💰 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 🔀 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 💰 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 9 Indices • 5 Cryptocurrency Pairs |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| JustForex offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustForex offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustForex offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustForex’s non-trading fees are reasonable | |

| The broker offers a risk warning, training webinars, an array of articles and education for inexperienced traders | |

| There is a wide choice between different types of accounts and excellent trading conditions | |

| One-click trading is offered in addition to insights to help Namibian traders make better trading decisions | |

| Real-time market analysis is offered alongside analysis tools and several other additional tools | |

| Client funds are kept in segregated bank accounts | |

| There are several research and resources that can help traders make improved independent investment decisions | |

| JustForex’s account-opening process is quick and easy | |

| JustForex offers several innovative features including a range of services | |

| There are several trading account currencies to choose from | |

| There is no fee for withdrawals |

How to choose a Forex Broker in Namibia

Namibian traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Namibians must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Namibians must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Namibians must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Namibians must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Namibian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and several other resources can help experienced traders make informed trading decisions.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

The Best Forex Brokers in Namibia

In this article, we have listed the best Forex brokers which offer Forex Brokers with a Minimum $1 Deposit to traders in Namibia. We have further identified the forex brokers that offer additional services and solutions to Namibian traders.

Best Forex Brokers with Minimum $1 Deposit MetaTrader 4 / MT4 Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overall, Oanda is the best Minimum $1 Deposit MT4 forex broker in Namibia. Oanda also provides competitive trading conditions, a proprietary platform that has won awards, and high-quality trading solutions. Professionals and novices alike can use OANDA’s platform to access a wide range of indicators and charting tools.

Best MetaTrader 5 / MT5 Forex Broker in Namibia

Min Deposit

$10 / 195 NAD

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Axiory is the best MT5 forex broker in Namibia. Axiory trades are executed in less than 200 milliseconds, and Namibian traders are given the best trading software that is linked to Equinix data centers. Axiory’s cTrader, MetaTrader, and the FIX API can be used to trade forex and CFDs.

Best Forex Broker for beginners in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HF Markets is the best forex broker for beginners in Namibia. HF Markets, formerly HotForex, is a low-risk CFD and forex broker that provides competitive trading conditions, retail investor accounts, client fund security, and customer support. HF Markets’ retail investor accounts are appropriate for both novice and expert traders, as well as professional traders seeking a competitive edge in their trading.

Best Minimum Deposit Forex Broker in Namibia

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overall, Trade Nation is the best minimum deposit forex broker in Namibia. Trade Nation is also a platform with minimal risk and an effective trading app. Trade Nation further has competitive costs, a secure trading environment, and cutting-edge solutions. Trade Nation provides a range of traders, regardless of their trading style or level of experience, with competitive costs, a secure trading environment, and cutting-edge solutions.

Best ECN Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best ECN forex broker in Namibia. AvaTrade is a CFD and FX broker that is globally regulated by financial watchdog authorities. It provides an optimal trading environment for traders of all levels, with 24-hour multilingual support desks. AvaTrade offers a wide range of trading instruments, including Forex, stocks, commodities, and indices.

Best Islamic / Swap-Free Forex Broker in Namibia

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best Islamic/swap-free forex broker in Namibia. XM was founded in 2009 and has been in operation for more than 12 years. It operates in over 196 countries, has a service team that speaks 30 languages, and is one of the most trusted and well-regulated brokers. XM also provides strong security, superior customer service, account financing, and low fees.

Best Forex Trading App in Namibia

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overall, OctaFX is the best forex trading app broker in Namibia. OctaFX is also a trustworthy broker due to its low required minimum deposit, commission-free trading, and unlimited practice account. OctaFX’s mission is to keep trading costs as low as possible while simultaneously achieving a slip-free execution rate of 97.5 percent of all orders through the utilization of STP (Straight Through Processing) and ECN models.

Best Lowest Spread Forex Broker in Namibia

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best lowest-spread forex broker in Namibia. Exness offers dynamic and adaptable account types as well as some of the industry’s most advantageous trading conditions. Exness offers over 200 financial products, several retail account types, and a wealth of resources.

Best Nasdaq 100 Forex Broker in Namibia

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best Nasdaq 100 forex broker in Namibia. FP Markets also provides over 10,000 products in stocks, indices, forex, commodities, and cryptocurrencies, as well as an easy-to-use mobile app and a variety of account types. FP Markets provides a variety of value-added services, including VPS hosting for automated trading solutions, copy trading through the MT4 Myfxbook service, and retail account management using the MT4 MAM/PAMM module.

Best Volatility 75 / VIX 75 Forex Broker in Namibia

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, Pepperstone is the best Volatility 75 / VIX 75 forex broker in Namibia. Pepperstone is capable of handling multiple order fills, allowing them to feed bigger orders into a liquidity aggregator on numerous levels. Orders placed by clients are filled on a “market execution” basis without requotes, with the possibility of positive or negative slippage, and without broker interference. Pepperstone is also known for its exceptional client service, research offerings, and broad platform selection.

