XM Review

XM is considered low-risk, with an overall Trust Score of 90 out of 100. XM is licensed by one Tier-1 Regulator (high trust), three Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). XM is currently not regulated by the Bank of Namibia

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overview

The broker offers four different retail trading accounts namely a Micro Account, a Standard Account, XM Ultra-Low Account, and a Shares Account.

The XM Group, also known just as XM, is a well-known and licensed internet trading broker with a worldwide presence. From my own experience, they are one of the greatest brokers for day trading. They are known for offering no-requotes, narrow spreads, rapid execution speeds, minimal fees, and negative balance protection.

XM’s 1.5 million traders and investors pick from a broad choice of trading products and services, including complex trading solutions that are also suited for starting traders.

The reason for the broker’s rapid development and trust is that the broker strives to give its customers one of the greatest user experiences in the business.

The broker builds on its reputation by offering a healthy combination of the features that consumers like most: security, support, quick account funding and withdrawals, and reasonable fees. It is regulated by stringent financial regulators in all key countries.

This advantageous mix makes them an excellent broker to begin or advance one’s trading career. This XM review for Namibia will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

The broker accepts Namibian clients and has an average spread of 0.0 pips with commissions from $1 per share. The broker has a maximum leverage ratio up to 1:888 and there is a demo and Islamic account available.

MT4, MT5, and XM mobile platforms are supported. The broker is headquartered in Belize and is regulated by FSCA, IFSC, ASIC, CySEC, and DFSA.

Distribution of Traders

XM currently has the largest market share in these countries:

Popularity among traders

Where do most of the broker’s traders come from?

The broker has a diverse global client base, but a significant portion of its traders come from various regions, including Europe, Asia, and Africa.

Does the broker offer services to traders in the United States?

No, the broker does not offer its trading services to residents of the United States. This restriction is due to regulatory differences and compliance requirements.

At a Glance

| 🏛 Headquartered | Belize |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2009 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

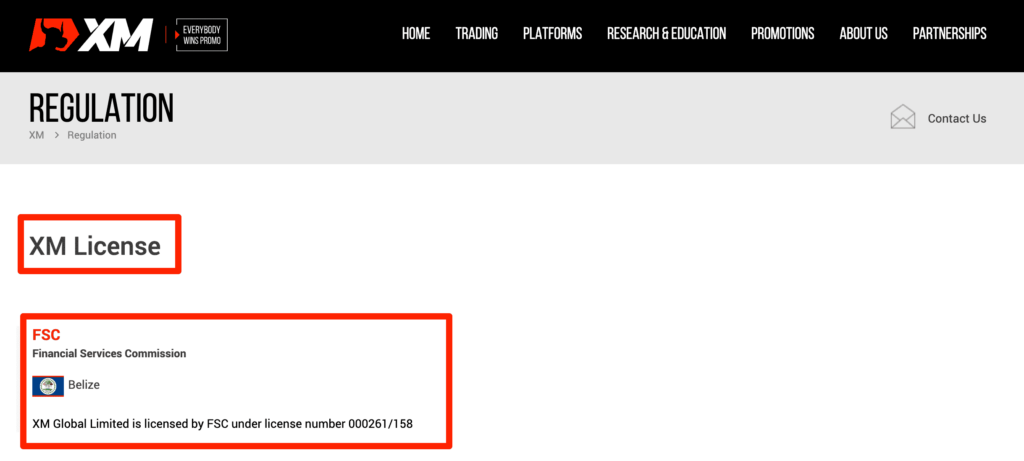

| 🪪 License Number | • Belize – 000261/158 • South Africa – 49976 • Australia – ABN 32 164 367 113, AFSL 443670 • Cyprus – 120/10 • Dubai – F003484 |

| ⚖️ BoN Regulation | None |

| 🚫 Regional Restrictions | The United States, Canada, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | Yes |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant, Market |

| 📊 Average spread | From 0.6 pips |

| 📞 Margin Call | 50% to 100% (EU) |

| 🛑 Stop-Out | 20% to 50% (EU) |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:888 |

| 🚫 Leverage Restrictions for Kenya? | No |

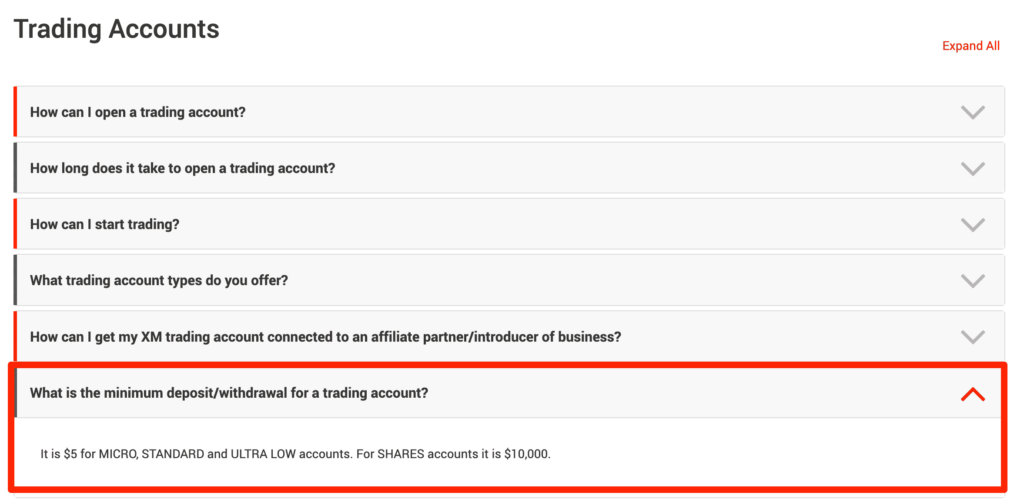

| 💰 Minimum Deposit | $5/96 NAD |

| ✅ Namibian Dollar Deposits Allowed? | Yes |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based XM customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Credit Card • Debit Card • Bank Wire Transfer • Local Bank Transfer • Skrill • Neteller • WebMoney |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • XM Mobile App |

| ✔️ Tradable Assets | • Forex • Stock CFDs • Commodities • Equity Indices • Precious Metals • Energies • Shares |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Malaysian, Chinese Simplified, Chinese Traditional, Russian, French, Italian, German, Polish, Spanish, Portuguese, and several others |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Customer Support Languages | No |

| ✅ Bonuses and Promotions for Namibians | Yes |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is XM a safe broker for Namibians? | Yes |

| 📊 Rating for XM Namibia | 9/10 |

| 🤝 Trust score for XM Namibia | 84% |

| 👉 Open an account | 👉 Open Account |

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Regulation and Safety of Funds

Regulation in Namibia

The broker is a globally recognized broker that has a presence in several regions. While the broker is not locally regulated by the Bank of Namibia, they are regulated by other Tier-1, Tier-2, and Tier-3 market regulators in Belize, South Africa, Dubai, Cyprus, and Australia.

Global Regulations

The broker is a well-regulated company established in Belize that operates via the following companies across the world:

Client Fund Security and Safety Features

To guarantee the protection of its customers, XM Group has chosen regulated organizations to execute withdrawals and deposits. Because consumer money is held in separate tier 1 banks than commercial funds, liquidity providers and the broker are unable to access them. Negative balance protection is also available for customers’ accounts.

As a member of the Investor Compensation Fund, the broker adheres to all the Markets in Financial Instruments Directive’s standards to protect investors (MiFID).

The broker strives to provide the finest possible trading conditions for its customers. They work with a variety of liquidity providers to guarantee that they always have some of the lowest spreads and the highest liquidity.

Is XM a regulated broker?

Yes, it is licensed and regulated by multiple reputable financial authorities, including the International Financial Services Commission (IFSC), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

How does the broker ensure the safety of clients’ funds?

The broker takes the safety of clients’ funds seriously. It employs several measures to safeguard clients’ funds, including the segregation of client funds from company funds, which means client deposits are kept in separate accounts.

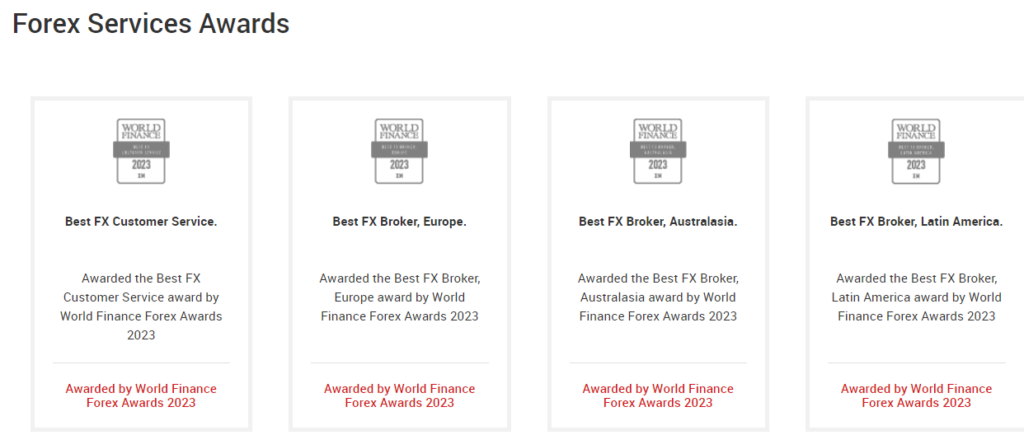

Awards and Recognition

The broker is not only a trusted broker but also one that has won several industry awards throughout its history and the latest awards are as follows:

Has the broker received any awards for its services?

Yes, the broker has received numerous awards and recognition for its exceptional services in the financial industry. These awards include accolades for its customer service, trading platforms, educational resources, and overall excellence.

What awards has the broker won?

The broker has received awards from well-known organizations such as the World Finance Forex Awards, Global Banking & Finance Review, and the Forex Awards, among others. These awards often recognize XM as a leader in areas like customer satisfaction, trading execution, and educational resources.

Account Types and Features

Retail investors in Namibia have the option of selecting from one of four separate account types, each of which is customized to the investor’s particular trading objectives. XM gives users several different live account choices to choose from, including the following:

Micro Account

This account type is suitable for beginner traders who are making the move from a risk-free demo account to a real trading account.

| Account Feature | Value |

| 📈 Base Currency Options | USD, EUR, GBP, JPY, CHF,AUD, HUF, PLN, SGD, ZAR |

| 📊 Position Size | 1,000 base currency units = 1 Lot |

| 📈 Maximum Leverage Ratio | Up to 1:1000** |

| 📉 Negative Balance Protection Applied? | Yes |

| 📊 Average spread on all forex major pairs | As Low as 1 Pip |

| 💸 Commission charges | None |

| 💰 Maximum open or pending orders per trader | 300 |

| 📈 Minimum trade volume MetaTrader 4 | 0.1 lot |

| 📉 Minimum trade volume MetaTrader 5 | 0.1 lot |

| ✔️ Hedging allowed? | Yes |

| 📈 Lot Restrictions per trade | 100 lots |

| ☪️ Islamic Account offered? | Optional |

| 📉 Minimum Deposit Requirement | $5/96 NAD |

| 👉 Open an account | 👉 Open Account |

Standard Account

This is the standard account that most global retail traders go with since it provides standard spreads and a variety of additional account features.

| Account Feature | Value |

| 📈 Base Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR |

| 📊 Position Size | 100,000 base currency units = 1 Lot |

| 📈 Maximum Leverage Ratio | Up to 1:1000** |

| 📉 Negative Balance Protection Applied? | Yes |

| 📊 Average spread on all forex major pairs | As Low as 1 Pip |

| 💸 Commission charges | None |

| 💰 Maximum open or pending orders per trader | 300 |

| 📈 Minimum trade volume MetaTrader 4 | 0.1 lot |

| 📉 Minimum trade volume MetaTrader 5 | 0.1 lot |

| ✔️ Hedging allowed? | Yes |

| 📈 Lot Restrictions per trade | 50 lots |

| ☪️ Islamic Account offered? | Optional |

| 📉 Minimum Deposit Requirement | $5/96 NAD |

| 👉 Open an account | 👉 Open Account |

XM Ultra-Low Account

Scalpers and other day traders may take advantage of the greatest trading circumstances available in today’s fast-paced financial market by opening an account of this kind, which is distinguished by its cheap trading costs.

| Account Feature | Value |

| 📈 Base Currency Options | EUR, USD, GBP, AUD, ZAR, SGD |

| 📊 Position Size | Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000 |

| 📈 Maximum Leverage Ratio | Up to 1:1000** |

| 📉 Negative Balance Protection Applied? | Yes |

| 📊 Average spread on all forex major pairs | As Low as 0.6 Pips |

| 💸 Commission charges | None |

| 💰 Maximum open or pending orders per trader | 300 |

| 📈 Minimum trade volume MetaTrader 4 | • Standard Ultra – 0.01 lots • Micro Ultra – 0.1 lots |

| 📉 Minimum trade volume MetaTrader 5 | 0.1 lot |

| ✔️ Hedging allowed? | Yes |

| 📈 Lot Restrictions per trade | • Standard Ultra – 50 lots • Micro Ultra – 100 lots |

| ☪️ Islamic Account offered? | Optional |

| 📉 Minimum Deposit Requirement | $5/96 NAD |

| 👉 Open an account | 👉 Open Account |

Shares Account

Traders in Namibia have access to a broad variety of shares via the Shares Account. Traders may engage in share trading. This account protects Namibians against negative balances in addition to having competitive commission rates.

| Account Feature | Value |

| 📈 Base Currency Options | USD |

| 📊 Position Size | 1 Share |

| 📈 Maximum Leverage Ratio | None |

| 📉 Negative Balance Protection Applied? | Yes |

| 📊 Average spread on all forex major pairs | According to the exchange |

| 💸 Commission charges | Between $1 to $9 |

| 💰 Maximum open or pending orders per trader | 50 |

| 📈 Minimum trade volume MetaTrader 4 | 1 lot |

| 📉 Minimum trade volume MetaTrader 5 | No |

| ✔️ Hedging allowed? | No |

| 📈 Lot Restrictions per trade | It will depend on each share |

| ☪️ Islamic Account offered? | Yes |

| 📉 Minimum Deposit Requirement | $10,000/192,200 NAD |

| 👉 Open an account | 👉 Open Account |

Base Account Currencies

The broker offers a range of account currencies including USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR. NAD, however, is not supported and this could mean that Namibians will be charged currency conversion fees when they deposit or withdraw in Namibian dollars.

Demo Account

A demo account is perfect for practising your trading skills and putting your trading ideas to the test. A demo account does not have a time limit and enables you to trade on live markets without taking any financial risk.

Demo accounts that have not been logged into for more than ninety days after the last time they were used will be removed from the system, but you are free to create a new demo account at any time. Traders from Namibia are cautioned, however, that they are only permitted a maximum of 5 active demo accounts each.

Islamic Account

Traders who adhere to Islam might benefit from the Islamic accounts provided by XM. We were relieved to find out that Islamic accounts at XM are not subject to any additional fees of any kind. This is unique since many other brokers charge Islamic accounts an administration fee in place of the swaps.

What types of trading accounts does the broker offer?

The broker offers a range of trading accounts to cater to different trading preferences. These include Micro, Standard, and XM Zero accounts. The Micro and Standard accounts have flexible trading conditions, while the XM Zero account offers ultra-low spreads and is suitable for those who prefer tight spreads for their trading strategies.

What features are available with the broker’s trading accounts?

The broker’s trading accounts come with a variety of features, including access to the MetaTrader 4 and MetaTrader 5 trading platforms, leverage of up to 1:1000, no hidden fees or commissions, and a range of trading instruments such as forex, stocks, and commodities.

How to open an Account

It will not take you more than a few minutes to set up a trading account with the broker. When Namibians begin the process of creating a new account, they can anticipate having their account authorized by the end of the next business day at the latest.

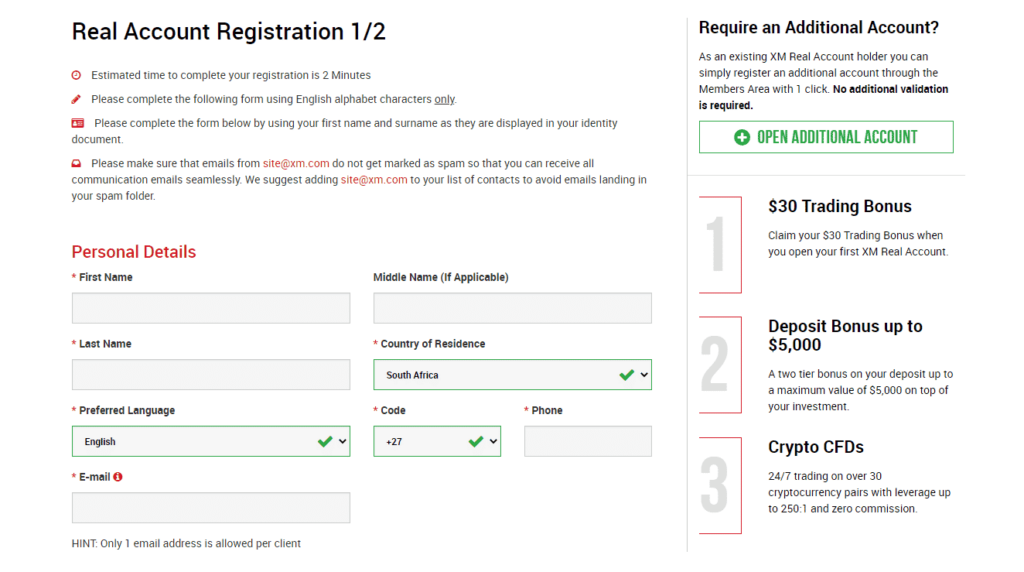

To register an account with XM, Namibian traders can follow these steps:

Step 1: Start the Application Process.

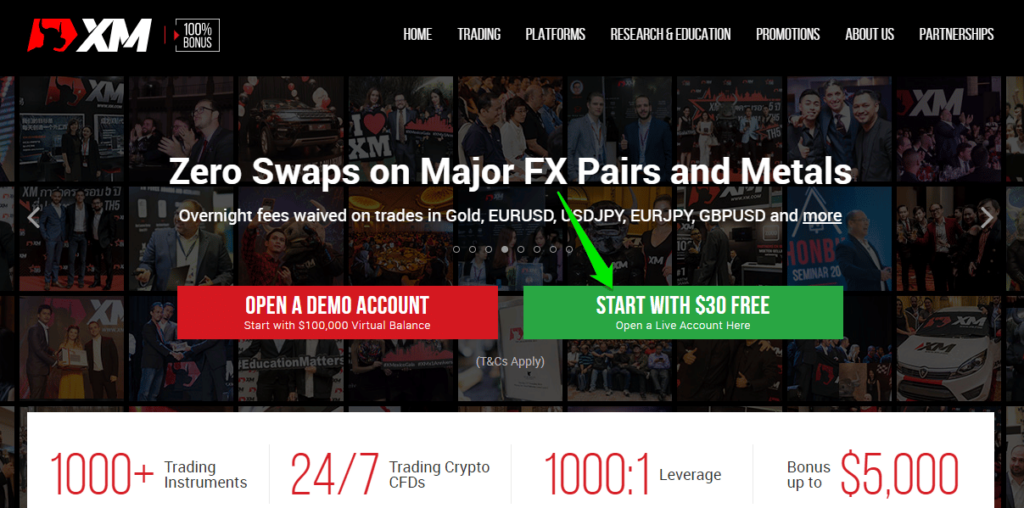

The account application process can be started by clicking on the Green “Open a live Account Here” button located on the brokers’ webpage.

Step 2: Personal and Trading Account Details

The applicant will be required to complete an application form by using their first name and surname as they are displayed in the applicant’s identity document.

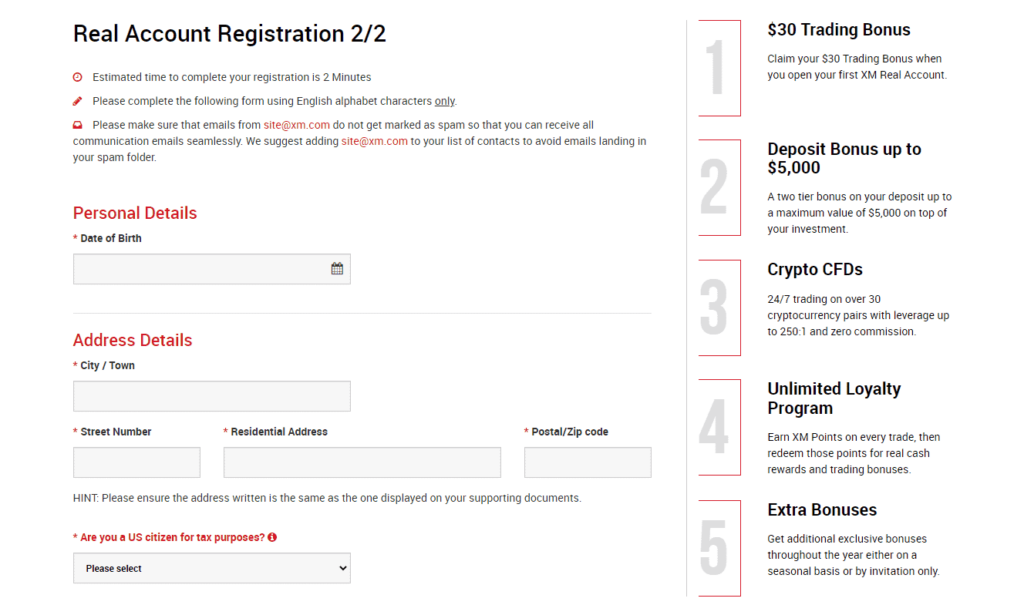

Step 3: Complete Registration.

In order to complete the registration, the applicant will be required to complete sections of information, including Personal details, Investor information, Trading Knowledge, and Experience.

XM VS IC Markets VS HFM – Broker Comparison

| XM | IC Markets | HFM | |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA | FSA | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • XM Mobile App | • MetaTrader 4 • MetaTrader 5 • cTrader | • MetaTrader 4 • MetaTrader 5 • HFM Platform |

| 💰 Withdrawal Fee | None | None | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | $5/96 NAD | $200/3,844 NAD | $0 |

| 📈 Leverage | Up to 1:1000** | 1:1000 | 1:2000 |

| 📊 Spread | 0.0 pips | 0.0 | 0.0 pips |

| 💰 Commissions | $1 to $9 | $3.0 to $3.5 | $3 to $4 |

| ✴️ Margin Call/Stop-Out | • 50%/20%, • 100%/50% (EU) | 50% | 50%/20% |

| ✴️ Order Execution | Instant, Market | Market, Instant | Market |

| 💳 No-Deposit Bonus | Yes | No | Yes |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | • Micro Account • Standard Account • XM Ultra-Low Account • Shares Account | • cTrader • Raw Spread • Standard | • Premium Account • Zero Account • Cent Account • Pro Account |

| 💳 NAD Deposits | No | No | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 3 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 💵 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 200 | 500 |

| 👉 Open an account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Trading Platforms

The broker offers Namibian traders a choice between these trading platforms:

Desktop Platforms

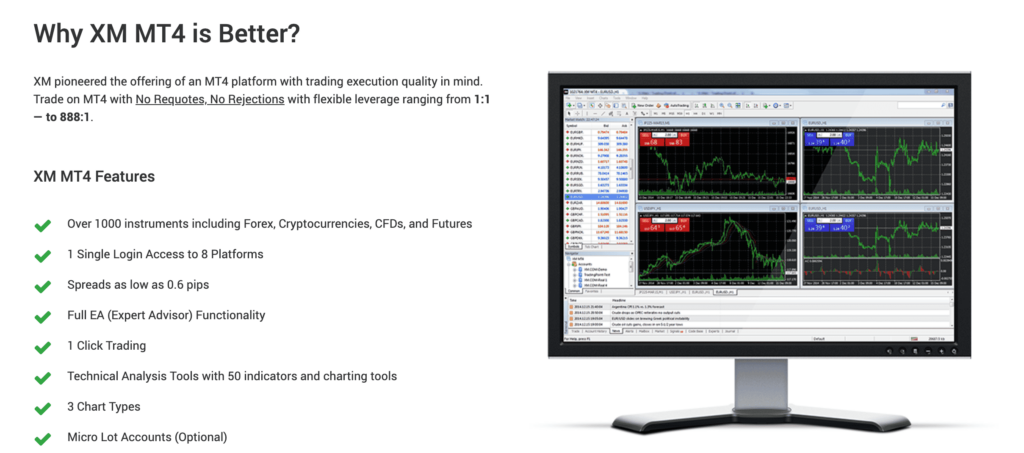

MetaTrader 4

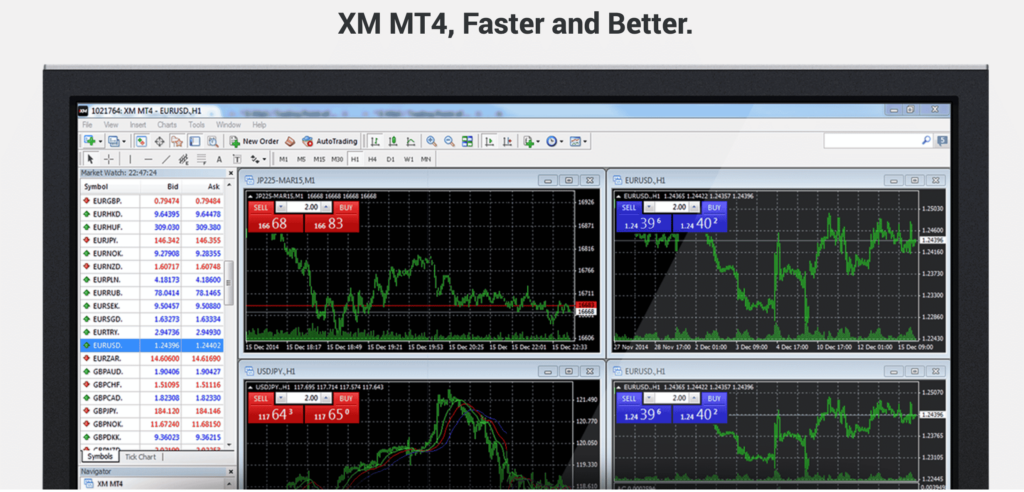

Traders in Namibia can manage many accounts from a single screen thanks to the MultiTerminal platform. Traders in Namibia may anticipate a similar trading experience while using the MT4 platform but with far greater power and capacity than before.

The most significant distinction between MT4 and MT5 is that the former does not provide trading on stock CFDs, while the latter provides more features and functions than the former. Nevertheless, if all you want to do is monitor market action while still easily making and managing trades, then MT4 should be sufficient for your needs.

MetaTrader 5

The MT5 platform was created to meet the demands of the broker’s consumers, regardless of their chosen trading style or asset class.

More features, better trading tools, stronger support, and ultimate control over the trader’s activities are all available on this sophisticated yet user-friendly platform. Namibian traders use MetaTrader 5, one of the most innovative and widely used trading platforms in the world.

WebTrader Platforms

MetaTrader 4

MT4 is still and has been for a long time the platform of choice for all distinct kinds of transactions all around the world.

It is well-known for having a user-friendly interface and a wealth of built-in trading tools, both of which enable efficient trading and extensive chart analysis to be carried out. Trading execution quality was one of the broker’s primary concerns when it first started supplying the MT4 platform.

Clients of the broker can trade on MT4 with variable leverage, no re-quotes, and no order rejections. It does not matter what kind of trader you are or how much expertise you have; MT4 is widely regarded as one of the most reliable platforms for online trading.

In addition, the broker provides access to a comprehensive library of video guides that may assist traders in becoming comfortable with the MT4 platform.

MetaTrader 5

The MT5 platform has all the excellent features seen in the MT4, plus more trading tools and sophisticated capabilities. It features an extra 1,000 CFDs on equities (shares), making it an excellent multi-asset platform.

With no rejections, no re-quotes, and variable leverage, you may trade FX and CFDs on stocks, gold, oil, and equities indexes from a single platform. If you want to trade FX, MT4 will suffice. If you want access to as many trading instruments as possible, MT5 is the way to go.

Even if you solely trade forex today, consider how much simpler it would be to diversify your portfolio in the future using XM’s offer alongside MT5.

Trading App

MetaTrader 4 and 5

The Android and iOS MT4 combine great charting with a broad variety of sophisticated trading tools and various other advanced features to make trading on the go simpler for traders.

Namibian traders may use the broker’s full-featured trading interface to access financial markets, do technical analysis, track market movements, and execute orders from anywhere around the globe.

For the convenience of XM’s Namibian clients, the MT4 Android, iPad, and iPhone Trader may be downloaded and used immediately.

The broker’s MetaTrader software was created expressly to make use of many of the sophisticated capabilities of a variety of mobile devices to provide all traders with a unique trading experience.

XM Mobile App

The broker features a proprietary mobile trading program that can be downloaded on any iOS or Android device, including tablets, iPads, and iPhones, as well as other smartphones.

Namibian traders may use this sophisticated proprietary tool to execute a variety of tasks, including:

Range of Markets

Namibian traders can expect the following range of markets from XM:

Which trading platforms does the broker offer to its clients?

The broker provides access to multiple trading platforms, including the popular MT4 and MT5. These platforms are known for their user-friendly interfaces, advanced charting tools, and automated trading capabilities.

Can I trade on the broker using mobile devices?

Yes, you can trade on the broker using mobile devices. The broker offers mobile trading apps for both MT4 and MT5.

Broker Comparison for Range of Markets

| XM | HotForex | Markets.com | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | Yes |

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Trading and Non-Trading Fees

Spreads

Regardless of account type or transaction size, the broker provides narrow spreads to all customers. We understand that tight spreads are only beneficial to our customers if they can trade with them. Variable spreads are used by the broker, much as in the interbank forex market.

Because fixed spreads are often greater than variable spreads, you will be required to pay an insurance premium if you trade fixed spreads.

Trading limits are often imposed by forex brokers that provide fixed spreads around the time of news releases, rendering your insurance useless.

During news releases, the broker has no limits on trading. To achieve the best rates from its different liquidity suppliers, the broker also provides fractional pip pricing. Instead of offering prices in four digits, customers may profit from even the tiniest price changes by adding a fifth number (fraction).

You can trade with narrower spreads and get the most accurate quotation with fractional pip pricing with the broker, which is a large benefit for many retail traders. Namibian traders can expect the following spreads from the broker per the account type they use:

Commissions

When Namibian traders register and use the Shares Account, they are charged commissions. The commissions on this account typically vary from $1 to $9, depending on the shares traded and the underlying exchange.

Overnight Fees, Rollovers, or Swaps

Namibian traders will need to examine a few factors when calculating overnight fees, including the financial instrument being traded, whether long or short positions are kept, the amount of money being exchanged, and so on.

The broker charges the following overnight fees:

Deposit and Withdrawal Fees

The broker does not charge any fees on the deposit or withdrawal methods available to Namibian traders. However, traders could face processing fees charged by their financial institutions.

Inactivity Fees

If the free balance in these accounts is less than $5, the broker charges a $5 monthly inactivity fee or the entire value of the free balance if the free balance is less than $5.

Trading accounts are considered inactive after 90 calendar days with no account activity. If the trading account’s free balance is zero, there is no fee.

Currency Conversion Fees

Because the broker only allows including USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, or ZAR as the default currencies for the Micro and Standard Account, with fewer options on the Shares and Ultra-Low Account, Namibian traders who deposit in NAD can expect currency conversion fees on deposits and withdrawals.

What are the trading fees on XM?

The broker offers competitive and transparent trading fees. The specific fees depend on the account type and the financial instruments you trade.

Does the broker charge any non-trading fees?

The broker aims to keep non-trading fees to a minimum. There are no deposit fees for most funding methods. However, XM may apply withdrawal fees depending on the method you use and your account activity.

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

How to Deposit Funds

To deposit funds to an account with XM, Namibian traders can follow these steps:

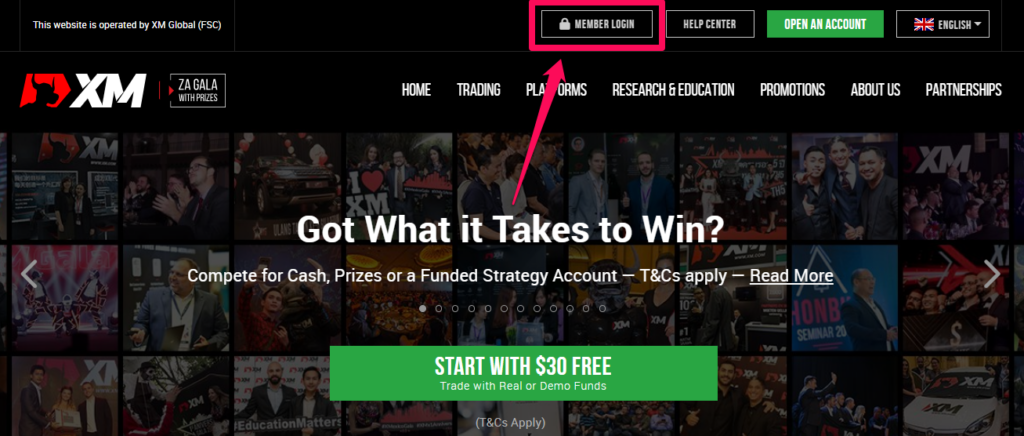

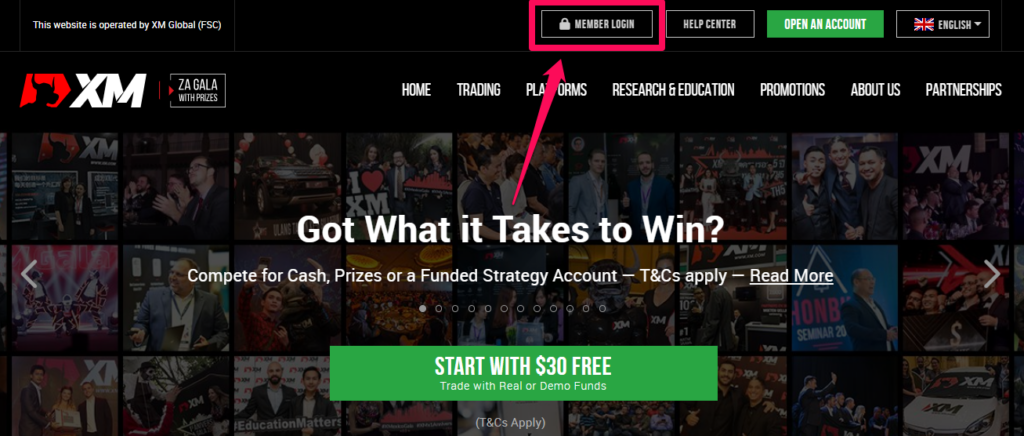

Sep 1 – Click on the login button.

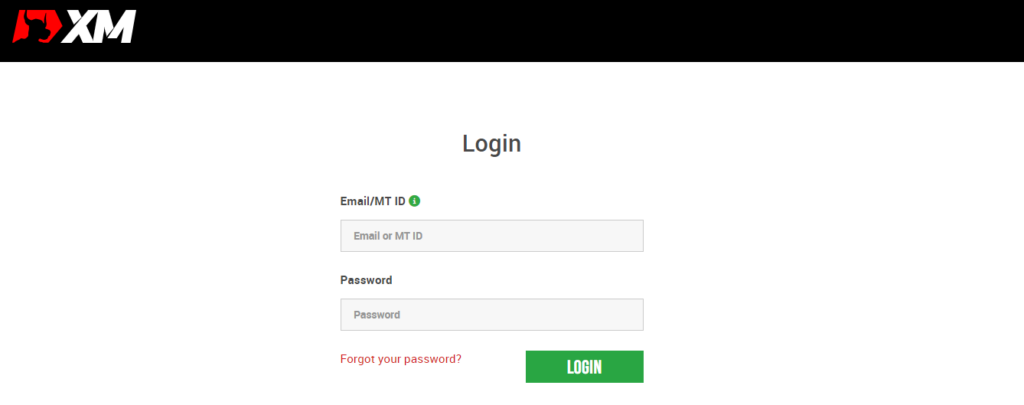

Step 2 – Log into your account.

Step 3 – Choose a deposit method.

Step 4 – Validate your identity.

Fund Withdrawal Process

To withdraw funds from an account with XM, Namibian traders can follow these steps:

Step 1 – Access your account.

Step 2 – Choose a withdrawal method.

Step 3 – Select a withdrawal amount.

How can I make a deposit into my trading account?

The broker offers a variety of convenient deposit methods, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. To make a deposit, log in to your XM account, go to the “Deposit” section, select your preferred payment method, and follow the instructions provided.

What is the withdrawal process on XM?

Withdrawing funds from your XM account is straightforward. Simply log in, go to the “Withdrawal” section, select your preferred withdrawal method, and follow the instructions. XM strives to process withdrawal requests promptly.

Education and Research

Education

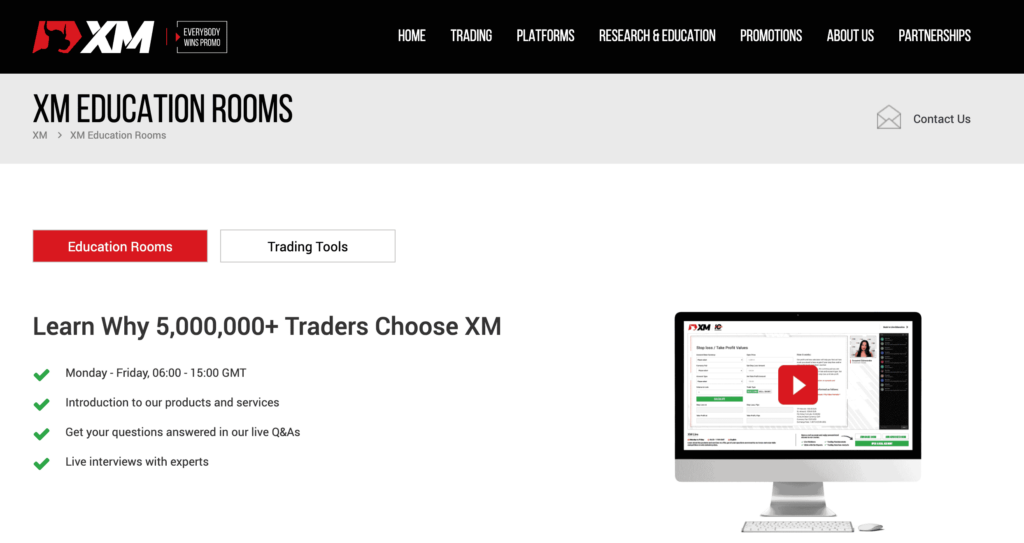

The broker offers the following Educational Materials:

The broker also offers Namibian traders the following additional Research and Trading Tools:

Does the broker provide educational resources for traders?

Yes, they offer a comprehensive range of educational materials to help traders of all levels improve their skills. These resources include webinars, video tutorials, trading articles, and daily market analysis.

What research tools are available for market analysis?

The broker provides a variety of research tools to help traders stay informed about market trends. This includes daily market analysis, technical analysis reports, economic calendars, and access to trading signals.

Bonuses and Promotions

The broker offers a wide range of incentives and promotions to lure new traders to join the platform, as well as to reward current customers and traders who stay active.

There is a $30 no-deposit bonus that is deposited into the trader’s account, as well as a 50% deposit bonus on top of a 20% deposit bonus of up to $4,500. Namibian traders have access to the following resources:

Does the broker offer a welcome bonus for new traders?

Yes, they frequently offer a welcome bonus to new clients. The specific terms and conditions of the bonus may vary, so it’s advisable to check XM’s official website or contact their customer support for the most up-to-date information on available bonuses for new traders.

Are there any ongoing promotions or loyalty programs for existing traders?

Yes, the broker often runs promotions and loyalty programs for its existing traders. These may include bonuses on subsequent deposits, loyalty points, and other special offers.

How to open an Affiliate Account

To register an Affiliate Account, Namibians can follow these steps:

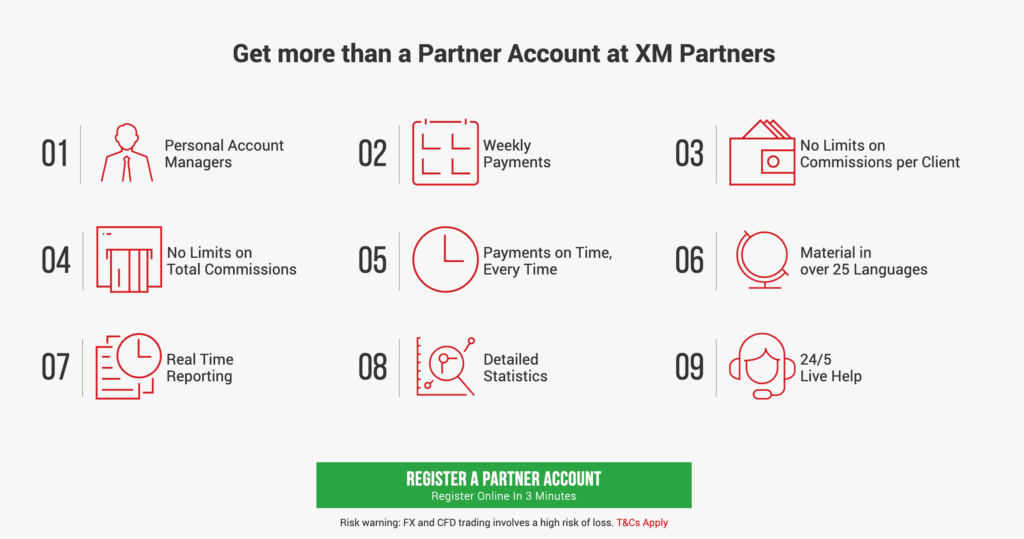

Affiliate Program Features

Some of the features that affiliates can expect from the broker include:

How does the Affiliate Program work?

The Affiliate Program allows individuals to earn commissions by referring new traders. When you become an XM affiliate, you will receive unique tracking links and marketing materials to promote XM’s services. You earn a commission based on the trading activity of the clients you refer.

What are the benefits of joining the Affiliate Program?

Joining the Affiliate Program can be financially rewarding. Affiliates can earn substantial commissions based on the trading volumes of their referred clients. Additionally, the broker provides affiliates with access to marketing tools, reporting dashboards, and support to help them maximize their earnings.

Customer Support

The broker offers award-winning support that is available in an array of languages over several communication channels. Support is prompt and helpful, and traders can contact them 24 hours a day, 5 days a week.

How can I contact the broker’s customer support?

You can contact the broker’s customer support through multiple channels. They offer support via email, live chat, and phone. Additionally, they have localized support in various languages to assist clients from different regions.

What are the operating hours of the broker’s customer support?

The broker’s customer support operates 24/5. This means they are available 24 hours a day from Monday to Friday to assist you with any inquiries or issues related to your trading account or platform.

Verdict

They are a reputable online brokerage firm known for providing a wide range of financial services to traders and investors worldwide. They offer access to various financial markets, including forex, commodities, and indices

Their platforms are well-regarded, with MetaTrader 4 and MetaTrader 5 being among the most popular choices for traders.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XM is multi-regulated by Tier-1, Tier-2, and Tier-3 regulators in Australia, Cyprus, South Africa, Dubai, and Belize | NAD is not a supported account default currency or deposit currency |

| Negative balance protection is applied to XM’s retail accounts and client fund security is guaranteed | Currency conversion and inactivity fees apply |

| XM offers a decent collection of account types, trading platforms, trading tools, and education | |

| Namibian traders are not restricted according to their trading strategies | |

| There is an enormous range of tradable instruments offered to Namibian traders | |

| XM offers some of the lowest trading fees in the industry | |

| Namibian beginner traders can register a free demo account | |

| Muslim traders can convert a live trading account into an Islamic account |

you might also like: CM Trading Review

you might also like: Trade Nation Review

you might also like: Octafx Review

you might also like: Oanda Review

you might also like: HF Markets Review

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Frequently Asked Questions

What is the withdrawal time with the broker?

The withdrawal time ranges from 1 working day up to 5 working days, depending on the withdrawal method that is used.

How much does the broker charge for withdrawal?

The broker does not charge any fees on withdrawals.

Is XM regulated?

Yes, they are well-regulated by CySEC, ASIC, FSCA, IFSC, and DFSA.

Does the broker have Nasdaq?

Yes, NASDAQ (US100) is available as a cash and futures CFD. The cash index CFDs from XM are untimed transactions that are adjusted for interest and dividends to reflect the underlying index’s cash price. Index futures CFDs expire on certain future dates and are paid in cash on that day.

Can I withdraw profits?

Yes, Profits earned on No Deposit Trading Bonus Accounts may be withdrawn at any time, if the trading volume in the relevant actual trading account reaches at least 10 micro-lots (0,1 standard lots) and at least 5 rounds of turn deals are completed.

Is XM safe or a scam?

They are a safe broker with a trust score of 90%, regulations through Tier-1, Tier-2, and Tier-3 market regulators, an award-winning history, and a good reputation in the industry.

Is XM good for Beginners?

Yes, they are a good option for beginners because there is a Micro Account, Demo Account, a range of educational materials and resources, and dedicated 24/5 multilingual customer support.

Does XM have Volatility 75?

No, even though they provide 14 equities indexes, the Volatility 75 Index is not part of this offer.

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Corporate Social Responsibility

The broker aspires to make a good influence in people’s lives all around the globe, regardless of their religion, culture, or ethical background, by assisting them in realizing their full potential. The broker supports the following initiatives:

The broker and MyCARE recently collaborated on a disaster relief program in Malaysia to aid individuals who were displaced because of the December 2021 floods that ravaged large parts of the country. MyCARE has been recognized by the United Nations Economic and Social Council as a non-profit organization that has worked tirelessly to assist the most vulnerable families.

The broker has donated to Plan Korea, a Korean children’s charity dedicated to improving children’s lives and ensuring that girls have equal rights and opportunities. Plan Korea also provides education and anti-discrimination initiatives.

The broker also helps youngsters in underdeveloped countries. The broker works with other humanitarian groups to enhance their quality of life and guarantee that they have enough money to meet their necessities.

The broker has partnered with the UN Refugee Agency as part of the UNHCR’s emergency response initiative for unaccompanied refugee children entering Greece (UNHCR). More than 5,000 unaccompanied refugee children have arrived in Greece, yet only 2,225 of them are housed and cared for properly.

The broker cooperated with Malaysia’s Bendera Putih (White Flag) campaign to support individuals in need during the COVID-19 pandemic in December 2021.

After delivering 300 food boxes to the Bendera Putih project in July of 2021, the broker teamed up with De. Wan restaurant to construct 250 take-out meal boxes on-site for folks who could not afford to purchase food daily.

Does the broker engage in any charitable activities as part of its Corporate Social Responsibility?

Yes, the broker is actively involved in charitable initiatives as part of its Corporate Social Responsibility efforts. They have supported various causes, including education, health, and disaster relief, through donations and partnerships with charitable organizations.

What steps has the broker taken to promote environmental sustainability as part of its CSR initiatives?

The broker is committed to environmental sustainability. They have implemented measures to reduce their carbon footprint, including energy-efficient practices and eco-friendly office operations.