7 Best Forex brokers Minimum $100 deposit in Namibia

The 7 Best Forex Brokers with a Minimum 100 USD Deposit in Namibia revealed. We tested and verified the best minimum of 100 Dollar (1 851 NAD) forex brokers for Namibia Traders.

This is a complete list of a minimum of one hundred Dollar deposit forex brokers in Namibia.

In this in-depth guide you’ll learn:

- What is a minimum $100 deposit broker?

- Who are the best $100 minimum deposit forex brokers for Namibians?

- Which minimum deposit brokers are best for beginner traders?

- Which NASDAQ Forex brokers offer a low minimum deposit?

- How to choose a forex broker – Compare them side by side against each other.

- Which brokers offer no minimum deposit?

- Which brokers offer a signup bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best-tested minimum $100 deposit forex brokers for Namibians…

Let’s dive right in…

- Louis Schoeman

Best Forex brokers $100 Minimum deposit in Namibia – Comparison

| 🥇 Broker | 👉 Open an Account | ✔️ $100 Deposit Broker? | 💰 Minimum Deposit in Namibian Dollars? | ✅ Offers Namibian Account? |

| 1. Exness | 👉 Open Account | Yes | 1 851 NAD ($100) | Yes |

| 2. AvaTrade | 👉 Open Account | Yes | 1 851 NAD ($100) | No |

| 3. HF Markets | 👉 Open Account | Yes | 1 851 NAD ($100) | Yes |

| 4. Tickmill | 👉 Open Account | Yes | 1 851 NAD ($100) | No |

| 5. OctaFX | 👉 Open Account | Yes | 1 851 NAD ($100) | No |

| 6. BD Swiss | 👉 Open Account | Yes | 1 851 NAD ($100) | No |

| 7. FP Markets | 👉 Open Account | Yes | 1 851 NAD ($100) | No |

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What are Forex brokers with a $100 minimum deposit?

Forex brokers with a $100 minimum deposit are those that will let you open an account to start trading by depositing a minimum of 100 USD (1 851 NAD). This is a fair starting point for beginner traders who are still feeling out of the financial markets but is enough to suit professional traders who want to test out new strategies.

The 7 Best Forex Brokers Minimum $100 Deposit in Namibia Summary

- Exness – Overall, Best Forex Broker with Minimum $100 Deposit in Namibia

- AvaTrade – Offers Multiple Trading Instruments

- HF Markets – Low Minimum Deposit Required

- Tickmill – No Minimum Deposit Required to Start Trading

- OctaFX – Low Minimum Spreads for Namibian Traders

- BD Swiss – Multiple Platforms Provided

- FP Markets – Commission-Free Trading Offered on All Accounts

1. Exness

Exness is headquartered in Cyprus and regulated by several authorities, including the FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA.

Exness accepts Namibian clients and offers five different retail trading accounts namely a Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, and Pro Account. MT4, MT5, and Exness platforms are supported.

Exness offers an average spread from 0.0 pips with commissions from $0.1 per lot, per side. Exness has an unlimited maximum leverage ratio and there is a demo and Islamic account available.

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Their user-friendly MT4 platform offers the ability to trade a variety of CFDs and Futures contracts on a variety of marketplaces.

Exness has won numerous awards as a retail broker because it provides reliable and competitive brokerage services, as well as a comfortable trading environment that is suited to the needs of most traders.

Unique Features

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | $10 / 192 NAD |

| 📊 Spreads | Variable, from 0.3 pips |

| 💵 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, KES, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💸 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| ✔️ Instruments Available | Forex major pairs, minor currency pairs, exotic pairs, energies, cryptocurrencies, stocks, indices |

| 📉 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📊 Maximum positions | Unlimited |

| % Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 60 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

| 👉 Open an account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Exness is well-regulated by several reputable market regulators across the globe | United States clients are excluded from Exness’ global reach |

| There are tight, variable spreads offered across five retail investor accounts | There is a limited selection of tradable instruments offered |

| There is a choice between dynamic retail investor accounts, each featuring competitive trading conditions | There is a limited selection of funding options offered |

| The broker offers solutions to both novice traders and professionals | |

| There are advanced trading tools offered | |

| Provides a powerful proprietary platform on the web and mobile devices | |

| Client fund safety and investor protection guaranteed | |

| Instant withdrawals and deposits supported | |

| Exness offers multilingual customer service that is available 24/7 |

2. AvaTrade

AvaTrade is headquartered in Dublin, Ireland and is regulated by the Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC. Overall, AvaTrade is considered low-risk, with proper licencing and regulation.

AvaTrade is a forex and CFD broker that was established in 2006 and is now one of the top trading firms in the world. AvaTrade has 300,000 registered traders that execute over 3 million deals each month.

AvaTrade offers a single live trading account with the option between Retail and Professional. AvaTrade has a maximum leverage ratio up to 1:30 on Retail Accounts and 1:400 on Pro Accounts, and there a demo and Islamic account are available. AvaTrade Accepts Namibian Clients and has an average spread from 0.9 pips EUR/USD with no commission charges.

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

AvaTradeGO, MetaTrader 4, MetaTrader 5, and several other platforms are supported.

AvaTrade is also a member of the Investor Compensation Company DAC, which reimburses qualifying customers up to EUR 20,000 in the event of their broker’s bankruptcy.

Unique features

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 1,870 Namibian Dollars/100 USD |

| 💵 Base Account Currency Options | ZAR, USD, GBP, or AUD |

| 📈 Maximum Leverage | 1:400 on forex majors |

| 📊 Range of Markets offered | More than 1,250 tradable instruments |

| 💰 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💸 Commissions on trades | None |

| 📊 Average spreads | From 0.9 pips EUR/USD |

| 💵 Margin Requirements | From 0.25% when using leverage of 1:400 |

| 📞 Customer Support Channels | Social Platforms, Email Request, Telephone, WhatsApp, Live Chat |

| 📚 Educational Materials offered | Trading Videos, Trading For Beginners, Trading Rules, Technical Analysis Indicators and Strategies, Economic Indicators, Market Terms, Order Types, Blog, Online Trading Strategies |

| 🔨 Trading tools offered | AvaProtect, Trading Central, CFD Rollover, Economic Calendar, Trading Calculator, Earnings Releases, Analysis |

| ✔️ Trading Strategies Allowed | All – scalping, swing trading, momentum trading, expert advisors, algorithmic trading, auto trading, etc. |

| 👉 Open an account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

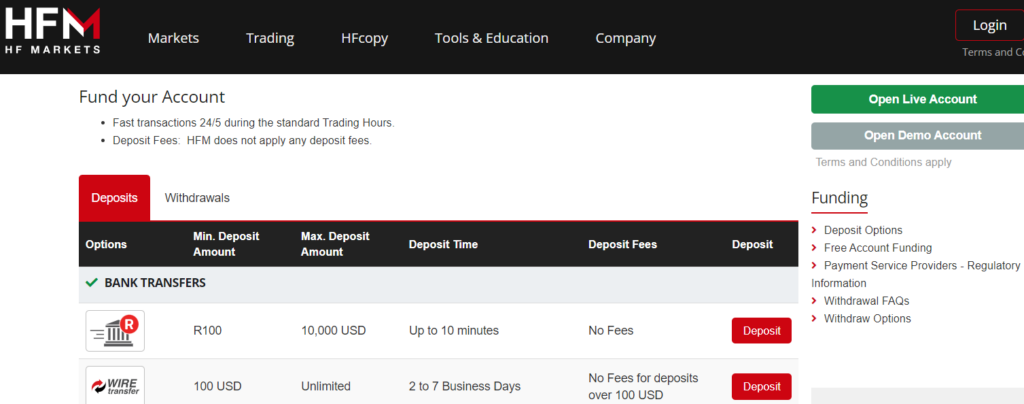

3. HF Markets

In operation since 2010, HF Markets, previously known as HotForex, is a leading worldwide online broker.

HF Markets is considered low-risk, with proper regulation. HF Markets is headquartered in Cyprus and regulated by FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA.

HF Markets offers five different retail trading accounts namely a Micro Account, a Premium Account, an HFCopy Account, a Zero Spread Account, and an Auto Account. MT4, MT5 and HF App platforms are supported.

HF Markets accepts Namibian clients and has an average spread from 0.0 pips with a $6 to $8 commission round turn. HF Markets has a maximum leverage ratio up to 1:1000 and there is a demo and Islamic account available.

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Customers may trade a broad selection of assets, including Forex, commodities, cryptocurrencies, shares and indices, precious metals, renewable energies, and bonds with them. They also provide institutional clients with a comprehensive range of trading services.

There are approximately 1.5 million active account holders at HF Markets, and overall, HF Markets employs more than 200 people throughout the world, who offer 24-hour assistance in over 27 languages to customers, with customer service and satisfaction an integral part of HF Markets’ mission.

Unique Features

| 💳 Minimum Deposit (₦) | 2,200 NGN or equivalent to $5 or 70 ZAR |

| 📈 Spreads | 1 pip EUR/USD |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💰 Trading Instruments | All |

| ✴️ Execution | Market Execution |

| 📈 Maximum Leverage Ratio | 1:1000 |

| 📈 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 7 Standard Lots (100,000 base currency) |

| 📊 Maximum Open Orders | 150 (Simultaneous) |

| 🌐 Margin Call (%) | 40 |

| 🌐 Stop-Out (%) | 10 |

| 💳 Account Base Currency | USD, ZAR |

| 👨💼 Personal Account Manager | Yes |

| ⚖️ Commission Charges | None |

| 🔎 Bonuses Offered | Flexible bonus offering |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Well-regulated CFD and Forex broker that has a decent trust score | United States clients and some other regions are not accepted by HotForex |

| The spreads offered are low and competitive | There may be restricted leverage for EU clients because of regulatory requirements |

| There are several account types to choose from with reasonable trading fees charged | There are no variable spread accounts offered |

| HotForex welcomes all types of traders and trading strategies | Limited funding options offered for deposits and withdrawals |

| There is a low minimum deposit requirement and secure methods for deposits and withdrawals | |

| Suited to beginner traders and experienced traders | |

| Offers comprehensive expert trading and market analysis | |

| Offers a decent selection of educational tools and a range of trading tools |

4. Tickmill

Overall, Tickmill is considered low-risk, with an overall Trust Score of 82 out of 100. Tickmill was started by an experienced group of experts with decades of combined work history, and the company is deeply committed to serving the best interests of its customers.

Tickmill is headquartered in London, United Kingdom and regulated by Seychelles FSA, FCA, CySEC, Labuan FSA, and FSCA.

Tickmill offers three different retail trading accounts namely a Pro Account, Classic Account, and a VIP Account. Through its VIP and Pro account tiers, Tickmill provides professionals with commission-based pricing that is quite competitive. There is a demo and Islamic account available.

Tickmill is a straight-through-processing (STP) broker that was founded in 2015 and is well-regulated.

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

The various distinctions that have been bestowed on Tickmill during its years of business provide undeniable evidence of the company’s unwavering devotion to clients.

Tickmill is a run-of-the-mill MetaTrader broker that provides clients with access to a restricted range of tradable securities. MetaTrader 4 and MetaTrader 5 platforms are supported.

Tickmill accepts Namibian clients and has an average spread from 0.0 pips with commissions from $1 per standard lot traded. Tickmill has a maximum leverage ratio of up to 1:500.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSA, FCA, CySEC, Labuan FSA, FSCA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Namibian Traders? | Yes |

| 💳 Minimum deposit (NGN) | 1851 NAD / $100 |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/5 |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| The trading platforms are robust and user-friendly | United States Clients cannot register with Tickmill |

| There are three dynamic Tickmill accounts offered, featuring competitive spreads and a commission-free classic account | There are no fixed spread accounts offered |

| Tickmill is well regulated in several regions with a proven track record of excellent trading services | Currency conversion fees may be deducted |

| There are flexible funding options provided including Skrill, Neteller, bank wire transfer, and others | The spreads are not the tightest |

| Traders are given access to AutoChartist, VPS, and FIX API trading | |

| There are industry standard initial deposits required to register an account | |

| There is a commission-free trading account offered and the minimum balance amounts are reasonable | |

| Negative balance protection is applied to retail accounts | |

| There is no deposit fee or withdrawal fee charged | |

| Educational videos and other educational resources are available | |

| Retail traders have access to several tools to help them navigate complex instruments | |

| Social trading opportunities are provided |

5. OctaFX

Overall, OctaFX is considered high-risk, with an overall Trust Score of 67 out of 100. OctaFX is headquartered in Saint Vincent and the Grenadines and regulated by CySEC and SVG FSA.

OctaFX offers two different retail trading accounts namely a MetaTrader 4 Habitual Trader Account and a MetaTrader 5 Smart Trader Account and there is a demo and Islamic account available.

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

OctaFX was established in 2011 and offers strong trading platforms. OctaFX accepts Namibian clients and has an average spread from 0.6 pips with zero commission charges. OctaFX has a maximum leverage ratio of up to 1:500. MT4, MT5, OctaFX, and CopyTrade platforms are supported.

OctaFX uses the STP (Straight Through Processing) and ECN (Electronic Communications Network) models and provides clients with a variety of Forex and CFD products at costs that are among the most reasonable in the industry. In addition to this, OctaFX provides traders with several helpful trading tools, educational materials, and a responsive customer support staff that are all available to assist them.

Unique Features

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | $25/480 NAD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, the mark-up is added to the spread |

| 🔧 Instruments offered on account | 32 currency pairs + gold and silver + 3 energies + 4 indices + 30 cryptocurrencies |

| 📊 Leverage Ratios | Forex 1:500 (ZARJPY 1:100) Metals 1:200 Energies 1:100 Indices 1:50 Crypto 1:25 |

| 💵 Minimum Trading Volume | 0.01 lots |

| 📈 Maximum Trading Volume | 200 lots |

| 📞 Margin Call/Stop-Out | 25% / 15% |

| 📲 Trade Execution Type | Market |

| 📊 Trade Execution Average Speed | Under 0.1 seconds |

| 💳 Base Account Currency Options | USD |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| OctaFX offers sophisticated trading platforms and two powerful trading apps | There is an extremely limited selection of trading instruments and asset classes offered |

| The trading accounts are both commission-free | There are only two available trading accounts |

| There are several modern funding options offered | There is no NAD-denominated trading account for Namibian traders |

| Namibian traders are given access to AutoChartist and several other tools | OctaFX has a low trust score because there is no Tier-1 regulation |

| Negative balance protection is offered on retail accounts | |

| OctaFX is well-regulated and follows strict client fund security protocols | |

| Namibian traders are not restricted on any trading strategies |

6. BD Swiss

Overall, BDSwiss is considered low-risk, with an overall Trust Score of 83 out of 100. BDSwiss is headquartered in Seychelles and is regulated by CySEC, FSC, BaFIN, and FSA.

BDSwiss offers four different retail trading accounts namely a Classic Account, a Premium Account, a VIP Account, and a RAW Account and there is a demo and Islamic account available. MT4, MT5, and BDSwiss platforms are supported.

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

BDSwiss Accepts Namibian Clients and has an average spread of 0.3 pips with a commission of 0.15%. BDSwiss has a maximum leverage ratio of up to 1:1000

BDSwiss was founded in 2012 in Zurich, Switzerland, and has developed to become one of Europe’s major financial organizations specializing in online trading, providing 250+ Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, and CFDs.

Unique Features

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1.5 pips |

| 📈 Maximum Leverage | 1:500 |

| 💵 Tradable Instruments | Over 250 |

| 💸 Available Assets | • Forex CFDs • Stocks CFDs • Indices CFDs • Commodities CFDs • Cryptocurrencies CFDs |

| 💰 Commissions per round lot | • $2 on Indices • 0.15% on Shares |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💰 0% fees on Deposits and CC Withdrawal? | Yes |

| 💻 Platforms available | All |

| 🚨 Are trading alerts offered? | Limited Access granted |

| 1️⃣ Priority Service | No |

| 🔧 AutoChartist Standard Tools | Yes |

| 💰 Access to Trading Central? | Yes |

| 📚 Trading Academy and Live Webinars | Yes |

| 👥 Trade Companion offered? | No |

| ☪️ Islamic Account option? | Yes |

| 🥇 VIP Webinars | No |

| 📞 24/5 Customer Service and Support? | Yes |

| 💰 Minimum deposit requirement | 1851 NAD or an equivalent to $100 |

| 👉 Open an Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Namibians can trade more than 250 financial instruments with BDSwiss | There is an inactivity fee charged on dormant accounts |

| BDSwiss is well-regulated and guarantees client fund security | There is a currency conversion fee when Namibian traders deposit or withdraw in NAD |

| Free VPS is available to eligible clients | There is no NAD-denominated account offered to Namibian traders |

| There are daily trading alerts that keep Namibian traders updated on daily market movements | The proprietary trading platform does not have a desktop terminal |

| There are free webinars offered to beginner traders along with a comprehensive trading academy | |

| There are commission-free trading options offered | |

| There is a choice between trading accounts | |

| BDSwiss offers a transparent fee schedule on trading and non-trading fees |

7. FP Markets

Overall, FP Markets are considered low-risk with proper regulation. FP Markets is headquartered in Australia and is regulated by ASIC and CySEC.

FP Markets is a well-established and licensed broker that provides a broad range of 10,000+ financial products to trade across a variety of global markets, including forex, stocks, cryptocurrencies, and contracts for difference (CFDs).

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

FP Markets accepts Namibian clients and has an average spread from 0.0 pips with a US$6 commission round turn ($3 per side). FP Markets has a maximum leverage ratio of up to 1:500. MT4, MT5, Myfxbook, and FP Markets platforms are supported.

FP Markets offers four different retail trading accounts namely an MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT4/5 Islamic Raw Account.

Unique Features

| Account Feature | Value |

| 💰 Minimum Deposit | $100 /1870 NAD |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

| 🎉 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| FP Markets is well-regulated by a Tier-1 and Tier-2 market regulators, which means that Namibian traders are dealing with a legit broker | There are additional fees that apply to Swap-free accounts |

| There is a massive range of markets across several asset classes | There is no NAD-denominated account |

| There are powerful and user-friendly trading platforms that can be used across different devices | Withdrawal fees are charged on most payment methods |

| There is reliable and fast trade execution through the Equinix servers | |

| There are commission-free accounts offered | |

| There are designated Islamic accounts offered to Muslim traders | |

| FP Makers offers beginner Namibian traders a range of educational materials | |

| There are a plethora of deposit methods and withdrawal options to choose from |

How to choose a Forex Broker in Namibia

Namibian traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Namibians must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Namibians must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Namibians must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Namibians must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Namibian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Namibia

In this article, we have listed the best Forex brokers that offer a $100 minimum deposit to traders in Namibia. We have further identified the forex brokers that offer additional services and solutions to Namibian traders.

Best MetaTrader 4 / MT4 Forex broker with a $100 minimum deposit in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overall, Oanda is the best MT4 forex broker with a $100 minimum deposit in Namibia. Oanda also provides competitive trading conditions, a proprietary platform and high-quality trading solutions.

Best MetaTrader 5 / MT5 Forex broker with $100 minimum deposit in Namibia

Min Deposit

$10 / 195 NAD

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Axiory is the best MT5 forex broker with a $100 minimum deposit in Namibia. Axiory trades are executed in less than 200 milliseconds, and Namibian traders are given the best trading software that is linked to Equinix data centres.

Best Forex brokers with a $100 minimum deposit for beginners in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HF Markets is the best forex broker with a $100 minimum deposit for beginners in Namibia. HF Markets provides competitive trading conditions, retail investor accounts, client fund security, and customer support.

Best Minimum Deposit Forex Broker in Namibia

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overall, Trade Nation is the best minimum deposit forex broker in Namibia. Trade Nation further has competitive costs, a secure trading environment and cutting-edge solutions.

Best Forex brokers with $100 minimum deposit ECN Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best ECN forex broker with a $100 minimum deposit in Namibia. AvaTrade is globally regulated and provides an optimal trading environment with 24-hour multilingual support desks.

Best Islamic / Swap-Free Forex broker in Namibia

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best Islamic/swap-free forex broker in Namibia. XM was founded in 2009 and has been in operation for more than 12 years. It has a service team that speaks 30 languages and is one of the most trusted and well-regulated brokers.

Best Forex brokers with a $100 minimum deposit Forex Trading App in Namibia

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overall, OctaFX is the best $100 minimum deposit forex trading app broker in Namibia. OctaFX is a trustworthy broker with commission-free trading and an unlimited practice account.

Best Lowest Spread Forex broker with a $100 minimum deposit in Namibia

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best lowest spread forex broker with a $100 minimum deposit in Namibia. Exness offers over 200 financial products, several retail account types, and a wealth of resources.

Best Nasdaq 100 Forex broker with a $100 minimum deposit in Namibia

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best Nasdaq 100 forex broker with a $100 minimum deposit in Namibia. FP Markets also provides over 10,000 products in stocks, indices, forex, commodities, and cryptocurrencies, as well as an easy-to-use mobile app and a variety of account types.

Best Volatility 75 / VIX 75 Forex brokers with a $100 minimum deposit in Namibia

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, Pepperstone is the Volatility 75 / VIX 75 best forex broker with a $100 minimum deposit in Namibia. Pepperstone is also known for its exceptional client service, research offerings, and broad platform selection.

Best NDD forex brokers with a $100 minimum deposit in Namibia

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Overall, BDSwiss is the best NDD forex broker with a $100 minimum deposit in Namibia. BDSwiss is also a well-regulated broker that offers a diverse range of trading instruments.

Best STP Forex brokers with a $100 minimum deposit in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best STP forex broker with a $100 minimum deposit in Namibia. Tickmill’s VIP and Pro accounts also offer very appealing commission-based pricing and a wide range of CFD currency, stock, commodity, and index CFDs.

Best sign-up bonus Forex broker with a $100 minimum deposit in Namibia

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

Overall, FBS is the best sign-up bonus forex broker with a $100 minimum deposit in Namibia. FBS offers a variety of trading accounts as well as a cutting-edge proprietary trading app.

Understanding how Forex brokers with $100 minimum deposit work

Beginners usually start with small accounts while somebody with a bit more experience may consider a deposit of $100.

A trader should however realise that the less money he or she invests, the less money can be made. If you have traded before and know the ropes, you can start trading with a Standard account and a deposit of $100. This should give you access to more services and perks from brokerages.

Due to more competition in the market, many forex brokers have lowered their minimum deposit requirements. This is because there is a lot of liquidity, which lowers the transaction costs and fees that traders pay when trading forex.

Namibian traders that have $100 to invest, will be able to trade with some of the best forex brokers.

Advantages of Forex brokers with a deposit of $100

Forex brokers with a $100 minimum deposit have several advantages. These advantages include:

➡️ The opportunity to trade without making a significant financial commitment.

➡️ The ability to use such accounts to live-test trading strategies that require real execution conditions.

➡️ Traders still have a degree of control over their positions when using smaller lot sizes.

➡️ They can make more money

Disadvantages of Forex brokers with minimum $100 deposit

Forex brokers with a minimum $100 deposit also have some drawbacks of traders in Namibia should take note of in order to mitigate their risk of losses:

➡️ The risk of losing money is much bigger than if they would start out with a smaller deposit.

Conclusion

In conclusion, the top 7 $100/1851 NAD brokers are Exness, Avatrade, HF Markets, Tickmill, OctaFX, BDSwiss and FP Markets. Exness as well as HF Markets offers a Namibian trading account while the other brokers do not.

you might also like: Best Volatility 75 Brokers

you might also like: Best Forex Trading Apps

you might also like: Best Cent Account Forex Brokers

you might also like: Best Forex Brokers with Minimum $1 Deposit

you might also like: Best Forex No-Deposit Brokers

Frequently Asked Questions

Can I start forex trading in Namibia with $100?

Yes, $100 will allow you to start trading forex without a significant financial commitment from your side.

Is $100 too much to deposit with a broker?

Once you have funded your account, the most important thing to remember is that your money is at risk. But the more you deposit, the more money you can make.

Can anyone start to trade forex?

Yes, you must just find a reputable broker with a fair choice of accounts and an affordable minimum deposit to open an account

Is a large deposit for forex trading risky?

Forex trading is similar to gambling, so you should not deposit money that you are not willing to lose.

What should you consider before trading forex?

- Don’t use the money you cannot afford to lose

- Do enough research

- Set realistic goals

- Keep your emotions intact

- Be patient

What should a new trader know about his broker before starting?

- What education and research are available?

- Is the broker regulated?

- What will happen if the brokerage goes bankrupt

- Will your deposits be kept separately

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia