Oanda Review

Overall OANDA is considered low-risk with an overall Trust Score of 92 out of 100. OANDA offers five different account types namely the Standard account, the Core account, the Swap-free account, the Premium account and the Premium Core account with access prices on 68 FX pairs. OANDA is currently not regulated by the Bank of Namibia

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Overview

They offer three different retail trading accounts namely a Standard Account, Core Account, and a Swap-Free Account.

The broker accepts Namibian clients and has an average spread from 0.1 pips with a $40 commission according to trading volume. The broker has a maximum leverage ratio up to 1:200 and there is a demo and Islamic account available. MT4, MT5, and TradingView platforms are supported. They are headquartered in the United States and regulated by IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, and BVI FSC.

OANDA, founded in 1996 by Dr. Stumm and Dr. Olsen, promotes that it performs “all things currency,” from currency conversion to FX data services for corporations to giving an established worldwide online brokerage service to consumers looking to trade the retail FX and CFD markets.

In the United States, they are one of the top performers in the CFTC’s Retail Forex Obligation report.

In addition, the brokers ranks among the best online forex brokers due to its well-organized website, stated purpose of openness, emphasis on customer education and research, different user interfaces, and worldwide regulatory monitoring.

This OANDA review for Namibia will provide local retail traders with the details that they need to consider whether OANDA is suited to their unique trading objectives and needs.

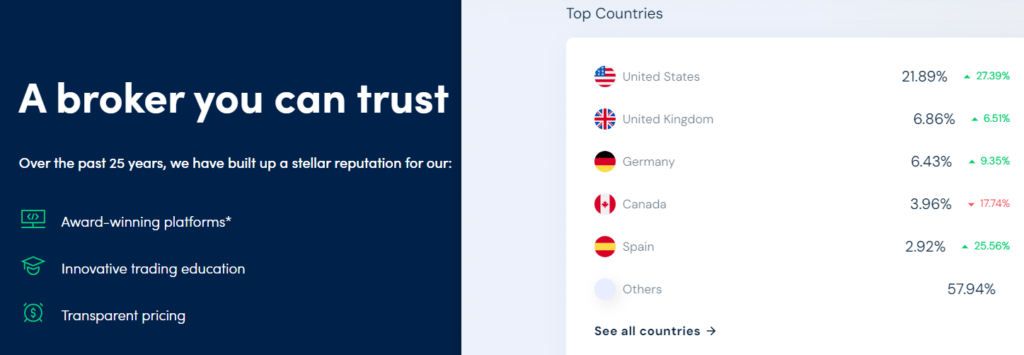

Distribution of Traders

The broker currently has the largest market share in these countries:

➡️️ United States – 21.89%

➡️️ United Kingdom – 6.86%

➡️️ Germany – 6.43%

➡️️ Canada – 3.96%

➡️️ Spain – 2.92%

Popularity among traders

🥇 OANDA is a prominent global broker, and it has a significant presence not just in the United States but also in other industrialized countries. On the other hand, the broker is utilized by a considerable number of traders in Africa, which places it in the Top 20 forex brokers for traders in Namibia.

What Is the broker’s Distribution of Traders?

Their Distribution of Traders refers to the statistical breakdown of its client base based on various trading metrics. It provides insights into how traders on the platform are positioned in terms of long and short positions, trade size, and sentiment.

How Can I Access the brokers’s Distribution of Traders Data?

The broker typically provides access to its Distribution of Traders data through its trading platform. Traders can log in to their trading accounts and navigate to the relevant section or tool that displays this data.

At a Glance

| 🏛 Headquartered | British Virgin Islands |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 1996 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, MAS, MFSA |

| 🪪 License Number | • IIROC • Australia – ABN 26 152 088 349, AFSL No. 412981 • United States – NFA ID 0325821 • United Kingdom – 542574 • Japan – 1571 • Singapore – 200704926K • Malta – VLT1455 |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| 📊 PAMM Accounts | No |

| 🤝 Liquidity Providers | JP Morgan, Deutsche Bank, Royal Bank of Canada |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market |

| 📊 Average spread | From 0.1 pips |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:200 |

| 🚫 Leverage Restrictions for Namibia? | No |

| 💰 Minimum Deposit (NAD) | 0 Namibian Dollar |

| ✅ Namibian Dollar Deposits Allowed? | Yes |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based OANDA customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Local Transfers • Debit Cards • Credit Cards • Bank Wire • Bank Transfers • Skrill • Neteller • Mobile Bank Transfers International e-Wallets |

| ⏰ Minimum Withdrawal Time | No |

| 💵 Instant Deposits and Instant Withdrawals? | Yes |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 🕐 Maximum Estimated Withdrawal Time | Up to 5 Working Days |

| 📊 Trading Platforms | • MetaTrader 4 • OANDA Platform • TradingView |

| ✔️ Tradable Assets | • Index CFDs • Forex • Metals • Commodity CFDs • Bonds CFDs • Precious Metals • Real-time Rates |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Chinese (Traditional), Spanish, Portuguese |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Customer Support Languages | Multilingual |

| ✅ Bonuses and Promotions for Namibians | Yes |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is OANDA a safe broker for Namibians? | Yes |

| 📊 Rating for OANDA Namibia | 8/10 |

| 🤝 Trust score for OANDA Namibia | 91% |

| 👉 Open an account | 👉 Open Account |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Regulation and Safety of Funds

Regulation in Namibia

The broker is a globally recognized entity but does not have any regulations or authorization from local authorities in Namibia. However, the offshore entities associated with OANDA accept Namibian traders.

Global Regulations

The broker is a globally-recognized brand that has the following regulations and authorization from global regulatory entities:

➡️ They are registered as a participant in the National Futures Association (NFA) in the United States under membership number 0325821.

➡️ They registered as a Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodities Futures Trading Commission (CFTC).

➡️ The Investment Industry Regulatory Organization of Canada (IIROC) is the body in charge of broker oversight in the Canadian market. They are well-regulated and authorized by IIROC.

➡️ The broker has a license issued by the Financial Conduct Authority (FCA) with the number 542574. This means that the company is both authorized and regulated.

➡️ The Monetary Authority of Singapore (MAS) is the governing body that oversees them under license number 200704926K.

➡️ The broker is registered in Malta and subsequently regulated and authorized by the Malta Financial Services Authority (MFSA) under license number VLT1455.

➡️ The Australian Securities and Investments Commission (ASIC) has granted OANDA Australia Pty Ltd authorization and regulates the company’s operations (ABN 26 152 088 349, AFSL No. 412981).

➡️ The Financial Futures Association of Japan (FFAJ) is the organization in charge of policing OANDA Japan Co. Ltd. under license number 1571,

➡️ In addition, OANDA Japan, Inc. is regulated and authorized by the Japanese Financial Services Authority (JFSA) under FIBO number 2137.

➡️ The British Virgin Islands’ BVI Financial Services Commission has granted the broker an operating license and oversees the company’s regulatory compliance.

Client Fund Security and Safety Features

The deposits made by customers are kept in separate bank accounts that are kept separate from one another. This money is stored at some of the most reputable financial institutions in Europe, including NatWest, Barclays, and Lloyds, as well as Ulster Bank in Ireland, Deutsche Bank in Germany, and Barclays in France.

Internal auditors at the broker provide routine checks and balances on the company’s accounting records. PricewaterhouseCoopers conducts an audit of the records on an annual basis, and then the results are submitted to the appropriate regulatory authorities.

Customers from the United Kingdom and Europe who trade with the broker are protected by the Financial Services Compensation Scheme (FSCS). If the broker goes out of business, customers who are qualified for compensation will get up to £85,000 for themselves.

The Canadian Investor Protection Fund (CIPF) provides insurance coverage for Canadian customers that is valid for up to one million Canadian dollars. MAS-regulated countries are eligible for insurance coverage of up to 50,000 Singapore dollars if they meet certain criteria.

Secure Socket Layer (SSL) encryptions are used to safeguard their trading platforms and websites from being hacked by identity thieves and other online criminals to provide users with a sufficient level of safety.

They welcome customers from all over the world, although inhabitants of some nations, such as those with more stringent regulations, cannot open an account with the company.

Is the broker Regulated Broker?

Yes, they are a regulated broker. It is authorized and regulated by several reputable financial authorities, including ASIC, the FCA in the UK, the CFTC in the United States, and more.

How Does the broker Ensure the Safety of Client Funds?

They prioritize the safety of client funds through various measures. Client funds are typically held in segregated accounts, separate from the company’s operational funds. Additionally, they may offer negative balance protection, ensuring that clients do not lose more than their initial deposit.

Awards and Recognition

The broker has won the following awards:

- Best Customer Service – Investment Trends, 2015, 2016, 2017.

- Best Mobile Platform/App – Investment Trends, 2016, 2017.

- Best Value for Money – Investment Trends, 2016.

- Best Forex Broker – Forex Magnates, 2012, 2013.

- Best Forex Brokerage Innovation – UK Forex Awards, 2017.

- Best Trading Platform – Online Personal Wealth Awards, 2015, 2016.

- Best Forex Customer Service – UK Forex Awards, 2012, 2013.

- Most popular broker – Champion of crowds, 2021.

- Best Forex and CFD broker – Empress of exchange, 2021.

Has the broker Received Any Awards for its Trading Services?

Yes, they have received numerous awards and recognitions for their trading services. Over the years, they have been consistently recognized by industry experts and organizations for their excellence.

Can You Provide Examples of Awards Won?

Certainly, the broker has won awards such as the “Best Mobile Platform” and the “Best Forex Broker” from prominent organizations in the financial industry.

Account Types and Features

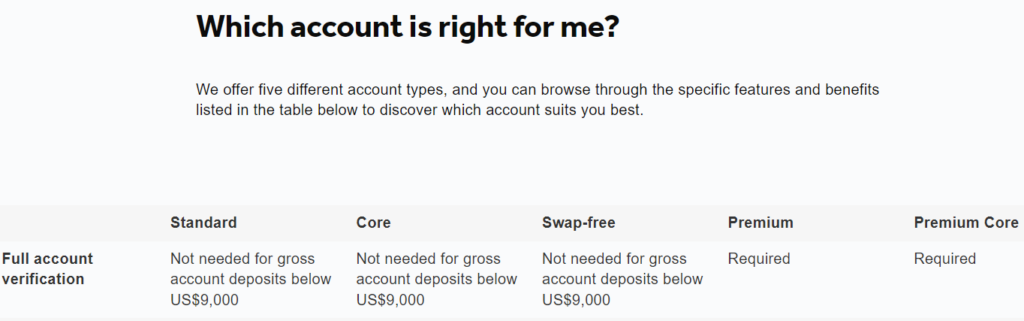

The broker provides retail investors with a choice between five distinct types of accounts, each of which comes with its own set of features and advantages.

Along with access to more complex financial instruments, these accounts come with a variety of extra benefits, such as OANDA Market Pulse, protection against negative balances, and a plethora of other advantages.

The broker provides residents of Namibia with the following account options:

➡️ Core Account

➡️ Swap-Free Account

➡️ Premium Account

➡️ Premium Core Account

Live Trading Accounts

Standard Account

This sort of account is suitable for most Namibian traders, independent of the traders’ trading objectives or personal preferences.

| Account Feature | Value |

| 💵 Minimum Deposit | USD 0 / 0 NAD |

| 📊 Average Spreads | 1.1 |

| 💸 Commissions (Per 1 mil traded) | None |

| 📈 Minimum order size | 0.01 lots |

| 🔧 Instruments | Over 200 |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✔️ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

| 👉 Open an account | 👉 Open Account |

Core Account

Day traders, high-frequency traders, algorithmic traders, and any other short-term Namibian traders who want trading conditions that are more competitive and have lower spreads will find it to be an appropriate trading environment.

| Account Feature | Value |

| 💰 Full Account Verification Needed? | Not needed for gross account deposits below US$9,000 |

| 📊 Average Spreads | 0.2 |

| 💸 Commissions (Per 1 mil traded) | 40 USD / 740 NAD |

| 💳 Minimum lot size | 0.01 lots |

| 🔧 Instruments | Over 200 |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✔️ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

| 👉 Open an account | 👉 Open Account |

Swap-Free Account

Traders who adhere to the principles of Sharia law may reap the benefits of utilizing this account to engage in the financial markets, with the advantage of not having to pay or earn interest on their transactions.

| Account Feature | Value |

| 💰 Full Account Verification Needed? | Not needed for gross account deposits below US$9,000 |

| 📊 Average Spreads | Variable, from 1.6 pips |

| 💸 Commissions (Per 1 mil traded) | None |

| 💳 Minimum lot size | 0.01 lots |

| 🔧 Instruments | 26 |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✔️ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

| 👉 Open an account | 👉 Open Account |

Premium Account

This sort of account is suitable for high-volume traders. Traders must maintain a USD 20,000 minimum balance and trade more than USD 10 million notional or equivalent per month.

| Account Feature | Value |

| 💰 Full Account Verification Needed? | Required |

| 📊 Average Spreads | 0.8 |

| 💸 Commissions (Per 1 mil traded) | None |

| 💳 Minimum lot size | 0.01 lots |

| 🔧 Instruments | Over 200 |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✔️ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

| 👉 Open an account | 👉 Open Account |

Premium Core Account

This sort of account is suitable for high-volume traders. Traders must maintain a USD 20,000 minimum balance and trade more than USD 10 million notional or equivalent per month.

| Account Feature | Value |

| 💰 Full Account Verification Needed? | Required |

| 📊 Average Spreads | 0.2 |

| 💸 Commissions (Per 1 mil traded) | 647 NAD/$35 |

| 💳 Minimum lot size | 0.01 lots |

| 🔧 Instruments | Over 200 |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✔️ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

| 👉 Open an account | 👉 Open Account |

Base Account Currencies

The broker offers a limited choice between account base currencies and Namibian traders cannot use NAD. Instead, Namibians must choose between USD, SGD, HKD, and EUR.

It is important to note, however, that it is preferable for investors who trade in significant quantities (more than ten lots per month) to create an account with a digital currency bank that is denominated in US dollars. This is especially relevant for Namibian traders who are trading assets such as the EUR/USD currency pair.

This is attributable to the fact that when trading a USD-quoted currency pair with another currency account, a small currency conversion charge will be applied to each transaction that is executed.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and the broker offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

The demo account offered by the broker is designed to replicate the settings of the Standard Account and comes with a simulated balance of one hundred thousand US dollars. If you contact their customer support and make this request, the demo account that you have will not expire.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

Instead of offering a conversion option on live trading accounts, the broker offers Muslim traders a dedicated account that exempts them from overnight fees. The trading conditions on this account are much higher to compensate for the absence of overnight fees.

However, Islamic traders will find that the account still offers several advantages and features.

What Types of Trading Accounts Does the broker Offer?

The broker primarily offers five types of trading accounts: a standard account, core account, swap-free account, a premium account and a premium core account.

What Features Are Available on the Brokers Trading Platform?

The broker’s trading platform provides a range of features, including real-time pricing, advanced charting tools, technical analysis indicators, economic calendars, and risk management tools.

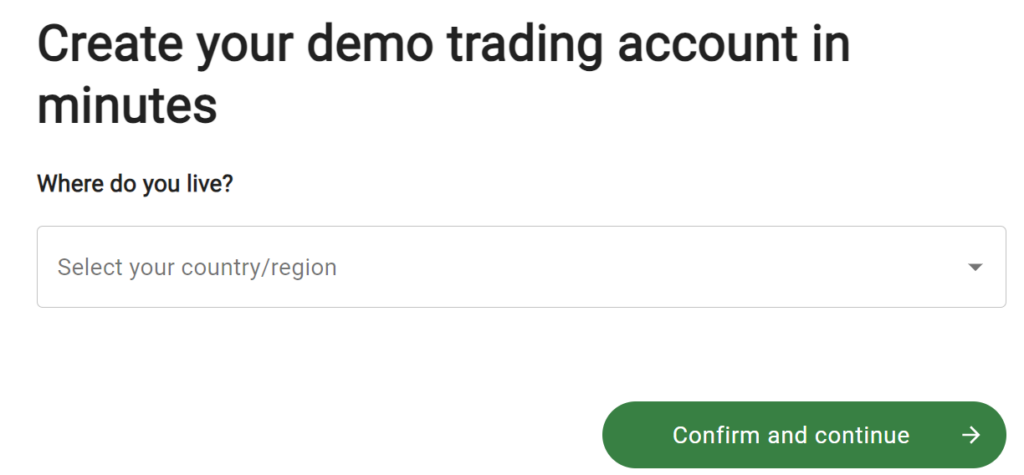

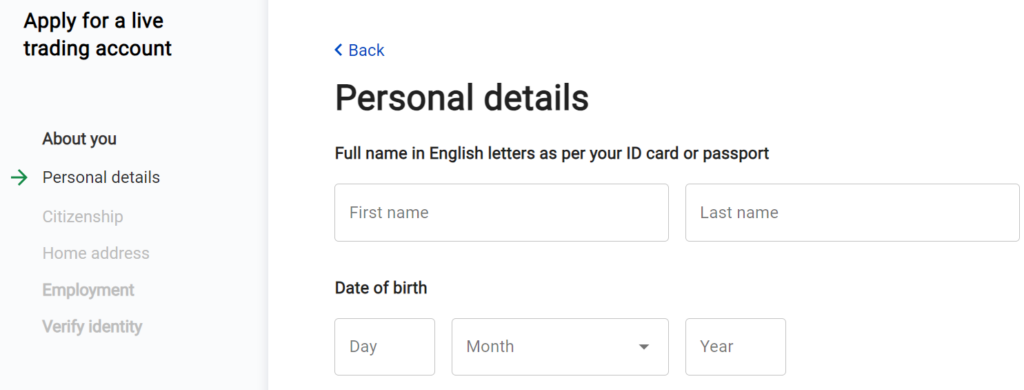

How to open an Account

To register an account, Namibian traders can follow these steps:

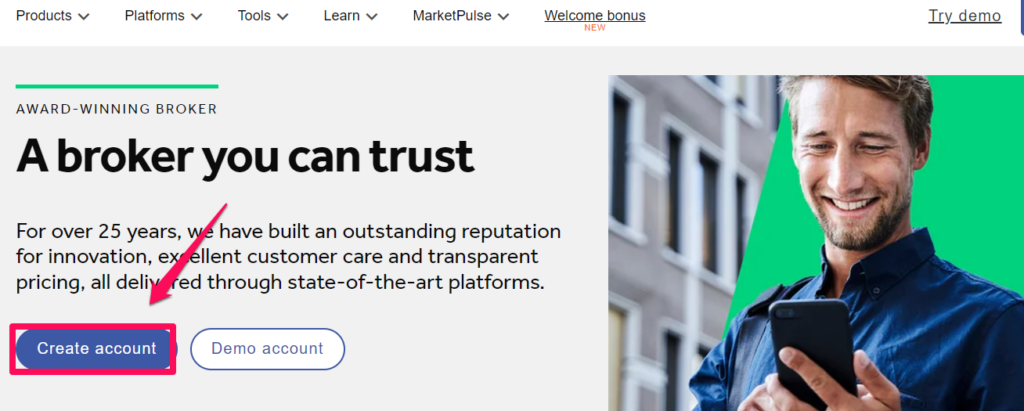

➡️ The first step is to access the OANDA website and select the option to “Start Trading” from several areas on the official website.

➡️ Traders must be 18 years or older to apply and OANDA will only pose questions that are relevant to the trader’s application, or for regulatory purposes.

➡️ Once Namibians have completed the online application, it will be sent to OANDA’s onboarding team where it will be reviewed and subsequently approved.

➡️ Traders can then proceed to fund the trading account and for all deposits below 166,590 NAD ($9,000), account verification is not needed.

Step 1 – Go to the Official Website

➡️ Go to the OANDA Website and click on “Create Account”.

Step 2 – Follow The Sign-Up Steps

➡️ Firstly, you will be asked what your country of residence is.

Step 3 – Follow The Prompts & Questions

➡️ Fill out further details and follow the steps until your account creation is completed.

OANDA VS FXCM VS Pepperstone – Broker Comparison

| OANDA | FXCM | Pepperstone | |

| ⚖️ Regulation | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, MAS, MFSA | FCA | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📱 Trading Platform | • MetaTrader 4 • OANDA Platform • TradingView | MetaTrader 4, Trading Station | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade |

| 💰 Withdrawal Fee | None | $40 / 740 NAD for all Bank Wire requests. | International bank withdrawal can incur a minimum charge of $20 / 370 NAD |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 0 NAD | 50 currency units | 0 NAD |

| 📈 Leverage | 1:200 | 1000:1 | 1:400 |

| 📊 Spread | Variable, from 0.1 pips | From 0.78 pips | 0 pips |

| 💰 Commissions | $40 / 740 NAD | yes | $3.50 / 64 NAD |

| ✴️ Margin Call/Stop-Out | 100%/ 50% | 100%/ 50% | 90%/20% |

| ✴️ Order Execution | Market | Instant and Market | Market, Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • Standard Account • Core Account • Swap-Free Account | Mini, Standard and Active Trader accounts. | Standard and Razor accounts |

| 💳 NAD Deposits | Yes | No | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 3 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📊 Minimum Trade Size | 0.01 lots | 1 lots | 0.01 lots |

| 📈 Maximum Trade Size | 1,000 lots | 50 million | 100 lots |

| 👉 Open an account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Trading Platforms

The broker offers Namibian traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️MetaTrader 5

➡️ OANDA Platform

➡️ TradingView

Desktop Platforms

➡️ MetaTrader 4

➡️ OANDA Platform

➡️ TradingView

MetaTrader 4 and MetaTrader 5

The charting and analysing capabilities of MT4 are integrated with their pricing and execution in a bridge that was designed specifically for this purpose.

An MT4 premium upgrade grants traders with access to supplementary indicators and expert advisors (EAs), such as tick-chart and keyboard trading, chart-ladder order input, five-minute order book, and alert trading.

Other features include tiny charts, OCO orders, chart-ladder order input, and a five-minute order book. MT5 is an upgraded version of its predecessor, which was known as MT4. When it comes to the capabilities of back-testing automated trading algorithms, MT5 is more powerful and more efficient than MT4.

In addition to that, MetaTrader 5 comes with an integrated news feed, market depth indicator, economic calendar, and the capability to trade directly from the charts.

OANDA Platform

This “next-generation” platform is the broker’s offering, and it has won multiple awards. There are a variety of tools available, some of which include advanced charting and transaction management. The trading environment offered by the platform is user-friendly and flexible, making it suitable for investors with varying degrees of expertise.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OANDA Platform

➡️ TradingView

MetaTrader 4

The web-based MT4 trading platform is intuitive, flexible, and fully adjustable, and it comes packed with a wide variety of important trading features. In addition to the benefits that come with having an account, Namibian traders can explore a diverse array of trading possibilities, including the following:

➡️ Access to the market monitor window, which provides price quotes in real-time

➡️ Candlestick charts, bar charts, and line charts that may be shown for a variety of timeframes

➡️ This application has over 20 different drawing tools and over 30 different technical indicators built into the platform.

➡️ You will get access to trading automation that is based on expert advisors (EAs)

MetaTrader 5

The web-based trading platform known as MetaTrader 5 was developed to assist Forex and stock traders in automating their trading activities via the use of trading robots, signals, and fundamental research.

Trading over the web, algorithmic trading, trading via mobile devices, and expert technical analysis are some of the key aspects. Through in-depth price research and accurate forecasting, teams who use MetaTrader 5 can anticipate the moves of the market in the future.

The program gives Namibian users the ability to track all the necessary financial instruments, analyse both short-term and long-term price patterns, and monitor price swings.

OANDA Platform

The WebTrader platform offered by the broker has been recognized with several honours, and it is well-known for its ability to assist traders in locating great trading opportunities.

Traders in Namibia have unrestricted access to various instruments of technical analysis, which enables them to verify their trading ideas and techniques and assists them in making better trading choices.

In addition, traders in Namibia may use the platform provided by the broker to monitor and analyse the performance data of their trades, which assists them in better comprehending the way they engage in trading. Traders may also customize their platform to meet the specific requirements and preferences of their own trading styles.

TradingView

Using either a genuine or trial account, Namibians can begin trading on TradingView’s market-leading charts from the trading platform of their choice instantly. Because the broker cooperates with TradingView, Namibian traders are now able to enjoy the benefits of using both platforms simultaneously.

By integrating an account with TradingView’s platform, Namibians can reap the benefits of TradingView’s community, advanced charting, and analytical tools, in addition to the broker’s transparent pricing, fully automated risk management systems, and market data.

Trading App

➡️ MetaTrader 5

➡️ OANDA Platform

MetaTrader 4 and 5

The MetaTrader 4 and 5 platforms support app development for both iOS and Android. Its capabilities and features are the same as those of the desktop applications, and they include any or all of the following:

➡️ The most accurate pricing available in real-time for all asset categories

➡️ Representations of data in a graphical form that may be used for doing technical analysis

➡️ A user interface that is intuitive and can be adapted to the specific needs of each user

➡️ While you are on the road, keep an eye on live trading, charts, and headlines

OANDA Platform

The mobile app for the broker is an extension of the company’s desktop platform, which is known for its ease of use. In terms of trading functionality, the desktop, and mobile platforms are the same and traders can expect the following features:

➡️ Traders in Namibia have access to the full range of charting choices via the mobile app, in addition to the trading functions that are available on the desktop platform.

➡️ Traders can analyse the outcomes of their transactions. The performance metrics offered by them are an excellent method for monitoring the evolution of trade over time.

➡️ Traders are provided with up-to-the-minute information on the market. The market news feed offered by OANDA includes commentary from market professionals in addition to reporting on all recent occurrences.

Range of Markets

Namibian traders can expect the following range of markets from OANDA:

➡️ Index CFDs

➡️ Forex

➡️ Metals

➡️ Commodity CFDs

➡️ Bonds CFDs

➡️ Precious Metals

➡️ Real-time Rates

What Trading Platforms Does the broker Offer?

The broker offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are widely recognized for their user-friendly interfaces, advanced charting tools, and automated trading capabilities, providing traders with a comprehensive trading experience.

Can I Access OANDA’s Trading Platforms on Mobile Devices?

Yes, they provide mobile trading capabilities through its MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile apps.

Broker Comparison for Range of Markets

| easyMarkets | SuperForex | XM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | No | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | No | Yes |

| ➡️️ Bonds | Yes | No | No |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Trading and Non-Trading Fees

Spreads

OANDA, which is renowned for having minimal spreads, makes it possible to trade all types of financial instruments. According to the broker, spreads may become more widespread at certain times of the day if significant international events or geopolitical events are taking place.

The broker gives traders two different pricing options to choose from spread-only pricing and commission pricing. Because the commission is already included in the spread, spread-only pricing will not result in any extra financial obligations on your part.

Alternately, traders who have accounts that solely allow spread trading may benefit from the smaller spreads. The suitable spread, in addition to any other fees spent by traders, becomes the basis for the calculation of trading expenses.

The following is a list of the typical spreads that traders in Namibia might anticipate seeing:

➡️ Standard Account – from 1 pip

➡️ Core Account – from 0.1 pips

➡️ Swap-Free Account – from 1.6 pips

Commissions

If traders want to use the Core Account, then they will be required to pay a commission fee of $40 for every million dollars that are traded.

Overnight Fees, Rollovers, or Swaps

Traders who use the Swap-free account get access to 26 popular products, each of which is subject to costs ranging from $4 to $7 for each lot sold. The exception to this rule is the Japan 225 Index, which incurs fees per 100 lots traded.

If a Muslim trader leaves their position open for more than five days, they will be subject to the fees that are described above.

Calculating the fees associated with forex pairings involves taking the average of the next SWAP rates offered by the underlying liquidity providers, deducting the instrument-specific admin charge, and then annualizing the resulting value.

The indices reflect the corresponding annual financing rate in addition to the administrative charge of 2.5% of the total amount. This is shown as a negative rate, which results in a charge being applied.

Overall, OANDA does not apply overnight interest on Islamic Accounts but calculates overnight fees for all other accounts as follows:

➡️ Forex and Precious Metals – On long/buy and short/sell positions the rates are calculated using a combination of the next SWAP rates offered by the underlying liquidity providers. These rates are then annualized after being modified by the instrument-specific admin charge.

➡️ Indices – On long/buy positions the rates consist of an administration charge of 2.5% in addition to the relevant annualized financing rate. This is portrayed by a negative interest rate, and hence, a charge. On short/sell positions, when the applicable one-month annualized financing rate is more than the OANDA 2.5% administrative charge, the difference between the two will be annualized and utilized as the rate. This is shown by a positive rate and, thus, a credit.

Deposit and Withdrawal Fees

When you deposit with the broker, there is no fee associated with it; however, there is a fee of $20 associated with bank wire transfers to and from the trading account.

Trading accounts are subject to a monthly inactivity charge once they have been dormant for 12 months. Inactive accounts are subject to a maximum cost of ten dollars per month until the amount in the account reaches zero, at which point the account is cancelled immediately.

Currency Conversion Fees

When Namibian traders deposit or withdraw funds to/from the trading account in any currency other than the accepted account currencies, they are charged a conversion fee.

What Are their Trading Fees?

The broker charges trading fees primarily through spreads, which are the differences between the bid and ask prices of currency pairs.

Does the broker Impose Inactivity Fees or Account Maintenance Fees?

They do not charge inactivity fees or account maintenance fees. This means that traders are not penalized for infrequent trading or for keeping their accounts open without trading activity.

Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

➡️ Local Transfers

➡️ Debit Card

➡️ Credit Card

➡️ Bank Wire

➡️ Bank Transfers

➡️ Skrill

➡️ Neteller

➡️ Mobile Bank Transfers

➡️ International e-Wallets

How to Deposit Funds

To deposit funds to an account, Namibian traders can follow these steps:

➡️ Traders who have not already funded a landing account before can do so by logging in to your portal and selecting “Fund Account” from the menu that appears on the right-hand side of the screen.

➡️ Traders may choose which of the various financing methods they would want to use to add a new bank account to their list of funding possibilities.

➡️ Subsequently, an investment account will be immediately formed once the first deposit has been made into the account.

Fund Withdrawal Process

To withdraw funds from an account, Namibian traders can follow these steps:

➡️ Traders may utilize debit or credit card payments, bank transfers, or other means to withdraw funds from a trading account to their bank account.

➡️ Traders can withdraw funds from a trading account to a landing account. Traders have a responsibility to realize that OANDA’s withdrawal procedures are structured hierarchically.

➡️ This indicates that traders are required to withdraw the total amount of money deposited using each method in the order in which the funds were deposited. For example, traders must first withdraw funds using debit cards, then credit cards, then Skrill, then Neteller, and finally a wire transfer from their bank account.

What Methods Can I Use to Deposit Funds into My Account?

The broker offers several convenient methods for depositing funds into your trading account. These include bank transfers, credit/debit cards, and online payment systems.

Are There Any Fees Associated with Deposits and Withdrawals?

The broker does not charge fees for deposits or withdrawals. However, keep in mind that your bank or payment provider may impose their own fees for transferring funds.

Education and Research

Education

The “Learn” section on their website provides traders with access to a wide variety of instructional resources covering a variety of topics. There are many training videos available, and they cover a wide range of subjects related to trading, such as fundamental analysis, technical indicators, forex/CFD trading, and many more.

The educational videos are organized into categories that are appropriate for beginning, intermediate, and experienced traders. There are trading guidelines available, each addressing a certain kind of trading.

In addition to this, some articles provide explanations of fundamental topics. Individuals who are just beginning their venture into online trading may find these articles to be helpful.

The broker offers the following educational videos and materials:

➡️ Introduction to Trading Analysis

➡️ Introduction to the trading platforms

➡️ Introduction to Capital Management

➡️ Live and Recorded Webinars

Research and Tools

The broker offers Namibian traders the following Research materials and resources

➡️ MetaTrader Premium Tools

➡️ Technical analysis offered by AutoChartist

➡️ VPS

➡️ Economic Calendar

In addition, the broker provides advanced traders with these useful trading tools:

➡️ Advanced Charting Capabilities

➡️ Algo Lab

➡️ Pattern Recognition as well as Price Projection

➡️ Module Linking

➡️ Chart Forum

➡️ Client Sentiment Tools

➡️ Market Calendar

➡️ Market Insights

➡️ Market News as well as Comprehensive Analysis

Advanced Charting Capabilities

On its own Trade platform, it provides an extensive charting suite. Over 65 indicators and drawing tools are included in the charting suite. Customers may place trades straight from the charts. There are around 11 configurable charts, including the Heikin-Ashin, Renko, and many others.

TradingView, a major web-based charting program and social networking site, provides the charting software. TradingView’s charting package has been simply incorporated into the ‘OANDA Trade’ platform by OANDA.

Algo Lab

This module provides access to historical backtesting, coding, and automated trading strategy deployment. QuantConnect, a free algorithmic trading platform for FX and CFD trading, powers it. Clients may use the Algo Lab to backtest OANDA’s tick data dating back to 2004.

In addition, the Algo Lab is accessible in a variety of programming languages, including C#, Python, and F#.

Pattern Recognition as well as Price Projection

The Next Generation trading platform includes a pattern detection feature. It analyses the charts for technical patterns like triangles and wedges, among others. When the patterns are finished, it generates a price projection box that highlights the region where it believes the price movement will go.

Module Linking

This tool allows you to arrange charts together for comparing purposes. This tool is handy for simultaneously studying the same assets over numerous charts, periods, indicators, and so on.

Chart Forum

Traders may debate tactics, share ideas, and share chart analyses in this forum. It is a component of the trading platform Next Generation. Traders may copy analyses, store them, and comment on them.

Client Sentiment Tools

This tool displays the proportion of traders who purchased a certain instrument as well as the percentage who sold the same item. Sentiment research is a popular component of a contrarian trading approach.

Market Calendar

This displays the dates and timings of several worldwide events, as well as their expected market effect. The Next Generation platform streams this calendar, which is powered by Reuters.

Market Insights

This includes daily commentary and video analysis. It is available via the trading platform. The goal is to provide traders with advice on how to proceed according to the analysis and price movements of different assets.

Market News as well as Comprehensive Analysis

Market comments, chart analysis, a weekly forecast, and technical and fundamental analysis are all addressed. This is also developed and delivered by the broker’s analysis team.

Does the broker Provide Educational Resources for Traders?

Yes, OANDA offers a comprehensive range of educational resources to assist traders in enhancing their skills and knowledge. These resources include webinars, tutorials, articles, and guides to help traders improve their understanding of the financial markets.

Does the broker Offer Market Analysis and Research Tools?

Absolutely. OANDA provides traders with access to a variety of market analysis tools and research resources. These include real-time market news, economic calendars, technical analysis, and market insights.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

The broker offers Namibian traders the following bonuses and promotions:

➡️ Welcome Bonus

➡️ Referral Bonus

Does the broker Offer Bonuses or Promotions to Traders?

Yes, OANDA does offer bonuses or promotions to traders.

What Bonuses or Promotions does the broker offer?

The broker offers a welcome bonus as well as a referral bonus to their clients.

How to open an Affiliate Account with OANDA

To register an Affiliate Account, Namibians can follow these steps:

➡️ Namibians can visit the official OANDA website and hover over the “Menu” option next to the OANDA logo on the homepage.

➡️ From the dropdown, select “Partners” under the “About OANDA” section.

➡️ This will open the affiliate page where you can read about the benefits of joining OANDA’s affiliate program.

➡️ You will find a link that will redirect you to the application, or you can scroll down to find the affiliate application on the page.

➡️ You can enter some basic details and provide a user-selected password. In addition, you must provide your company name and website to continue.

➡️ Once you have completed all the required fields, you must read and accept the Payment Disclaimer and the Privacy Policy and confirm that you are not a robot by completing the CAPTCHA.

Affiliate Program Features

Customers of OANDA’s broker affiliate program may earn additional money by bringing in new traders to the platform. Traders might earn between 5% and 15% of the spread of the consumers indicated by this referral scheme.

How Does the brokers Affiliate Program Work?

The brokers Affiliate Program allows individuals and businesses to earn commissions by referring new clients. Affiliates receive a unique tracking link, and they earn commissions based on the trading activity of the clients they refer.

Is There a Minimum Requirement to Join the Affiliate Program?

No, there is no specific minimum requirement to join the Affiliate Program. It is open to individuals and businesses interested in referring clients.

Customer Support

The broker offers multilingual support that can be accessed 24 hours a day, 5 days a week through several diverse ways.

How Can I Contact the brokers’ Customer Support?

You can contact OANDA’s customer support team through various channels, including email, phone, and live chat. They offer 24/5 support to assist you with any trading-related inquiries or issues.

What Languages Does the brokers Customer Support Team Speak?

OANDA’s customer support team is proficient in several languages to accommodate their diverse clientele. They can assist you in languages including English, Spanish, French, German, Italian, Portuguese, Chinese, Japanese, and more, ensuring effective communication and support.

Verdict

OANDA is a brand name that seasoned traders in the foreign exchange industry are familiar with. Its proprietary platform provides traders with an exceptional desktop trading experience.

When combined with superior research and analysis features, it makes the platform an excellent choice for traders who are already familiar with the requirements of trading on the retail foreign exchange market.

According to the broker, its primary objective is to separate itself from the competition by improved transaction execution and transparency, and all available evidence suggests that this objective will be achieved.

They are one of the forex and CFD brokers in the industry that has regulations and authorization through several Tier-1 market regulators, which means that they can be trusted.

you might also like: AvaTrade Review

you might also like: Exness Review

you might also like: HF Markets Review

you might also like: Octafx Review

you might also like: XM Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| OANDA is registered, licensed, and regulated by several Tier-1 regulators | There are no fixed spread accounts offered by OANDA |

| OANDA offers flexible and user-friendly trading platforms, in addition to a proprietary trading platform | There is a withdrawal fee and an inactivity fee |

| There are three dynamic account types to choose from and there is a designated Islamic Account | There is no NAD-denominated account offered to Namibian traders |

| OANDA offers advanced trading tools to more experienced Namibian traders | |

| There is an ultra-low minimum deposit requirement when registering an account with OANDA | |

| There are several trading guides and educational videos offered | |

| There is a selection of reliable deposit and withdrawal options offered | |

| OANDA provides competitive trading conditions |

Min Deposit

0 USD / 0 NAD

Regulators

FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA

Trading Desk

MetaTrader 4, OANDA Platform, TradingView

Crypto

Total Pairs

45

Islamic Account

Trading Fees

Account Activation

Frequently Asked Questions

What is the withdrawal time?

The arrival of your money will often take at least one business day, but more frequently may take several business days depending on the method that you use when withdrawing funds.

Is the broker regulated?

Yes, they are regulated by IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, and BVI FSC.

Does the broker have Nasdaq?

Yes, the broker offers Namibian traders access to Nasdaq under NAS100 as part of its comprehensive indices trading portfolio.

What is the minimum deposit?

OANDA does not have a minimum deposit requirement. However, when you deposit, you can only deposit up to 50% of your net worth.

Can I trade stocks?

Yes, but you cannot buy or sell physical stocks. The broker only offers stocks as contracts for difference, where you can speculate on the price movement of stocks without owning the underlying asset.

Does OANDA allow copy trading?

Yes, OANDA introduced copy trading recently. customers can opt to make use of OANDA’s world-class copy-trading service to help them develop their investment portfolios by copying the trades of experienced experts.

Is there an inactivity fee?

Yes, there is an inactivity fee. When there have been no open transactions on your account for at least a year, you will be subject to a monthly fee equal to 10 units of the currency in which your account is denominated.

Is OANDA safe or a scam?

OANDA is a safe broker with a trust score of 92 out of 100. OANDA is also regulated by eight Tier-1 Regulators (high trust) and two Tier-3 (low trust) market regulators, which forces OANDA to comply with several global regulations.

Does OANDA have Volatility 75?

No, the broker does not currently have Volatility 75 (VIX) but offers AUS200, UK100, and several others.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with OANDA?

➡️ What was the determining factor in your decision to engage with OANDA?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with OANDA such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Corporate Social Responsibility

There is currently no information available on the active CSR projects or initiatives of OANDA.