FXView Review

FXView is a low-risk broker that provides online trading in several financial markets. Most customers rate FXView 8/10 for excellent trading conditions and fast trade execution. The broker welcomes Namibians and provides an immersive trading experience.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

934 NAD / 50 USD

Regulators

CySEC, FSCA, FSC, SEBI

Trading Desk

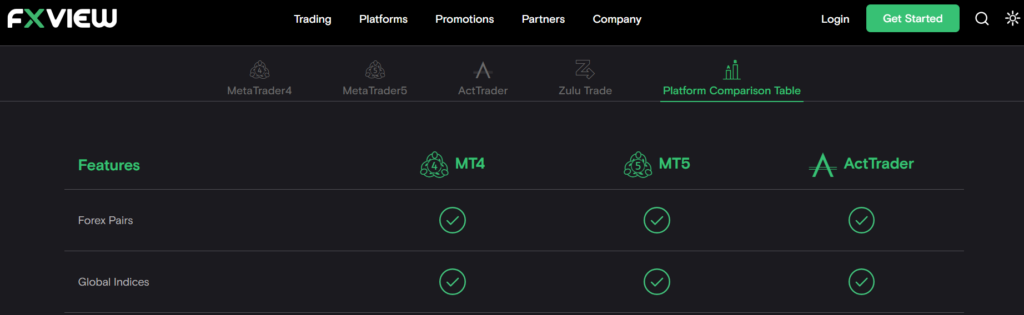

ActTrader, MetaTrader 4, MetaTrader 5, ZuluTrade

Crypto

Total Pairs

70

Islamic Account

Trading Fees

Account Activation

Overview

Established in 2009, it has become a major participant in the competitive forex and CFD brokerage market. They differ from competitors by emphasizing fair trade practices and leveraging cutting-edge technologies.

FXView gives Namibian traders access to global financial markets in settings suited for new and seasoned investors.

Notably, FXView provides multi-currency accounts, including Namibian dollars, demonstrating their commitment to fulfilling local demands and lowering currency conversion expenses for Namibian customers.

Since the start, FXView has been recognized for combining robust trading platforms such as MetaTrader 4 and MetaTrader 5.

These systems are noted for their easy-to-use interfaces and powerful analytical features, making them perfect for Namibia’s diversified trading community. They enable both novice and experienced traders to traverse financial markets confidently.

Our review recognizes FXView’s efforts to provide instructional tools, especially useful for Namibian traders wishing to broaden their market knowledge and enhance their trading abilities.

Furthermore, FXView’s compliance with respectable bodies such as CySEC and FSCA proves their dedication to upholding high industry standards. This, along with reasonable spreads and adjustable leverage ratios, makes FXView a compelling choice for Namibian traders.

Today, FXView is recognized as a brokerage that has not only weathered market swings but also adapted to the changing demands of traders.

Their ongoing emphasis on technology innovation and customer service quality appeals to Namibian traders looking for a reliable and forward-thinking partner.

Our detailed evaluation demonstrates that FXView’s solutions are intended not just for trading but also to provide Namibian traders with a seamless, secure, and advantageous trading environment.

Is FXView regulated in Namibia?

No, FXView is not locally regulated in Namibia, but it possesses licenses from recognized regulatory authorities like CySEC, FSCA, FSC, and SEBI, assuring compliance with worldwide standards.

Which languages are offered by the FXView website for Namibian users?

The FXView website is available in English, making it easy for Namibian traders to explore and acquire information.

At a Glance

| 🗓 Established Year | 2009 |

| ⚖️ Regulation and Licenses | CySEC, FSCA, FSC, SEBI |

| 🪪 Ease of Use Rating | 4/5 |

| 🚀 Bonuses | Yes, 100% deposit bonus, loyalty program, referral bonus |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | ActTrader, MetaTrader 4, MetaTrader 5, ZuluTrade |

| 💻 Account Types | Zero Commission, Raw ECN, Premium ECN |

| 💰 Base Currencies | EUR, USD, GBP, AUD, CAD, ZAR |

| 📈 Spreads | 0.0 pips |

| 📉 Leverage | 1:500 |

| 💸 Currency Pairs | 70; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 934 NAD / 50 USD |

| 🛑 Inactivity Fee | None |

| 📞 Website Languages | English, Spanish, Chinese, Arabic, Vietnamese, German |

| ✔️ Fees and Commissions | Spreads from 0.0 pips; commissions from $1 per 100,000 USD traded |

| ✅ Affiliate Program | Yes |

| 🚫 Banned Countries | United States, North Korea, Sudan, Cuba, Myanmar, India, Syria, and others |

| 👨💻 Scalping | Yes |

| 👥 Hedging | Yes |

| 🏦 Trading Instruments | Forex, commodities, cryptocurrencies, indices, stocks |

| 👉 Open an account | Open Account |

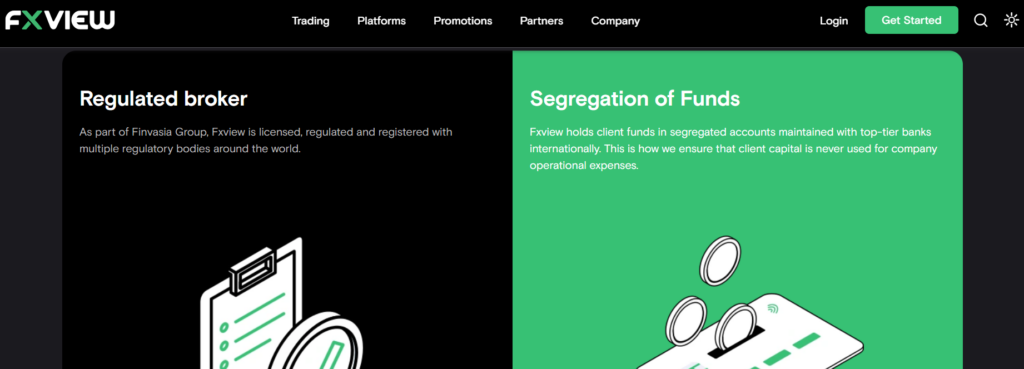

Regulation and Safety of Funds

Our investigation of FXView’s safety features revealed that, despite the lack of Namibian regulation, the broker is deeply dedicated to trader protection by adhering to rigorous international regulatory requirements.

Financial Sector Conduct Authority (FSCA) and Cyprus Securities and Exchange Commission (CySEC) regulations add credibility to FXView and guarantee compliance with international financial regulations and standards.

FXView also enforces the segregation of customer money. An important protection against fraud and bankruptcy is that trader money is not mixed up with the broker’s operating capital.

Additionally, we saw that FXView is part of a compensation fund, which provides traders with an extra layer of protection in case their broker goes bankrupt.

Regarding online safety, we can affirm that FXView uses SSL encryption to encrypt sensitive data before sending it, lowering the probability of cyber-attacks.

To further strengthen account access against unauthorized users, two-factor authentication (2FA) is utilized. This adds another layer of protection.

These steps are part of FXView’s effort to create a safe trading environment, which is very important for Namibian traders involved in international markets.

Regulation in Namibia

FXView is not currently regulated by the Bank of Namibia (BoN). However, FXView’s global regulations are listed in the table below.

Global Regulations

⚖️ Registered Entity 🏦 Country of Registration 🪪 Company Reg. ✅ Regulatory Entity 🛍 Tier 🤝 License Number/Ref

FXView Europe under Charlgate Limited Cyprus 372060 CySEC 1 367/18

Finvasia Securities Private Limited India INZ000176037 SEBI 4 Reg. INZ000176037

Finvasia Capital Ltd Mauritius – FSC 4 IK21000018

Orivest Proprietary Limited South Africa 2018/30345/07 FSCA 2 FSP50410

Protection of Client Funds

🚫 Security Measure 🪪 Information

Segregated Accounts Yes

Compensation Fund Member No

Compensation Amount None

SSL Certificate Yes

2FA (Where Applicable) Yes

Privacy Policy in Place Yes

Risk Warning Provided Yes

Negative Balance Protection Yes

Guaranteed Stop-Loss Orders No

Is FXView permitted to operate in Namibia?

Yes, it is. FXView is not officially regulated in Namibia, but it conforms to global regulatory requirements that make it a safe and reliable broker for Namibians.

How transparent are FXView’s trading activities in Namibia?

Extremely transparent. FXView maintains high levels of transparency by displaying comprehensive trading conditions and financial reports on the official website.

Awards and Recognition

According to our research, we found the following awards that FXView has won recently:

➡️Receiving the prestigious “Best CFD Broker” accolade at the Dubai Forex Expo in 2023.

➡️Being crowned “Best Global Broker” by the UF Awards Global in 2023.

➡️Receiving the “Best ECN/STP Broker” award at the 2024 MEA UF Awards.

➡️Achieving the prestigious “Best Multi-Asset Broker” award at the 2023 FMAS.

➡️Being awarded the “Most Trusted Broker” at the Ultimate Fintech Awards in 2022.

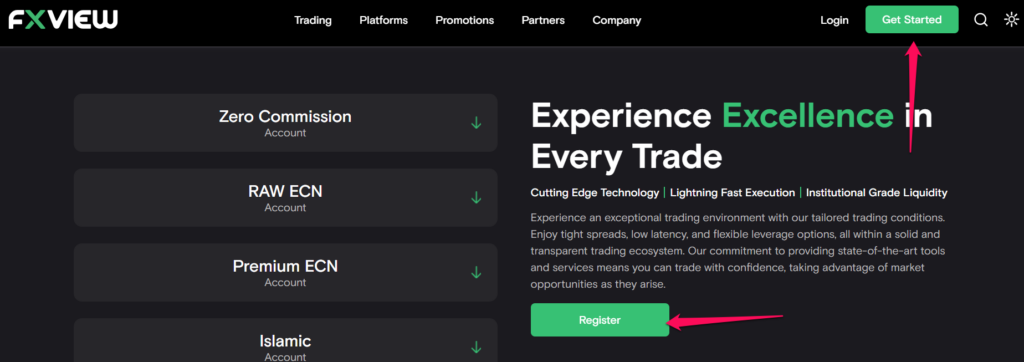

FXView Account Types

Zero Commission Raw ECN Premium ECN

✔️ Availability All; ideal for casual traders and beginners All; ideal for experienced traders All; ideal for scalpers and high-volume traders

💵 Markets All All All

💰 Commissions None; only the spread is charged $2 per 100,000 USD traded, per side $1 per 100,000 USD traded, per side

💻 Platforms All All All

🔨 Trade Size From 0.01 to 100 lots From 0.01 to 100 lots From 0.01 to 100 lots

📊 Leverage Up to 1:500 Up to 1:500 Up to 1:500

💸 Minimum Deposit 934 NAD / 50 USD 934 NAD / 50 USD 93,350 NAD / 4927 USD

👉 Open an account Open Account Open Account Open Account

Demo Account

Traders from Namibia can use the FXView Demo Account as a practice ground. You may test it out for 30 days with $100,000 in virtual funds, just as in the real market.

This provides a risk-free environment where traders of all experience levels may practice and perfect their craft. This is an excellent opportunity for Namibian traders looking to gain experience and self-assurance before entering the actual trading arena.

Zero Commission Account

An FXView Zero Commission Account is a great choice for those in Namibia who are trying to save money. Casual traders and beginners will appreciate it because there are no transaction costs (other than spreads), and leverage goes up to 1:500.

The fact that there is a low 973 NAD deposit makes it available to everyone. The Zero Commission is a good starting point for foreign exchange and contracts for difference (CFD) trading since traders may use it to buy and sell various assets.

Raw ECN Account

With a $2 commission fee per $100,000 moved per side and low spreads starting at 0.0 pips, the Raw ECN Account is perfect for experienced traders in Namibia.

Catering to active traders who appreciate quick execution and direct access to the market, it’s all about efficiency and transparency. Ideal for those looking to maximize their trading success, it offers a choice of trading instruments and leverage possibilities.

Premium ECN Account

Professional traders in Namibia can benefit from a high-level trading experience with the Premium ECN Account.

We found that this account is optimized for heavy traders because of its low fee charge of $1 for every $100,000 transacted and spreads as low as 0.0 pips. Traders with sophisticated trading strategies and a need for a powerful platform to back their market moves are best suited for this account type.

Islamic Account

FXView strives to welcome all traders, thus they provide the Islamic Account to the Muslims of Namibia.

With this account, Muslim traders can open and hold overnight positions without swap costs with this Sharia-compliant account.

The FXView Islamic Account exemplifies the broker’s dedication to diversity and inclusion, letting Muslim traders participate in the foreign exchange markets without compromising their religious convictions.

Does FXView have any account limits depending on trading volume for Namibian traders?

No, FXView’s account types are open to all Namibian traders, with no limits on trading volume, ensuring equitable trading possibilities.

Can Namibian traders change their leverage levels using FXView account types?

Yes, FXView provides leverage of up to 1:500 across all account types, allowing Namibian traders to tailor leverage to their risk tolerance and trading strategy.

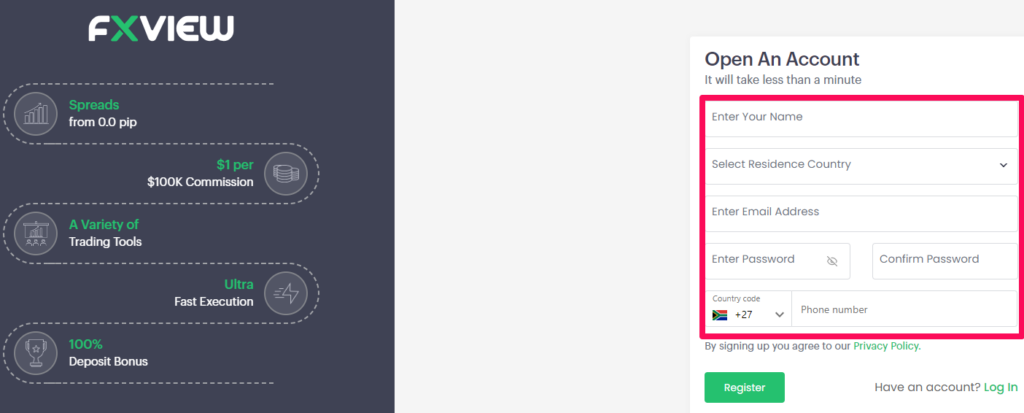

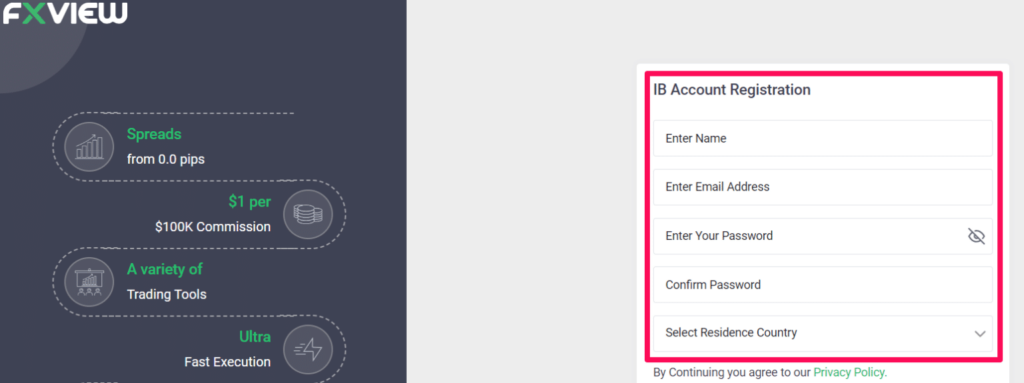

How To Open a FXView Account

To register an account with FXView, follow these steps:

Step 1 – Click on the Register option.

Find the “Open an Account” button on the official FXView website and click it to start the account registration procedure.

Step 2 – Fill out the form.

After you’ve entered your complete name, email address, and other contact information into the registration form, be sure to set a strong password to protect your new FXView account.

Step 3 – Submit the required documents.

Submit the required identity documents (usually a government-issued ID and a current utility bill or bank statement for verification of address) to meet the requirements of Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

FXView vs. FXPesa vs. CPT Markets – Broker Comparison

| FXView | FXPesa | CPT Markets | |

| ⚖️ Regulation | CySEC, FSCA, FSC, SEBI | FCA, CMA | FCA, FSCA, IFSC |

| 📱Trading Platform | MetaTrader 4 MetaTrader 5 ActTrader | MetaTrader 4 MetaTrader 5 Equiti Trader App | MetaTrader 4 MetaTrader 5 cTrader |

| 💰 Withdrawal Fee | No | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Min Deposit | 960 NAD ($50) | 96 NAD ($5) | 0 NAD ($0) |

| 📈 Leverage | 1:500 | 1:400 | 1:1000 (IFSC) 1:500 (FSCA) 1:30 (FCA) |

| 📊 Spread | From 0.0 pips | 0.0 pips | From 0.0 pips |

| 💰 Commissions | From $1 per lot | $7 | From $4 |

| ✴️ Margin Call/Stop-Out | 70%/50% | 100%/30% | 100% – 50% (M) 50% – 30% (S/O) |

| ✴️ Order Execution | ECN | Market | Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Zero Commission RAW ECN Premium ECN | Executive Account Premiere Account | Classic Account Standard Account ECN Account Prime Account Platinum Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | No | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/6 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 2 | 5 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 150 lots | Unlimited |

| 💸 Minimum Withdrawal Time | 1 day | Instant | Instant |

| 💰Maximum Estimated Withdrawal Time | 1 day | Up to 15 working days | 3 – 7 days |

| 📞 Instant Deposits and Instant Withdrawals? | Yes, deposits | Yes | Yes |

| 🎉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms and Software

MetaTrader 5

Our evaluation of MT5 within the FXView ecosystem revealed a sophisticated and ever-changing trading environment. What stood out to us was how accurately MT5 displayed FXView’s competitive spreads, which began at 0.0 pips.

For traders in Namibia who need to respond quickly to changes in the market, the platform’s faster execution speeds are a perfect match with FXView’s claim of rapid transaction execution.

With FXView’s extensive instrument offering, which includes 70 currency pairings and a diversified variety of equities, we could trade across numerous asset classes.

In addition, we performed thorough market studies with the help of MT5’s improved charting capabilities. These tools are essential when using FXView’s high-leverage alternatives.

ZuluTrade

We had an exceptional experience with ZuluTrade. We could access FXView’s zero-commission accounts and other competitive trading conditions through this portal, allowing us to start social trading easily.

With ZuluTrade, Namibians can easily track and duplicate the transactions of expert traders worldwide. The client-centric strategy of FXView is well-complemented by ZuluTrade, which is ideal for traders who want an immersive approach or want to learn from experienced investors.

In addition, we found that traders could save money and have a dynamic trading experience by combining ZuluTrade’s community insights with FXView’s raw ECN account conditions.

ActTrader

The level of personalization and flexibility became apparent while investigating ActTrader. By integrating it with its broad asset offerings and adjustable leverage, FXView has fully used this platform’s potential.

The intuitive design of ActTrader’s user interface allowed us to effortlessly handle our transactions and access the diverse range of markets provided by FXView.

We could implement intricate strategies at the prices we wanted by utilizing the platform’s cutting-edge ‘IFO’ (If Done Order) function, which lets you put up contingent orders in conjunction with FXView’s ECN pricing mechanism.

MetaTrader 4

Working with FXView’s MetaTrader 4 (MT4) trading platform should give Namibians a comforting feeling of efficiency and familiarity.

Although MT4 is renowned for its stability and dependability, we discovered that FXView’s lack of an inactivity fee enhanced the platform’s functioning for traders in Namibia.

Namibians will value this synergy throughout testing since it permits a patient trading strategy that is not constrained by the pressure of increased costs during inactivity.

The combination of FXView’s trader-friendly conditions with MT4’s well-established interface provides a dependable and cost-effective trading experience for traders in Namibia.

Does FXView provide a web-based trading platform for Namibian traders?

Yes, FXView offers a user-friendly web-based trading platform for Namibian traders who want to trade straight from their internet browsers.

Are there any costs for using FXView’s trading platforms in Namibia?

FXView does not charge fees for utilizing their trading platforms; thus, Namibian traders may access them for free.

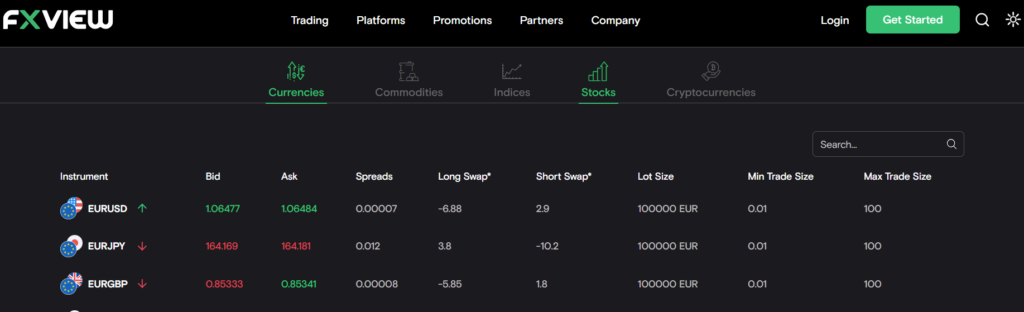

Trading Instruments & Products

FXView offers the following trading instruments and products:

➡️Commodities – Namibians can access five commodity instruments with FXView through CFD trading with leverage up to 1:100.

➡️Indices – Namibians can trade 11 major indices through FXView, letting them speculate on various market sectors and the companies’ overall performance without holding the underlying asset.

➡️Cryptocurrencies – FXView allows Namibian traders to trade in 5 different cryptocurrencies, allowing them to enter the ever-changing world of digital currencies.

➡️Forex – FXView provides Namibian traders access to 70 currency pairs, including majors, minors, and exotics.

➡️Stocks – Namibian investors can access a wide range of 392 stocks via FXView. This platform provides a gateway to global companies and industry leaders, enabling investors to build a diversified portfolio.

Can I trade any Namibian stock CFDs with FXView?

No, FXView does not offer any domestic stock CFDs listed in Namibia.

Can Namibian traders trade cryptocurrency with FXView?

Yes, Namibian traders may trade cryptocurrencies like Bitcoin, Ethereum, and Ripple on FXView’s platform.

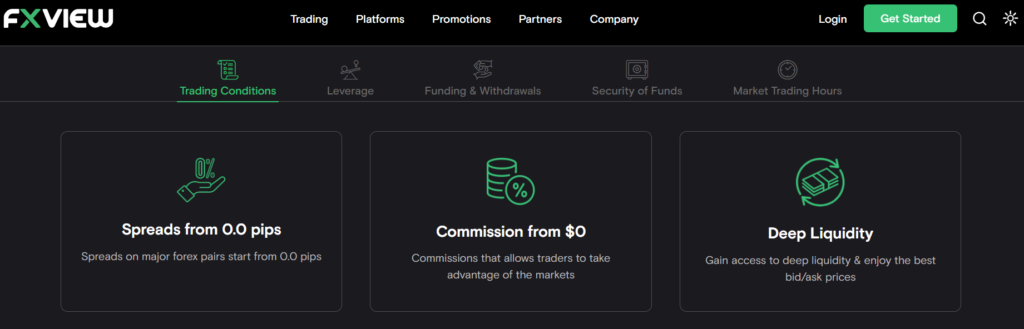

FXView Spreads and Fees

Spreads

The tight spreads charged by FXView give traders from Namibia a distinct tactical edge. Spreads on key forex pairs start at 0.0 pips with this broker, which is great for precision-based methods like scalping.

Namibians can execute transactions more cost-effectively because of FXView’s consistently narrow spreads. This is one of the main reasons why FXView is attractive to cost-conscious traders who want to make the most of their trades.

Commissions

With their transparent commission structure, FXView offers a Premium ECN account as cheap as $1 for every $100,000 transacted.

This is a fair price to pay compared to other brokers, particularly for an ECN account with the raw spread environment. On the Raw ECN account, the commission is $2, which is still competitive despite being higher.

Namibians’ expectations for ECN trading could be met by this structure, which provides Namibian traders with a clear pricing structure for trading and decreased spreads that justify the commission expenses.

Overnight Fees

An essential component of trading expenses for positions kept open overnight is the overnight fees, also known as swap rates, imposed by FXView. Our research shows that these costs are typical in the market, and the trading platform makes them easy to see.

Traders who use overnight holdings as part of their strategy should be aware of these charges. Islamic Account customers are exempt from exchange fees for three nights when FXView offers a grace period.

Deposit and Withdrawal Fees

We were happy to find that FXView did not charge any hidden costs for making deposits or withdrawals when we conducted our investigation.

Because of this, Namibian traders may be certain that their deposits are accessible for trading and that they will receive their entire withdrawal amount.

Inactivity Fees

Unlike other brokers, FXView does not charge inactivity fees to its traders’ accounts. Traders who aren’t actively trading all the time but want to re-enter the market immediately without worrying about costs during inactivity will like this move.

Currency Conversion Fees

Transactions using currencies other than the account’s base currency are subject to currency conversion fees enforced by FXView.

This charge becomes important for Namibian traders whose account-based currency is not the currency they are trading in.

Furthermore, currency conversion rates are something traders should be aware of, particularly when managing capital and assessing the cost-effectiveness of their trading plan, even if they are prevalent in the sector.

Are there any hidden fees or expenses that Namibian traders should know while dealing with FXView?

No, FXView is devoted to being a reliable, fair, and transparent forex and CFD broker.

How do FXView’s spreads compare to other brokers offered to Namibian traders?

Compared to other brokers available to Namibian traders, FXView provides competitive spreads while maintaining high service quality.

Min Deposit

934 NAD / 50 USD

Regulators

CySEC, FSCA, FSC, SEBI

Trading Desk

ActTrader, MetaTrader 4, MetaTrader 5, ZuluTrade

Crypto

Total Pairs

70

Islamic Account

Trading Fees

Account Activation

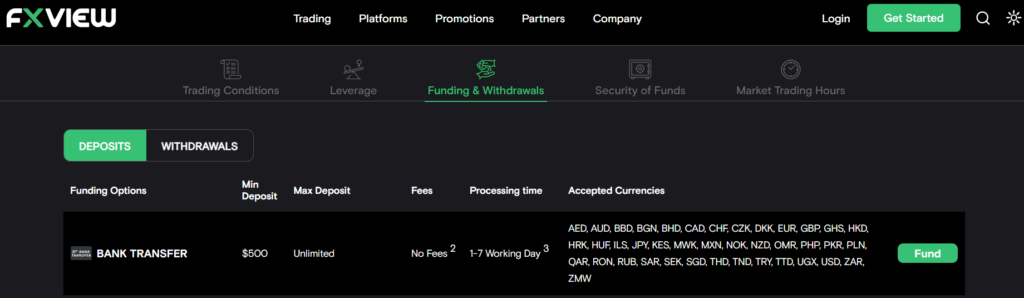

FXView Deposit & Withdrawal Options

📚 Payment Method 🌎 Country 💸 Currencies Accepted ⏰ Processing Time

Bank Transfer (international) All AED, AUD, BBD, BGN, BHD, CAD, CHF, CZK, DKK, EUR, GBP, NAD, HKD, HRK, HUF, ILS, JPY, KES, MWK, MXN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, RUB, SAR, SEK, SGD, THB, TND, TRY, TTD, UGX, USD, ZAR, ZMW 1 – 7 days

Local Bank Transfer All USD, EUR, GBP, AUD, CAD, ZAR 1 working day

Visa and MasterCard All EUR, USD, GBP, AUD, ZAR Instant

Help2Pay All USD, EUR, GBP, AUD, CAD, VND, IDR, THB, PHP, MYR Instant

Skrill All EUR, USD, GBP, AUD, ZAR, CAD Instant

Neteller All EUR, USD, GBP, AUD, ZAR, CAD Instant

Cryptocurrencies All BTC, USDT, ETH, USDC Instant

Deposits

How to Deposit using Bank Wire Step by Step

✅Log into your FXView Account to obtain the broker’s banking information, then log into your banking portal using FXView’s details

✅Ensure that you select NAD (if available) as the currency for the transaction and that the amount you’re transferring aligns with the minimum deposit requirements of your account type.

✅Include the unique reference number provided by FXView in your wire transfer. This will ensure that the deposit is correctly attributed to your trading account.

✅Keep an eye on your FXView account for the deposit. It’s important to note that international bank transfers could take a few days to process.

How to Deposit using Credit or Debit Card Step by Step

✅Access your FXView client area and go to the deposits section to select the credit or debit card option.

✅Provide your card details, including the card number, expiration date, CVV code, and the deposit amount in NAD (if available).

✅Ensure you review the transaction details and follow the necessary verification process to complete the deposit.

How to Deposit using Cryptocurrency Step by Step

✅Once logged into the FXView client portal, you can choose the cryptocurrency option for depositing funds.

✅Take the unique cryptocurrency wallet address provided by FXView and enter it into the send form of your crypto wallet.

✅Ensure that you send the specified cryptocurrency to the given wallet address, and check that the cryptocurrency type matches the address provided by FXView.

✅Wait for the required network confirmations. Once completed, the deposit will be reflected in your FXView trading account.

How to Deposit using e-Wallets or Payment Gateways Step by Step

✅To make a deposit, go to the deposit section in your FXView client interface and choose the e-wallet or payment gateway that suits you best.

✅Once you’ve selected, you’ll be directed to the website of your preferred e-wallet or payment gateway. Simply log in and proceed to authorize the payment to FXView.

✅Once confirmed, the deposit will be processed and credited to your trading account.

Withdrawals

How to Withdraw using Bank Wire Step by Step

✅To initiate a withdrawal, access the FXView client portal and choose the bank wire transfer option as your preferred withdrawal method.

✅Ensure that you provide accurate bank account details, including the currency for the withdrawal if NAD is available.

✅Verify the amount you wish to withdraw, proceed with your request, and patiently await the processing and crediting of the funds to your bank account.

How to Withdraw using Credit or Debit Cards Step by Step

✅Use the FXView client portal to request a withdrawal to your card easily. Just remember to keep the withdrawal amount within the limit of your previous card deposits.

✅Choose the card you would like to credit, input the withdrawal amount in GHS (if necessary), and proceed to confirm the transaction. Your funds will usually be returned to your card within a few business days, depending on FXView’s processing times.

How to Withdraw using Cryptocurrency Step by Step

✅Once logged into your FXView client portal, choose to withdraw your cryptocurrency.

✅Ensure you accurately provide your crypto wallet address to prevent potential transfer issues.

✅Provide the withdrawal amount and confirm the transaction. Namibians must note that crypto withdrawals require network confirmations, and it could take some time for funds to appear in your wallet.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

✅Select your preferred e-wallet or payment gateway from the withdrawal section in the FXView client portal.

✅Provide accurate e-wallet or payment gateway information and specify the amount in NAD if available. This will ensure a seamless transaction process.

✅Submit your withdrawal request. E-wallet transactions are usually processed promptly, and you can expect the funds to appear in your account shortly after FXView processes the withdrawal.

What are the deposit options for Namibian traders on FXView?

Namibian traders can use bank wire transfers, credit/debit cards, and major online payment processors like Skrill and Neteller to deposit funds into an FXView account.

Does FXView impose any deposit fees for Namibian traders?

No, FXView does not charge deposit fees to Namibian traders; however, third-party payment processors may apply their costs, which traders should consider.

Leverage and Margin

Based on our research of FXView’s margin and leverage features, we can confidently say that the broker caters to Namibian traders with a unique strategy for leverage.

We found FXView’s dynamic and adaptable strategy quite useful for traders seeking to increase their market exposure with a little initial investment, as it allows leverage for forex transactions of up to 1:500.

This high leverage ratio allows traders with different risk appetites and trading styles to increase their market earning potential.

We like how FXView responds to the number of open positions by offering leverage choices that change automatically.

Higher leverage is available to traders for smaller amounts and diminishes when positions are scaled up. Furthermore, scalping is a beneficial strategy that could help traders be careful as they get more exposed to the market.

As an example of the broker’s dedication to responsible trading, FXView provides substantial leverage for commodities like gold up to 1:500 for holdings as little as 10 lots, with a gradual reduction as positions get larger.

There is even more leeway because the broker needs a margin for the net open position in hedged trades.

Are there any leverage limitations on certain financial instruments offered to Namibian traders on FXView?

To safeguard Namibian traders from undue risk exposure, FXView may apply leverage limitations on specific instruments, notably risky assets, or during periods of increased market volatility.

What margin call or stop-out thresholds should Namibian traders know on FXView?

Yes, FXView has margin call and stop-out settings to safeguard Namibian traders from extreme losses, as well as alerts and automated position-closing methods.

Educational Resources

FXView offers the following educational resources:

➡️The Learn segment – Namibian traders can access FXView’s “Learn” section, offering individualized content for both novice and experienced traders. This resource bridges the gap between academic understanding and practical trading, promoting self-determination in Namibia.

➡️Webinars – FXView’s seminars are valuable for Namibian traders seeking market insights and trading strategies. Market specialists host webinars on various subjects, allowing real-time question-answering and enhancing their trading environment.

➡️Market Insights – FXView’s Market Insights provides Namibian traders with expert predictions and assessments, enabling them to make better judgments and understand the impact of global economic events on African markets.

➡️Forex Glossary – Namibian traders can benefit from FXView’s currency Glossary, which simplifies trading jargon and provides a solid foundation of forex expertise.

➡️Video Tutorials – FXView provides visually appealing video tutorials for traders of all skill levels in Namibia, covering fundamentals to complex technical analysis in forex.

➡️Market News – FXView’s Market News component provides timely information for traders to stay informed about global financial events, enabling Namibian traders to make informed trades.

➡️FAQs – FXView’s FAQs section offers comprehensive answers to frequently asked Namibian questions, providing valuable information on the platform’s functionality and navigation.

➡️Market Holidays – The Market Holidays calendar is crucial for Namibian traders to prepare for market closures, preventing unexpected market gaps or liquidity issues.

Does FXView provide interactive training or seminars to help Namibian traders improve their trading knowledge?

Yes, FXView periodically conducts interactive workshops and seminars for Namibian traders, both online and offline, with skilled presenters and diverse trading-related subjects.

Does FXView provide educational resources in several languages to accommodate Namibians?

Yes, FXView offers its educational materials in different languages, including English, to appeal to Namibian traders of all linguistic backgrounds, assuring accessibility and inclusion.

Bonuses and Promotions

After thoroughly examining FXView’s offerings for the Namibian market, we are highly impressed by their attractive bonuses and promotions.

The Referral Bonus is instrumental in the growth of FXView’s client base in Namibia.

FXView’s strategy of rewarding current clients to refer new traders helps expand its market presence and fosters a collaborative trading community where members can support and learn from one another.

In our experience, this approach creates a robust trading environment that benefits all participants.

FXView’s Loyalty Program plays a vital role in its promotional strategy in Namibia. The rewards for consistent trading include enhanced support services and personalized trading conditions.

The 100% deposit bonus is an outstanding feature that provides new traders an immediate boost to their trading capital.

This is particularly remarkable in Namibia, where forex trading is becoming increasingly popular, and these incentives can attract a larger group of potential traders.

In our experience, FXView’s approach to bonuses and promotions in Namibia effectively supports both new and existing traders by providing them with tools and incentives to enhance their trading experience.

Can Namibian traders join the FXView loyalty program?

Yes, the loyalty program is open to all active traders and provides benefits like lower spreads and transaction fees.

How do referral incentives work for Namibian traders?

Traders receive incentives for each referred user who registers and meets the minimum trading volume requirements.

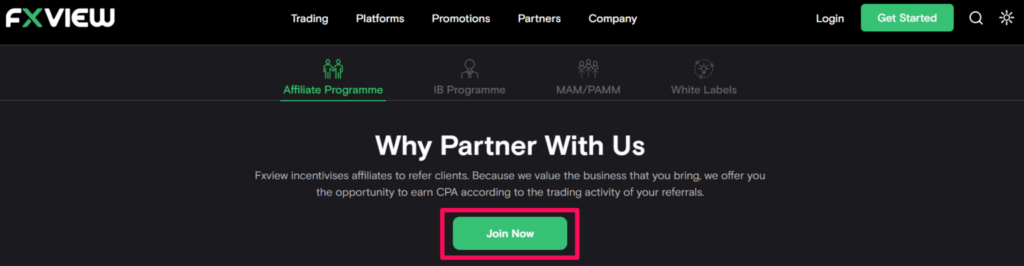

Affiliate Programs

Features

After reviewing FXView’s affiliate program in detail, we can say that it is well-suited to the Namibian market and might provide traders with a substantial additional revenue stream.

The program aims to pay affiliates a commission depending on how much trading activity their referred clients partake in on FXView.

Because of the expanding foreign exchange market and the great need for trustworthy trading platforms, this configuration is especially beneficial in Namibia.

After exploring FXView’s program, we noticed that affiliates in Namibia can promote FXView’s services more successfully with the help of the many marketing tools and resources provided by FXView.

Moreover, to meet the varied needs of prospective traders in Namibia, these materials are designed to fit in with a wide range of marketing strategies.

In addition, the program comes with an easy-to-use dashboard that lets you monitor your referral activity and profits in real-time. Using this, affiliates can easily make better decisions on how to boost their promotional efforts.

Another major benefit we found while evaluating this program is the high-quality support that FXView provides to its affiliates in Namibia.

Dedicated account managers are available to affiliates and can offer tailored help. If affiliates want to grow their referral networks and overcome obstacles effectively, they need this support.

Overall, the affiliate program at FXView presents an enticing chance for traders in Namibia to profit from the expanding forex market by using their personal connections and marketing knowledge.

How to Register an Affiliate Account with FXView Step-by-Step

Step 1 – Go to the Affiliate section.

Find the “Affiliate” section on the FXView website.

Step 2 – Click on the join button.

Click on the option to join the program offered by FXView.

Step 3 – Complete the form.

Ensure all information on the affiliate registration form is accurate, including your Namibian contact details and any pertinent corporate details (if applicable).

What are the commissions for FXView affiliates in Namibia?

Commission rates are competitive and depend on referred clients’ trading volume, with more information supplied upon registration.

Is there a minimum payment level for FXView affiliates in Namibia?

Yes, affiliates must meet a certain earnings barrier before withdrawing their commissions.

Customer Support

Customer Support FXView Customer Support

⏰ Operating Hours 24/5

🗣 Support Languages Multilingual

👥 Live Chat Yes

📱 Email Address Yes

📞 Telephonic Support Yes

✅ The overall quality of FXView Support 4/5

Response Time

📞 Support Channel ⏰ Average Response Time 👥 User-based Response Time

Phone 5 – 6 minutes 3 – 4 minutes

Email 24 – 48 hours 24 – 48 hours

Live Chat 2 – 4 minutes 3 – 4 minutes

Social Media 5 minutes 2 – 6 minutes

Affiliate 24 – 48 hours 24 – 48 hours

Is FXView customer service available 24/7 for Namibian traders?

No. Customer support is provided around the clock but only five days a week like the Forex market.

How can Namibian traders provide feedback on their experiences with FXView support?

Feedback can be offered using the support interface or following up with a support conversation.

FXView User Comments and Reviews

➡️I’m reassured by FXView’s security, notably negative balance protection. Starting with their sample account was easy, and their commission structure made real trading easy.”

➡️”FXView’s teaching features have improved my trading. Especially perceptive are their market insights. But I’d like to see more account options for specialist trading.”

➡️”FXView has genuinely narrow spreads, which enhance my trading profits. Their 24/5 customer support is exceptional – always there when you need them. It’s been smooth sailing with their MT4 platform, making my trading experience quite efficient.”

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Conclusion

Our conclusion on FXView as a Namibian forex and CFD broker is that it is a viable and reliable option for traders.

FXView’s compliance with CySEC, FSC, SEBI, and FSCA regulations ensures dependability and safety in Namibia, where no local authority exists. Segregating client assets, participating in compensation funds, and using strong digital security standards safeguard Namibian investors.

Furthermore, FXView’s narrow spreads from 0.0 pips and straightforward, competitive commission structure make trading cost-effective in Namibia.

Our Insight

In my opinion, FXview is not the best option for Nambians as some of their minimum deposits on accounts are higher than those of competitors offering similar accounts, but the account types are flexible, letting Namibians choose one that fits their strategies and risk tolerance best.

Our Recommendations on FXView

➡️FXView can explore working with local Namibian financial institutions to make it easier to fund and withdraw from trading accounts in local currency

➡️Hosting webinars and seminars with Namibian financial experts might tremendously help traders.

➡️FXView should constantly monitor the impact of worldwide economic events on African markets and give insights tailored to the Namibian economy.

FXView Pros & Cons

| ✔️ Pros | ❌ Cons |

| Namibians can choose from four powerful trading platforms that are feature-rich | FXView is not locally regulated in Namibia |

| There are several educational materials and resources available to traders | NAD is not an option for the account base currency |

| While not regulated in Namibia, FXView is regulated by other entities like FSCA and CySEC | Investor protection might not apply to Namibians |

| There is a large portfolio of tradable instruments available | Some of FXView’s minimum deposits on accounts are higher than those of competitors offering similar accounts |

| Namibians can use leverage of up to 1:500, and FXView offers negative balance protection across retail accounts | |

| There are flexible account types, letting Namibians choose one that fits their strategies and risk tolerance best | |

| Namibians can expect multilingual customer support from FXView | |

| There are transparent fee structures with competitive pricing |

you might also like: IG Review

you might also like: Exness Review

you might also like: InstaForex Review

you might also like: Global GT Review

you might also like: Axi Review

Frequently Asked Questions

How can I withdraw funds from FXView?

To withdraw funds, go to FXView’s secure client portal, select “Account Funding,” and follow the directions.

Does FXView offer any bonuses or promotions?

Yes, FXView provides global traders with a 100% deposit bonus, subject to terms and conditions.

Can I trade cryptocurrency using FXView?

Yes, FXView provides trading in various cryptocurrencies to non-EU customers.

Are there withdrawal fees with FXView?

FXView does not impose fees for deposits or withdrawals; however, third-party fees may apply.

Which trading platforms does FXView support?

FXView supports MetaTrader 4, MetaTrader 5, ActTrader, and ZuluTrade for social trading.

What is the minimum deposit necessary to trade on FXView?

FXView requires a minimum investment of $50 or 934 NAD from worldwide traders.

Does FXView provide a demo account?

Yes, FXView provides a demo account with virtual funds so traders can practice trading methods risk-free.

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Social Responsibility

FXView does not currently provide any information regarding CSR initiatives or projects.