7 Best Forex Brokers in Namibia

The 7 Best Forex Brokers in Namibia revealed. We tested and verified the best forex brokers for Namibian Traders.

This is a complete list of the best forex brokers in Namibia.

In this in-depth guide you’ll learn:

- What is a forex broker?

- How to start trading forex in Namibia?

- Which brokers are best for beginner traders?

- Which brokers offer trading on mobile apps, compatible with IOS and Android?

- The best broker for MT4 and MT5 in Namibia.

- How to choose a forex broker – Compare them side by side against each other.

- Top 7 Best Forex Brokers in Namibia.

- Which brokers offer a signup bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best forex brokers for Namibians…

Let’s dive right in…

- Kayla Duvenage

7 Best Forex Brokers in Namibia – Comparison

| 🥇 Broker | 🎉 Open an Account | ✔️ Accepts Namibian Traders? | 💰 Minimum Deposit in Namibian Dollars? | ✅ Offers Namibian Account? |

| 1. Exness | Open Account | Yes | 10 USD / 186 NAD | Yes |

| 2. AvaTrade | Open Account | Yes | 100 USD / 1,862 NAD | Yes |

| 3. HFM | Open Account | Yes | 100 USD / 1,862 NAD | Yes |

| 4. FBS | Open Account | Yes | 5 USD / 93 NAD | Yes |

| 5. Pepperstone | Open Account | Yes | 0 USD / 0 NAD | Yes |

| 6. OANDA | Open Account | Yes | 0 USD / 0 NAD | Yes |

| 7. FP Markets | Open Account | Yes | 100 USD / 1,862 NAD | Yes |

What are Forex Brokers?

Forex Brokers are financial services companies that provide traders with access to a trading platform where they can buy and sell foreign currencies and stock. Foreign exchange is abbreviated as forex. Transactions in the forex market are always made between two different currencies.

7 Best Forex Brokers in Namibia (2024)

Exness – Overall, Best Micro Account Forex Brokers in Namibia

AvaTrade – Most Trusted Online Broker in the World

HFM – Great For Dedicated Forex Day Traders

- FBS – 24/7 Support for Namibian Traders

- Pepperstone – Low FX commission and tight spreads

- OANDA – Regulated by Several Tier-1 Regulators

- FP Markets – Massive Range of Markets Across Several Asset Clauses

1. Exness

Overall, Exness is considered low-risk and properly licenced and regulated. Exness is headquartered in Cyprus and regulated by FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA.

Exness offers five different retail trading accounts namely a Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, and Pro Account.

Exness accepts Namibian clients and has an average spread from 0.0 pips with commissions from $0.1 per lot, per side. Exness has an unlimited maximum leverage ratio and there is a demo and Islamic account available. MT4, MT5, and Exness platforms are supported.

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Exness has won numerous awards as a retail broker because it provides stable and reliable brokerage services, as well as a comfortable trading environment tailored to the needs of the most demanding traders.

The trading process is handled using the user-friendly MT4 platform, which offers the ability to trade a variety of CFDs and Futures contracts on a variety of marketplaces.

Exness Overview

| 🔎 Broker | Exness |

| 📝 Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 💻 Trading Desk | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 🎉 No Deposit Bonus | None |

| ➖ Min. Deposit from | USD 10 / 195 NAD |

| 🔁 Spreads from | From 0.0 pips |

| ➕ Max Leverage | Unlimited |

| 💳 Commission | Raw Spread – Up to $3.5 per side, per lot Zero – From $0.1 per side, per lot |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is well-regulated by several reputable market regulators across the globe | United States clients are excluded from Exness’ global reach |

| There are tight, variable spreads offered across five retail investor accounts | There is a limited selection of tradable instruments offered |

| There is a choice between dynamic retail investor accounts, each featuring competitive trading conditions | There is a limited selection of funding options offered |

| The broker offers solutions to both novice traders and professionals | |

| There are advanced trading tools offered | |

| Provides a powerful proprietary platform on the web and mobile devices | |

| Client fund safety and investor protection guaranteed | |

| Instant withdrawals and deposits supported | |

| Exness offers multilingual customer service that is available 24/7 |

2. AvaTrade

AvaTrade is a forex and CFD broker that was established in 2006 and has grown to become one of the top trading firms in the world. AvaTrade now has 300,000 registered traders that execute over 3 million deals each month and have transacted over $1.47 trillion in value since its launch.

AvaTrade is headquartered in Dublin, Ireland and is regulated by the Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC.

Overall, AvaTrade is considered low-risk, with proper licencing and regulation. AvaTrade offers a single live trading account with the option between Retail and Professional.

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

AvaTrade Accepts Namibian Clients and has an average spread from 0.9 pips EUR/USD with no commission charges. AvaTrade has a maximum leverage ratio up to 1:30 on Retail Accounts and 1:400 on Pro Accounts, and there a demo and Islamic account are available.

AvaTradeGO, MetaTrader 4, MetaTrader 5, and several other platforms are supported.

AvaTrade is also a member of the Investor Compensation Company DAC, which reimburses qualifying customers up to EUR 20,000 in the unusual event of their broker’s bankruptcy.

AvaTrade Overview

| 🔎 Broker | AvaTrade |

| 📝 Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 💻 Trading Desk | AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade |

| 🎉 No Deposit Bonus | None |

| ➖ Min. Deposit from | 100 USD / 1,862 NAD |

| 🔁 Spreads from | 0.9 pips EUR/USD |

| ➕ Max Leverage | 1:30 (Retail) 1:400 (Pro) |

| 💳 Commission | None |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker provides a range of leverage levels to accommodate diverse risk appetites and trading strategies | Depending on the jurisdiction, leverage restrictions may hinder certain trading strategies |

| Their $100 minimum deposit makes trading accessible to a wide range of investors | Islamic accounts do not permit cryptocurrency trading, limiting the options available to those who adhere to Shariah law |

| The broker is suitable for Muslim traders due to the availability of Shariah-compliant Islamic accounts | Bonuses and promotions are not as extensive as some competitors, which may disadvantage some traders |

| Support for MetaTrader 4 and 5, in addition to web-based trading options, offers traders flexibility | Some withdrawal methods may incur fees, which increases the cost of trading |

| The broker is regulated in multiple jurisdictions, which lends credibility and safety to its services | |

| Traders have access to a vast array of financial instruments, including Forex, cryptocurrencies, and shares, among others |

3. HFM

Overall, HF Markets is considered low-risk, with proper regulation. HF Markets is headquartered in Cyprus and regulated by FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA.

In operation since 2010, HF Markets, previously known as HotForex, is a leading worldwide online broker.

HF Markets offers five different retail trading accounts namely a Micro Account, a Premium Account, an HFCopy Account, a Zero Spread Account, and an Auto Account. MT4, MT5 and HF App platforms are supported.

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

HF Markets accepts Namibian clients and has an average spread from 0.0 pips with a $6 to $8 commission round turn. HF Markets has a maximum leverage ratio up to 1:1000 and there is a demo and Islamic account available.

Customers may trade in a broad variety of assets, including Forex, commodities, cryptocurrencies, shares and indices, precious metals, renewable energies, and bonds with them. They also provide institutional clients with a comprehensive range of trading services as well.

There are approximately 1.5 million active account holders at HF Markets, and overall, HF Markets employs more than 200 people throughout the world, they offer 24-hour assistance in over 27 languages to customers, with customer service and satisfaction an integral part of HF Markets’ overall mission.

HFM Overview

| 🔎 Broker | HFM |

| 📝 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 💻 Trading Desk | MetaTrader 5, MetaTrader 4, HFM App |

| 🎉 No Deposit Bonus | Yes |

| ➖ Min. Deposit from | 100 USD / 1,862 NAD |

| 🔁 Spreads from | 0.0 pips |

| ➕ Max Leverage | 1:2000 |

| 💳 Commission | $6 to $8 commission round turn |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Well-regulated CFD and Forex broker that has a decent trust score | United States clients and some other regions are not accepted by HotForex |

| The spreads offered are low and competitive | There may be restricted leverage for EU clients because of regulatory requirements |

| There are several account types to choose from with reasonable trading fees charged | There are no variable spread accounts offered |

| HotForex welcomes all types of traders and trading strategies | Limited funding options offered for deposits and withdrawals |

| There is a low minimum deposit requirement and secure methods for deposits and withdrawals | |

| Suited to beginner traders and experienced traders | |

| Offers comprehensive expert trading and market analysis | |

| Offers a decent selection of educational tools and a range of trading tools |

4. FBS

Overall, FBS is considered an average risk, although licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). FBS is headquartered in Belize and is regulated by IFSC, CySEC, ASIC, and FSCA.

As an online forex and CFD broker that has been around for a long time, FBS is a popular choice for many traders. FBS Inc. was founded in 2009 and has since expanded in size, strength, and financial resources.

FBS offers six different retail trading accounts namely an FBS Cent Account, FBS Micro Account, FBS Standard Account, FBS Zero Account, FBS ECN Account, and FBS Crypto Account.

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

FBS has millions of customers in over 150 countries throughout the globe. In addition, FBS offers Namibian traders the opportunity to purchase and sell over 75 different trading products spread across financial asset classes.

FBS accepts Namibian clients and has an average spread from 0.0 pips with $6 commissions round turn. FBS has a maximum leverage ratio up to 1:3000 and there is a demo and Islamic account available. MT4, MT5, FBS Trader, and CopyTrade platforms are supported.

FBS Overview

| 🔎 Broker | FBS |

| 📝 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 💻 Trading Desk | FBS Trader, MetaTrader 4, MetaTrader 5, CopyTrade |

| 🎉 No Deposit Bonus | Yes |

| ➖ Min. Deposit from | 5 USD / 93 NAD |

| 🔁 Spreads from | 0.0 pips |

| ➕ Max Leverage | 1:3000 |

| 💳 Commission | $6 commissions round turn |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is an ultra-low minimum deposit when Namibians register a trading account | FBS does not have Tier-1 regulations |

| There is a range of tradable financial instruments which are spread across asset classes | There are inactivity fees that apply to dormant accounts |

| Namibian traders have a choice between versatile and powerful trading platforms | There could be currency conversion fees applied to NAD deposits |

| There is a selection of instant deposit methods offered | There is no dedicated NAD-denominated account |

| Namibian traders can expect competitive trading conditions and comprehensive copy trading solutions | There are both deposit and withdrawal fees charged on payment methods |

| There are demo accounts offered and once an account expires, traders can register a new demo account | |

| There are swap-free options provided to Muslim traders | |

| There is a helpful and prompt customer support team available |

5. Pepperstone

Overall, Pepperstone is considered low-risk, and properly authorised. Pepperstone is headquartered in Australia and regulated by ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB.

Pepperstone is one of the largest trading brokers in the world. They provide traders all over the world with access to trade across all markets via powerful, yet user-friendly platforms equipped with innovative technology, low costs, low latency high-speed execution, and award-winning customer service.

Pepperstone offers two different retail trading accounts namely a Standard Account and a Razor Account. MT4, MT5, cTrader, TradingView, Myfxbook, and DupliTrade platforms are supported.

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Pepperstone accepts Namibian clients and has an average spread from 0.0 pips with AU$7 commission round turn. Pepperstone has a maximum leverage ratio up to 1:200 (Retail) and 1:500 (Pro), and there is a demo and Islamic account available.

Pepperstone boasts some of the lowest expenses in the industry with its exceptionally low spreads, and its Razor Account is ideal for traders who are more comfortable with traditional ECN trading thanks to its cheap fees and spreads that average only 0.00 pips on the EUR/USD.

Pepperstone, which was established in Australia in 2010 and is famous all over the world for its cheap trading fees and selection of trading platforms, is consistently ranked as one of the best brokers available to traders in Namibia.

Pepperstone Overview

| 🔎 Broker | Pepperstone |

| 📝 Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB |

| 💻 Trading Desk | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| 🎉 No Deposit Bonus | None |

| ➖ Min. Deposit from | 0 USD / 0 NAD |

| 🔁 Spreads from | From 0.0 pips |

| ➕ Max Leverage | 1:3000 |

| 💳 Commission | AU$7 commission round turn |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Namibian traders are given access to powerful and user-friendly trading platforms | There is no NAD-denominated account for Namibian traders |

| Pepperstone offers competitive trading conditions and trading accounts that suit all types of traders | There are restrictions on the countries that can access the Pepperstone Islamic Account |

| Namibians can expect award-winning customer support in several languages | Additional admin fees apply to the Islamic account |

| There are several flexible account funding and withdrawal options offered | There are leverage restrictions applied to certain regions |

| Pepperstone is well-regulated and guarantees client fund security | Negative balance protection is limited to certain regions |

| There is a decent selection of trading tools for advanced Namibian traders | |

| Social trading opportunities are offered | |

| There are no fees charged on deposits |

6. Oanda

Overall, OANDA is considered low-risk, with proper regulation. OANDA was founded in 1996, headquartered in the United States, and regulated by IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, and BVI FSC.

OANDA, MT4, MT5, and TradingView platforms are supported. OANDA offers three different retail trading accounts namely a Standard Account, Core Account, and a Swap-Free Account.

OANDA accepts Namibian clients and has an average spread from 0.0 pips with a $40 commission according to trading volume. OANDA has a maximum leverage ratio of up to 1:200, and a demo and Islamic account are available.

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

In the United States, OANDA is one of the top performers in the CFTC’s Retail Forex Obligation report.

In addition, OANDA ranks among the best online forex brokers due to its well-organized website, stated purpose of openness, emphasis on customer education and research, different user interfaces, and worldwide regulatory monitoring.

OANDA Overview

| 🔎 Broker | OANDA |

| 📝 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 💻 Trading Desk | MetaTrader 4, OANDA Platform, TradingView |

| 🎉 No Deposit Bonus | Welcome Bonus |

| ➖ Min. Deposit from | 0 USD / 0 NAD |

| 🔁 Spreads from | From 0.0 pips |

| ➕ Max Leverage | 1:200 |

| 💳 Commission | $40 commission |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Proprietary desktop trading platforms offered alongside MetaTrader 4 and 5 | Fixed spreads are not offered |

| Offers an impressive array of financial instruments including most currency pairs | There is a monthly inactivity fee applied |

| Innovative mobile trading apps and mobile platforms provided | |

| There are several advanced charting tools and charting features offered | |

| Negative balance protection is applied to accounts | |

| The broker accepts a wide range of trading strategies including algorithmic trading, hedging, scalping, and more | |

| There is a comprehensive range of trading tools and analytical tools offered | |

| Deposit fees are not charged and there are several deposit options | |

| Offers a decent selection of educational materials including educational articles | |

| Client funds are kept in segregated accounts |

7. FP Markets

Overall, FP Markets is considered low-risk with proper regulation. FP Markets is headquartered in Australia and is regulated by ASIC and CySEC.

FP Markets is a well-established and licensed broker that provides a broad range of 10,000+ financial products for you to trade across a variety of global markets, including forex, stocks, cryptocurrencies, and contracts for difference (CFDs).

FP Markets accepts Namibian clients and has an average spread from 0.0 pips with a US$6 commission round turn ($3 per side). FP Markets has a maximum leverage ratio of up to 1:500. MT4, MT5, Myfxbook, and FP Markets platforms are supported.

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

FP Markets offers four different retail trading accounts namely an MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT 4/5 Islamic Raw Account.

FP Markets’ mission is to deliver the finest trading experience to all traders, regardless of their investment size or prior trading experience. The company is dedicated to understanding the needs of traders.

Furthermore, FP Markets uses cutting-edge technology to ensure that ECN pricing is maintained at all times, regardless of market conditions.

FP Markets Overview

| 🔎 Broker | FP Markets |

| 📝 Regulation | ASIC, CySEC, FSCA, FSA |

| 💻 Trading Desk | MT4, MT5, Myfxbook AutoTrade, FP Markets App |

| 🎉 No Deposit Bonus | None |

| ➖ Min. Deposit from | 100 USD / 1,862 NAD |

| 🔁 Spreads from | From 0.0 pips |

| ➕ Max Leverage | 1:500 |

| 💳 Commission | US$6 commission round turn ($3 per side) |

| 🚀 Open an Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FP Markets is well-regulated by a Tier-1 and Tier-2 market regulators, which means that Namibian traders are dealing with a legit broker | There are additional fees that apply to Swap-free accounts |

| There is a massive range of markets across several asset classes | There is no NAD-denominated account |

| There are powerful and user-friendly trading platforms that can be used across different devices | Withdrawal fees are charged on most payment methods |

| There is reliable and fast trade execution through the Equinix servers | |

| There are commission-free accounts offered | |

| There are designated Islamic accounts offered to Muslim traders | |

| FP Makers offers beginner Namibian traders a range of educational materials | |

| There are a plethora of deposit methods and withdrawal options to choose from |

How to Choose a Forex Broker in Namibia

Namibian traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Namibians must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

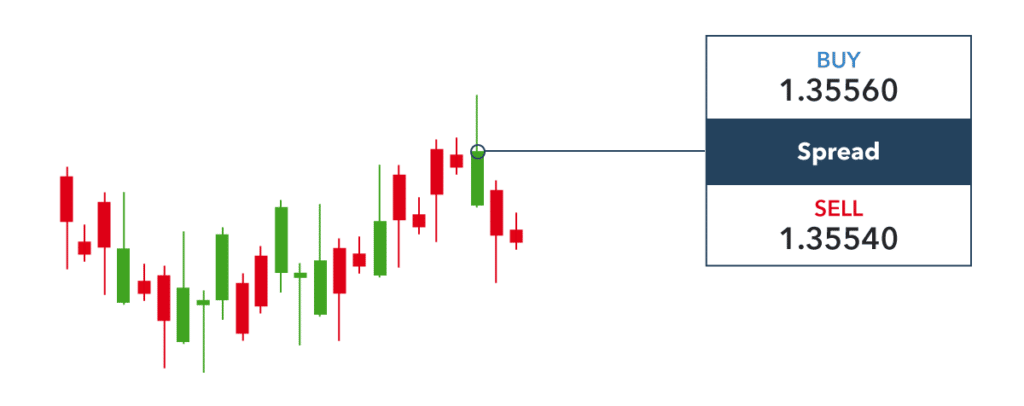

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Namibians must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Namibians must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Namibians must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Namibian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and several other resources can help experienced traders make informed trading decisions.

Understanding how Forex Brokers work

Virtually everyone with internet access, the funds to open a trading account, and a fairly positive past financial history can now engage in the market through online trading. It is not required to have a personal broker or a huge sum of money on hand to trade stocks, and most analysts believe that stock trading is no longer a portent of impending disaster.

You must first choose an online broker before you can engage in online stock trading. Trade execution will be handled by your online broker, who will also maintain track of your funds and shares in an account.

Advantages of Forex Brokers

They have several advantages. These advantages include:

➡️ A reputable broker provides a wide range of financial services to their clients, as well as research and suggestions.

➡️ Portfolio analysis and construction, estate planning, tax advice, access to initial public offering shares, access to international markets, and a range of other services may be available.

➡️ Despite the fact that low-cost brokers provide lower fees, their principal goal is to provide simple execution services to self-directed investors and traders.

➡️ If you do not want to undertake your own investing research but still want to engage in the financial markets, reliable brokers are worth considering.

Disadvantages of Forex Brokers

They also have some drawbacks of which traders in Namibia should take note in order to mitigate their risk of losses:

➡️ There are fees associated with nearly every transaction you make on a forex exchange.

➡️ Forex brokers seek to protect their bottom line and may stay in business through clever methods that skim much more than necessary off their customers.

➡️ Some brokers may take your money willingly but will be much more hesitant to return it to you.

➡️ Some brokers have terms and conditions meant to confuse and stifle your efforts to withdraw your money

The Best Forex Brokers in Namibia

In this article, we have listed the best Forex brokers which offer Forex Brokers to traders in Namibia. We have further identified the forex brokers that offer additional services and solutions to Namibian traders.

Best Forex Brokers MetaTrader 4 / MT4 Forex Broker in Namibia

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overall, Trade Nation is the best MT4 forex broker in Namibia. Trade Nation also has an effective trading app. Trade Nation further has competitive costs, a secure trading environment and cutting-edge solutions.

Best Forex Brokers MetaTrader 5 / MT5 Forex Broker in Namibia

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best MT5 forex broker in Namibia. Exness offers dynamic and adaptable account types as well as some of the industry’s most advantageous trading conditions. Exness offers over 200 financial products, several retail account types, and a wealth of resources.

Best Forex Brokers Forex Broker for beginners in Namibia

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Overall, BDSwiss is the best forex broker for beginners in Namibia. BDSwiss is also a well-regulated broker that has a large international clientele. It offers a diverse range of trading instruments, including forex, commodities, stocks, indices, and many cryptocurrencies.

Best Forex Brokers Minimum Deposit Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overall, Oanda is the best minimum deposit forex broker in Namibia. Oanda also provides competitive trading conditions, a proprietary platform that has won awards, and high-quality trading solutions. Professionals and novices alike can use OANDA’s platform to access a wide range of indicators and charting tools.

Best Forex Brokers ECN Forex Broker in Namibia

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, Pepperstone is the best ECN forex broker in Namibia. Pepperstone is capable of handling multiple order fills, allowing it to feed bigger orders into a liquidity aggregator on numerous levels. Orders placed by clients are filled on a “market execution” basis without requotes, with the possibility of positive or negative slippage, and without broker interference.

Best Forex Brokers Islamic / Swap-Free Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HF Markets is the best Islamic/swap-free forex broker in Namibia. HF Markets, formerly HotForex, is a low-risk CFD and forex broker that provides competitive trading conditions, retail investor accounts, client fund security, and customer support. HF Markets’ retail investor accounts are appropriate for both novice and expert traders.

Best Forex Brokers Forex Trading App in Namibia

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best forex trading app broker in Namibia. FP Markets provides over 10,000 products in stocks, indices, forex, commodities, and cryptocurrencies, as well as an easy-to-use mobile app and a variety of account types. FP Markets provides a variety of value-added services, including VPS hosting for automated trading solutions, copy trading through the MT4 Myfxbook service, and retail account management using the MT4 MAM/PAMM module.

Best Forex Brokers Lowest Spread Forex Broker in Namibia

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

Overall, FBS is the best lowest spread forex broker in Namibia. FBS is also a top forex and CFD broker for Namibians, offering a variety of trading accounts as well as a cutting-edge proprietary trading app. FBS charges low, competitive fees, and traders can rest assured that their clients’ funds are safe.

Best Forex Brokers Nasdaq 100 Forex Broker in Namibia

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overall, OctaFX is the best Nasdaq 100 forex broker in Namibia. OctaFX is also a trustworthy broker due to its low required minimum deposit, commission-free trading, and unlimited practice account. OctaFX’s mission is to keep trading costs as low as possible through the utilisation of STP (Straight Through Processing) and ECN models.

Best Forex Brokers Volatility 75 / VIX 75 Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best Volatility 75 / VIX 75 forex broker in Namibia. AvaTrade is a CFD and FX broker that is globally regulated by financial watchdog authorities. It provides an optimal trading environment for traders of all levels, with 24-hour multilingual support desks.

Best Forex Brokers NDD Forex Broker in Namibia

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best NDD forex broker in Namibia. XM was founded in 2009 and has been in operation for more than 12 years. It operates in over 196 countries, has a service team that speaks 30 languages, and is one of the most trusted and well-regulated brokers. XM also provides strong security, superior customer service, account financing, and low fees.

Best Forex Brokers STP Forex Broker in Namibia

Min Deposit

$10 / 195 NAD

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Axiory is the best STP forex broker in Namibia. Axiory trades are executed in less than 200 milliseconds, and Namibian traders are given the best trading software that is linked to Equinix data centres. Axiory’s cTrader, MetaTrader, and the FIX API can be used to trade forex and CFDs.

Best Forex Brokers sign up bonus Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best sign-up bonus broker in Namibia. Tickmill’s VIP and Pro accounts also offer very appealing commission-based pricing. Tickmill provides a wide range of CFD currency, stock, commodity, and index CFDs in addition to low spreads, massive leverage, and fast execution speeds.

Conclusion

In conclusion, the top 7 Best Forex Brokers are Exness, AvaTrade, HFM, FBS, Pepperstone, OANDA and FP Markets.

Dealing with a trustworthy trading platform in Namibia might provide huge profits when done appropriately. Trading currencies is not the same as trading stocks or commodities, even though the foreign exchange market is the world’s largest and most liquid. The licenced trading platforms listed in this article are the finest for forex trading in Namibia.

you might also like: Forex Trading for Beginners

you might also like: Best Forex brokers Minimum $100 deposit

you might also like: Best Forex Trading Apps

you might also like: Best Forex No-Deposit Brokers

you might also like: Best Cent Account Forex Brokers

Frequently Asked Questions

How does forex trading work?

Trading foreign exchange involves making simultaneous purchases of one currency and sales of another. The joining of two different currencies results in the creation of a currency pair.

What is the role of forex brokers?

A forex broker is a currency trading platform or company that provides traders with a software interface that allows them to trade in the forex markets.

Do I need a broker to trade forex?

Yes, if you want to trade foreign exchange, you must do it through a forex broker.

Can you trust all forex brokers?

No, some brokers may behave unethically or illegally. When you join a brokerage firm, make sure that it is properly licenced and regulated by a reputable authority.

Do you need the experience to start trading forex?

No, but beginners should first practice on a demo account, especially since the vast majority of forex traders lose money. Forex trading is complicated and the more experience you already have as a beginner, the better.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia