Saxo Bank Review

Saxo Bank is a large and prominent forex broker and bank founded in 1992. They are strictly regulated by 14 Tier-1 regulatory entities globally and provide Namibian traders with a dynamic and safe trading environment.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

0 NAD / 0 USD

Regulators

FSA, FCA, MAS, FINMA, CONSOB, JFSA, FSC, ASIC, and more.

Trading Desk

SaxoTraderGO, SaxoTraderPRO

Crypto

No

Total Pairs

185+

Islamic Account

Trading Fees

Account Activation

Overview

With a sharp focus on the dynamic world of online trading, we shift our attention to Saxo Bank, a pioneering force in the realm of digital financial services.

Since its inception in Denmark in 1992, the broker has experienced remarkable growth that has captivated the global trading community, including traders in Namibia.

From the very start, the broker showed a clear dedication to innovation. Since its establishment, they have continuously adapted its range of products to encompass a staggering 71,000 instruments spanning multiple asset classes.

Their meticulous focus on every detail and dedication to offering a wide range of educational resources highlight their commitment to empowering traders.

This educational support is highly appreciated in Namibia, as it resonates with traders’ strong desire for knowledge and self-sufficiency in trading.

Saxo Bank’s expansion into global markets has been characterized by a customized approach, accurately addressing the specific requirements of international and regional clients.

Their platform provides access to global markets, offering valuable tools and insights tailored to various global trading environments, including Namibia.

Our experiences with Saxo Bank demonstrate their strong dedication to meeting regulatory requirements and ensuring customer happiness.

The bank’s strict compliance with regulations set by financial authorities worldwide instils a strong sense of trust and security for Namibian traders as they navigate the complexities of online trading.

Our initial impression of the broker is that it has gained recognition for successfully combining traditional banking services with cutting-edge trading solutions. Furthermore, depending on their trading objectives and strategies, we consider it a suitable broker for Namibians.

Can Namibian traders access worldwide markets via Saxo Bank?

Yes, Saxo Bank offers Namibian traders access to over 71,000 worldwide trading products.

Is Saxo Bank’s trading platform available in several languages?

Saxo Bank’s services offer a variety of languages, including English for Namibians.

At a Glance

| 🗓 Established Year | 1992 |

| ⚖️ Regulation and Licenses | Danish FSA, Danish FSA in UAE, Danish FSA in Brazil, Danish FSA in Czech, FCA, MAS, FINMA, CONSOB, Japan JFSA, Hong Kong FSC, ASIC, Dutch Central Bank and Authority for Financial Markets in the Netherlands, National Bank of Belgium and Financial Services and Market Authority, Banque de France and Autorite Marche Financial |

| 🪪 Ease of Use Rating | 4/5 |

| 🚀 Bonuses | Yes, Saxo Rewards, Referral Program |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | SaxoTraderGO, SaxoTraderPRO |

| 💻 Account Types | Classic, Platinum, VIP |

| 💰 Base Currencies | 18 currencies |

| 📈 Spreads | From 0.4 pips |

| 📉 Leverage | 1:30 |

| 💸 Currency Pairs | 185+; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 0 NAD / 0 USD |

| 🛑 Inactivity Fee | None |

| 📞 Website Languages | English, Danish, French, Thai, Chinese, Italian, Polish, Russian, Japanese, etc. |

| ✔️ Fees and Commissions | Spreads from 0.4 pips; commissions from $0 on Mutual Funds |

| ✅ Affiliate Program | Yes |

| 🚫 Banned Countries | United States |

| 👨💻 Scalping | Yes |

| 👥 Hedging | Yes |

| 🏦 Trading Instruments | Forex, CFDs, stocks, commodities, futures, FX options, listed options, ETFs, bonds, mutual funds |

| 👉 Open an account | Open Account |

Regulation and Safety of Funds

During our evaluation of their security measures, we noticed a dedicated focus on safeguarding the interests of Namibian traders.

Even though there is no local regulation in Namibia, the broker is subject to rigorous oversight from global authorities like the Danish FSA and the UK’s Financial Conduct Authority.

In our experience, when a broker like Saxo Bank has a wide range of regulatory oversight, it tends to ensure that operational and financial compliance standards are consistently upheld.

We could also clearly see that ensuring the safety of trader funds is a top priority. As part of this commitment, client funds are kept separate from corporate funds and held in top-tier banks.

Furthermore, the broker prioritizes the security of trader data and transactions by implementing advanced encryption protocols across their platforms. In addition, the login process incorporates two-factor authentication (2FA) to bolster security.

The broker offers traders a range of risk management tools, including stop-loss orders and margin alerts, to assist Namibians in effectively managing exposure to market volatility.

In addition, their participation in investor compensation schemes provides an extra layer of protection by offering compensation in the event of bank failure.

Regulation in Namibia

The Bank of Namibia (BoN) does not currently regulate Saxo Bank. However, Saxo Bank’s global regulations are listed in the table below.

Global Regulations

⚖️ Registered Entity 🏦 Country of Registration 🪪 Company Reg. ✅ Regulatory Entity 🛍 Tier 🤝 License Number/Ref

Saxo Bank A/S Denmark 15731249 Danish FSA 1 1149

Saxo Capital Markets UK Limited United Kingdom 551422 FCA 1 551422

Saxo Capital Markets Pte. Ltd. Singapore 200601141M MAS 1 –

BG SAXO Società di Intermediazione Mobiliare S.p.A. Italy 296 CONSOB 1 –

Saxo Bank Securities Ltd. Japan 0104 – 01 – 082810 JFSA 1 –

Saxo Capital Markets HK Limited Hong Kong 1395901 SFC Hong Kong 1 ADV061

Saxo Bank (Schweiz) AG Switzerland CHE-106.787.764 FINMA 1 –

Saxo Capital Markets (Australia) Limited Australia 32 110 128 ASIC 1 AFSL

BinckBank N.V. Netherlands 33162223 Dutch Central Bank and Authority for the Financial Markets 1 BO341

Protection of Client Funds

🚫 Security Measure 🪪 Information

Segregated Accounts Yes

Compensation Fund Member Yes

Compensation Amount 100,000 EUR

SSL Certificate Yes

2FA (Where Applicable) Yes

Privacy Policy in Place Yes

Risk Warning Provided Yes

Negative Balance Protection Yes

Guaranteed Stop-Loss Orders No

Can Saxo Bank offer its services legally in Namibia?

Yes. Saxo Bank complies with financial rules worldwide, including Namibia’s, and works per international standards. This includes authorization to offer services in many countries.

Does Saxo Bank offer any risk management tools to Namibian traders?

Yes. Saxo Bank provides a range of risk management tools like margin alerts and stop-loss orders, assisting Namibian traders in efficiently managing their trading risks.

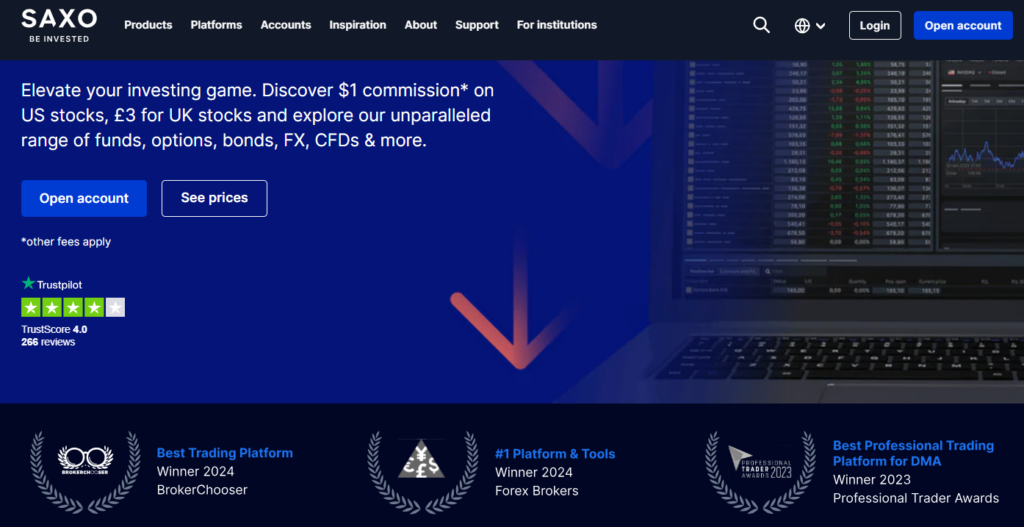

Awards and Recognition

We reviewed the Saxo Bank website to find some of the most recent and top awards that the broker has won, including the following:

➡️Saxo Bank was named the “Best Forex Broker” by BrokerChooser in the same year.

➡️BrokerChooser named Saxo Bank the “Best Trading Platform” for 2024.

➡️ForexBrokers.com gave Saxo Bank the 2024 “#1 Desktop Platform” distinction.

➡️Additionally, Good Money Guide awarded Saxo Bank the titles of “Best DMA/Professional Trading Account” and “Best CFD Broker” in 2023.

Saxo Bank Account Types

While evaluating Saxo Bank, we looked closer at the trading accounts that Namibians can register. We formulated a snapshot of these accounts for Namibians, available in the table below, followed by a discussion on each account and what they offer traders.

Classic Platinum VIP

✔️ Availability All; beginners and casual traders Experienced and professional traders Professional and Institutional traders

💵 Markets 71,000 71,000 71,000

💰 Commissions $1 – Stocks

$1 – Commodities

$1 – Futures

$0.75 – Listed Options

$1 – ETFs

0.05% – Bonds

$0 – Mutual Funds$1 – Stocks

$1 – Commodities

$1 – Futures

$0.75 – Listed Options

$1 – ETFs

0.05% – Bonds

$0 – Mutual Funds$1 – Stocks

$1 – Commodities

$1 – Futures

$0.75 – Listed Options

$1 – ETFs

0.05% – Bonds

$0 – Mutual Funds

💻 Platforms All All All

🔨 Trade Size From 0.01 lots From 0.01 lots From 0.01 lots

📊 Leverage 1:30 1:30 1:30

💸 Minimum Deposit 0 NAD 3.6 million NAD 18.4 million NAD

👉 Open an account Open Account Open Account Open Account

Classic Account

The Classic Account is tailored to cater to the needs of Namibian traders who are just starting in online trading across global financial markets.

One of the advantages of this account is that there is no minimum deposit requirement, which makes it accessible for individuals who prefer to start with a smaller amount.

Traders can enjoy a wide range of trading instruments with this account, including an impressive selection of 71,000 options.

Both SaxoTraderGO and SaxoTraderPRO are accessible to Classic account holders, offering them the convenience of a user-friendly platform or the advanced features of a more sophisticated one.

The support provided is exceptional, with assistance available 24/5, ensuring that any issues are resolved promptly.

With commissions starting at just $1 for stocks, the Classic Account provides cost-conscious traders with competitive entry-level spreads.

Platinum Account

Per our findings, the Platinum Account is designed for seasoned Namibian traders with extensive experience.

It provides a more sophisticated trading experience with a 30% decrease in spreads, making it appealing for traders who deal in larger volumes.

One of the impressive aspects of this account is the exceptional customer support, which is prompt and well-informed, especially helpful for resolving intricate inquiries.

Even though the Platinum tier has a more exclusive vibe, it still grants you access to all trading platforms and the complete range of instruments offered by the broker.

Additionally, the account offers reduced commissions, resulting in substantial long-term savings on trading expenses. Overall, the Platinum Account is a great fit for traders in Namibia who value a higher level of service and are willing to invest in it.

VIP Account

The VIP Account represents the highest level of individualized attention and exclusivity that the broker provides.

It offers traders in Namibia a premium trading experience, complete with a dedicated relationship manager who is available round the clock.

Trading in high volumes can be highly profitable for VIP members, thanks to the lowest spreads and commissions.

In addition, VIP members can attend exclusive events and gain direct access to Saxo’s expert strategists, which further enhances their trading experience.

Overall, the VIP Account is perfect for Namibian traders who are committed to trading at the highest levels and appreciate the assistance of a trusted institution.

Demo Account

The Demo Account provides a risk-free environment for Namibian traders to learn about trading. With $100,000 in virtual funds and 20 days, traders can become acquainted with the trading environment without risking their real capital.

During this trial period, traders can explore and become acquainted with the SaxoTraderGO and SaxoTraderPRO platforms in a simulated market environment.

This is perfect for testing strategies and getting to know the various tools available on the platform.

What account types does Saxo Bank offer?

Saxo Bank offers Namibian traders three major account types: Classic, Platinum, and VIP, each with unique features and perks targeted to different degrees of trading expertise.

What are the key advantages of a Saxo Bank Platinum account for Namibia traders?

The Platinum account at Saxo Bank provides Namibian traders with cheaper price structures, priority customer service, and improved trading conditions.

How To Open a Saxo Bank Account

To register an account with Saxo Bank, follow these steps:

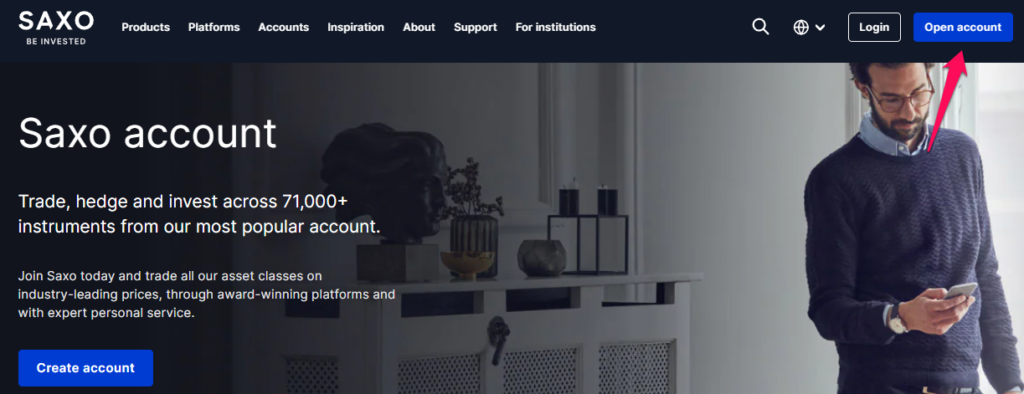

Step 1 – Click on the Register button.

Start the account setup process by visiting the official website of Saxo Bank. Find the “Open Account” link on the homepage.

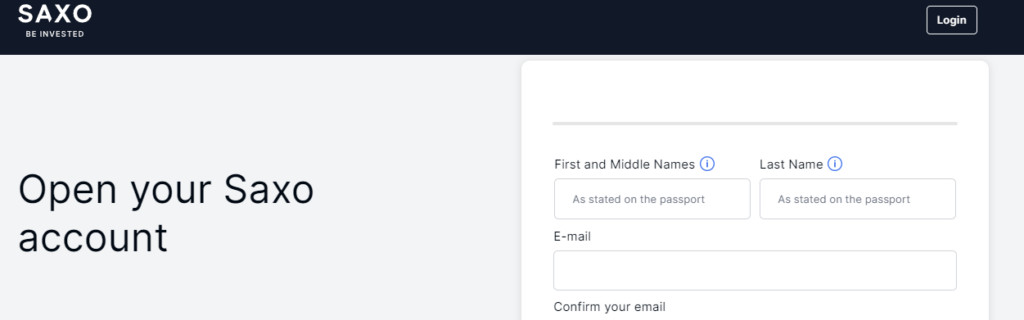

Step 2 – Complete the form.

Complete an electronic application form, and please provide correct personal information, including your full name, address, and tax residency details, as Saxo Bank needs these for the initial registration process.

Step 3 – Provide your identification documents.

Please provide the necessary identification documents as part of the Know Your Customer (KYC) requirements. It is important to provide a clear, legible copy of a government-issued ID or passport and a recent utility bill or bank statement for address verification.

Saxo Bank vs. PrimeXBT vs. FXPesa – Broker Comparison

| Saxo Bank | PrimeXBT | FXPesa | |

| ⚖️ Regulation | Danish FSA, Danish FSA in UAE, Danish FSA in Brazil, Danish FSA in Czech, FCA, MAS, FINMA, CONSOB, Japan JFSA, Hong Kong FSC, ASIC, Dutch Central Bank and Authority for Financial Markets in the Netherlands, National Bank of Belgium and Financial Services and Market Authority, Banque de France and Autorite Marche Financial | None; licensed in Seychelles and The Marshall Islands | FCA, CMA |

| 📱Trading Platform | SaxoTraderGO SaxoTraderPRO | PrimeXBT | MetaTrader 4 MetaTrader 5 Equiti Trader App |

| 💰 Withdrawal Fee | No | Yes | Yes |

| 📊 Demo Account | Yes | Yes, with contests | Yes |

| 📈 Min Deposit | 0 NAD ($0) | 1,250 NAD (0.001 BTC) | 19 NAD ($5) |

| 📈 Leverage | 1:30 | 1:1000 | 1:400 |

| 📊 Spread | From 0.4 pips | From 0.05% | 0.0 pips |

| 💰 Commissions | From $0 on Mutual Funds | 0.05% | $7 |

| ✴️ Margin Call/Stop-Out | Flexible | Flexible | 100%/30% |

| ✴️ Order Execution | Market | Instant | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Classic Account Platinum Account VIP Account | Live Account | Executive Account Premiere Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | No | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/6 |

| 📊 Retail Investor Accounts | 3 | 1 | 2 |

| ☪️ Islamic Account | No | No | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Flexible | Flexible | 150 lots |

| 💸 Minimum Withdrawal Time | Instant | Instant | Instant |

| 💰Maximum Estimated Withdrawal Time | Up to 5 days | Depends on the payment method – a few minutes to 48 hours | Up to 15 working days |

| 📞 Instant Deposits and Instant Withdrawals? | Yes, deposits | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms and Software

As professional reviewers, we test brokers’ platforms using demo accounts. We did the same with the broker and were pleased to find robust, user-friendly, and versatile trading platforms across multiple devices.

Keep reading to discover the features we uncovered that will benefit Namibian traders.

SaxoTraderGO

We gained valuable insights from our experience with SaxoTraderGO as we explored its user-friendly interface.

The broker has carefully crafted this platform to provide traders in Namibia with a user-friendly and adaptable experience.

We were highly impressed by the seamless execution and up-to-the-minute data updates, which are crucial for making well-informed decisions in the dynamic forex and CFD markets.

With a range of risk management tools at your disposal, such as stop-loss and take-profit orders, they ensure a robust regulatory framework to enhance the security of your trades.

Utilizing market analysis tools allowed for timely insights, essential for capitalizing on market opportunities during Namibia’s trading hours and economic cycles.

SaxoTraderGO stands out with its cloud-based infrastructure, guaranteeing consistent device settings and preferences. This provides us with effortless trading experiences, whether we’re at our desks or on the go.

Third-Party Tools

During our examination, we thoroughly explored the third-party tools ecosystem provided by them, which greatly enhances the platform’s capabilities.

By incorporating platforms like TradingView, we enhanced our technical analysis with a wide range of advanced indicators and drawing tools, providing us with more comprehensive charting solutions.

Namibia traders can connect external tools to their accounts, allowing them to create personalized trading environments that cater to their unique analytical preferences.

These integrations demonstrate Saxo Bank’s understanding that trading is a personalized endeavour, allowing traders to customize their experiences to match their individual strategies and market perspectives.

SaxoInvestor

Our extensive experience with SaxoInvestor has shown us a platform that prioritizes simplicity and long-term investment strategies. It is an ideal choice for Namibian traders who are looking for sustainable growth opportunities.

Our thematic investment collections provide strategic directions that align with Namibia’s emerging market status, offering opportunities for diversification in sectors such as renewable energy and technology.

The curated selection of investment ideas encourages exploration beyond traditional asset classes, offering a personalized approach for traders in Namibia.

Our testing has shown that SaxoInvestor is a great choice for individuals new to trading or with long-term investment objectives. It streamlines the investment process while providing access to Saxo Bank’s extensive range of financial instruments.

SaxoTraderPRO

Our analysis of SaxoTraderPRO uncovered a platform designed for experienced traders seeking sophisticated control and functionality.

With a wide range of customization options available, you have the flexibility to implement advanced trading strategies.

You can tailor your trading experience to suit your needs, from workspace layouts to complex order types. Algorithmic orders, available on SaxoTraderPRO, allow trades to be executed automatically based on specific conditions.

This feature is designed to meet the requirements of Namibian traders who are looking for accurate entry and exit points.

With our top-notch analytics tools and direct market access execution, you can expect a strong and reliable trading experience. The comprehensive and professional trading environment provided by the broker demonstrates their dedication to meeting the needs of advanced traders in Namibia.

Connectivity and APIs

Our investigation into Saxo Bank’s Connectivity and APIs uncovered exciting opportunities for Namibian traders to customize their trading experiences.

We were impressed by the OpenAPI for Excel, which enabled us to create custom applications using a familiar spreadsheet interface.

This feature is particularly advantageous for traders who heavily depend on data analysis and modelling for their trading decisions.

Having direct access to Saxo’s infrastructure through APIs allows traders to automate trades, access real-time and historical data, and develop proprietary applications.

This is a valuable resource for Namibian traders who want to create customized solutions that align with the nuances of the Namibian market and their trading strategies.

Can Namibian traders use Saxo Bank’s platforms on mobile devices?

Yes, both SaxoTraderGO and SaxoInvestor are available on mobile devices, offering full trading functionality and account management capabilities on the go.

What are the key features of SaxoTraderGO that benefit Namibian traders?

SaxoTraderGO offers an intuitive user interface, comprehensive charting tools, and integration with trading tools that allow seamless trading and portfolio monitoring.

Min Deposit

0 NAD / 0 USD

Regulators

FSA, FCA, MAS, FINMA, CONSOB, JFSA, FSC, ASIC, and more.

Trading Desk

SaxoTraderGO, SaxoTraderPRO

Crypto

No

Total Pairs

185+

Islamic Account

Trading Fees

Account Activation

Trading Instruments & Products

While researching Saxo Bank’s instruments, the first thing that amazed us was the number of instruments available. With over 71,000 instruments across markets, they are one of the best brokers for portfolio diversification. Here’s what Namibians can trade when they sign up with Saxo:

➡️FX Options – Namibian traders can choose from 45 vanilla FX options. These unique and popular instruments can help traders strategically manage currency risk in a developing market like Namibia.

➡️Stocks – The broker gives Namibian investors access to international stock markets with 23,500 equities from over 50 exchanges. Namibians can easily offset local economic risks by diversifying their portfolio with worldwide growth and leverage up to 1:5.

➡️Commodities – Namibian traders can diversify their portfolios or hedge against inflation by trading several commodities. Namibian traders can easily profit from or protect against commodities market volatility using options for futures, spots, and more and leverage up to 1:10.

➡️Forex – They offer approximately 185 forex pairs, including exotics majors and minors. With leverage topping at 1:30, Namibian traders can capitalize on the smallest price fluctuations in a highly liquid market that operates 24/5. Different pairings allow for personalized methods to hedge against Namibian dollar swings.

➡️Mutual Funds – Commission-free mutual funds let Namibian clients invest in professionally managed funds. This can appeal to investors who want a hands-off attitude yet tailored asset exposure.

➡️Futures – Over 250 futures contracts allow Namibian traders to bet or hedge on price changes. This forward-looking tool matches Namibian traders’ strategic strategy for their economy and currency.

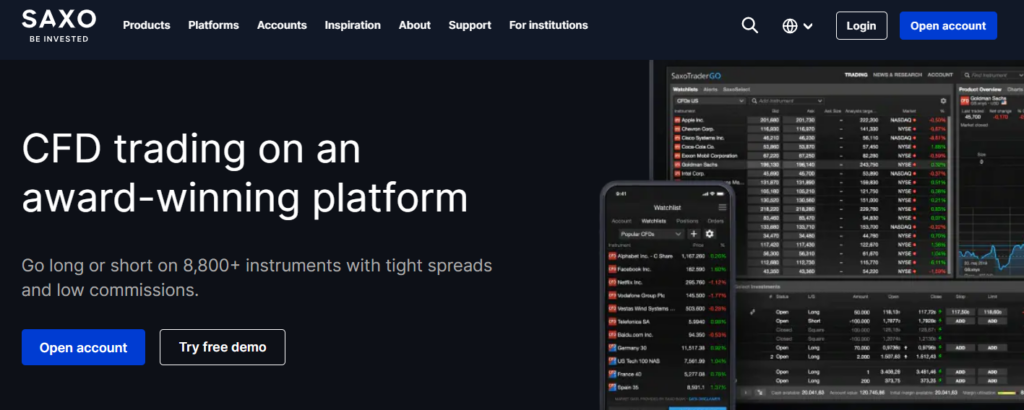

➡️CFDs – The broker allows Namibian traders to speculate on price changes without owning the underlying assets via CFDs on indices, commodities, and equities. Due to leverage, CFD traders may readily execute short and long trades and enter greater positions than their money allows, making them excellent for flexible trading methods in shifting market attitudes.

➡️Bonds – The broker offers government and corporate bonds from 26 countries and 21 currencies to risk-averse Namibian investors seeking stability or diversity. Bonds are essential for a defensive strategy, especially in unstable economies.

➡️Listed Options – Namibian traders may utilize volatility and market-specific techniques using a wide range of FX and listed options.

➡️ETFs – Namibian traders can diversify risk across sectors, strategies, and commodities with over 7,000 ETFs on 30 worldwide exchanges. The combination of diversification and simplicity makes this instrument ideal for investors who want to trade many markets.

What bond trading opportunities does Saxo Bank offer to traders in Namibia?

Saxo Bank offers bonds from over 40 countries in developed and emerging markets, including government and corporate bonds.

Can Namibian traders use Saxo Bank to trade options and futures?

Yes, options and futures are available for trading, offering tools for hedging, speculation, and managing portfolio risk.

Saxo Bank Spreads and Fees

The broker charges competitive spreads across instruments, and the broker is extremely transparent about all other trading and non-trading fees. In the sections below, we discuss these fees in detail, allowing Namibians to get an idea of what they can expect from them.

Spreads

The broker provides highly competitive spreads, with rates as low as 0.4 pips for major forex pairs such as EUR/USD. These competitive spreads are especially beneficial for Namibian traders who are involved in high-volume or day trading, where even minor pip changes make a difference.

Saxo Bank’s tight spreads result from their direct access to liquidity providers, allowing Namibian traders to take advantage of small price movements effectively.

Commissions

The commission structure is designed to accommodate a wide range of trading activities. Commissions start at a low rate of $1 for stocks, making it suitable for traders with both active and conservative trading styles in Namibia.

With a tiered commission model, traders can enjoy lower commissions as their trading volume increases. This greatly incentivizes those who want to expand their trading activities.

Overnight Fees

Namibians interested in using Saxo Bank must note that there are fees for holding positions overnight, something that we found is common practice in Forex and CFD trading.

These fees are calculated based on interbank rates and include an extra markup called swaps. The fees can differ based on the instrument type and the trade’s nature.

In our experience, Namibian traders need to keep an eye on these fees, particularly for positions held for extended periods, as they can significantly impact profitability in the long run.

Deposit and Withdrawal Fees

The broker does not impose any internal fees for deposits or withdrawals. However, Namibians must consider the potential fees imposed by their bank or payment service providers, as these external charges can impact transaction costs.

Inactivity Fees

The broker does not charge any inactivity fees, which sets it apart from other brokers.

Currency Conversion Fees

When it comes to trades involving currency pairs that are not in the trader’s account-based currency, they apply a currency conversion fee. Traders in Namibia, who frequently deal with foreign currencies due to these instruments’ global nature, should consider this fee.

What are the typical spreads for major forex pairs offered by Saxo Bank to Namibian traders?

Saxo Bank offers competitive spreads starting as low as 0.4 pips for major currency pairs like EUR/USD, which can significantly benefit traders looking to minimize trading costs.

Are there any withdrawal fees for Namibian traders using Saxo Bank?

No. Saxo Bank does not generally charge withdrawal fees, but traders must check if their bank imposes any charges for receiving funds.

Saxo Bank Deposit & Withdrawal Options

Because of its regulatory framework, they are one of the most trusted and secure brokers for Namibians. The broker only accepts certain deposits and withdrawals and while this limits Namibians, it can provide them the certainty that their funds are safe.

In the table below, Namibians can view the deposit and withdrawal information. Then, in the sections after the table, we break down the steps traders can follow to deposit and withdraw funds.

📚 Payment Method 🌎 Country 💸 Currencies Accepted ⏰ Processing Time

TT Wire Transfer All Multi-currency Instant – 5 days

Onshore inter-bank transfer All Multi-currency Instant – 5 days

Credit/Debit Card All Multi-currency Instant – 5 days

Bank Transfers All Multi-currency Instant – 5 days

Deposits

How to Deposit using Bank Wire Step by Step

✅To access their account, you can log in and find the ‘Deposit and Transfer’ section in the platform interface.

✅Choose ‘Bank Transfer’ as the deposit method, then select the Saxo Bank account you want to fund.

✅Saxo Bank will provide you with all the banking details, including account numbers and reference codes. Using these details is important to ensure your funds are accurately credited.

✅Proceed with the wire transfer using the account details provided by the bank. It is important to ensure that the name on the bank account matches the name on the Saxo Bank account to comply with anti-money laundering regulations.

How to Deposit using Credit or Debit Card Step by Step

✅To access their account, log in and navigate to the ‘Deposit and Transfer’ section.

✅Choose ‘Credit/Debit Card’ as the payment method and carefully enter the deposit amount and card details.

✅Verify that the billing address matches the one on file with Saxo Bank.

✅Ensure that all details are accurate before authorizing the deposit transaction.

How to Deposit using Cryptocurrency Step by Step

✅According to our research, the broker does not offer the option for Namibian traders to deposit cryptocurrencies directly.

How to Deposit using e-Wallets or Payment Gateways Step by Step

✅Unfortunately, they do not provide the option to deposit funds through e-wallets or Payment Gateways for traders in Namibia.

Withdrawals

How to Withdraw using Bank Wire Step by Step

✅To access the platform’s ‘Withdraw Funds’ section, navigate to the appropriate section.

✅Select the Saxo account you’d like to withdraw from, indicate the amount and currency for the withdrawal, and then choose a previously linked external bank account for the transfer.

✅Simply follow the on-screen instructions to complete the transaction, which might involve additional security measures such as entering an SMS code.

How to Withdraw using Credit or Debit Cards Step by Step

✅Traders should note that withdrawals are usually processed by returning the funds to the bank account they came from. As a result, direct withdrawal to a credit or debit card is not a standard procedure.

How to Withdraw using Cryptocurrency Step by Step

✅Currently, the broker does not allow Namibian traders to withdraw cryptocurrency funds.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

✅Withdrawal via e-wallets or Payment Gateways is currently unavailable for Namibian traders, according to the latest information from Saxo Bank.

What is the processing time for a deposit made to a Saxo Bank account?

Deposit processing times can range from instant to a few business days, depending on the deposit method.

How can I withdraw funds from a Saxo Bank account?

Submit a withdrawal request within your Saxo Bank platform and choose an approved external bank account for the transfer.

Leverage and Margin

When researching Saxo Bank’s leverage and margin offerings for Namibian traders, we gathered information from reliable sources such as regulatory releases and the bank’s client agreement.

Using leverage in trading can significantly amplify both potential profits and losses. The leverage rates offered by the broker are influenced by regulatory requirements and the specific financial instruments being traded.

For Namibian traders, forex leverage is limited to a maximum of 1:30 for major currency pairs per the standards set by top-tier regulators.

This ratio balances opportunity and risk management, enabling traders to have control over a significant amount of currency in their account balance.

The leverage for other instruments, such as commodities or indices, can vary, typically lower because of the varying market volatility and liquidity.

The broker employs a tiered margin approach, which considers position size and market volatility to determine the requirements.

In our experience, this approach is wise, offering protection against market volatility, which is beneficial for traders in Namibia, where financial markets can be highly unpredictable.

Overall, per our findings on the matter, Saxo Bank’s leverage and margin policies are designed to give Namibian traders the ability to enhance their market exposure while also protecting them from potential uncertainties in the global market.

What leverage options does Saxo Bank offer to Namibian forex traders?

Saxo Bank provides leverage up to 1:30 for major forex pairs to Namibian traders, aligning with regulatory standards to enhance trading capacity while managing exposure risks.

Are margin requirements at Saxo Bank static or dynamic for Namibian clients?

Yes. Margin requirements at Saxo Bank are dynamic and can change based on market volatility and the positions held by the trader, enhancing risk management.

Educational Resources

Another area where the broker impressed us relates to its educational materials and resources. Here’s what we found.

SaxoStrats

Exploring SaxoStrats, we discovered a wealth of expert insights and strategic guidance. This resource is extremely valuable for Namibian traders, providing up-to-the-minute analysis and insights from Saxo Bank’s strategists on worldwide market trends and significant events.

Reviewing the SaxoStrats articles, videos, and reports gave us valuable insights into market perspectives and how they relate to the global economy and various trading environments. Furthermore, this information helps traders make well-informed decisions.

Introduction to Trading (Courses)

The ‘Introduction to Trading’ courses are specifically tailored to equip novice Namibian traders with a strong foundation.

We found these courses incredibly engaging, as they covered a wide range of topics, from fundamental trading principles to advanced strategies.

The structure of these trading tools is designed to perfectly complement Saxo Bank’s platform features, ensuring that Namibian traders can effectively utilize them.

Risk Management Rules

The importance of risk management is highlighted in the ‘Risk Management Rules’ section.

As we explored this resource, it became clear that Namibian traders are advised to use careful risk management techniques, which are essential for protecting investments.

Furthermore, the guidelines are specifically designed to align with the trading conditions and instruments provided by Saxo Bank, promoting responsible trading practices.

Trade Inspiration

According to our findings, while exploring their resources, Trade Inspiration provides a range of market updates and articles filled with practical insights.

We were intrigued by how these inspirations address the strategic requirements of Namibian traders, focusing on market opportunities that align with their trading schedules and economic interests.

Podcasts

We found their range of podcasts highly engaging and informative, allowing us to stay updated on the go.

For Namibian traders seeking convenient and accessible information, these podcasts offer a wealth of knowledge. With in-depth market analysis and interviews with financial experts, they can provide traders with valuable insights.

Events and Webinars

The events and webinars provide a valuable opportunity for Namibian traders to enhance their knowledge and skills with expert guidance.

These sessions cover a wide range of topics, including global economic trends impacting various local markets and specific strategies traders can use.

Thought Starters

The ‘Thought Starters’ sparked our strategic thinking. This resource offers Namibian traders cutting-edge trading ideas and comprehensive market insights, connecting the dots between fundamental analysis and practical trading strategies.

Become a Better Trader

The ‘Become a Better Trader’ section stood out to us for its advanced content designed to enhance the trading skills of experienced traders.

Traders in Namibia can greatly benefit from these resources by acquiring the skills to navigate the intricacies of the market using Saxo Bank’s advanced trading tools.

Platform Video Guides

The Platform Video Guides we explored were concise and informative. They are especially helpful for Namibian traders who want to efficiently master Saxo Bank’s platforms and make the most of its features and tools tailored to the unique trading objectives of the Namibian market.

Money Matters

‘Money Matters’ is an educational segment focused on enhancing financial literacy. This resource is extremely helpful for Namibian traders to gain a deeper understanding of broader economic concepts and trends.

This knowledge can greatly influence their trading strategies and decisions when navigating the global markets available through the broker.

Market Call Podcast

The ‘Market Call’ podcasts offer daily market briefings for Namibian traders. These podcasts are a valuable resource for staying updated on global financial developments that can impact the trading strategies of Namibians, given the country’s interconnectedness in the global trading ecosystem.

Are there any live trading sessions or webinars offered by Saxo Bank for Namibian clients?

Yes. Saxo Bank hosts live webinars and trading sessions where traders can learn from experts and gain insights into market trends and strategies.

Can Namibian traders access on-demand videos and tutorials at Saxo Bank?

Yes. A vast library of on-demand videos, tutorials, and recorded webinars is available on Saxo Bank’s platform, allowing Namibian traders to learn at their own pace.

Bonuses and Promotions

After evaluating Saxo Bank’s bonuses and promotions, we found that clients from Namibia who open an account with Saxo Bank are automatically enrolled in the Saxo Rewards program.

Furthermore, this program aims to encourage trading activities by rewarding points that can elevate the client’s account tier.

The program starts as soon as you open an account, and the initial tier is based on your first deposit. Then, traders can progress to higher tiers by earning points through their trading activities.

The rewards traders can earn are 250 points for every EUR 10,000 traded in stocks, ETFs, or ETNs. In bonds, trading the same value yields 320 points.

Traders should note that during the initial 30 days after opening your account, every Euro deposited or transferred will earn you 0.6 points. This period is especially important for maximizing your rewards, allowing for quick advancement to higher levels based on the investment amount.

After the first 30 days, the rewards system changes its focus to the total average AuM (Assets Under Management), and points are given based on the monthly average.

Saxo Calculates the points earned by Namibians two trading days before the end of each month, with each Euro of AuM earning 0.025 points.

From what we understood of the program, the ongoing rewards structure is intended to encourage consistent engagement and investment. Furthermore, it effectively aligns clients’ interests with long-term account growth and enhanced trading conditions.

How frequently does Saxo Bank update its promotional offers?

Saxo Bank revises its promotional offers frequently according to market trends and the institution’s promotional strategy. According to our research, clients who are signed up to receive the Saxo Bank newsletter are kept updated on new offerings.

Does Saxo Bank offer educational incentives to newly registered Namibian traders as part of their promotional activities?

Yes. Saxo Bank frequently incorporates educational incentives into its promotions for newly registered Namibian traders, including complimentary webinars or access to premium educational materials.

Bonuses and Promotions

After evaluating Saxo Bank’s bonuses and promotions, we found that clients from Namibia who open an account with Saxo Bank are automatically enrolled in the Saxo Rewards program.

Furthermore, this program aims to encourage trading activities by rewarding points that can elevate the client’s account tier.

The program starts as soon as you open an account, and the initial tier is based on your first deposit. Then, traders can progress to higher tiers by earning points through their trading activities.

The rewards traders can earn are 250 points for every EUR 10,000 traded in stocks, ETFs, or ETNs. In bonds, trading the same value yields 320 points.

Traders should note that during the initial 30 days after opening your account, every Euro deposited or transferred will earn you 0.6 points. This period is especially important for maximizing your rewards, allowing for quick advancement to higher levels based on the investment amount.

After the first 30 days, the rewards system changes its focus to the total average AuM (Assets Under Management), and points are given based on the monthly average.

Saxo Calculates the points earned by Namibians two trading days before the end of each month, with each Euro of AuM earning 0.025 points.

From what we understood of the program, the ongoing rewards structure is intended to encourage consistent engagement and investment. Furthermore, it effectively aligns clients’ interests with long-term account growth and enhanced trading conditions.

How frequently does Saxo Bank update its promotional offers?

Saxo Bank revises its promotional offers frequently according to market trends and the institution’s promotional strategy. According to our research, clients who are signed up to receive the Saxo Bank newsletter are kept updated on new offerings.

Does Saxo Bank offer educational incentives to newly registered Namibian traders as part of their promotional activities?

Yes. Saxo Bank frequently incorporates educational incentives into its promotions for newly registered Namibian traders, including complimentary webinars or access to premium educational materials.

Affiliate Programs

Features

The affiliate program at Saxo Bank provides a one-of-a-kind opportunity to collaborate with an industry-leading bank.

Not only will you receive valuable rewards for recommending new clients, but you will also have access to special marketing materials and expert assistance.

The program is designed to attract high-value clientele with rewards ranging as high as €600 per VIP referral. Furthermore, apart from VIP referrals, Namibians could also earn commissions from Platinum or Classic clients.

However, Namibians must note that a strong web presence with financial industry-related material is crucial to achieving success.

By doing so, you can advertise Saxo Bank’s products and services to your current audience. As part of the Saxo Bank affiliate program, you can elevate your credibility and maximize your earning potential by collaborating with an internationally renowned and well-regulated broker and bank.

How to Register an Affiliate Account with Saxo Bank Step-by-Step

Step 1 – Go to the Affiliate section.

Visit Saxo Bank’s affiliate program page and find the “Apply as an Affiliate” banner when the page loads.

Step 2 – Send an email.

Provide more information about your online presence, such as website traffic statistics, audience demographics, and content focus. Saxo Bank uses this information to evaluate your ability to promote their services. Please provide a detailed outline of your planned affiliate marketing strategy, showcasing your strategy for attracting potential clients to Saxo Bank.

Step 3 – Choose a commission method.

Select the method that suits you best for receiving affiliate commissions. Saxo Bank provides a range of pay-out options to its customers. After finishing the application, submit it for review.

Must I fulfil any performance requirements to become and remain a Saxo Bank affiliate?

Yes. Affiliates based in Namibia must fulfil specific performance criteria, encompassing a minimum threshold of generated trading volume or an exact count of active customers referred.

Which promotional materials are accessible to Saxo Bank affiliates?

Saxo Bank provides Namibian affiliates with an assortment of promotional materials, such as personalized banners, links, and content, to bolster their marketing endeavours.

Customer Support

Customer Support Saxo Bank Customer Support

⏰ Operating Hours 24/5

🗣 Support Languages Multilingual

👥 Live Chat No

📱 Email Address Yes

📞 Telephonic Support Yes

✅ The overall quality of FXView Support 4/5

Response Time

📞 Support Channel ⏰ Average Response Time 👥 User-based Response Time

Phone 5 – 8 minutes 6 minutes

Email 24 – 48 hours 24 – 48 hours

Live Chat No live chat No live chat

Social Media 6 minutes 4 – 6 minutes

Affiliate 24 – 48 hours 24 – 48 hours

What customer support languages can I access with Saxo Bank?

The primary language of customer support at Saxo Bank is English, a widely spoken language in Namibia that facilitates effective and unambiguous communication.

How does Saxo Bank address grievances raised by Namibian traders?

Per our findings, customer grievances lodged with Namibian traders are addressed using a systematic procedure encompassing recognition, inquiry, and resolution in strict adherence to elevated customer service benchmarks.

Social Responsibility

Based on our findings, Saxo Bank is making promises and taking action to back them up. Their Sustainability Strategy prioritizes Environmental, Social, and Governance (ESG) factors, demonstrating a commitment to responsible investment options and informed clients.

The company offers a wide range of educational resources to help its global clients make well-informed decisions that are in line with their values. Saxo Bank’s dedication goes beyond investment products.

Furthermore, Saxo Bank highly emphasizes being environmentally responsible in their operations. Moreover, Saxo Bank is actively working towards a greener future, with significant investments in renewable energy sources and emission reduction initiatives.

Saxo Bank User Comments and Reviews

➡️“I’ve been using Saxo Bank for a while and I truly value the user-friendly design and the option to start trading with no minimum deposit, making it incredibly convenient. However, the minimums for Platinum and VIP accounts can be quite challenging to meet.”

➡️“Setting up my account was a breeze, although the funding process took longer than expected due to some delays with the wire transfer. It’s a reliable platform, although there may be some waiting involved.”

➡️“The customer support could use some improvement; they are helpful once you manage to get through, but contacting them can be quite frustrating at times. Overall, Saxo’s platform has advantages, but it’s important to consider the support issues.”

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Conclusion

After thoroughly examining Saxo Bank, conducting practical tests, and gathering user feedback, we can give our concluding thoughts to Namibians.

Saxo Bank offers over 71,000 trading instruments across forex and bonds, allowing Namibian traders to diversify their portfolios effectively.

Furthermore, during our testing of SaxoTraderGO and SaxoTraderPRO, we found that these platforms are suitable for all levels of traders due to their extensive tools and customizable features.

Our Insight

I would recommend Saxo Bank for more experienced Namibian traders. They have a great customer support system, but their platform is not easy to use, there is much functionality available.

Our Recommendations on Saxo Bank

➡️Saxo Bank can consider using AI-driven tools to enhance market analysis, provide trade suggestions, and improve overall risk management.

➡️Saxo Bank can consider offering more tailored accounts that can cover various trading styles and trader experience levels, especially for beginners.

➡️Creating a community forum for Saxo Bank users can be beneficial as it allows them to discuss market trends, support one another, and share strategies.

Saxo Bank Pros & Cons

| ✔️ Pros | ❌ Cons |

| Namibian traders can expect competitively low commission fees on some instruments while others are commission-free | Saxo Bank’s unique offer is geared more towards professional traders with large investment profiles |

| Saxo Bank offers an impressive suite of educational tools and resources for Namibians | Namibians cannot deposit or withdraw in NAD |

| Several regulatory entities oversee Saxo Bank, ensuring a transparent and safe trading environment | There are limited deposit and withdrawal methods, and neither crypto wallets nor payment gateways are supported |

| Namibians can choose from 18 account currencies when they register an account | Namibians face currency conversion fees when they transact using NAD |

| Namibians have access to robust, feature-rich platforms across several devices | The investment requirements are extremely high on most accounts |

| There are three levels of investment with Saxo Bank, each catering to different types of traders according to their investment size | There is no opportunity to trade cryptocurrencies with Saxo Bank |

| Namibians can expect several risk management and several security tools to manage their risk in volatile markets | Leverage is capped at 1:30 with Saxo Bank |

| Saxo Bank is reputable and has been operating for decades |

you might also like: Axi Review

you might also like: RoboForex Review

you might also like: Go Markets Review

you might also like: Tickmill Review

you might also like: FP Markets Review

Frequently Asked Questions

Does Saxo Bank Singapore charge any inactivity fees?

No. Saxo Bank is a great choice for traders who don’t trade as frequently because they do not charge any inactivity fees.

Can I trade commodities on Saxo Bank?

Yes. Namibian traders have the opportunity to participate in commodity trading with Saxo Bank, which covers a wide range of products such as metals, energy, and agricultural commodities.

Does Saxo Bank Singapore offer a demo account?

Yes. Saxo Bank offers a demo account that allows you to practice trading strategies without any risk using virtual funds.

What kind of leverage does Saxo Bank provide for forex traders in Namibia?

Saxo Bank provides leverage of up to 1:30 for forex trading.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia