7 Best Volatility 75 Brokers in Namibia

The 7 Best Volatility 75 Index Forex Brokers in Namibia. We tested the best VIX 75 index forex brokers for Namibia Traders.

This is a complete guide to brokers that offers traders in Namibia the chance to trade on the Volatility 75 Index.

In this in-depth guide you’ll learn:

- What is the Volatility 75 Index?

- What is the difference between the Volatility 75 Index vs NASDAQ 100 Index – Explained

- How to choose the best VOL 75 broker for your trading style?

- The Best Metatrader 4 (MT4) and Metatrader 5 (MT5) on the VIX 75 platforms revealed.

- Who is our #1 recommended 75 Index Volatility Broker in Namibia?

- Which Vix 75 broker offers a sign-up bonus for first-time traders?

- How to trade Volatility 75 Index

- Which Volatility 75 Index broker accepts M-PESA?

And lots more…

So if you’re ready to go “all-in” with VIX 75 Index Forex Brokers, this guide is for you.

Let’s dive right in…

- Louis Schoeman

Best Volatility 75 Brokers in Namibia – Comparison

| 🥇 Broker | 👉 Open Account | ✔️ High Leverage Broker? | 💵 Minimum Deposit |

| 1. HFM | 👉 Open Account | Yes | $0/0 NAD |

| 2. eToro | 👉 Open Account | Yes | $50/945 NAD |

| 3. XTB | 👉 Open Account | Yes | $0/0 NAD |

| 4. Pepperstone | 👉 Open Account | Yes | $0/0 NAD |

| 5. AvaTrade | 👉 Open Account | Yes | $100/1870 NAD |

| 6. IC Markets | 👉 Open Account | Yes | $200/3780 NAD |

| 7. FXCM | 👉 Open Account | Yes | $50/945 NAD |

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is the Volatility 75 Index, and How is it traded?

The Volatility 75 Index, commonly referred to as the VIX, is a metric utilized to gauge the expected volatility of the S&P 500 index, a stock market index comprising the 500 largest publicly traded companies in the United States.

The VIX is often referred to as the “Fear Index” or “Fear gauge” as it measures market risk and investor sentiment. The VIX is calculated by the Chicago Board Options Exchange (CBOE) and is a widely followed and quoted market indicator.

While the VIX itself is not a tradable index, the CBOE offers futures and options on the VIX, enabling traders to speculate on or hedge against changes in the level of volatility.

These VIX options and futures are cash-settled, meaning traders do not have to take delivery of an underlying asset. In addition, VIX options and futures have expiration dates, with the value of these contracts determined by the VIX index level at the expiration date.

While the VIX can be a valuable tool for traders and investors in gauging market sentiment and risk, it does have certain limitations. Specifically, the VIX is based solely on the S&P 500 index and does not consider other markets or sectors.

Additionally, the VIX is backward-looking, only reflecting the market’s perception of future volatility based on recent past performance.

Furthermore, the VIX is not a perfect indicator of market risk as it can be influenced by factors such as changes in interest rates, economic conditions, and geopolitical events and is also subject to manipulation.

7 Best Volatility 75 Brokers in Namibia Summary

- HFM – Overall, Best Volatility 75 Broker in Namibia

- eToro – Commission-Free Trading Offered

- XTB – Guarantees Client Fund Security

- Pepperstone – Offers Several Trading Platforms For Namibian Traders

- AvaTrade – Multitude of Trading Opportunities Offered

- IC Markets – Deposits And Withdrawals Are Free

- FXCM – Offers Free Demo Account to Beginner Namibian Traders

HFM

HFM is widely known and respected as a broker on a global level, allowing Namibian traders to access its services and solutions no matter where they are. In addition, with four account types, HFM provides more options than many other brokers.

Additionally, it features low spreads, the MT4 and MT5 trading platforms, and its own mobile HF App, which allows clients to trade from charts and make deposits/withdrawals easily.

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Furthermore, with a low minimum investment requirement, HFM ensures that all Namibian traders can easily access its services.

HFM offers Namibian traders a wide range of top-notch trading tools, including spot and futures contracts on a selection of global indexes, such as the Nikkei, NASDAQ, S&P500, and FTSE100, along with the VIX and DAX30, which is a more extensive selection than what other brokers offer.

HFM Overall Features

| Feature | Information |

| 📈 Account Base Currencies | USD, ZAR, NGN |

| 📊 Minimum Spread | 0.0 pips EUR/USD |

| 💳 Minimum deposit | $0/0 NAD |

| ⚖️ BoN Regulation | No |

| 📊 Account Types | Micro Account, Premium Account, Zero Spread Account, Auto Account, HFCopy Account |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC |

| 📈 Leverage | 1:1000 |

| 📊 Micro Account Offered? | Yes |

| 📈 Trading Tools | HF App, VPS Hosting Services, AutoChartist, Trading Calculators, myHF Client Area, Advanced Insights, Economic Calendar, Traders’ Board, One-Click trading, and more |

| 💻 Educational Material | Educational Videos, Forex Education, eCourses, Events, Podcasts, Live Webinars, Training Course Videos |

| 👥 Namibian-Based Customer Support | No |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Well-regulated in several global regions | There are no variable spread accounts |

| Offers some of the lowest spreads in the forex market on major currency pairs | There is a limited selection of funding options and withdrawal methods. |

| There are several account types to choose from | |

| HotForex accommodates all types of traders despite their trading strategies | |

| Low minimum deposit requirement | |

| Beginner traders and professional investors are both welcome | |

| Educational tools, advanced trading tools, and several other comprehensive solutions are offered | |

| There is a comprehensive market analysis offered | |

| Technical analysis and fundamental analysis offered |

eToro

eToro was founded in January 2007 by a group of entrepreneurs to decentralize the trading business so that anybody, regardless of location, could participate.

The site’s user experience is centered on copy trading and eToro’s social network. However, these techniques are more often utilized by novice traders who have not yet developed sophisticated market tactics.

The fact that eToro has consumers from over a hundred countries attests to the platform’s global popularity. The company’s flagship product is CopyTrader, a social investing platform.

Min Deposit

$ 50 / 945 NAD

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

* Etoro has lowered the amount of the minimum FTD to $ 50 for the following countries: Germany, Austria, Netherlands, Norway, UK, Ireland, Spain, Italy, Sweden, Switzerland.

Based on star ratings, currency preferences, and performance indicators, Namibians can find suitable providers to copy. With a minimum investment of merely $200 / 3,300 NAD, Namibians can easily replicate up to a hundred distinct investors at once.

This functionality is only available for usage in cryptography. Compared to other brokers in its class, eToro’s index selection is about average. The UK 100, SPX 500, NASDAQ 100, VIX, and other indexes are among them.

eToro Overall Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| ⚖️ BoN Regulation? | No |

| 📊 Trading Accounts | Retail, Professional |

| 📊 Trading Platform | eToro trading app and web-based platform |

| 💰 Minimum Deposit | $50/935 NAD |

| 💰 Trading Assets | Forex pairs, Commodities, Exchange-Traded Funds (ETFs), Indices, Stocks, Crypto trading, Stocks |

| 🔎 Namibian Naira-based Account? | No |

| 💳 NAD Deposits Allowed? | No |

| 💰 Bonuses for Namibian traders? | Yes |

| 📈 Minimum spread | 1 pip EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| eToro has a strict and solid regulatory framework | There are limitations on leverage for retail traders |

| Client fund safety is guaranteed and there is consumer protection offered | There is a limited selection of retail investor accounts |

| eToro offers commission-free trading | Fixed spreads are not offered |

| There are over 2,000 complex instruments that can be traded | The spreads are not the tightest |

| The broker offers several trading opportunities and a social trading feature | There is a high minimum deposit on the Islamic Account |

| There is an award-winning proprietary platform offered | There is an inactivity fee charged on dormant accounts |

| eToro offers 24/6 dedicated customer services | |

| eToro offers a demo account and an Islamic Account | |

| Algorithmic trading and margin trading supported | |

| Real time quotes are offered alongside a wide range of benefits | |

| The mobile app is secure and features robust security such as two-factor authentication | |

| The app can be used as a wallet app for digital currencies | |

| Offers several resources that help traders make improved financial decisions with confidence | |

| Offers several helpful tools and services as a solid basis for investment decision along with investment advice | |

| Provides access to several popular cryptocurrencies that can be traded and crypto staking services | |

| There is a comprehensive portfolio management service and popular investor program offered |

XTB

XTB Online Trading is a foreign currency brokerage firm operating for almost two decades and primarily serves the European Union.

XTB Online Trading is one of the most well-known and well-established forex brokers available. In addition to forex, it provides access to various markets, including equities, commodities, cryptocurrencies, indices, etc.

Regarding account security, the broker takes the topic carefully as well. For example, even though they do not provide two-factor authentication, they employ biometrics (fingerprint/voice verification) to protect your account.

In addition, the broker’s services are inexpensive, making them suitable for aggressive traders. Even though the business is quite competitive, this broker has remained one of those providing the finest value for all traders.

Furthermore, because of their competitively low trading costs and access to several marketplaces, they are one of the best options available to Namibian traders.

XTB Overall Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FCA, KNF, IFSC |

| 📊 Trading Accounts | Standard, Swap Free |

| 📊 Trading Platform | xStation 5, xStation Mobile |

| 💰 Minimum Deposit | $0/0 NAD |

| 💰 Trading Assets | Forex, Shares, Commodities, Indices, Cryptos and EFTs |

| 📈 Minimum spread | 1 pip EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| XTB offers competitive trading conditions to Namibians | cTrader and MetaTrader are not offered |

| Account protection is offered, and there are several innovative security features included in the proprietary trading platform | Deposit and withdrawal fees apply |

| XTB is well-regulated | |

| Deposits and withdrawals are processed quickly by the XTB team | |

| Xstation5 is a powerful and full-featured platform that is user-friendly and sophisticated |

Pepperstone

Pepperstone provides straightforward market access to several financial asset classes, making it easy for beginners to start their journey and for experienced Namibian traders to refine their trading.

Pepperstone is perfectly suited for traders who need a suitable selection of low-cost services, a diverse user interface and account type options, and effective customer service.

In addition, the platforms are white-label, third-party products since Pepperstone has avoided developing a proprietary interface.

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

All instruments are accessible across all account types, although cryptocurrency costs are not well-documented, which is surprising given this category’s high volatility and large spreads.

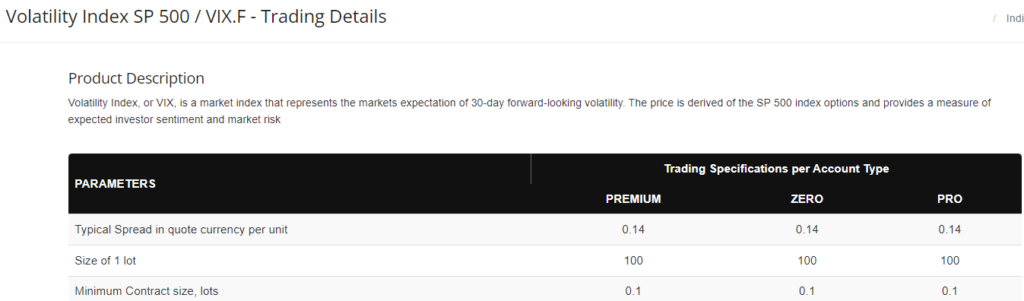

Pepperstone offers VIX 75 as a CFD on indices, letting Namibians benefit from this highly volatile asset without worrying about owning the underlying asset. Furthermore, Pepperstone charges a spread from 0.16 pips and commissions from AU$7 per standard lot traded on VIX 75.

Pepperstone Overall Features

| Feature | Information |

| ⚖️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 💰 Minimum Deposit (NAD) | $0/0 NAD |

| 💵 Deposit and Withdrawal Options | • Visa • Mastercard • Bank transfer • MPESA • Paypal |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Namibian traders are given access to powerful and user-friendly trading platforms | There is no NAD-denominated account for Namibian traders |

| Pepperstone offers competitive trading conditions and trading accounts that suit all types of traders | There are restrictions on the countries that can access the Pepperstone Islamic Account |

| Namibians can expect award-winning customer support in several languages | Additional admin fees apply to the Islamic account |

| There are several flexible account funding and withdrawal options offered | There are leverage restrictions applied to certain regions |

| Pepperstone is well-regulated and guarantees client fund security | Negative balance protection is limited to certain regions |

| There is a decent selection of trading tools for advanced Namibian traders | |

| Social trading opportunities are offered | |

| There are no fees charged on deposits |

AvaTrade

AvaTrade is the leading forex broker in Namibia for novice traders. The broker provides various instructional resources, including forex articles, guidelines, tutorials, educational films, and more.

Through MT5, AvaTrade provides access to 1,260 symbols, and WebTrader provides access to about the same number of symbols, even though a few hundred symbols are sometimes unavailable.

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

The VIX 75 is one of AvaTrade’s 33 Index CFDs, offering Namibian traders access to global markets. In addition, most traders will be pleased with the mobile experience provided by AvaTrade’s proprietary applications (beginners included).

AvaTrade is advancing in this field and provides a wide variety of practical solutions suitable to different traders and trading strategies.

AvaTrade Overall Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| ✔️ BoN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 💻 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (NAD) | 100 NAD / 1,862 NAD |

| 💵 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Namibian-based Account? | No |

| 💳 NAD Deposits Allowed? | No |

| 💰 Bonuses for Namibian traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✅ Social Trading Offered | Yes |

| 👉 Open Account | Open Account |

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

IC Markets

IC Markets is one of the world’s leading forex CFD providers by daily trading volume, with more than $15 billion in foreign currency transactions and over 500,000 orders handled daily.

In addition, IC Markets provides its clients with narrow variable spreads starting at 0.0 pips on key currency pairings.

The broker is well-known for its ultra-fast order execution, with transactions often completed in less than 40 milliseconds, making it an ideal habitat for high-frequency trading, algorithmic methods, and institutional investors.

Min Deposit

200 USD / 3,800 NAD

Regulators

FSA, CySEC, ASIC

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader, IC Social, Signal Start, ZuluTrade

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The NASDAQ, S&P 500, FTSE 100, VIX 75, and Nikkei are among the 25 worldwide indices on which IC Markets provides cash and futures contracts. This index selection is comparable to other brokers, offering Namibians a flexible choice between indices to ensure portfolio diversification.

IC Markets is popular among traders because of its leverage, low spreads, and inexpensive fees. However, IC Markets should be considered by everyone, from seasoned traders to beginners and even Namibians who use automated trading strategies.

IC Markets Overall Features

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| 📈 Retail Investor Accounts | 3 |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, cTrader |

| 💰 Minimum Deposit (NAD) | $200/3780 NAD |

| 💳 Deposit and Withdrawal Options | Credit Card Debit Card PayPal Neteller Neteller VIP Skrill UnionPay Bank Wire Transfer Bpay FasaPay Broker to Broker POLi Thai Internet Banking Vietnamese Internet Banking Rapidpay Klarna |

| 💰 Tradable Assets | Forex Commodities Indices Bonds Cryptocurrencies Stocks Futures |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 📈 Maximum Leverage | 1:500 |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| IC Markets is a well-regulated and high trust broker that offers competitive trading conditions | There could be a currency conversion fee when traders deposit in NAD |

| Namibian traders can choose from three powerful trading platforms | Namibian traders cannot use NAD as a base account currency |

| There is an impressive selection of tradable instruments | There are no proprietary trading platforms offered |

| The deposits and withdrawals with IC Markets are free | |

| There is no inactivity fee charged on dormant accounts | |

| IC Markets uses a true ECN model that provides Namibian traders with the best trading environment | |

| There is a large selection of useful tools for experienced traders | |

| There is support for social and copy trading offered |

FXCM

FXCM (Forex Capital Markets) is a forex broker in London, UK, formed in 1999 in New York. FXCM provides customers with various trading platforms, including ZuluTrade for social/copy trading and NinjaTrader for automated trading.

Namibian traders who use FXCM get access to a basic set of tools and a wide range of technical analysis tools. In addition, the charting tools are excellent and customizable, with over 50 indicators that can be applied, giving Namibians a detailed overview of instruments and the market.

Min Deposit

$50/945 NAD

Regulators

FCA

Trading Desk

MetaTrader 4, Trading Station

Crypto

Yes

Total Pairs

7

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FXCM offers fewer financial instruments than other brokerages, with just 15 indices and CFDs on indices available for trading. Most investors prefer indexes that follow the performance of a basket of stocks from some of the world’s largest and best-known firms.

FXCM Overall Features

| Feature | Information |

| ⚖️ Regulation | FCA |

| 💻 Trading Platform | Trading Station, MT4, Capitalise AI, Tradingview pro |

| 💰 Minimum Deposit (NAD) | $50/945 NAD |

| 💳 Deposit and Withdrawal Options | Debit / Credit, Bank Wire, Google Pay, Skrill, Neteller, China Online Payment, Crypto |

| 💰 Tradable Assets | Forex, Shares, Indices, Commodities, Cryptocurrencies, Bitcoin |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 📈 Maximum Leverage | 1000:1 |

| 👉 Open Account | 👉 Open Account |

| ✔️ Pros | ❌ Cons |

| Namibians can trade VIX and other instruments using 1:20 leverage | There is only one trading account |

| The average fee that Namibians can expect with FXCM on VIX is 21 USD | FXCM does not support MetaTrader 5 |

| There is a free demo account offered that can be used to practice VIX trading strategies | |

| Traders can expect competitively low commission charges from $0.01 | |

| FXCM is ideal for beginners and experienced traders |

How to choose a Forex Broker in Namibia

Namibian traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Namibians must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Namibians must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Namibians must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Namibians must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Namibian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Namibia

In this article, we have listed the best Forex brokers that offer Forex Brokers to traders in Namibia. We have further identified the forex brokers that offer additional services and solutions to Namibian traders.

Best Forex Brokers MetaTrader 4 / MT4 Forex Broker in Namibia

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overall, Trade Nation is the best MT4 forex broker in Namibia. Trade Nation also has an effective trading app. Trade Nation further has competitive costs, a secure trading environment and cutting-edge solutions.

Best Forex Brokers MetaTrader 5 / MT5 Forex Broker in Namibia

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best MT5 forex broker in Namibia. Exness offers dynamic and adaptable account types as well as some of the industry’s most advantageous trading conditions. Exness offers over 200 financial products, several retail account types, and a wealth of resources.

Best Forex Brokers Forex Broker for beginners in Namibia

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Overall, BDSwiss is the best forex broker for beginners in Namibia. BDSwiss is also a well-regulated broker that has a large international clientele. It offers a diverse range of trading instruments, including forex, commodities, stocks, indices, and many cryptocurrencies.

Best Forex Brokers Minimum Deposit Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overall, Oanda is the best minimum deposit forex broker in Namibia. Oanda also provides competitive trading conditions, a proprietary platform that has won awards, and high-quality trading solutions. Professionals and novices alike can use OANDA’s platform to access a wide range of indicators and charting tools.

Best Forex Brokers ECN Forex Broker in Namibia

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, Pepperstone is the best ECN forex broker in Namibia. Pepperstone is capable of handling multiple order fills, allowing it to feed bigger orders into a liquidity aggregator on numerous levels. Orders placed by clients are filled on a “market execution” basis without requotes, with the possibility of positive or negative slippage, and without broker interference.

Best Forex Brokers Islamic / Swap-Free Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HF Markets is the best Islamic/swap-free forex broker in Namibia. HF Markets, formerly HotForex, is a low-risk CFD and forex broker that provides competitive trading conditions, retail investor accounts, client fund security, and customer support. HF Markets’ retail investor accounts are appropriate for both novice and expert traders.

Best Forex Brokers Forex Trading App in Namibia

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best forex trading app broker in Namibia. FP Markets provides over 10,000 products in stocks, indices, forex, commodities, and cryptocurrencies, as well as an easy-to-use mobile app and a variety of account types. FP Markets provides a variety of value-added services, including VPS hosting for automated trading solutions, copy trading through the MT4 Myfxbook service, and retail account management using the MT4 MAM/PAMM module.

Best Forex Brokers Lowest Spread Forex Broker in Namibia

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

Overall, FBS is the best lowest spread forex broker in Namibia. FBS is also a top forex and CFD broker for Namibians, offering a variety of trading accounts as well as a cutting-edge proprietary trading app. FBS charges low, competitive fees, and traders can rest assured that their clients’ funds are safe.

Best Forex Brokers Nasdaq 100 Forex Broker in Namibia

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overall, OctaFX is the best Nasdaq 100 forex broker in Namibia. OctaFX is also a trustworthy broker due to its low required minimum deposit, commission-free trading, and unlimited practice account. OctaFX’s mission is to keep trading costs as low as possible through the utilisation of STP (Straight Through Processing) and ECN models.

Best Forex Brokers Volatility 75 / VIX 75 Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best Volatility 75 / VIX 75 forex broker in Namibia. AvaTrade is a CFD and FX broker that is globally regulated by financial watchdog authorities. It provides an optimal trading environment for traders of all levels, with 24-hour multilingual support desks.

Best Forex Brokers NDD Forex Broker in Namibia

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best NDD forex broker in Namibia. XM was founded in 2009 and has been in operation for more than 12 years. It operates in over 196 countries, has a service team that speaks 30 languages, and is one of the most trusted and well-regulated brokers. XM also provides strong security, superior customer service, account financing, and low fees.

Best Forex Brokers STP Forex Broker in Namibia

Min Deposit

$10 / 195 NAD

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Axiory is the best STP forex broker in Namibia. Axiory trades are executed in less than 200 milliseconds, and Namibian traders are given the best trading software that is linked to Equinix data centres. Axiory’s cTrader, MetaTrader, and the FIX API can be used to trade forex and CFDs.

Best Forex Brokers sign up bonus Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best sign-up bonus broker in Namibia. Tickmill’s VIP and Pro accounts also offer very appealing commission-based pricing. Tickmill provides a wide range of CFD currency, stock, commodity, and index CFDs in addition to low spreads, massive leverage, and fast execution speeds.

Conclusion

HFM offers a zero minimum deposit and high leverage. Similarly, XTB and Pepperstone provide high-leverage trading with no minimum deposit required. eToro offers a reasonable $50 minimum deposit with advantageous leverage.

AvaTrade requires a minimum deposit of $100 with high-leverage opportunities. For those willing to invest, IC Markets requires a $200 minimum deposit and offers substantial leverage. FXCM also provides high-leverage trading with a minimum deposit of $50.

you might also like: Best Forex Trading Apps

you might also like: Best Cent Account Forex Brokers

you might also like: Best Forex Brokers with Minimum $1 Deposit

you might also like: Best Forex No-Deposit Brokers

you might also like: HF Markets Review

Frequently Asked Questions

Which are the best synthetic indices brokers in Namibia?

The best synthetic brokers in Namibia are IFC Markets, Deriv, and Darwinex. These are currently the only synthetic indices brokers.

How can I read a Volatility 75 index chart?

Namibians must remember that 30 is a standard suggestive value. Therefore, when the VIXX reading is more than 30, it indicates that the market is volatile and fearful. In contrast, when the figure is less than 30, it indicates contentment or less stressful moments in the market.

What is the best Volatility 75 index strategy?

There is no holy grail in trading Volatility 75. However, when trading VIX, Namibians can concentrate on strategies considering Support and Resistance, Trendlines, and Market Structure.

Does XM have Volatility 75 Index instruments?

XM does not currently offer VIX 75 as a CFD on Indices. However, the brokers that we have listed above offer Volatility 75 trading.

Which broker has the Boom and Crash Index?

Deriv is currently the only broker that offers the Boom and Crash index. Furthermore, this index includes Boom 300, Boom 500, Boom 1000, Crash 300, Crash 500, and Crash 1000.

Is the VIX 75 1-minute Strategy ideal for beginners?

No, the VIX 75 1-minute strategy might be too risky, volatile, and fast-paced for beginners. Therefore, beginner traders can consider momentum and swing trading on less volatile instruments until they have gained enough trading experience and skill to trade VIX 75.

What is the best scalping strategy for VIX 75?

According to experts, the best scalping strategy for VIX 75 involves using a larger lot size and putting the stop-loss immediately above or below the moving average.

When the price reverses, move the stop-loss to the entry point to eliminate the risk. Namibian traders can then close the position with a profit if the risk-reward ratio is favourable, or if an opposite rejection is anticipated.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia