7 Best CFD Trading Platforms in Namibia

The 7 Best CFD Trading Platforms in Namibia revealed. We tested and verified the best CFD trading platforms for Namibian Traders.

This is a complete list of Namibia’s best CFD trading platforms and forex platform brokers.

In this in-depth guide you’ll learn:

- What are CFD Trading Platforms?

- Who are the top CFD trading platform, brokers?

- How to choose a forex broker – Compare them side by side against each other.

- Which brokers are best for beginner traders?

- Which broker offers a sign-up bonus for first-time traders?

- Which broker offers a low minimum deposit of $5 to Namibian traders?

And lots more…

So if you’re ready to go “all in” with the best-tested CFD Trading brokers for Namibians…

Let’s dive right in…

- Louis Schoeman

Best CFD Trading Platforms in Namibia – Comparison

| 🥇 Forex Broker | 🎉 Open An Account | ✔️ Offers a CFD Trading Platform? | 💳 Minimum Deposit (NAD) | 📱 Namibian Dollar-based Account? | 💰 NAD Deposits Allowed? |

| 1. Exness | Open Account | Yes | 10 USD / 188 NAD | Yes | Yes |

| 2. OANDA | Open Account | Yes | 0 USD / 0 NAD | Yes | Yes |

| 3. AvaTrade | Open Account | Yes | 100 USD / 1,883 NAD | No | No |

| 4. IG | Open Account | Yes | 0 USD / 0 NAD | No | No |

| 5. Markets.com | Open Account | Yes | 100 USD / 1,883 NAD | No | No |

| 6. Tickmill | Open Account | Yes | 100 USD / 1,883 NAD | No | Yes |

| 7. IC Markets | Open Account | Yes | 200 USD / 3,766 NAD | No | No |

What is a CFD Trading Platform?

A virtual platform utilized for CFD (Contract for Difference) trading is a web-based portal that allows traders to hypothesize on the fluctuations of financial instruments such as equities, commodities, currencies, and indices.

CFD trading platforms equip traders with accessibility to manifold financial markets, real-time quotations, charting apparatus, technical analysis cues, and other trading paraphernalia.

7 Best CFD Trading Platforms in Namibia (2024)

- Exness – Overall, the Best CFD Trading Platform Broker

- OANDA – Top Trading Platform for Namibia

- AvaTrade – Best Social Trading Broker in Namibia

- IG – Best CFD Broker for Professional Traders

- Markets.com – Verified CFD Proprietary Trading Software

- Tickmill – Most Competitive Spreads for CFDs

- IC Markets – User-Friendly True ECN CFD Broker

1. Exness

Exness is a reputable and licensed broker that offers low-risk CFD and Forex trading. With its market-leading trading conditions, such as spreads from 0.0 pips, Exness is well-known for providing exceptional trading services to its clients.

One of the key advantages of trading with Exness is its flexible and dynamic account types. These account types are tailored to suit the needs of different traders, whether they are beginners or experienced professionals. Additionally, Exness provides access to over 200 financial products, including major and minor currency pairs, metals, energies, and indices.

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Another reason why Exness stands out from the crowd is its commitment to customer satisfaction. The company provides a range of retail account choices, which are designed to cater to the specific trading needs of its clients. Furthermore, Exness offers excellent customer support, ensuring that its clients have access to assistance whenever they need it.

In conclusion, Exness is a broker that delivers low spreads, exceptional trading conditions, and a wide range of financial products. With its dedication to customer satisfaction, Exness has established itself as a leader in the trading industry.

Exness Overview

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📲 Social Media Platforms | Instagram, Facebook, X, YouTube, LinkedIn |

| 💻 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💳 Minimum Deposit (NAD) | 10 USD / 188 NAD |

| 💵 Trading Assets | Forex, Metals, Crypto, Energies, Indices, Stocks |

| 📊 Minimum spread | From 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness offers a selection of asset classes and trading accounts to Namibian traders | Exness does not currently have a comprehensive list of educational materials |

| Namibian traders can use Naira as their base account currency | There is a limited range of tradable instruments |

| Namibian traders can contact customer support 24 hours a day, 7 days a week | |

| Exness offers unlimited leverage ratios to traders | |

| MetaTrader 4 and 5 are offered across devices |

2. OANDA

OANDA is a forex and CFD trading platform that is available to Namibian traders. It was founded in 1996 and is based in Canada, but it offers services to traders around the world.

OANDA offers a wide range of trading instruments, including over 70 currency pairs, commodities, indices, and bonds. It also offers access to MetaTrader 4, one of the most popular trading platforms in the world.

One of the key features of OANDA is its low minimum deposit requirement. Namibian traders can open an account for as little as $1, which makes it accessible to traders with different levels of experience and capital.

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

OANDA also offers a range of educational resources, including webinars, articles, and video tutorials, to help traders improve their skills and knowledge. It also provides a demo account that traders can use to practice their trading strategies without risking any real money.

In terms of regulation, OANDA is licensed by several regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC).

Overall, OANDA is a reputable and established trading platform that offers a range of trading instruments, low minimum deposit requirements, and educational resources to Namibian traders.

OANDA Overview

| Feature | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📲 Social Media Platforms | Facebook, Twitter, YouTube, LinkedIn |

| 💻 Trading Accounts | Standard Account, Core Account, Swap-Free Account, Premium Account, Premium Core Account |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, OANDA Platform, FxTrade |

| 💳 Minimum Deposit (NAD) | 0 USD / 0 NAD |

| 💵 Trading Assets | Index CFDs, Forex, Metals, Commodity CFDs, Bonds CFDs, Precious Metals, Real-time Rates |

| 📊 Minimum spread | From 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| OANDA delivers tailormade solutions to Namibian beginner and professional traders | An inactivity fee is charged on dormant accounts |

| There is no specific minimum deposit, giving traders flexibility over how much they want to invest or trade | There is no NAD-denominated account or local deposit and withdrawal options |

| OANDA supports reliable funding options | |

| There are competitive spreads offered and flexible trading platforms | |

| Advanced traders are granted a competitive edge with some of the best trading tools |

3. AvaTrade

AvaTrade is a forex and CFD trading platform that is available to Namibian traders. It was founded in 2006 and is headquartered in Dublin, Ireland, but it offers services to traders around the world.

AvaTrade offers a wide range of trading instruments, including over 50 currency pairs, commodities, indices, and stocks. It also offers access to several trading platforms, including MetaTrader 4 and its proprietary AvaTradeGO platform.

One of the key features of AvaTrade is its educational resources. It offers a range of educational materials, including webinars, ebooks, and video tutorials, to help traders improve their skills and knowledge. It also provides a demo account that traders can use to practice their trading strategies without risking any real money.

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

In terms of regulation, AvaTrade is licensed and regulated by several regulatory bodies, including the Central Bank of Ireland, the Financial Services Commission in the British Virgin Islands, and the Financial Sector Conduct Authority in South Africa.

AvaTrade also offers several account types to cater to the needs of different traders, including a standard account, a professional account, and a demo account.

Overall, AvaTrade is a reputable and established trading platform that offers a range of trading instruments, educational resources, and account types to Namibian traders.

AvaTrade Overview

| Feature | Information |

| ⚖️ Regulation | CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 📲 Social Media Platforms | Instagram, Facebook, Twitter, YouTube |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 📱 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💳 Minimum Deposit (NAD) | 100 USD / 1,883 NAD |

| 💵 Trading Assets | Forex, Stocks, Commodities, Cryptocurrencies, Treasuries, Bonds, Indices, Exchange-Traded Funds (ETFs), Options, Contracts for Difference (CFDs), Precious Metals |

| 📊 Minimum spread | From 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is a comprehensive and popular CFD and forex broker that is regulated by several entities | Inactivity fees apply |

| AvaTrade offers personalized trading conditions to Muslim traders who want an Islamic trading account | There are no variable spread accounts offered |

| AvaTrade offers extensive resources to beginner and professional traders | There is a limited choice between retail trading accounts |

| There are several trading platforms offered to Namibian traders | Currency conversion fees may apply when traders deposit in NAD |

| There is ample social trading offered through AvaTrade |

4. IG

IG is a forex and CFD trading platform that is available to Namibian traders. It was founded in 1974 and is headquartered in London, UK, but it offers services to traders around the world.

IG offers a wide range of trading instruments, including over 80 currency pairs, commodities, indices, shares, and cryptocurrencies. It also offers access to several trading platforms, including its proprietary web-based platform and MetaTrader 4.

One of the key features of IG is its educational resources. It offers a range of educational materials, including webinars, articles, and video tutorials, to help traders improve their skills and knowledge. It also provides a demo account that traders can use to practice their trading strategies without risking any real money.

Min Deposit

250 USD / 4,700 NAD

Regulators

FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA

Trading Desk

MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In terms of regulation, IG is licensed and regulated by several regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

IG also offers several account types to cater to the needs of different traders, including a standard account, a professional account, and a demo account.

Overall, IG is a reputable and established trading platform that offers a range of trading instruments, educational resources, and account types to Namibian traders.

IG Overview

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📲 Social Media Platforms | Facebook, Twitter, YouTube, LinkedIn |

| 💻 Trading Accounts | IG Trading Account, Limited Risk Account, Islamic Account (Dubai traders only), Demo Account |

| 📱 Trading Platform | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 💳 Minimum Deposit (NAD) | 0 USD / 0 NAD |

| 💵 Trading Assets | Forex, Indices, Shares, Commodities, Cryptocurrencies, Futures, Options |

| 📊 Minimum spread | From 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes (Dubai customers only) |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IG is a well-regulated CFD and forex broker and a global name in the trading industry | There are deposit fees applied to funding options |

| Traders have access to trading accounts for their specific region | The minimum deposit is higher than that of competitors |

| There are flexible trading and non-trading fees that cater for all types of traders | Islamic accounts are only available to Dubai residents |

| Namibian traders have access to a large range of markets | IG only offers a few payment methods that can be used by Namibian traders for deposits and withdrawals |

| There is an impressive portfolio of trading platforms offered | There is no NAD-denominated account or deposit currency |

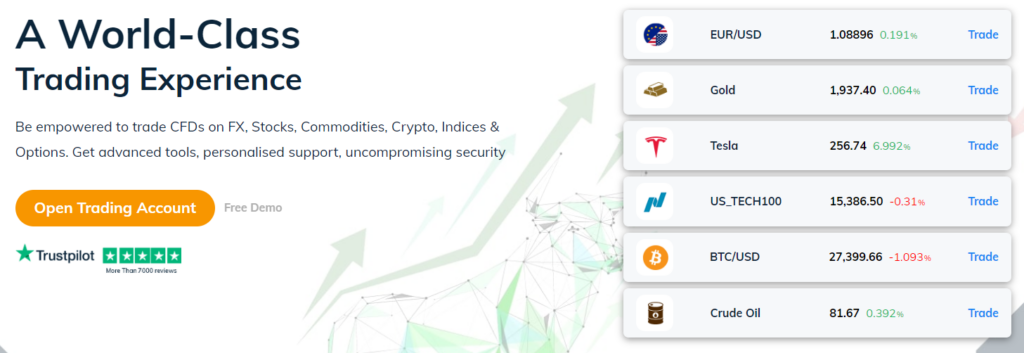

5. Markets.com

Markets.com is a forex and CFD trading platform that is available to Namibian traders. It was founded in 2010 and is headquartered in Cyprus, but it offers services to traders around the world.

Markets.com offers a wide range of trading instruments, including over 2,000 currency pairs, commodities, indices, shares, and cryptocurrencies. It also offers access to several trading platforms, including MetaTrader 4 and its proprietary Markets platform.

One of the key features of Markets.com is its educational resources. It offers a range of educational materials, including webinars, articles, and video tutorials, to help traders improve their skills and knowledge. It also provides a demo account that traders can use to practice their trading strategies without risking any real money.

Min Deposit

USD 100 / 1,500 NAD

Regulators

CySec, ASIC, FCA, BVI FSC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, Markets.com propietary platform

Crypto

Yes

Total Pairs

67

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

In terms of regulation, Markets.com is licensed and regulated by several regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC).

Markets.com also offers several account types to cater to the needs of different traders, including a standard account, a professional account, and a demo account.

Overall, Markets.com is a reputable and established trading platform that offers a range of trading instruments, educational resources, and account types to Namibian traders.

Markets.com Overview

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC |

| 📲 Social Media Platforms | Facebook, Twitter, YouTube, LinkedIn |

| 💻 Trading Accounts | MarketsX Account, Marketsi Account |

| 📱 Trading Platform | MarketsX, Marketsi, MetaTrader 4, MetaTrader 5, MarketsX App |

| 💳 Minimum Deposit (NAD) | 100 USD / 1,883 NAD |

| 💵 Trading Assets | Shares, Bonds, Cryptocurrencies, Forex, Primary CFDs, ETFs, Indices, Blends, Commodities |

| 📊 Minimum spread | From 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Markets.com offers over 2,200 financial instruments that can be traded, including CFDs | The proprietary trading platform could be too simplified for advanced traders |

| Namibian traders have access to a range of educational materials | Namibian traders cannot register an account with NAD as the base account currency |

| Commission-free trading is offered | An inactivity fee is applied to dormant accounts |

| Markets.com offers competitive trading conditions | Namibian traders do not have any local payment options for deposits or withdrawals |

| Namibian traders have the option of converting a live trading account into that an Islamic account |

6. Tickmill

Tickmill is a forex and CFD trading platform that is available to Namibian traders. It was founded in 2014 and is headquartered in Seychelles, but it offers services to traders around the world.

Tickmill offers a wide range of trading instruments, including over 60 currency pairs, commodities, indices, and bonds. It also offers access to several trading platforms, including MetaTrader 4 and its proprietary WebTrader platform.

One of the key features of Tickmill is its low spreads and commissions. It offers some of the lowest spreads in the industry, which can help traders save on trading costs.

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

In terms of regulation, Tickmill is licensed and regulated by several regulatory bodies, including the Seychelles Financial Services Authority (FSA), the Financial Conduct Authority (FCA) in the UK, and the Cyprus Securities and Exchange Commission (CySEC).

Tickmill also offers several account types to cater to the needs of different traders, including a classic account, a pro account, and a demo account.

Overall, Tickmill is a reputable and established trading platform that offers a range of trading instruments, low trading costs, and account types to Namibian traders.

Tickmill Overview

| Feature | Information |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 📲 Social Media Platforms | Instagram, Facebook, Twitter, YouTube, LinkedIn, Telegram |

| 💻 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📱 Trading Platform | MetaTrader 5, MetaTrader 4 |

| 💳 Minimum Deposit (NAD) | 100 USD / 1,883 NAD |

| 💵 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 📊 Minimum spread | From 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill is reputable and has a high trust score | There is no NAD-denominated account offered to Namibian traders, which may subject them to currency conversion fees |

| Tickmill offers a choice between a dynamic retail account and offers an Islamic account to Muslim Namibian traders | The spreads which are offered are not the tightest |

| Tickmill caters extensively for advanced Namibian traders by offering AutoChartist, VPS< and FIX API | |

| Commission-free trading is offered and there are no fees on either deposits or withdrawals |

7. IC Markets

IC Markets is a forex and CFD trading platform that is available to Namibian traders. It was founded in 2007 and is headquartered in Sydney, Australia, but it offers services to traders around the world.

IC Markets offers a wide range of trading instruments, including over 60 currency pairs, commodities, indices, and cryptocurrencies. It also offers access to several trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary cTrader platform.

One of the key features of IC Markets is its low spreads and fast execution speeds. It offers some of the lowest spreads in the industry, and its servers are located in Equinix data centres, which can help to ensure fast and reliable execution.

Min Deposit

200 USD / 3,800 NAD

Regulators

FSA, CySEC, ASIC

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader, IC Social, Signal Start, ZuluTrade

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In terms of regulation, IC Markets is licensed and regulated by several regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

IC Markets also offers several account types to cater to the needs of different traders, including a standard account, a raw spread account, and a demo account.

Overall, IC Markets is a reputable and established trading platform that offers a range of trading instruments, low trading costs, and fast execution speeds to Namibian traders.

IC Markets Overview

| Feature | Information |

| ⚖️ Regulation | FSA, CySEC, ASIC |

| 📲 Social Media Platforms | Instagram, Facebook, Twitter, YouTube, LinkedIn, Telegram |

| 💻 Trading Accounts | cTrader, Raw Spread, Standard Account |

| 📱 Trading Platform | MT4, MT5, WebTrader, cTrader, Mobile |

| 💳 Minimum Deposit (NAD) | 200 USD / 3,766 NAD |

| 💵 Trading Assets | Currencies, Stocks, CFDs on Commodities, Futures, Bonds, and Digital assets |

| 📊 Minimum spread | 0.0 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets has a high trust score and a decent market share in Namibia, despite the competition that it faces with other brokers in the region | There is a high initial deposit requirement |

| IC Markets offers a choice between three powerful, popular trading platforms and the benefit that mobile trading apps are supported by all three | There could be currency conversion fees when Namibian traders deposit funds in NAD |

| IC Markets has a true ECN model and allows any type of trading strategy | There is no NAD-denominated trading account |

| Advanced traders have access to FIX API when they use cTrader | |

| IC Markets is known for its low trading and non-trading fees | |

| Namibian traders have access to a demo account and Islamic Account conversion option when they trade using IC Markets |

A Dive into the Details Behind Contract for Differences

A Contract for Difference (CFD) is an agreement between two entities that permits them to speculate on the fluctuations of an underlying asset’s worth, without the obligation of owning it. CFDs usually involve a buyer and a seller, who finalize the deal by exchanging cash.

This type of contract is widely used in financial trading, where both parties agree to trade the variance in the value of the underlying asset between the beginning and conclusion of the agreement. This simply means that the buyer can reap profits if the price of the underlying asset ascends, whereas the seller can gain if the price of the underlying asset depreciates.

CFDs are a favoured method to speculate on various financial assets, such as stocks, commodities, currencies, and indices. These contracts are commonly used by traders who aim to benefit from transient price movements in the market, without possessing the underlying asset.

One merit of CFDs is that traders can employ leverage to trade with bigger positions than they would normally be able to with their own capital. However, this comes with increased risk.

CFDs are usually traded through a broker who acts as an intermediary between the buyer and seller. The broker charges a commission or spreads on the trade, which is their means of earning from the transaction.

It is worth noting that CFDs entail high risk and may not be suitable for everyone. It is important to comprehend the risks and only trade with funds that one can afford to lose.

How to Choose a Forex Broker

Choosing a forex broker is an important decision for any trader, as it can significantly impact their trading experience and profitability. Here are some factors to consider when choosing a forex broker:

Regulation

It’s important to choose a broker that is regulated by a reputable financial authority in their home country or the country where they operate. This provides a level of protection for traders, as regulated brokers must adhere to certain standards and rules.

Trading platforms

The broker’s trading platform should be user-friendly, and reliable, and offer a range of tools and features that suit the trader’s needs. Traders should consider whether the platform is available on desktop and mobile devices and whether it offers access to a range of financial instruments.

Spreads and fees

Traders should compare spreads and trading fees across different brokers to find the most competitive pricing. While low spreads can be beneficial, traders should also consider other fees such as commissions and swap rates.

Customer support

The broker should offer responsive and helpful customer support that is available through multiple channels, such as phone, email, and live chat.

Educational resources

The broker should provide educational resources such as webinars, tutorials, and market analysis to help traders improve their skills and knowledge.

Deposit and withdrawal options

Traders should consider the broker’s deposit and withdrawal options and ensure that they support their preferred payment methods.

Reputation

Traders should research the broker’s reputation online and look for reviews from other traders to get an idea of their experience with the broker.

By considering these factors, traders can choose a forex broker that meets their needs and helps them achieve their trading goals.

Best CFD Trading Platforms in Namibia in 2024

In this article, we have listed the Best CFD Trading Platforms in Namibia. We have further identified the forex brokers that offer additional services and solutions to Namibian traders.

Best Forex Brokers MetaTrader 4 / MT4 Forex Broker in Namibia

Min Deposit

USD 0 / 0 NAD

Regulators

FCA, ASIC, FSCA, SCB

Trading Desk

MetaTrader 4, Trade Nation proprietary platform

Crypto

Total Pairs

33

Islamic Account

No

Trading Fees

Account Activation

Overall, Trade Nation is the best MT4 forex broker in Namibia. Trade Nation also has an effective trading app. Trade Nation further has competitive costs, a secure trading environment and cutting-edge solutions.

Best Forex Brokers MetaTrader 5 / MT5 Forex Broker in Namibia

Min Deposit

Depending on the payment system, typically, low

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal

Crypto

Total Pairs

107

Islamic Account

Trading Fees

Account Activation

Overall, Exness is the best MT5 forex broker in Namibia. Exness offers dynamic and adaptable account types as well as some of the industry’s most advantageous trading conditions. Exness offers over 200 financial products, several retail account types, and a wealth of resources.

Best Forex Brokers Forex Broker for beginners In Namibia

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Overall, BDSwiss is the best forex broker for beginners in Namibia. BDSwiss is also a well-regulated broker that has a large international clientele. It offers a diverse range of trading instruments, including forex, commodities, stocks, indices, and many cryptocurrencies.

Best Forex Brokers Minimum Deposit Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overall, Oanda is the best minimum deposit forex broker in Namibia. Oanda also provides competitive trading conditions, a proprietary platform that has won awards, and high-quality trading solutions. Professionals and novices alike can use OANDA’s platform to access a wide range of indicators and charting tools.

Best Forex Brokers ECN Forex Broker in Namibia

Min Deposit

200 AUD / 2,500 NAD

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Trading Fees

Account Activation

Overall, Pepperstone is the best ECN forex broker in Namibia. Pepperstone is capable of handling multiple order fills, allowing it to feed bigger orders into a liquidity aggregator on numerous levels. Orders placed by clients are filled on a “market execution” basis without requotes, with the possibility of positive or negative slippage, and without broker interference.

Best Forex Brokers Islamic / Swap-Free Forex Broker in Namibia

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, MetaTrader 5, HF App

Crypto

No

Total Pairs

50+

Islamic Account

Trading Fees

Account Activation

Overall, HF Markets is the best Islamic/swap-free forex broker in Namibia. HF Markets, formerly HotForex, is a low-risk CFD and forex broker that provides competitive trading conditions, retail investor accounts, client fund security, and customer support. HF Markets’ retail investor accounts are appropriate for both novice and expert traders.

Best Forex Brokers Forex Trading App in Namibia

Min Deposit

100 AUD / 1,200 NAD

Regulators

ASIC, CySEC, CMA, FSCA

Trading Desk

MT4, MT5, IRESS, cTrader, FP Markets App

Crypto

Total Pairs

63

Islamic Account

Trading Fees

Account Activation

Overall, FP Markets is the best forex trading app broker in Namibia. FP Markets provides over 10,000 products in stocks, indices, forex, commodities, and cryptocurrencies, as well as an easy-to-use mobile app and a variety of account types. FP Markets provides a variety of value-added services, including VPS hosting for automated trading solutions, copy trading through the MT4 Myfxbook service, and retail account management using the MT4 MAM/PAMM module.

Best Forex Brokers Lowest Spread Forex Broker in Namibia

Min Deposit

95 NAD / 5 USD

Regulators

IFSC, CySEC, ASIC, FSCA

Trading Desk

FBS Trader, MetaTrader 4, MetaTrader 5

Crypto

Total Pairs

36

Islamic Account

No

Trading Fees

Account Activation

Overall, FBS is the best lowest spread forex broker in Namibia. FBS is also a top forex and CFD broker for Namibians, offering a variety of trading accounts as well as a cutting-edge proprietary trading app. FBS charges low, competitive fees, and traders can rest assured that their clients’ funds are safe.

Best Forex Brokers Nasdaq 100 Forex Broker in Namibia

Min Deposit

25 USD / 470 NAD

Regulators

CySEC, SVG, FSA

Trading Desk

MT4, MT5, OctaTrader

Crypto

Total Pairs

28

Islamic Account

Trading Fees

Account Activation

Overall, OctaFX is the best Nasdaq 100 forex broker in Namibia. OctaFX is also a trustworthy broker due to its low required minimum deposit, commission-free trading, and unlimited practice account. OctaFX’s mission is to keep trading costs as low as possible through the utilisation of STP (Straight Through Processing) and ECN models.

Best Forex Brokers Volatility 75 / VIX 75 Forex Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

Trading Desk

AvaTrade WebTrader, AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade

Crypto

Total Pairs

55+

Islamic Account

Trading Fees

Account Activation

Overall, AvaTrade is the best Volatility 75 / VIX 75 forex broker in Namibia. AvaTrade is a CFD and FX broker that is globally regulated by financial watchdog authorities. It provides an optimal trading environment for traders of all levels, with 24-hour multilingual support desks.

Best Forex Brokers NDD Forex Broker in Namibia

Min Deposit

5 USD / 95 NAD

Regulators

FSCA, IFSC, ASIC, CySEC, DFSA, FCA

Trading Desk

MT4, MT5, XM Mobile App

Total Pairs

57

Islamic Account

Trading Fees

No (Just spread)

Account Activation

Overall, XM is the best NDD forex broker in Namibia. XM was founded in 2009 and has been in operation for more than 12 years. It operates in over 196 countries, has a service team that speaks 30 languages, and is one of the most trusted and well-regulated brokers. XM also provides strong security, superior customer service, account financing, and low fees.

Best Forex Brokers STP Forex Broker in Namibia

Min Deposit

$10 / 195 NAD

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Axiory is the best STP forex broker in Namibia. Axiory trades are executed in less than 200 milliseconds, and Namibian traders are given the best trading software that is linked to Equinix data centres. Axiory’s cTrader, MetaTrader, and the FIX API can be used to trade forex and CFDs.

Best Forex Brokers sign up bonus Broker in Namibia

Min Deposit

100 USD / 1,900 NAD

Regulators

Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA

Trading Desk

MT4, MT5, Tickmill Mobile

Crypto

Total Pairs

62

Islamic Account

Trading Fees

Account Activation

Overall, Tickmill is the best sign-up bonus broker in Namibia. Tickmill’s VIP and Pro accounts also offer very appealing commission-based pricing. Tickmill provides a wide range of CFD currency, stock, commodity, and index CFDs in addition to low spreads, massive leverage, and fast execution speeds.

Conclusion

In Conclusion the Best CFD Trading Platforms are Exness, OANDA, AvaTrade, IG, Markets.com, Tickmill and IC Markets.

Many of these brokers also provide Islamic accounts that are appropriate for Namibian investors and provide demo trading. They offer minimal spreads and secure account deposits.

you might also like: Best Low Spread Forex Brokers

you might also like: Best High Leverage Forex Brokers

you might also like: Best Day Trading Strategies

you might also like: Best Forex Brokers in Namibia

you might also like: Best Micro Account Forex Brokers

Frequently Asked Questions

What is the meaning of “CFD”?

CFD stands for Contract for Difference, which is a type of financial contract used in online trading. The purpose of a CFD is to allow traders to speculate on the price movements of an underlying financial asset without actually owning the asset. This means that traders can profit from the price difference between the opening and closing of the contract, without having to buy or sell the underlying asset.

What are the benefits associated with CFDs?

There are several benefits associated with trading CFDs, such as leverage trading, the ability to trade 24/7 using a range of strategies, and the fact that traders do not need a large amount of capital to get started. However, it’s important to note that CFD trading is a high-risk activity and traders must be aware of the risks involved.

Which is the best trading software for CFD trading in Namibia?

If you’re looking to trade CFDs in Namibia, there are several trading software options available, such as cTrader, MetaTrader 4, and MetaTrader 5. IG is one of the most prominent CFD trading brokers in Namibia, offering over 17,000 financial instruments, including a wide range of CFDs.

Which Forex Broker in Namibia offers the most CFD instruments?

IG is one of the most prominent CFD trading brokers that offers over 17,000 financial instruments, including a wide range of CFDs.

How do CFD Trading Platforms make money?

CFD Platforms that offer commission-free CFD trading in Namibia will make their fees from the spread.

Which CFDs can I trade online in Namibia?

You can trade anything from forex to stocks, indices, cryptocurrencies, bonds, interest rates, exchange-traded funds, commodities, and much more.

Can I make money trading CFDs?

Yes, you can be profitable when you trade CFDs. However, CFD trading is a very risky trading strategy that is done by more advanced traders.

How do I short-sell with CFDs?

You do this when you believe that a financial instrument’s price will depreciate instead of appreciating. You do not buy low and sell high but instead, you sell high and buy low, allowing you to profit from the depreciation of the underlying instrument.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia