BDSwiss Review

Overall, BDSwiss is considered low-risk, with an overall Trust Score of 83 out of 100. BDSwiss is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). BDSwiss offers four different retail trading accounts namely a Classic Account, a Premium Account, VIP Account, and a RAW Account. BDSwiss is currently not regulated by the Bank of Namibia

- Louis Schoeman

Updated : March 27, 2024

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Overview

BDSwiss Accepts Namibian Clients and has an average spread of 0.3 pips with a commission of 0.15%. The broker has a maximum leverage ratio up to 1:1000 and there is a demo and Islamic account available. MT4, MT5, and BDSwiss platforms are supported. BDSwiss is headquartered in Seychelles and is regulated by CySEC, FSC, BaFIN, and FSA.

They are an online trading broker with millions of customers worldwide. They were founded in 2012 in Zurich, Switzerland, and have developed to become one of Europe’s major financial organizations specializing in online trading, providing 250+ Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, and CFDs.

They take immense pleasure in providing the greatest trading circumstances available, including innovative trading platforms and superior customer service.

This BDSwiss review for Namibia will provide local retail traders with the details that they need to consider whether BDSwiss is suited to their unique trading objectives and needs.

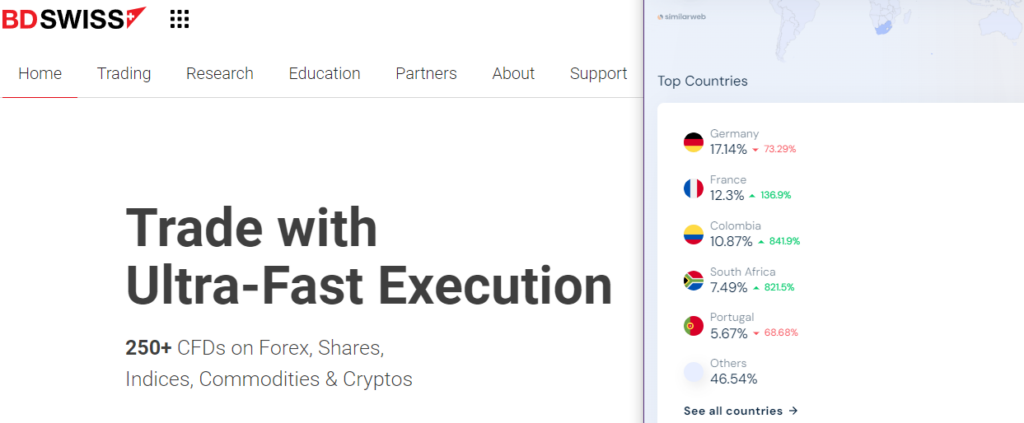

Distribution of Traders

The broker currently has the largest market share in these countries:

➡️️ Germany – 17.14%

➡️️ France – 12.3%

➡️️ Colombia – 10.87%

➡️️ South Africa – 7.49%

➡️️ Portugal – 5.67%

Popularity among traders

🥇 While BDSwiss does not have a significant market share in Namibia, it remains a viable alternative for Namibian traders, ranking among the country’s Top 100 brokers.

What is BDSwiss?

BDSwiss stands as a respected online trading platform, granting access to financial instruments, spanning forex, CFDs, stocks, commodities, and indices.

What sets BDSwiss apart from its peers?

The platform distinguishes itself through transparent customer service and a diverse range of tradable assets.

At a Glance

| 🏛 Headquartered | Seychelles |

| 🏙 Local office in Windhoek? | No |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2012 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube • Blog • Telegram |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA |

| 🪪 License Number | • Cyprus – 199/13 • Mauritius – C116016172 • Germany – 10134687 • Seychelles – SD047 |

| ⚖️ BoN Regulation | None |

| 🚫 Regional Restrictions | The United States, Belgium, and other OFAC sanctioned regions |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | None |

| 🤝 Liquidity Providers | None indicated |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Instant, Market |

| 📊 Average spread | From 0.3 pips |

| 📞 Margin Call | 50% |

| 🛑 Stop-Out | 20% |

| ✅ Crypto trading offered? | Yes |

| 💰 Offers a NAD Account? | No |

| 👨💻 Dedicated Namibian Account Manager? | No |

| 📊 Maximum Leverage | 1:1000 |

| 💰 Minimum Deposit (NAD) | USD 10 / 195 NAD |

| ✅ Namibian Dollar Deposits Allowed? | No, only USD, GBP, EUR |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based BDSwiss customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank wire transfer • Debit Cards • Credit Cards • Skrill • Neteller |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web |

| ✔️ Tradable Assets | • Forex • Commodities • Shares • Indices • Cryptocurrencies |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | No |

| 🗣 Languages supported on Website | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Thai, Vietnamese, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Namibian-based customer support? | No |

| ✅ Bonuses and Promotions for Namibians | None |

| 📚 Education for Namibian beginners | Yes |

| 📱 Proprietary trading software | Yes |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is BDSwiss a safe broker for Namibians? | Yes |

| 📊 Rating for BDSwiss Namibia | 9/10 |

| 🤝 Trust score for BDSwiss Namibia | 78% |

| 👉 Open an account | Open Account |

Regulation and Safety of Funds

Regulation in Namibia

BDSwiss is a subsidiary of a globally operating business headquartered in Zug, Switzerland. The BDSwiss Group is licensed and registered in several different countries, except locally in Namibia by the Bank of Namibia.

Global Regulations

BDS Markets is regulated and approved by the Mauritius Financial Services Commission (FSC).

The Cyprus Securities and Exchange Commission (CySEC) has authorized and licensed BDSwiss Holding PLC. BDSwiss GmbH is BDSwiss Holding PLC’s registered tied agent in Germany, governed by BaFIN with license number 10134687.

Additionally, BDS Ltd. is registered and regulated by the Seychelles Financial Services Authority (FSA) under license number SD047.

BDSwiss Holding PLC is governed by the Markets in Financial Instruments Directive (MiFID), which improves market transparency and harmonizes regulatory disclosure requirements for certain markets in the European Union.

This kind of regulation helps reassure potential customers that they are working with a safe and trustworthy broker.

Client Fund Security and Safety Features

As a regulated investment business, the broker must comply with all applicable European and local rules and regulations governing the provision of investment services, the conduct of investment activities, and the functioning of regulated markets.

BDS does not keep customer cash in the company’s bank accounts. They are separated into top-tier banks to prevent them from being utilized for other purposes, such as operating expenditures. Client monies should be immediately and efficiently accessible for withdrawal.

All customer information is encrypted using innovative security software and is kept encrypted and not shared with other parties.

Is BDSwiss a regulated platform?

Yes, the broker is regulated by the Cyprus Securities and Exchange Commission, ensuring that it complies with stringent financial standards and operates securely and transparently.

How does BDS protect user funds?

The broker prioritizes the safety of funds by employing security measures, including encryption, and holding client funds in segregated accounts.

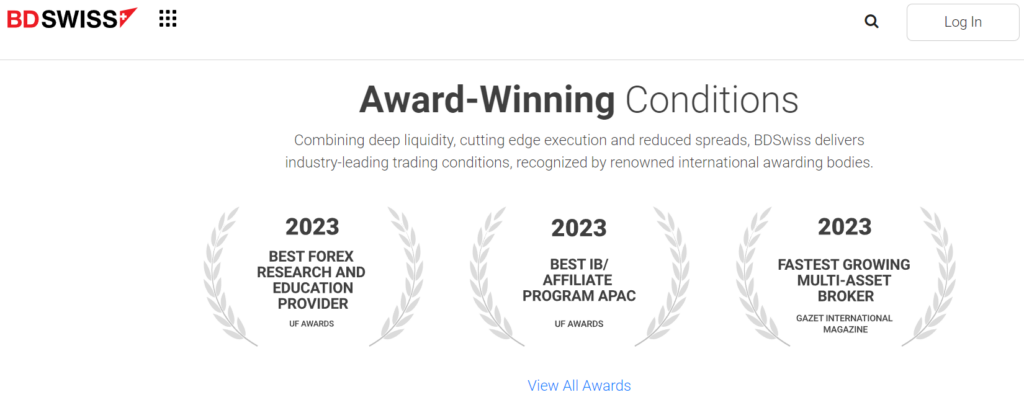

Awards and Recognition

BDS has won several different industry awards during its time in operation, with the most recent as follows:

➡️ In 2021, BDSwiss won the award for being the “Best FX Education & Research Provider”, issued by the World Finance Awards.

➡️ In 2021, the Global Banking and Finance Awards issued BDSwiss the “Best Mobile Trading Platform in Europe” Award.

➡️ In 2020, BDSwiss won the “Best FX & CFD Provider” award which was issued during the International Investor Awards.

Has BDSwiss received any awards for its services?

Yes, they have been recognized with several awards for their outstanding services in the online trading industry.

What are some notable awards won?

BDS has received accolades such as “Best Trading Conditions” and “Best Forex Broker” from prestigious industry awards.

BDSwiss Account Types and Features

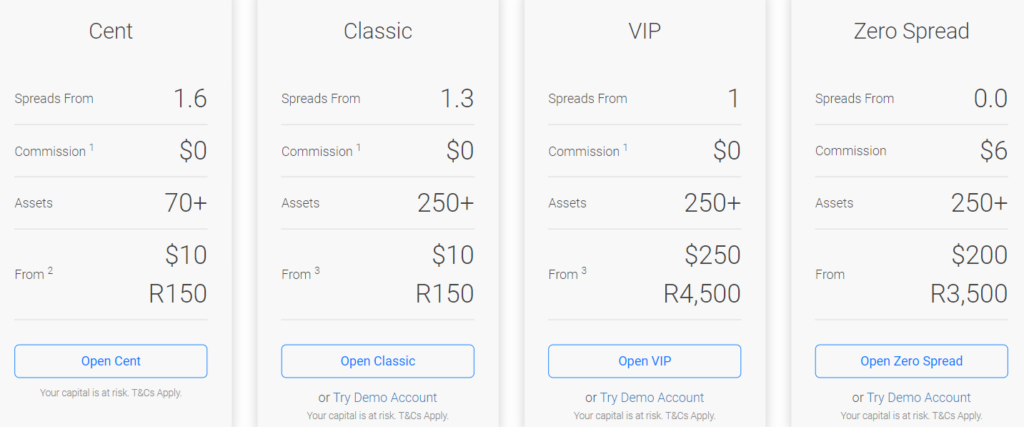

BDS offers Namibian traders a choice between four live trading accounts namely:

➡️ Cent Account

➡️ Classic Account

➡️ VIP Account

➡️ Zero Account

Cent Account

Cent accounts are very similar to standard accounts but instead, traders’ account balance and position size are quoted in cents, rather than dollars, euros, pounds, etc. This means that when a trader deposits the minimum $10 FTD, their balance will be displayed as 1,000 cents in their trading account.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1.6 |

| 📈 Maximum Leverage | up to 1:2000 |

| 💵 Tradable Instruments | 70+ |

| 💸 Available CFDs Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| 💰 Commissions | $0 on all pairs $2 (200CUD) on Indices & 0.15% on Shares |

| 📞 Margin Call | 50% margin level |

| 🛑 Stop-out level | 20% margin level |

| 💻 Platforms available | WebTrader, Mobile App, MetaTrader 4 and MetaTrader 5 |

| 🚨 Trading Alerts | Limited Access |

| 💰 Minimum deposit requirement | USD 10 / 185 NAD |

| 👉 Open an Account | Open Account |

Classic Account

This is a standard and entry-level trading account that is quite popular among average Namibian traders despite their trading styles or experience.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1.3 |

| 📈 Maximum Leverage | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) |

| 💵 Tradable Instruments | 250+ |

| 💸 Available CFDs Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| 💰 Commissions | $0 on all pairs $2 on indices & 0.15% on shares |

| 📞 Margin Call | 50% margin level |

| 🛑 Stop-out level | 20% margin level |

| 💻 Platforms available | WebTrader, Mobile App, MetaTrader 4 and MetaTrader 5 |

| 🚨 Trading Alerts | Limited Access |

| 💰 Minimum deposit requirement | USD 10 / 185 NAD |

| 👉 Open an Account | Open Account |

VIP Account

This is the BDSwiss Professional account, which is designed for experienced traders and investors who require the best possible trading conditions as well as additional features.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1 |

| 📈 Maximum Leverage | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) |

| 💵 Tradable Instruments | 250+ |

| 💸 Available CFDs Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| 💰 Commissions | $0 on all pairs $0 on indices & 0.15% on shares |

| 📞 Margin Call | 50% margin level |

| 🛑 Stop-out level | 20% margin level |

| 💻 Platforms available | WebTrader, Mobile App, MetaTrader 4 and MetaTrader 5 |

| 🚨 Trading Alerts | VIP Access |

| 💰 Minimum deposit requirement | USD 250 / 4,642 NAD |

| 👉 Open an Account | Open Account |

Zero Account

This is a trading account that provides the narrowest spreads for scalpers, day traders, and other high-volume traders who trade at a rapid speed.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 0.0 |

| 📈 Maximum Leverage | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) |

| 💵 Tradable Instruments | 250+ |

| 💸 Available CFDs Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| 💰 Commissions | $6 on all pairs $6 on commodities $2 on indices & 0.15% on shares |

| 📞 Margin Call | 50% margin level |

| 🛑 Stop-out level | 20% margin level |

| 💻 Platforms available | WebTrader, Mobile App, MetaTrader 4 and MetaTrader 5 |

| 🚨 Trading Alerts | VIP Access |

| 💰 Minimum deposit requirement | USD 200 / 3,714 NAD |

| 👉 Open an Account | Open Account |

Base Account Currencies

With BDS, Namibian traders can only register a trading account with USD, GBP, or EUR as their base account currency.

This is a frustrating limitation in comparison to many other foreign brokers since it means that Namibians, who have bank accounts denominated in NAD, may have to pay conversion fees on all deposits and withdrawals.

Trading may become costly due to conversion costs, which are often hidden from view on the fee report but have an impact on profitability.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and the broker offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

BDS also offers a Forex or CFD “Demo Account,” which allows inexperienced traders to put their trading talents to the test on risk-free Demo accounts with changeable virtual balances of up to 100,000€/$/£ in value.

BDS customers may open any kind of account provided by BDSwiss, including Classic, Raw, VIP, and Premium (under FSC only) as a Demo Account, allowing them to experiment with the tools, conditions, and spreads that are available.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

Muslim traders in Namibia may convert their Classic, Premium, or VIP accounts to Islamic Accounts, which frees them from overnight costs.

What types of accounts does BDS offer?

The broker provides various account types to cater to the diverse needs of traders. Each account offers different features and trading conditions to accommodate different trading styles and preferences.

What are some key features of the trading accounts?

The trading accounts come with a range of features, including access to a broad selection of financial instruments such as forex, CFDs, stocks, commodities, and indices.

How to open an Account

To register an account with BDSwiss, Namibian traders can follow these steps:

Step 1 – Go to the BDSwiss website to sign up.

➡️ You can click on any website button to go to the registration page.

Step 2 – Fill in your details as requested.

➡️ Provide your personal information to complete the registration process.

Step 3 – Submit document requests for validation.

➡️ This is a mandatory step for all traders to complete the registration process.

BDSwiss Vs Exness Vs IC Markets – Broker Comparison

| BDSwiss | Exness | IC Markets | |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | ASIC, CySEC, FSA, SCB |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web | MetaTrader 4, MetaTrader 5, Exness App, Exness Terminal | MetaTrader 4, MetaTrader 5, cTrader |

| 💰 Withdrawal Fee | Yes, <100 EUR withdrawals | No | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | USD 10 / 185 NAD | USD 10 / 185 NAD | USD 200 / 3,738 NAD |

| 📈 Leverage | Up to 1:1000 | Unlimited | 1:500 |

| 📊 Spread | From 0.3 pips | Variable, from 0.0 pips | From 0.0 pips |

| 💰 Commissions | $2 to $5 | From $0.1 per side, per lot | From $3 to $3.5 |

| ✴️ Margin Call/Stop-Out | 50%/20% | 60%/0% | 100%/50% |

| ✴️ Order Execution | Instant/Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes | Yes | No |

| 📈 Account Types | Cent, Classic, VIP and Zero Accounts. | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account | cTrader Account, Raw Spread Account, Standard Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | No | No |

| 📊 Namibian Dollar Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 4 | 5 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

Trading Platforms

BDS offers Namibian traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ BDSwiss Mobile

➡️ BDSwiss Web

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

Because of its innovative technology and user-friendly interface with an abundance of features, the MT4 is ideal for traders of any experience level.

It has real-time quotes, customizable charts with numerous timeframes and various technical indicators, several trade order/execution types, notifications, a news feed, automated trading, and many other features.

In addition, Namibian traders can easily carry out in-depth market research and trading thanks to the availability of all necessary instruments.

MetaTrader 5

MetaTrader 5 is the successor of MT4 and offers a few new features, including more complex trading tools and indicators, to help with market analysis and trade, yet the overall layout and feel are like that on MetaTrader 4, giving Namibian traders some familiarity.

Advanced order kinds, over 80 technical indicators, over 40 analytical objects, different charting/analytic choices, and more timeframes are among the additional features.

An improved trading experience with MT5 and an expanded selection of trading instruments in additional markets are available to BDS customers.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ BDSwiss Web

MetaTrader 4

The brokers’ innovative technology has converted the MetaTrader MT4 platform into a user-friendly trading platform for traders of all skill levels.

BDSwiss’ Forex MT4 offers Namibian traders all that they could need to start participating in forex and CFD trading.

Materials and tools are provided for studying the price dynamics of financial instruments, making trades, and amending them, as well as for designing and using automated trading algorithms (also known as Expert Advisors).

MetaTrader 5

The MT5 trading platform from BDSwiss provides Namibian traders with a lot more features than MetaTrader 4 does. The BDSwiss MT5 platform contains all the pioneering features of MT4, but it also offers more advanced trading tools and indicators that help traders maintain more control over their trades and make better decisions based on new and comprehensive research.

BDSwiss Web

In-house BDS WebTrader is a simple, fast, and reliable trading platform that can be used on any browser and operating system without the need for any other software.

Many tools and indications are available, as well as an order window that may be tailored to suit your needs. Additionally, BDS App and MetaTrader 4 are fully interoperable, and BDS Web is available in over 24 languages.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ BDSwiss Mobile

MetaTrader 4

Mobile trading using MetaTrader 4’s BDS app gives Namibian traders unrestricted access to a broad variety of financial products. Different MetaTrader 4 functionalities and features have been enhanced for mobile trading from all over the globe.

MetaTrader 5

BDS customers may now trade a wider choice of CFD instruments across several asset classes using the MT5 mobile app, which provides a better trading experience thanks to its adjustable settings, lack of strategy limits, reduced slippage, and lightning-fast order execution.

BDSwiss Mobile

Users of BDS Mobile can effortlessly access, monitor, and manage their trading positions while on the go thanks to an easy user interface. The same market monitoring and trading tools that are available on the web-based platform are also available to Namibians.

To make deposits and withdrawals, traders may use the trading account dashboard. There are no restrictions on the kind of assets that may be traded. The BDSwiss mobile app may be downloaded from the Android and iOS app stores.

Which trading platforms does the broker offer?

They provide a user-friendly trading experience through their proprietary platform, BDSwiss WebTrader, and the popular MetaTrader 4 platform.

What features are available on the trading platforms?

The trading platforms offer a range of features, including real-time market quotes, advanced charting tools, technical analysis indicators, and the ability to execute trades seamlessly.

Range of Markets

Namibian traders can expect the following range of markets:

➡️ Forex

➡️ Commodities

➡️ Shares

➡️ Indices

➡️ Cryptocurrencies

What financial instruments can I trade with BDSwiss?

BDSwiss offers a diverse array of financial instruments for trading. Traders can participate in the dynamic world of forex by engaging in transactions with currency pairs.

Does BDSwiss support cryptocurrency trading?

BDSwiss extends its support to cryptocurrency trading, providing users with the ability to trade popular digital assets like Bitcoin and Ethereum.

This inclusion of cryptocurrencies adds a modern and dynamic dimension to the range of tradable instruments offered.

Broker Comparison for Range of Markets

| BDSwiss | Exness | IC Markets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

BDSwiss Trading and Non-Trading Fees

Spreads

The spreads charged by BDS are dynamic, meaning they change based on the kind of account, the financial instrument, and the market conditions of the day. Investors in Namibia might expect to see the following spreads:

➡️ Classic Account – 1.5 pips EUR/USD

➡️ Premium Account – 1.1 pips EUR/USD

➡️ VIP Account – 1.1 pips EUR/USD

➡️ RAW Account – 0.3 pips EUR/USD

Commissions

Because of this, BDS charges fees on some accounts and financial products. This list of fees varies by account type and should be considered by traders. Typical commissions that Namibian traders can expect include:

➡️ Classic Account – $2 on indices and 0.15% on shares

➡️ VIP Account – 0.15% on shares

➡️ RAW Account – $2 on indices, $5 on forex pairs, 0.15% on shares

Overnight Fees, Rollovers, or Swaps

When Namibian traders leave positions open after 24 hours, they are either debited or credited overnight fees. These are according to the financial instrument being traded, the position size, the holding time, and overall market conditions.

Some typical overnight fees that Namibian traders can expect, which are subject to change, include the following:

➡️ GBP/USD – a short swap of -0.7 and a long swap of -6.7

➡️ USD/JPY – a short swap of -10.8 and a long swap of 0.05

➡️ USD/HKD – a short swap of -8.5 and a long swap of -20.0

➡️ USOIL – a short swap of -23.0 and a long swap of -39.0

➡️ XAU/USD – a short swap of -3.5 and a long swap of -8.2

➡️ XAG/USD – a short swap of -0.05 and a long swap of -0.25

➡️ Stocks – a short swap of -2.0 and a long swap of -4.0

➡️ NAS100 – a short swap of -4.1706 and a long swap of -3.2694

➡️ Cryptocurrencies – short swaps of -100% and long swaps of -100%

Deposit and Withdrawal Fees

The broker does not charge any fees for deposits except a charge of 10 EUR for any withdrawal that is less than 100 EUR.

Inactivity Fees

If a BDSwiss account is inactive for more than three months, BDS imposes a 10% inactivity fee.

Currency Conversion Fees

It is necessary to pay currency conversion fees if deposits are made by Namibian traders in a currency other than the British pound, the euro, or the US dollar.

What fees should I be aware of when trading with BDSwiss?

The broker maintains transparency in its fee structure, ensuring users are well-informed about the costs associated with trading. The specific trading fees can vary based on factors such as the chosen financial instrument and the type of account.

Are there fees for depositing and withdrawing funds with BDS?

The broker typically does not charge fees for deposits, but fees may apply to certain withdrawal methods or if there are currency conversions involved.

Min Deposit

USD 10 / 195 NAD

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Trading Fees

Account Activation

BDSwiss Deposits and Withdrawals

The broker offers the following deposit and withdrawal methods:

➡️ Bank wire transfer

➡️ Debit Card

➡️ Credit Card

➡️ Skrill

➡️ Neteller

What methods are available for depositing funds into my BDSwiss account?

The broker offers a variety of convenient deposit methods, including bank wire transfers, credit/debit cards, and popular e-wallets.

How do I withdraw funds from my trading account?

To initiate a withdrawal, users can log in to their BDSwiss account, proceed to the “Withdrawal” section, and follow the provided instructions. The withdrawal process is intentionally designed to be user-friendly, with clear guidance throughout the necessary steps.

How to Deposit Funds

To deposit funds to an account, Namibian traders can follow these steps:

Step 1 – Log into your account.

➡️ Log into your BDSwiss account using your credentials.

Step 2 – Choose a trading account.

➡️ Choose the trading account that you want to fund by clicking on “Payments” followed by “Deposit.”

Step 3 – Select a deposit amount.

➡️ Indicate the amount that you want to deposit.

Fund Withdrawal Process

To withdraw funds from an account, Namibian traders can follow these steps:

Step 1 – Log into your account.

➡️ Log into your BDSwiss profile and select “Payments” followed by “Withdraw.”

Step 2 – Choose an account.

➡️ Select the account from where you want to withdraw funds along with the amount to be withdrawn.

Step 3– Select a withdrawal method.

➡️ Proceed to the next step which allows you to choose your preferred withdrawal method, considering that BDSwiss could require additional proof that the account is in your name.

Education and Research

Education

The broker offers the following Educational Materials:

➡️ A learning centre

➡️ Forex eBooks

➡️ Live Education

➡️ Forex Basic Lessons

➡️ Forex Glossary

➡️ Educational Videos

➡️ Seminars

The broker offers Namibian traders the following Research and Trading Tools:

➡️ Daily Analysis of the markets

➡️ Technical Analysis

➡️ VPS Service

➡️ Trade Comparison

➡️ Trend Analysis

➡️ Daily Videos

➡️ Weekly Outlook

➡️ Market Insights

➡️ Special Reports

➡️ Analyst financial commentary

➡️ Live Daily Webinars

➡️ Economic Calendar

➡️ Trading Central

➡️ AutoChartist

➡️ Real-Time Trading Alerts

➡️ Currency Heatmap

➡️ Trading Calculators

Does BDS offer educational materials for traders of all levels?

Yes, the broker is committed to empowering traders with educational resources. The platform provides a range of materials, including webinars, video tutorials, articles, and interactive courses.

What research tools and market insights are offered?

The broker provides traders with an extensive set of research tools, including daily market analysis, economic calendars, and live market news.

Bonuses and Promotions

The broker does not currently offer Namibian traders any bonuses.

Affiliate Program Features

Members of the BDS network may have a substantial online presence, such as a blog, social media account, Forex educational centre, or other digital media. The affiliate program allows you to earn money while advertising BDSwiss’ goods and services to your intended audience.

Affiliates may promote the broker using a range of marketing and tracking methods. To benefit from the affiliate’s impact, partners must be aware of BDSwiss affiliate commission options.

The broker offers its associates the following perks:

➡️ High conversion rates (37%), speedy referral onboarding, specialist contact centres, and several local and international payment methods all contribute to its success.

➡️ Multi-product solutions include over 250 CFDs and assets from several asset classes. Multi-award-winning platforms are accessible on many devices.

➡️ 100% response rate in 13 seconds or less. Affiliate managers and VIP account managers are available.

➡️ BDSwiss delivers independent mobile traffic monitoring, speedy and detailed reporting performance, and other features.

What steps do I need to take to become a part of the Affiliate Program?

Start by visiting the BDSwiss website and locate the “Affiliate Program” section. Once there, carefully follow the provided instructions to complete the registration process.

This typically involves providing necessary information and agreeing to any terms and conditions outlined by the affiliate program.

What resources and tools are available for affiliates to promote BDSwiss effectively?

The broker equips its affiliates with a range of marketing tools, including banners, tracking links, widgets, and other promotional materials.

How to open an Affiliate Account

To register an Affiliate Account, Namibians can follow these steps:

Step 1 – Click on the “Partners” section.

➡️ Navigate to the official BDSwiss website and navigate to the “Partners” tab on the homepage, at the top of the main menu.

Step 2 – Select the “Start Now” button.

➡️ A new page will load to the Partner Page where prospective affiliates can select “Start Now.”

Step 3 – Choose a program.

➡️ Affiliates can choose their preferred program and click on “Register.”

Step 4 – Complete the form.

➡️ Next, affiliates can complete the registration form and submit it to BDSwiss’ customer support.

Customer Support

The broker is well-known for its award-winning customer support that can be reached over several communication channels.

In what languages does BDSwiss provide customer support?

The broker offers customer support in multiple languages. Understanding the importance of effective communication, the support team is skilled in languages including English, German, Spanish, French, and many others.

What are the available channels for reaching BDSwiss customer support?

The broker provides multiple channels for customer support. Traders can contact the support team through live chat on the website, email, or phone.

Verdict

BDSwiss is a multi-regulated and award-winning broker offering a wide selection of trading products. They have won various industry accolades for their effective operating and trading technology investments.

The proprietary trading app and overall trade execution are both highly praised by BDSwiss, indicating its sustainable trading conditions.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Namibians can trade more than 250 financial instruments with BDSwiss | There is an inactivity fee charged on dormant accounts |

| BDSwiss is well-regulated and guarantees client fund security | There is a currency conversion fee when Namibian traders deposit or withdraw in NAD |

| Free VPS is available to eligible clients | There is no NAD-denominated account offered to Namibian traders |

| There are daily trading alerts that keep Namibian traders updated on daily market movements | The proprietary trading platform does not have a desktop terminal |

| There are free webinars offered to beginner traders along with a comprehensive trading academy | |

| There are commission-free trading options offered | |

| There is a choice between trading accounts | |

| BDSwiss offers a transparent fee schedule on trading and non-trading fees |

you might also like: FxPro Review

you might also like: FBS Review

you might also like: IC Markets Review

you might also like: JustMarkets Review

you might also like: Trade Nation Review

Frequently Asked Questions

Is BDS regulated?

Yes, BDS is regulated by one Tier-1, one Tier-2, and two Tier-3 market regulators namely BaFIN, CySEC, FSA, and FSC, respectively.

Does BDSwiss have Volatility 75?

No, the broker does not offer Volatility 75. However, they offer a wide range of other indices that can help Namibian traders diversify their investment and trading portfolio.

Is it easy to withdraw funds from BDSwiss?

Yes, it is easy to withdraw funds from BDSwiss because there are several payment methods supported.

Does BDSwiss have Nasdaq?

Yes, BDSwiss offers NAS100 which can be traded from 0.01 points per lot with zero commissions and a margin requirement of 1%.

How long do withdrawals take with BDSwiss?

All withdrawals are processed within 48 hours. Depending on the withdrawal method you chose it could take from a day up to 10 days for funds to reflect in your bank account.

Is BDSwiss good for beginners?

Yes, in terms of ease of use and educational materials, BDSwiss is an excellent choice for novice traders. However, certain costs with the Classic account are hefty.

For more experienced traders, VIP and Raw accounts provide better pricing and access to more complex tools.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Corporate Social Responsibility

BDS is a firm devoted to social responsibility. BDSwiss does this by instilling philanthropic values in employees and establishing a culture that supports important global and local initiatives focused on positive change.

As part of their CSR initiatives, BDSwiss gave €5,000 to the “Elpida” Foundation for Children with Cancer & Leukaemia in December 2021. This kind of contribution helped the hospital provide financial and emotional assistance to cancer patients and their families.

On December 10, 2021, BDSwiss sponsored a blood donation drive in Limassol as part of its ongoing corporate social responsibility. BDS employees, colleagues, friends, and family members donated blood and organized the camp.

What are BDSwiss’ Corporate Social Responsibility initiatives?

The broker actively participates in various initiatives. These efforts encompass promoting financial literacy through educational programs, contributing to charitable causes, and adhering to ethical business practices.

Is BDS actively involved in promoting environmental sustainability?

Yes, they are dedicated to environmental sustainability. The company implements eco-friendly practices in its operations, such as adopting energy-efficient technologies and reducing its carbon footprint.