FxPro Review

Overall FxPro is very competitive regarding its trading fees and spreads. FxPro is a multi-regulated forex broker headquartered in London. They have an overall Trust Score of 90% out of 100% and are currently not regulated by the Central Bank of Namibia.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawals

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD / 1,861 NAD

Regulators

CySEC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader, FxPro Trading Platform

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Overview

FxPro is considered low-risk, with an overall Trust Score of 90 out of 100. FxPro is licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). FxPro offers four retail trading accounts: Standard Account, Pro Account, Raw+ Account, and ECN Account.

FxPro is a supportive community for traders of all skill levels, offering a wide range of accounts and platforms that facilitate easy comparison of asset prices and fees. Even with its advanced charting tools, the cTrader platform’s intuitive layout makes parameterizing charts and placing trades a breeze on desktop and mobile devices.

In addition, FxPro’s onboarding process is simple, no matter your location or payment preferences. However, certain features that advanced users may appreciate are missing, such as a guaranteed stop-loss trade type and extensive educational resources. Additionally, selecting the optimal platform (MT4, MT5, cTrader) and account type can be challenging.

However, once new traders familiarize themselves with the simple spread-betting platform FxPro Edge, the automated market news reporting, and the ability to view other clients’ positions, they can enjoy these benefits even as beginners.

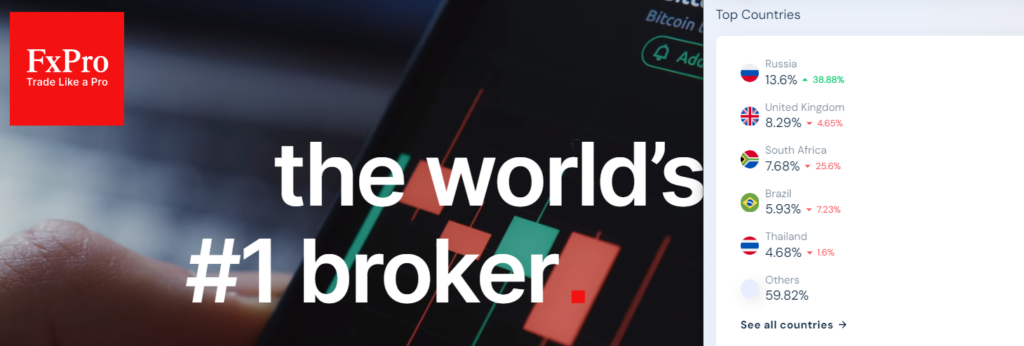

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among traders

Is FxPro a regulated broker?

Yes, they are a regulated broker. They are authorized and regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Sector Conduct Authority (FSCA) in South Africa, among others.

What trading platforms are offered by FxPro?

The broker offers a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces, catering to the needs of both beginner and experienced traders.

At a Glance

| 🏛 Headquartered | London, England |

| 🏙 Local office in Windhoek? | United Kingdom, Cyprus, South Africa, the Bahamas, Mauritius |

| ✅ Accepts Namibian Traders? | Yes |

| 🗓 Year Founded | 2006 |

| 📞 Namibian Office Contact Number | None |

| 🤳 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | FCA, CySEC, SCB, FSCA, FSC |

| 🪪 Regulatory Licenses | Financial Conduct Authority (FCA) • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) • The Securities Commission of the Bahamas (SCB) • The Financial Services Commission (FSC) |

| Registrations | • United Kingdom – 509956 • Cyprus – 078/07 • Bahamas – SIA-F184 • South Africa – FSP 45052 • Mauritius – GB21026568 |

| ⚖️ BoN Regulation | No |

| 🚫 Regional Restrictions | The United States, Canada, Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | Only MAM |

| 🤝 Liquidity Providers | Unknown |

| 💸 Affiliate Program | Yes |

| 📲 Order Execution | Market Execution |

| 📊 Average spread | 0.0 pips |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| ✅ Crypto trading offered? | 0.01 lots |

| 💰 Offers a NAD Account? | Unlimited |

| 👨💻 Dedicated Namibian Account Manager? | Yes |

| 📊 Maximum Leverage | 1:500 |

| 🚫 Leverage Restrictions for Namibia? | No |

| 💰 Minimum Deposit | $100 / 1,922 NAD |

| ✅ Namibian Dollar Deposits Allowed? | Yes |

| 📊 Active Namibian Trader Stats | 150,000+ |

| 👥 Active Namibian-based FxPro customers | Unknown |

| 💳 Namibia Daily Forex Turnover | Unknown, overall Forex Daily Trading Volume is over $6.6 Trillion |

| 💵 Deposit and Withdrawal Options | • Bank Transfers • Credit/Debit Cards • Neteller • PayPal • Skrill • UnionPay • Fasapay |

| 🏦 Segregated Accounts with Namibian Banks? | No |

| 📊 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • cTrader • FxPro App |

| ✔️ Tradable Assets | • Forex • Futures • Indices • Shares • Metals • Energies • Cryptocurrency CFDs |

| 💸 Offers USD/NAD currency pair? | No |

| 📈 USD/NAD Average Spread | N/A |

| 📉 Offers Namibian Stocks and CFDs | None |

| 🗣 Languages supported on Website | English, Spanish, French, German, Italian, Polish, Czech, Hungarian, Swedish, Bulgarian, Finnish, Lithuanian, Danish, Croatian, Estonian, Norwegian, Romanian, Russian, Dutch, Portuguese, Indonesian, Malay, Vietnamese, Thai, Arabic, Korean, Chinese (Simplified), Chinese (Traditional), Mongolian, Japanese |

| 📞 Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/5 |

| 👥 Namibian-based customer support? | No |

| ✅ Bonuses and Promotions for Namibians | Yes |

| 📚 Education for Namibian beginners | Yes, App |

| 📱 Proprietary trading software | No |

| 💰 Most Successful Namibian Trader | Michael Amushelelo (Net Worth Unknown) |

| ✅ Is FxPro a safe broker for Namibians? | Yes |

| 📊 Rating for FxPro Namibia | 8/10 |

| 🤝 Trust score for FxPro Namibia | 90% |

| 👉 Open an account | Open Account |

Regulation and Safety of Funds

Regulations in Namibia

The Bank of Namibia does not currently regulate FxPro. However, the broker is well-regulated by several reputable market regulators in other countries, as per the table in the following section.

How FxPro Protects Namibian Traders and Client Funds

| ➡️ Security Measure | Information |

| ➡️ Segregated Accounts | Yes |

| ➡️ Compensation Fund Member | Yes, ICF – this does not cover Namibians |

| ➡️ Compensation Amount | 20,000 EUR |

| ➡️ SSL Certificate | Yes |

| ➡️ 2FA (Where Applicable) | Yes |

| ➡️ Privacy Policy in Place | Yes |

| ➡️ Risk Warning Provided | Yes |

| ➡️ Negative Balance Protection | Yes |

| ➡️ Guaranteed Stop-Loss Orders | No |

Security while Trading

The broker employs several security features to ensure the safety of its traders and their funds. Some of these features include:

➡️ Regulation: They are regulated by several reputable regulatory bodies. This ensures that the broker operates transparently and fairly and that clients’ funds are protected by law.

➡️ Negative balance protection: They offer negative balance protection, meaning clients cannot lose more than their account balance. In the event of a market gap or extreme volatility, the broker will close out all open positions to prevent clients from incurring losses that exceed their account balance.

➡️ Segregated client funds: They keep client funds in segregated bank accounts, which means that clients’ funds are kept separate from the broker’s operating funds. This ensures that clients’ funds are protected during the broker’s insolvency.

➡️ Two-factor authentication (2FA): They offer two-factor authentication (2FA) as a security measure for clients’ accounts. With 2FA, clients must provide a verification code generated by a mobile app or sent via SMS in addition to their login credentials to access their accounts.

➡️ Encryption: The broker uses encryption technology to protect clients’ personal and financial information. This ensures that all communication between clients’ devices and the broker’s servers is encrypted and cannot be intercepted by third parties.

Is FxPro a regulated broker?

Yes, they are a regulated broker. They are authorized and regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Sector Conduct Authority (FSCA) in South Africa, among others.

How does the broker ensure the safety of funds?

The broker places a strong emphasis on the safety of client funds. They do this by segregating client funds from company funds and using reputable banks to hold them in separate accounts.

Additionally, FxPro offers negative balance protection, ensuring clients can never lose more than their initial investment. These measures and regulatory oversight contribute to the safety of funds for FxPro clients.

Awards and Recognition

The broker has won several awards in recent years. However, the latest indicated on their website is for 2021, and these are as follows:

➡️ Best Broker in the United Kingdom 2021: Ultimate Fintech Awards.

➡️ Best Forex Provider 2021: Online Personal Wealth Awards.

Has FxPro received any awards for its services?

Yes, they have received numerous awards and recognition for their services in the financial industry. These awards often acknowledge their excellence in areas like trading platforms, customer service, and overall broker performance.

What are some of the notable awards that FxPro has won?

The broker has been honoured with awards such as “Best FX Provider” by the Online Personal Wealth Awards, “Best Forex Trading Platform” by the Financial Times and Investors Chronicle, and “Best FX Broker” at the Shares Awards, among others. These awards highlight FxPro’s commitment to delivering top-notch services to its clients.

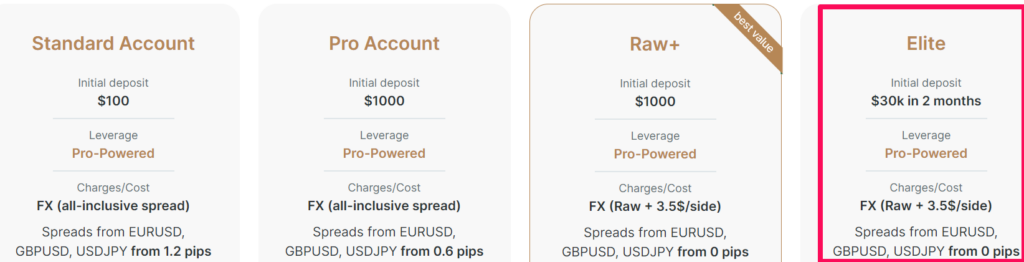

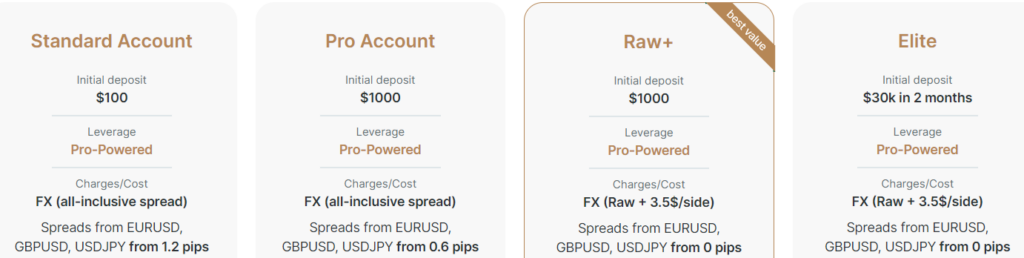

Account Types and Features

| 👉 Open an account | 💵 Minimum Dep. | 📊 Average Spread | 💸 Trade size | |

| Standard | Open Account | $100 / 1,922 NAD | 1.2 pips | From 0.01 |

| Pro | Open Account | $1,000 / 19,220 NAD | 0.6 pips | From 0.01 |

| Raw+ | Open Account | $1,000 / 19,220 NAD | 0.0 pips | From 0.10 |

| ECN | Open Account | $30,000 / 576,600 NAD (in 2 months) | 0.0 pips | From 0.10 |

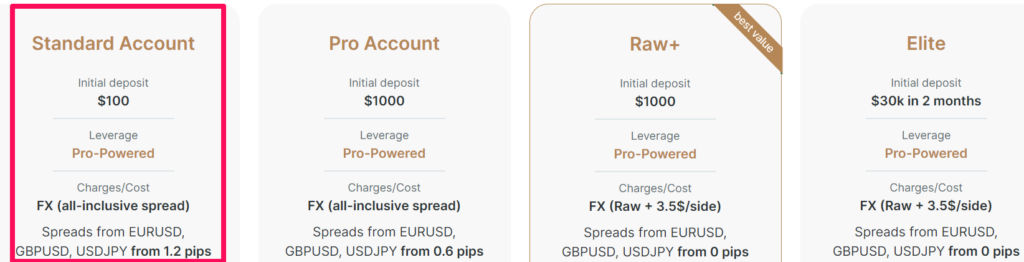

Standard Account

The Standard account is suited for traders who desire spreads that are fixed. This account is commission-free and offers fixed spreads beginning at 1.2 pips.

| 💸 Minimum Deposit | $100 / 1,922 NAD |

| 📊 Forex Spread | Spreads from EURUSD, GBPUSD, USDJPY from 1.2 pips |

| 📈 Gold Spread | Spreads from 25 cents |

| 📉 Crypto Spread | Spreads from 30 USD |

| 💰 Commission Fees | None, only the spread is charged |

| 💵 Maximum Leverage | 1:500 |

| 📊 Minimum Trade Size | 0.01 lots |

| 📱 Margin call / Stop out | 25%/20% |

| 👉 Open an account | Open Account |

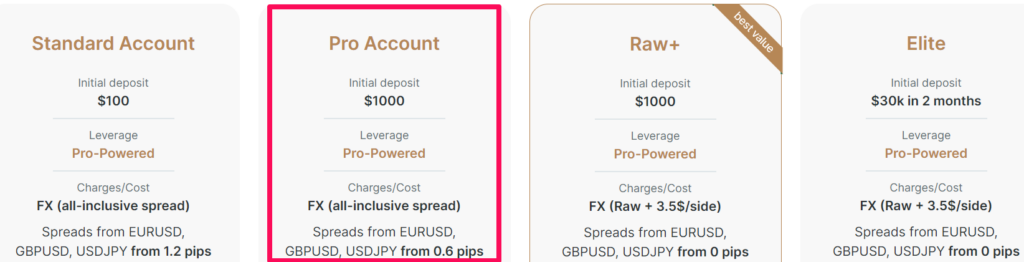

Pro Account

The Pro account is intended for more experienced traders who favour narrower spreads and greater trading conditions flexibility. This account offers variable EUR/USD spreads beginning at 0.6 pips with no commission fees.

| 💸 Minimum Deposit | $1,000 / 19,220 NAD |

| 📊 Forex Spread | Spreads from EURUSD, GBPUSD, USDJPY from 0.6 pips |

| 📈 Gold Spread | Spreads from 20 cents |

| 📉 Crypto Spread | Spreads from 15 USD |

| 💰 Commission Fees | None, only the spread is charged |

| 💵 Maximum Leverage | 1:500 |

| 📊 Minimum Trade Size | 0.01 lots |

| 📱 Margin call / Stop out | 25%/20% |

| 👉 Open an account | Open Account |

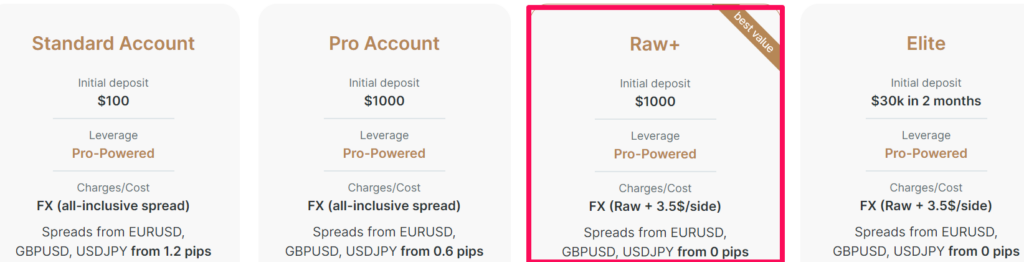

Raw+ Account

The Raw+ account is meant for traders willing to pay a fee for the tightest spreads possible. This account offers spreads from 0 pips and commissions of $3.5 per lot per side.

| 💸 Minimum Deposit | $1,000 / 19,220 NAD |

| 📊 Forex Spread | Spreads from EURUSD, GBPUSD, USDJPY from 0 pips |

| 📈 Gold Spread | Spreads from 10 cents |

| 📉 Crypto Spread | Spreads from 15 USD |

| 💰 Commission Fees | From $3.5 per side |

| 💵 Maximum Leverage | 1:500 |

| 📊 Minimum Trade Size | From 0.10 |

| 📱 Margin call / Stop out | 25%/20% |

| 👉 Open an account | Open Account |

ECN Account

The ECN account is intended for traders who want to transact directly with liquidity providers. It gives them access to spreads and execution suitable for institutions. Also, this account offers variable spreads beginning at 0 pips and a commission rate of $3.5 per lot per side.

| 💸 Minimum Deposit | $30,000 / 576,600 NAD (in 2 months) |

| 📊 Forex Spread | Spreads from EURUSD, GBPUSD, USDJPY from 0 pips |

| 📈 Gold Spread | Spreads from 10 cents |

| 📉 Crypto Spread | Spreads from 15 USD |

| 💰 Commission Fees | From $3.5 per side |

| 💵 Maximum Leverage | 1:500 |

| 📊 Minimum Trade Size | From 0.10 |

| 📱 Margin call / Stop out | 25%/20% |

| 👉 Open an account | Open Account |

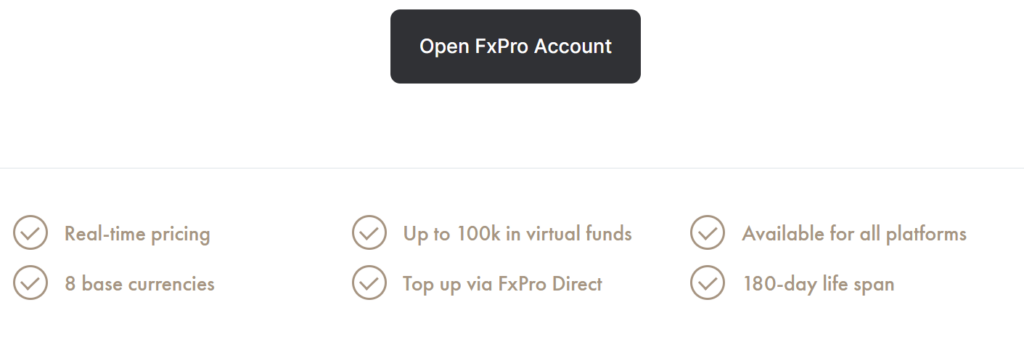

Demo Account

MetaTrader 4, MetaTrader 5, and cTrader provide access to free demo accounts. Demo accounts are especially beneficial for novice traders since they allow them to test their strategies and become familiar with the trading platform without risking any real cash.

The trial account contains live quotes and simulates real-time market conditions for assets, including FX and CFDs on commodities, indices, and stocks. Once users have mastered a demo account, switching to a live account is seamless.

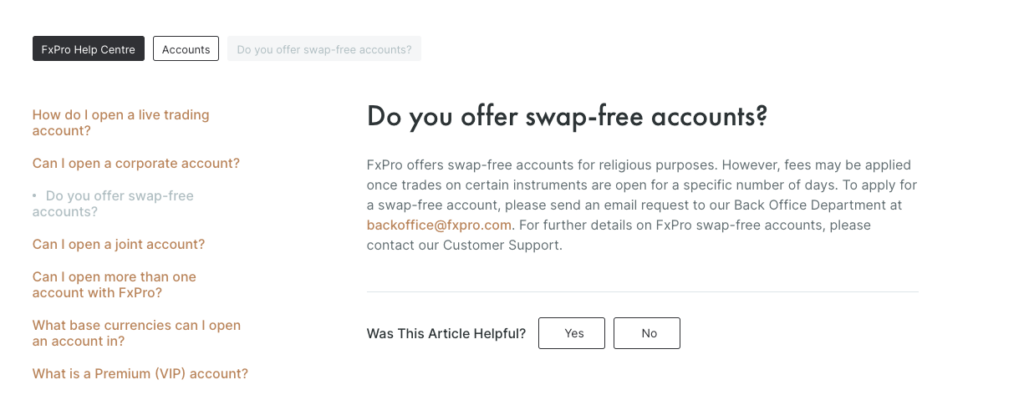

Islamic Account

FxPro provides a swap-free Islamic account that complies with Sharia law rules.

Base Account Currencies

While opening an account with FxPro, Namibian traders can select USD, EUR, GBP, CHF, PLN, AUD, JPY, or ZAR as their base currency.

However, if Namibians deposit or withdraw in a currency other than the trading account’s base currency, they will incur currency conversion fees.

What types of accounts does FxPro offer?

The broker offers several account types, including the MT4, MT5, cTrader, and Edge accounts. Each account type is designed to cater to different trading preferences, with varying spreads, leverage, and other features.

Can I access FxPro’s account types on mobile devices?

Yes, the broker provides mobile trading options for all its account types. Traders can download mobile apps compatible with both iOS and Android devices to access their accounts and trade on the go.

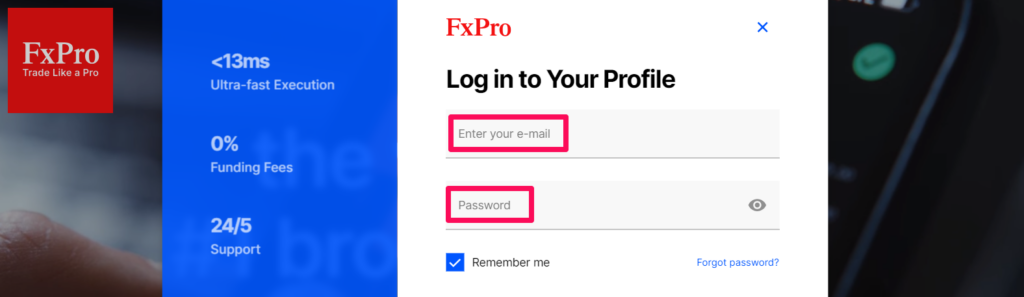

How to open an Account with FxPro

To register an account with FxPro, Namibian traders can follow these easy steps:

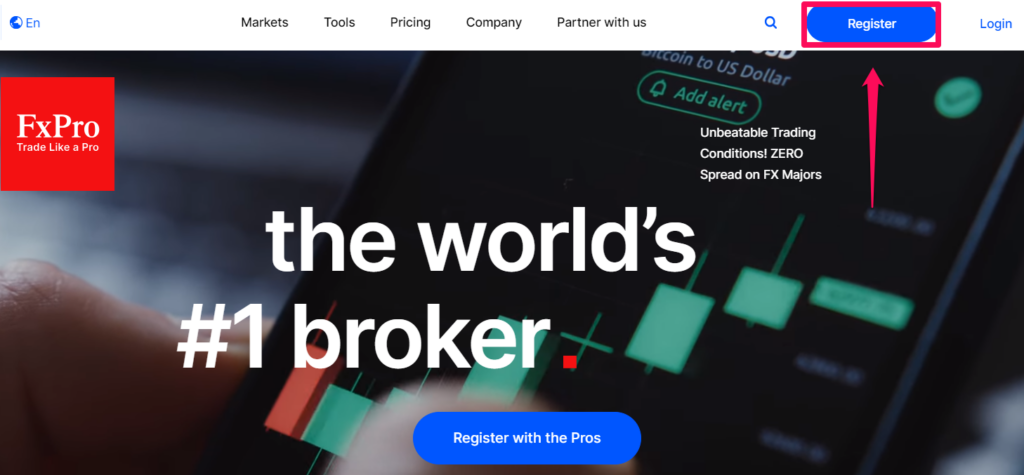

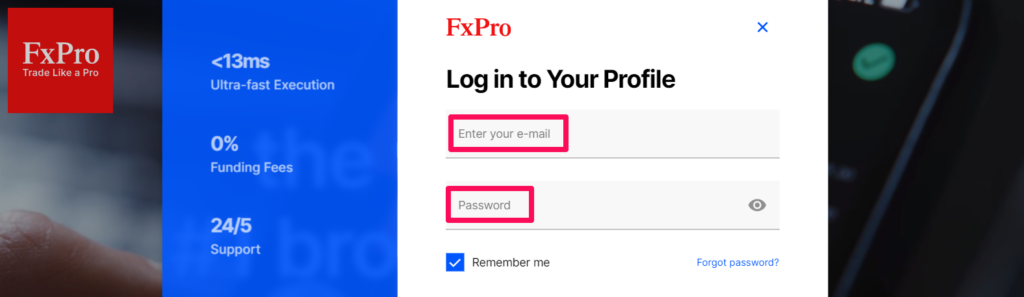

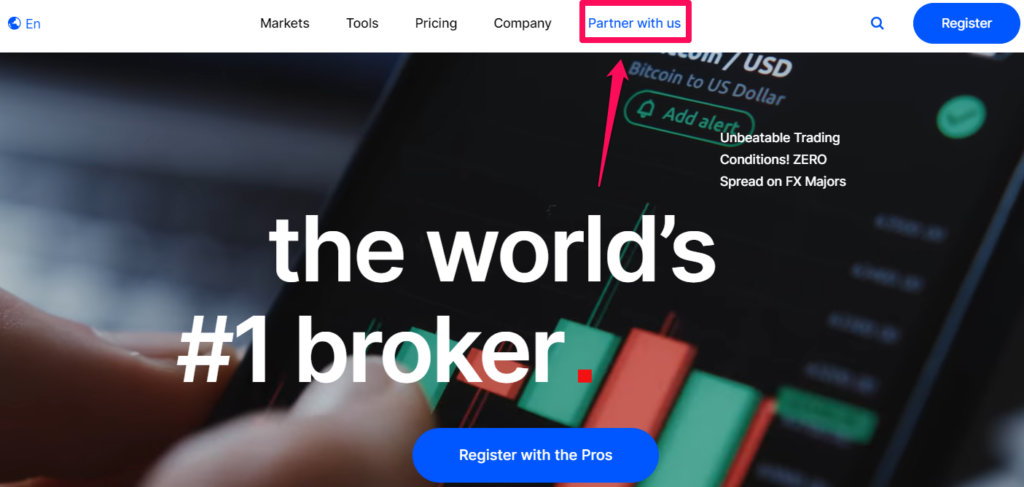

Step 1 – Go to the official FxPro website.

➡️ To register for an account with FxPro, please navigate to the official website at www.fxpro.com and locate the “Register” button at the top right corner of the homepage.

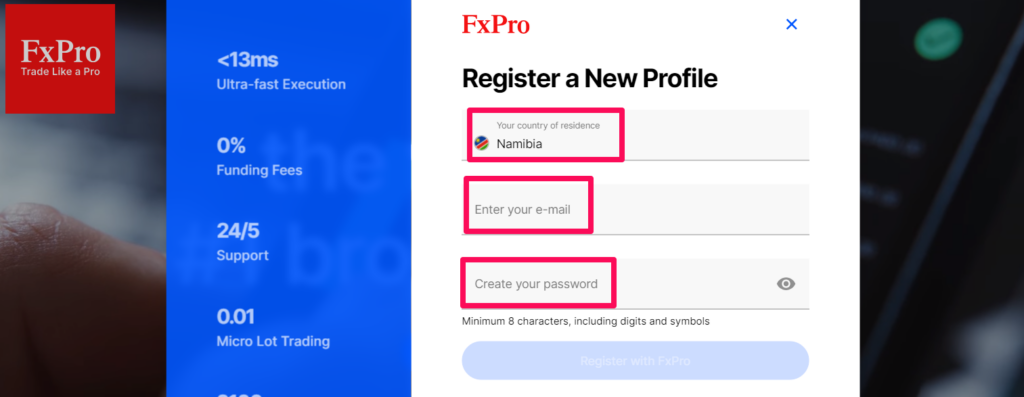

Step 2 – Provide your information.

➡️ You will be redirected to a registration form requiring you to provide your personal information, including your name, email address, phone number, and country of residence.

Step 3 – Choose an account type.

➡️ After that, you can select the account type you wish to open, including a demo, Standard, Pro, Raw+, or ECN account.

Step 4 – Submit your form.

➡️ Once you have filled out the registration form, submit it and wait for FxPro to approve your account.

FxPro VS Exness VS IC Markets – Broker Comparison

| 🥇 Fxpro | 🥈 Exness | 🥉 IC Markets | |

| ⚖️ Regulation | FCA, CySEC, SCB, FSCA, FSC | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | ASIC, CySEC, FSA, SCB |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • cTrader • FxPro App | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • cTrader |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | $100 / 1,922 NAD | $10/192 NAD | $200 / 3,844 NAD |

| 📈 Leverage | 1:500 | Unlimited | 1:500 |

| 📊 Spread | 0.0 pips EUR/USD | Variable, from 0.0 pips | From 0.0 pips |

| 💰 Commissions | $3.5 per side | From $0.1 per side, per lot | From $3 to $3.5 |

| ✴️ Margin Call/Stop-Out | 100%/50% | 60%/0% | 100%/50% |

| ✴️ Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes, Micro | Yes | No |

| 📈 Account Types | • Standard Account • Pro Account • Raw+ Account • ECN Account | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account | • cTrader Account • Raw Spread Account • Standard Account |

| ⚖️ BoN Regulation | No | No | No |

| 💳 NAD Deposits | No | Yes | No |

| 📊 NAD Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 4 | 5 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | Open Account | Open Account | Open Account |

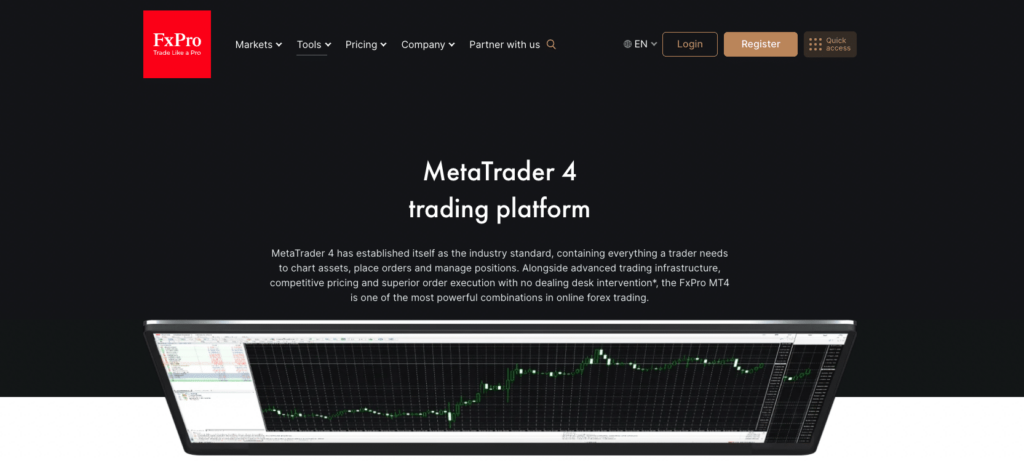

Trading Platforms

The broker offers Namibian traders a choice between these trading platforms:

➡️ MetaTrader 4 is globally recognized as one of the leading trading platforms due to its intuitive interface, advanced charting tools, extensive indicators, and algorithmic trading features. It is available for desktop, mobile, and web.

➡️ MetaTrader 5, the upgraded version of MT4, provides similar features and additional capabilities like support for advanced order types and multiple timeframes. MT5 is also accessible on desktop, mobile, and web.

➡️ cTrader is a favoured trading platform among professional traders. Furthermore, cTrader provides advanced charting tools and an extensive range of order types and supports algorithmic trading. In addition, cTrader can be accessed via desktop, web, and mobile devices.

➡️ The FxPro App is a mobile trading platform that enables traders to trade on the go with access to a broad range of markets, advanced charting tools, real-time market news, and analysis. In addition, the platform supports algorithmic trading and features an intuitive interface.

What trading platforms are available at FxPro?

The broker offers a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and FxPro Edge. These platforms are renowned for their user-friendly interfaces and advanced trading tools.

Can I use automated trading strategies on FxPro’s platforms?

Yes, their trading platforms support automated trading strategies. Traders can use Expert Advisors (EAs) on MT4 and MT5, as well as cAlgo on cTrader, to implement algorithmic trading strategies and automated trading systems.

Range of Markets

Namibian traders can expect the following range of markets from the broker:

➡️ Forex

➡️ Futures

➡️ Indices

➡️ Shares

➡️ Metals

➡️ Energies

➡️ Cryptocurrency CFDs

What financial markets can I trade?

The broker provides access to a wide range of financial markets, including forex currency pairs, commodities like gold and oil, indices representing global stock markets, cryptocurrencies, and shares of some of the world’s largest companies.

Does FxPro offer access to cryptocurrency trading?

Yes, the broker allows traders to trade cryptocurrencies. You can trade popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, providing opportunities to participate in the rapidly growing digital asset markets.

Broker Comparison for a Range of Markets

| 🥇 FxPro | 🥈 Exness | 🥉 IC Markets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

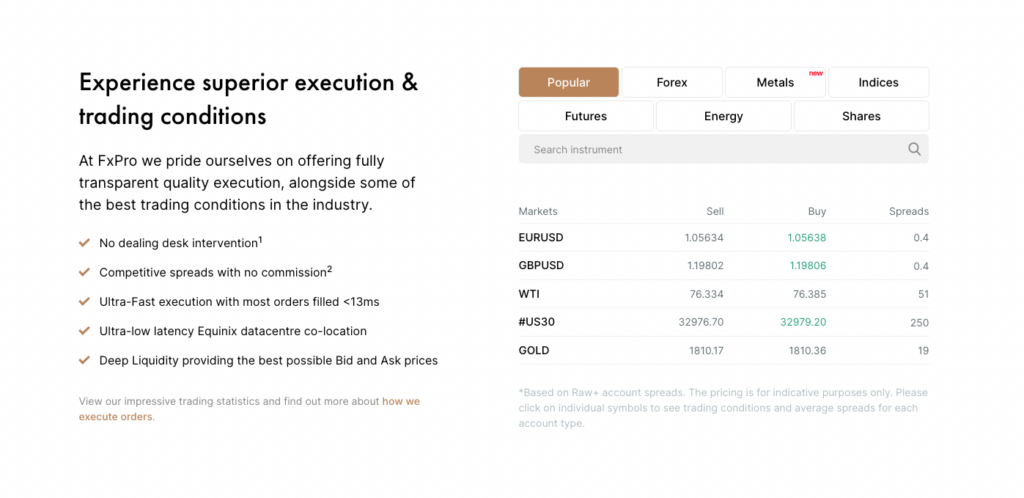

Trading and Non-Trading Fees

Spreads

There are a variety of spreads, where a spread is the difference between ask and bid and where the broker receives the money. The spread rates that traders can anticipate with FxPro vary by account type, with the following standard spread rates for each account type:

➡️ Standard Account – 1.2 pips EUR/USD

➡️ Pro Account – 0.6 pips EUR/USD

➡️ Raw+ Account – 0.0 pips EUR/USD

➡️ ECN Account – 0.0 pips EUR/USD

Commissions

The Raw+ and ECN Accounts have spreads of 0 pips. Depending on the financial instrument, traders might anticipate paying commissions beginning at $3.5 per side.

Overnight Fees, Rollovers, or Swaps

On both the MetaTrader and cTrader platforms, overnight fees in the form of rollover fees will be assessed and publicized.

In the foreign exchange market, a rollover charge is an interest paid or assessed on purchasing or selling one currency against another based on the difference between their overnight interest rates.

Namibians can visit the website for additional details on these prices. In addition, if they intend to hold positions for more than a day, Namibian traders must comprehend spreads and factor them into their trading strategy.

Moreover, Namibians can utilize the Swap charge calculator to determine the costs they would incur when utilizing FxPro.

Deposit and Withdrawal Fees

Deposit and withdrawal fees do not apply.

Inactivity Fees

The broker might charge inactivity fees on a dormant account. These fees typically range from $5 to $15.

Currency Conversion Fees

Traders will incur currency conversion costs on trades, deposits, and withdrawals when they utilize a currency other than their base account currency.

Other Trading / Non-Trading Fees

Because circumstances are subject to change, there may be additional or new expenses that we have not covered in this exhaustive analysis. Therefore, when creating a trading account, Namibians must verify all trading and non-trading expenses with FxPro.

What are the trading fees charged by FxPro?

The broker charges trading fees in the form of spreads, which are the differences between the buy and sell prices of assets. The exact spread cost varies depending on the asset you’re trading and the type of account you have.

Are there any non-trading fees associated with FxPro accounts?

Yes, the broker may charge non-trading fees, such as overnight financing fees for positions held overnight, withdrawal fees, or inactivity fees for dormant accounts.

It’s essential to review FxPro’s fee schedule or contact their customer support for specific details on non-trading fees.

Deposits and Withdrawals

The broker offers Namibian traders the following deposit and withdrawal methods:

➡️ Bank Transfers

➡️ Credit/Debit Cards

➡️ Neteller

➡️ PayPal

➡️ Skrill

➡️ UnionPay

How can I deposit funds into my trading account?

You can deposit funds into your trading account using various methods, including bank wire transfers, credit/debit cards, and various online payment systems like Skrill, Neteller, and PayPal. The available deposit methods may vary depending on your location and the type of FxPro account you have.

What is the withdrawal process like and are there any associated fees?

To make a withdrawal from your account, you can typically request it through the FxPro client portal. The processing time and fees may vary depending on the withdrawal method you choose and your account type. It’s advisable to check FxPro’s website or contact their customer support for specific details on the withdrawal process and associated fees.

How to Deposit Funds with FxPro

To deposit funds to an account with FxPro, Namibian traders can follow these steps:

Step 1 – Log into your account.

➡️ Log into your FxPro account using your credentials.

Step 2 – Click on the “Deposit Funds” option.

➡️ On the upper right corner of the page, click “Deposit Funds”.

Step 3 – Choose a deposit option.

➡️ Choose the deposit payment option you intend to use. FxPro accepts bank transfers, credit/debit cards, PayPal, Skrill, and Neteller as payment methods.

Step 4 – Choose a deposit amount.

➡️ Input the amount of the deposit and click “Next.”

➡️ Follow the on-screen directions to complete the payment procedure. Depending on your payment option, you may be required to enter your payment information or transfer to a payment gateway.

➡️ After a successful payment, your FxPro trading account will be credited with cash.

How long do FxPro Deposits take?

Deposits with FxPro can be instantaneous or take up to three days, depending on when you deposit and the method you select.

Fund Withdrawal Process

To withdraw funds from an account with FxPro, Namibian traders can follow these steps:

Step 1 – Log into your account.

➡️ Sign in using your FxPro credentials.

Step 2 – Choose the “Withdraw Money” option.

➡️ Click the “Withdraw Money” button in the upper right corner of the page.

Step 3 – Choose a withdrawal option.

➡️ FxPro offers a variety of payment options, such as bank transfers, credit/debit cards, PayPal, Skrill, and Neteller.

Step 4 – Follow the directions.

➡️ Input the withdrawal amount and then click “Next.” Finally, follow the on-screen directions to finish the withdrawal process.

➡️ Depending on your chosen payment method, you may be required to enter your payment information or be redirected to a payment gateway.

➡️ FxPro will process your withdrawal request within one to two business days after submission.

How long do FxPro Withdrawals take?

The broker processes withdrawal requests within two days. However, the process may take a few days to complete, depending on the payment method you select and the payment provider’s/internal bank’s procedures.

Min Deposit

100 USD / 1,861 NAD

Regulators

CySEC, FSCA

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader, FxPro Trading Platform

Crypto

Total Pairs

70+

Islamic Account

Trading Fees

Account Activation

Education and Research

Education

The broker offers the following Educational Materials to Namibian traders:

➡️ 9 Online Courses

➡️ 4 Fundamental Analysis Courses

➡️ 5 Technical Indicator Courses

➡️ Trading Psychology

➡️ YouTube Videos on the official channel

Research and Trading Tool Comparison

The broker also offers Namibian traders the following additional Research and Trading Tools:

➡️ Economic Calendar

➡️ Forex News

➡️ Trading Calculators

➡️ Earnings Calculators

➡️ FxPro Market News

➡️ Technical Analysis through Trading Central

➡️ Trader’s Dashboard

➡️ FxPro Direct App

➡️ FxPro VPS

➡️ Download Centre

Does the broker offer educational resources for traders?

Yes, they provide a range of educational resources for traders, including webinars, video tutorials, articles, and trading guides. These materials cover various aspects of trading, from beginner to advanced topics, to help traders enhance their knowledge and skills.

Does the broker offer research tools and analysis to assist traders in their decision-making?

Yes, they offer a variety of research tools and market analysis, including daily market updates, economic calendars, and access to trading signals. These resources are designed to help traders stay informed about market trends and make well-informed trading decisions.

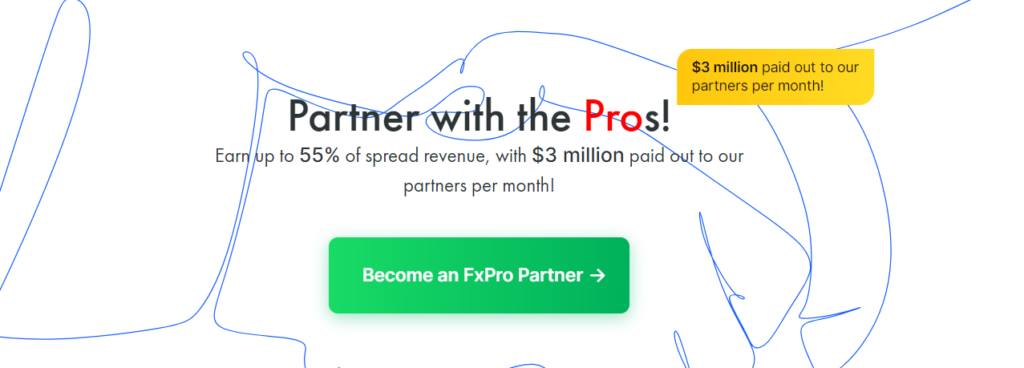

Bonuses and Promotions

FxPro does not offer any bonuses or promotions to Namibian traders. Nonetheless, FxPro’s great rebate program rewards partners and customers.

Does the broker offer any bonuses or promotions to its traders?

They typically do not offer deposit bonuses or promotions that involve additional trading funds. However, they may have occasional promotional offers or contests. It’s advisable to check their official website for any ongoing promotions.

Are there any specific requirements to participate in the promotions?

The eligibility criteria for the promotions may vary depending on the specific promotion. Traders should carefully review the terms and conditions of each promotion to understand the requirements and qualifications for participation.

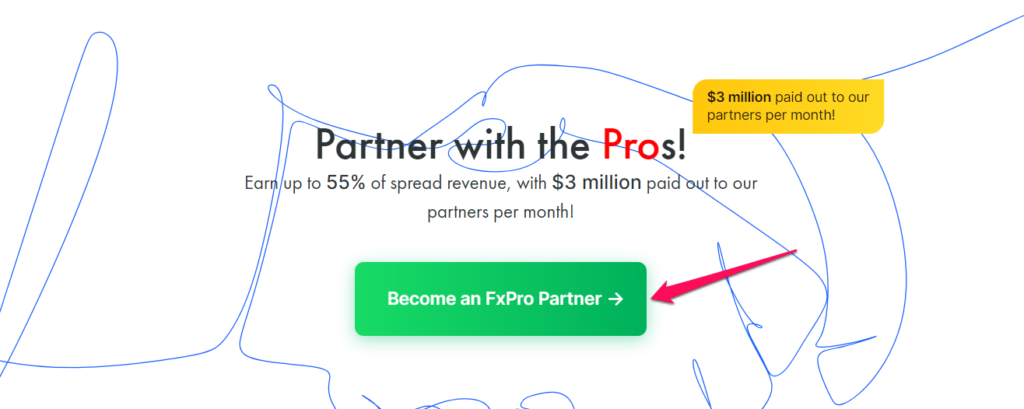

Affiliate Program Features

➡️ Attractive commission rates: FxPro’s Affiliate Program offers competitive commission rates, allowing affiliates to earn up to $1,000 per client referral.

➡️ Real-time tracking and reporting: Affiliates can monitor their referrals’ trading activities and commissions earned in real-time through FxPro’s user-friendly affiliate portal.

➡️ Marketing tools and resources: FxPro provides affiliates with various marketing tools and resources to help promote the platform and attract new clients.

➡️ Customized commission structures: Affiliates can negotiate customized commission structures based on their needs and preferences.

➡️ Dedicated support: FxPro’s Affiliate Program offers dedicated support to affiliates, with a dedicated account manager assigned to assist with any questions or issues that may arise.

What are the commission structures available in the Affiliate Program?

The Affiliate Program offers various commission structures, including cost-per-acquisition (CPA), revenue share, and hybrid deals. These structures allow affiliates to choose the most suitable option for their marketing strategy and goals.

Is there a minimum requirement for becoming an affiliate?

The Affiliate Program typically does not have strict minimum requirements for becoming an affiliate. However, potential affiliates should review the program’s terms and conditions to ensure they meet any specific criteria or obligations for participation.

How to open an Affiliate Account with FxPro

To register an Affiliate Account, Namibians can follow these steps:

Step 1 – Click on the “Partner with us” button.

➡️ Visit the website of FxPro and click the “Partner with us” button at the top of the page.

Step 2 – Click on the “Become an FxPro Partner” button.

➡️ Choose the “Become an FxPro Partner” button.

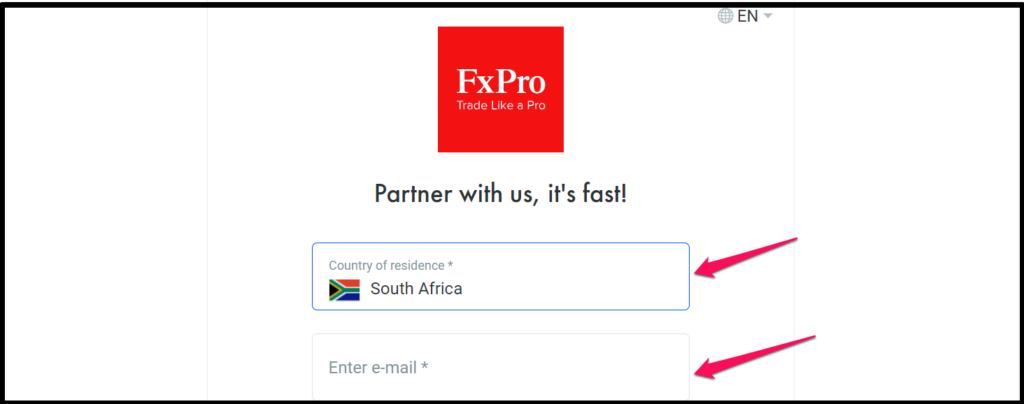

Step 3 – Fill out the form.

➡️ On the registration form, provide your personal information, including your name, email address, phone number, and country of residence.

Step 4 – Choose a partnership type.

➡️ Choose your desired partnership, such as Introducing a Broker or Affiliate.

Step 5 – Provide necessary information.

➡️ Provide any other information your partnership type requires, such as your business name and website for Affiliate accounts.

Customer Support

| 🤝 Customer Support | 📞 FxPro Customer Support |

| Operating Hours | 24/5 |

| Support Languages | Multilingual |

| Live Chat | Yes |

| Email Address | [email protected] |

| Telephonic Support | Yes |

| Local Support in Namibia? | No |

| The overall quality of FxPro Support | 5/5 |

Verdict

FxPro is a reputable and reliable forex and CFD broker with various account types, platforms, and tools suitable for traders of different experience levels.

They provide traders with various educational materials, market analysis, and technical tools to aid their trading decisions.

10 Best Forex Brokers in Namibia

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FxPro offers a diverse portfolio of tradable instruments. | Namibian traders have limited protections as the CBN does not regulate FxPro. |

| Namibian traders can choose from tailored accounts to ensure that their needs and objectives are met. | Namibians do not get a no-deposit bonus when they sign up. |

| There are competitive variable spreads charged. | Some account types have much larger minimum deposit requirements. |

| Third-party tools are available. | There are limited options for deposits and withdrawals. |

| The order execution is fast and dependable. | There is no NAD-denominated account offered. |

| Deposits and withdrawals are fast and reliable. |

you might also like: Exness Review

you might also like: IC Markets Review

you might also like: FBS Review

you might also like: JustMarkets Review

you might also like: Trade Nation Review

Frequently Asked Questions

How long does it take to withdraw from FxPro?

The processing time for withdrawals varies depending on the payment method used. For example, withdrawals to e-wallets such as Skrill and Neteller are typically processed within one business day. At the same time, bank transfers may take 2-5 business days.

Does FxPro have VIX 75?

No, the broker does not offer VIX 75 on their trading platforms.

Is FxPro regulated in Namibia?

No, FxPro is not regulated by the Namibian financial regulator, but other reputable entities regulate it.

What trading platforms are available?

The broker offers various trading platforms for Namibians, including MetaTrader 4, MetaTrader 5, cTrader, and the FxPro mobile app.

Does FxPro offer demo accounts for Namibians?

Yes, they offer Namibians free demo accounts, enabling them to practice trading strategies and test the platform’s features without risking real money.

Does FxPro have Nasdaq 100?

Yes, they offer Nasdaq 100 on their trading platforms.

Can Namibians participate in FxPro’s partner program?

Yes, Namibians can participate in their partner program, which offers commission-based earnings for referring clients to the broker. The commission structure ranges from 30% to 55%, depending on the partner’s status and the client’s trading volume.

Is FxPro Safe or a Scam?

They are a reputable and trustworthy broker that is considered safe for trading.

What payment methods are available for Namibians to deposit and withdraw funds from their accounts?

Namibians can deposit and withdraw funds from their accounts using payment methods such as bank transfers, credit/debit cards, PayPal, Skrill, and Neteller.

Is FxPro regulated?

Yes, they are a regulated broker. They are authorized and regulated by several reputable financial authorities in different jurisdictions, including the FCA in the UK, CySEC in Cyprus, SCB in the Bahamas, FSC in Mauritius, and FSCA in South Africa.

Table of Contents

Table of Contents

Scam Forex Brokers in Namibia

Scam Forex Brokers in Namibia

Corporate Social Responsibility

FxPro, as a socially responsible business, has implemented several Corporate Social Responsibility (CSR) projects to promote social and environmental concerns. Following are some of the CSR projects in which FxPro has participated:

➡️ Education Program: They have worked with various colleges and educational institutions to offer students and traders financial education and trading courses.

➡️ The broker has contributed to several philanthropic organizations, including UNICEF, Doctors Without Borders, and the Red Cross.

➡️ Environmental measures: They have implemented a few steps to lessen its environmental impact, including adopting energy-efficient technology and reducing paper consumption.

➡️ The broker has created community outreach activities to benefit local communities, such as supplying school supplies to disadvantaged children and funding local sports teams.

➡️ The broker has sponsored various sporting events and teams, including Formula 1 team Aston Martin Cognizant and Premier League football club Watford FC.

What is FxPro’s approach to corporate social responsibility (CSR)?

They are committed to CSR initiatives that focus on responsible trading practices and community engagement. They prioritize transparency, ethical conduct, and investor education to promote responsible trading behaviour among their clients.

Does the broker engage in any philanthropic activities as part of its CSR efforts?

While they primarily emphasize responsible trading practices, they may also engage in philanthropic activities or initiatives that contribute positively to society. Details of any specific philanthropic efforts can be obtained from FxPro’s official website or CSR reports.