Best NDD Forex Broker in Namibia

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Overall, BDSwiss is the best NDD forex broker in Namibia. BDSwiss is also a well-regulated broker that has a large international clientele. It offers a diverse range of trading instruments, including forex, commodities, stocks, indices, and many cryptocurrencies.

Best STP Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best STP forex broker in Namibia. Tickmill’s VIP and Pro accounts also offer very appealing commission-based pricing. Tickmill provides a wide range of CFD currency, stock, commodity, and index CFDs in addition to low spreads, massive leverage, and fast execution speeds.

Best Minimum $1 Deposit sign-up bonus Broker in Namibia

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

Overall, FBS is the best Minimum $1 Deposit sign-up bonus broker in Namibia. FBS is also a top forex and CFD broker for Namibians, offering a variety of trading accounts as well as a cutting-edge proprietary trading app. FBS charges low, competitive fees, and traders can rest assured that their client’s funds are safe

Understanding how Forex Brokers with Minimum $1 Deposit works

Small accounts or starting with a minimum deposit of as little as $1, are usually the best strategy for beginners to use because it reduces their risks and potential losses while providing them with the opportunity to gain live training experience.

Even experienced traders use small accounts to experiment with new strategies or skills, allowing them to recover quickly if they incur losses.

If you are a beginner trader looking to get started with minimal risk, a Cent account is a good place to start because it allows traders to use a micro-lot size of 0.01. However, the trader must recognize that the lower the capital, the lower the profit.

Because of the increased competition in the market, many forex brokers have reduced their minimum deposit requirements, offering trading accounts as low as 1 USD.

This is due to the high levels of liquidity, which significantly reduce the transaction costs and fees that traders pay when trading forex, allowing Kenyan traders to access some of the best forex brokers while only using small amounts of capital.

If you are thinking about entering the forex trading market and looking for the best forex brokers, or if you are already working with an FX broker, one of the most important factors to consider is the minimum deposit.

According to customer reviews, some do not require a minimum deposit, and in some cases, the minimum deposit is as low as $1.

Advantages of Forex Brokers with Minimum $1 Deposit

Forex Brokers with a Minimum $1 Deposit have several advantages. These advantages include:

➡️ Traders can test the waters with a broker’s live account without committing serious money.

➡️ With a Forex mini account, mini lot sizes are 10,000 units as opposed to 100,000 units with a standard lot. This means a one-pip move in a currency pair based on USD is equal to $1, compared with $10 for a standard lot.

➡️ Smaller lot sizes also give traders greater control over position sizing.

Disadvantages of Forex Brokers with Minimum $1 Deposit

Forex Brokers with a Minimum $1 Deposit also have some drawbacks of traders in Namibia should take note of in order to mitigate their risk of losses:

➡️ The smaller the amount with which a broker trades, the smaller his profit will be.

Conclusion

FBS emerges as a versatile option for traders. They offer accessibility with a robust regulatory framework from IFSC, FSCA, ASIC, and CySEC. The broker provides a choice of trading platforms, including MetaTrader 4, MetaTrader 5, and FBS Trader.

OANDA maintains a strong regulatory presence from ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, and NFA. OANDA supports Metatrader 4 and Metatrader 5 platforms.

Trade Nation is regulated by FCA, ASIC, FSCA, and SCB. They offer the TN Trader platform or MetaTrader 4.

JustMarkets rounds off the list, holding licenses from FSA, CySec, FSCA, and FSC, it offers traders the MetaTrader 4, MetaTrader 5, and the JustMarkets App.

you might also like: Best Forex No-Deposit Brokers

you might also like: Best Cent Account Forex Brokers

you might also like: FBS Review

you might also like: Oanda Review

you might also like: Trade Nation Review

Frequently Asked Questions

Can I start forex trading in Namibia with only $1?

Yes, you can start with as little as $1 by opening an account with a broker in Namibia that only requires a $1 minimum deposit.

How much should I put down as a minimum deposit to begin forex trading?

This depends on the type of trading you plan, but you should never trade more than you can afford to lose. Some brokers allow you to open an account with a minimum deposit of $1, an amount that most traders can afford without exposing themselves to unnecessary risk of loss.

Can any person make money with forex trading?

Yes, it is possible to make money with forex trading, but it will depend on skill and self-discipline.

Why can I lose money with forex trading?

Unless you make a thorough study of forex trading before starting, you may lose lots of your money before getting into the swing of trading.

Can you make a lot of money with forex trading?

It depends on how much you are willing to risk per trade. Risking $1000 can make you an average of $20 000 per year.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia